Compass’s 10.3% return over the past six months has outpaced the S&P 500 by 5.1%, and its stock price has climbed to $8.80 per share. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Compass, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Compass Not Exciting?

Despite the momentum, we're cautious about Compass. Here are three reasons why you should be careful with COMP and a stock we'd rather own.

1. Weak Growth in Transactions Points to Soft Demand

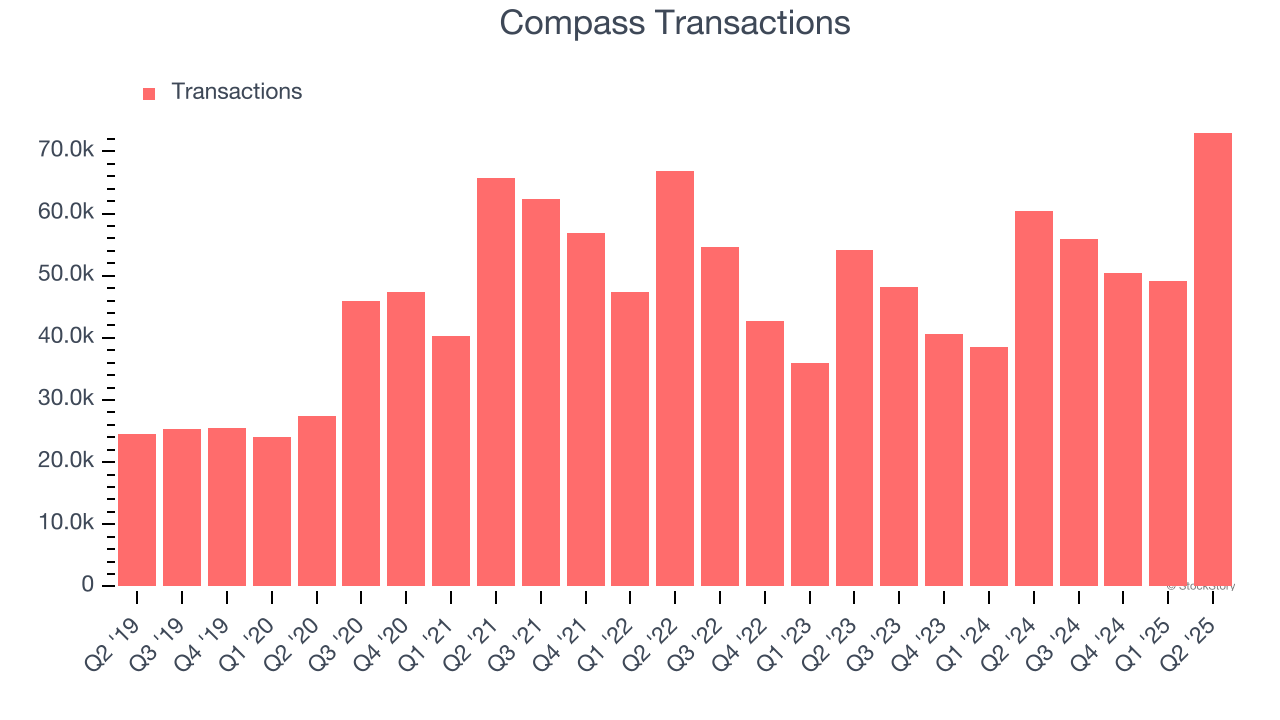

Revenue growth can be broken down into changes in price and volume (for companies like Compass, our preferred volume metric is transactions). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Compass’s transactions came in at 73,025 in the latest quarter, and over the last two years, averaged 11.3% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Operating Losses Sound the Alarms

