Cybersecurity platform provider Palo Alto Networks (NASDAQ: PANW) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 15.8% year on year to $2.54 billion. Guidance for next quarter’s revenue was better than expected at $2.46 billion at the midpoint, 0.9% above analysts’ estimates. Its non-GAAP profit of $0.95 per share was 7.3% above analysts’ consensus estimates.

Is now the time to buy Palo Alto Networks? Find out by accessing our full research report, it’s free.

Palo Alto Networks (PANW) Q2 CY2025 Highlights:

- Revenue: $2.54 billion vs analyst estimates of $2.50 billion (15.8% year-on-year growth, 1.4% beat)

- Adjusted EPS: $0.95 vs analyst estimates of $0.89 (7.3% beat)

- Revenue Guidance for Q3 CY2025 is $2.46 billion at the midpoint, above analyst estimates of $2.44 billion

- Adjusted EPS guidance for the upcoming financial year 2026 is $3.80 at the midpoint, beating analyst estimates by 3.2%

- Operating Margin: 19.6%, up from 10.9% in the same quarter last year

- Market Capitalization: $118.3 billion

"Our strong execution in Q4 reflects a fundamental market shift in which customers understand that a fragmented defense is no defense at all against modern threats. They are partnering with us because our platforms are designed to work in concert, creating powerful operational synergies that deliver superior, near real-time outcomes and the efficiency our customers need," said Nikesh Arora, chairman and CEO of Palo Alto Networks.

Company Overview

Founded in 2005 by security visionary Nir Zuk who sought to reimagine firewall technology, Palo Alto Networks (NASDAQ: PANW) provides AI-powered cybersecurity platforms that protect organizations' networks, clouds, and endpoints from sophisticated threats.

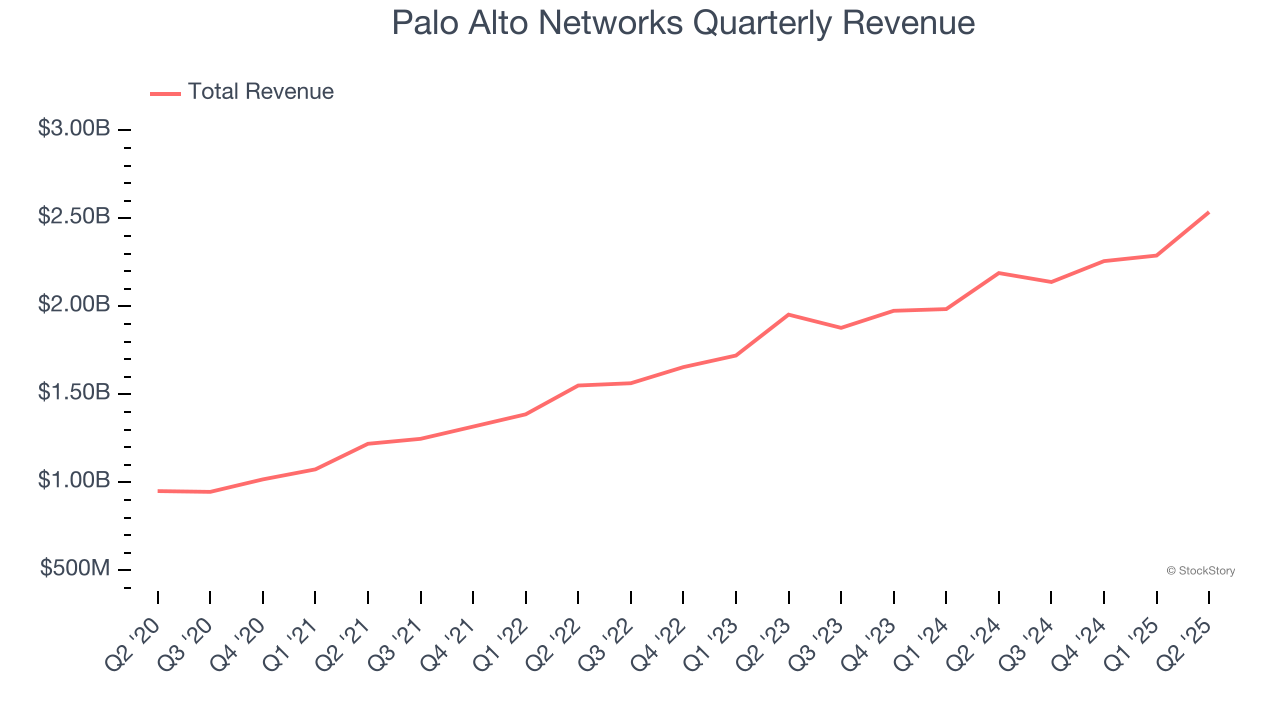

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality.

Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Over the last three years, Palo Alto Networks grew its sales at a 18.8% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, Palo Alto Networks reported year-on-year revenue growth of 15.8%, and its $2.54 billion of revenue exceeded Wall Street’s estimates by 1.4%. Company management is currently guiding for a 15% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.2% over the next 12 months, a deceleration versus the last three years. Still, this projection is noteworthy and indicates the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Palo Alto Networks is extremely efficient at acquiring new customers, and its CAC payback period checked in at 19.3 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Palo Alto Networks’s Q2 Results

We were impressed by Palo Alto Networks’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also glad its EPS guidance for next quarter exceeded Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 6.6% to $188.10 immediately following the results.

Indeed, Palo Alto Networks had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.