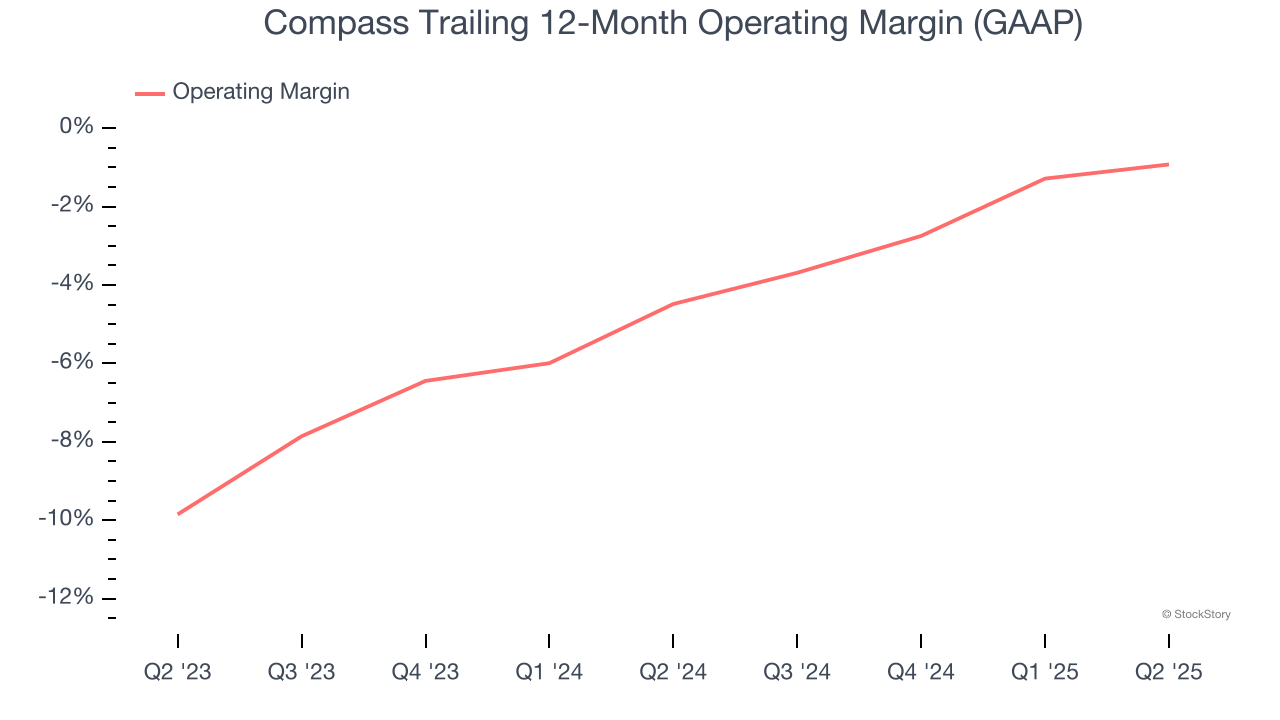

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Compass’s operating margin has been trending up over the last 12 months, but it still averaged negative 2.5% over the last two years. This is due to its large expense base and inefficient cost structure.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

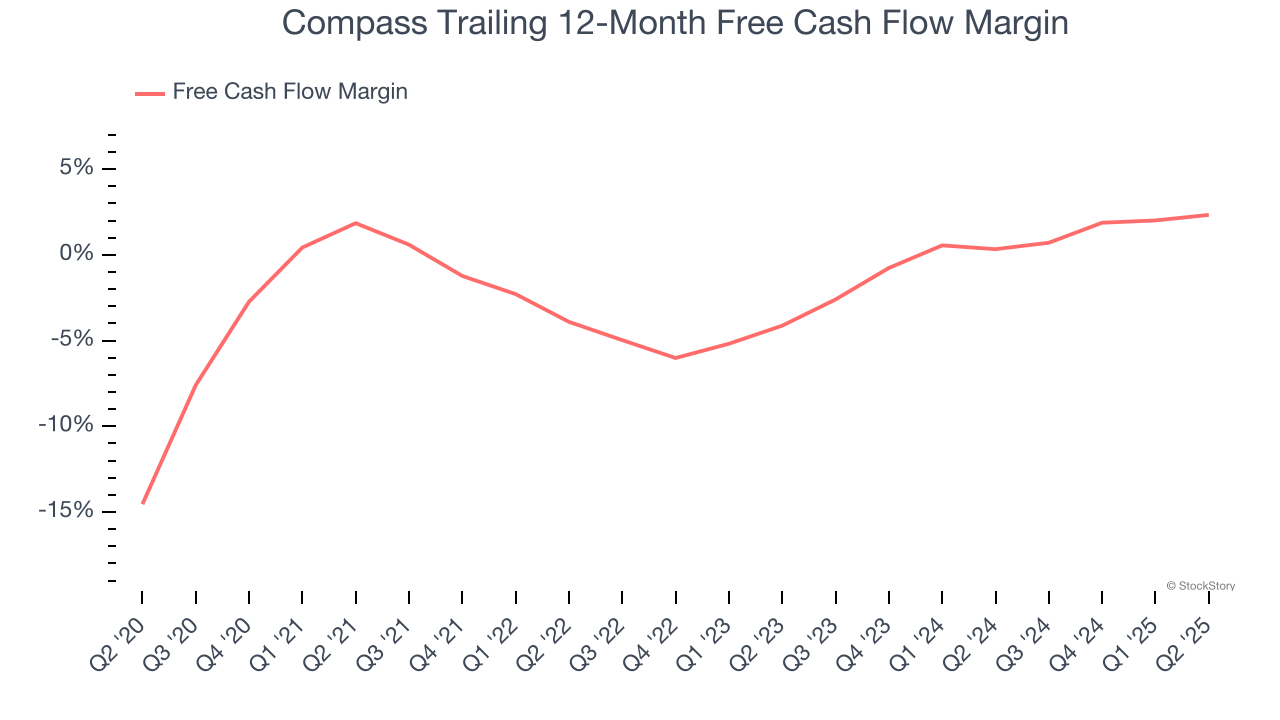

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Compass has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.4%, lousy for a consumer discretionary business.

Final Judgment

Compass isn’t a terrible business, but it isn’t one of our picks. With its shares outperforming the market lately, the stock trades at 19.8× forward P/E (or $8.80 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.