Markel Group currently trades at $1,928 per share and has shown little upside over the past six months, posting a middling return of 2.9%.

Is there a buying opportunity in Markel Group, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Markel Group Not Exciting?

We're cautious about Markel Group. Here are three reasons why MKL doesn't excite us and a stock we'd rather own.

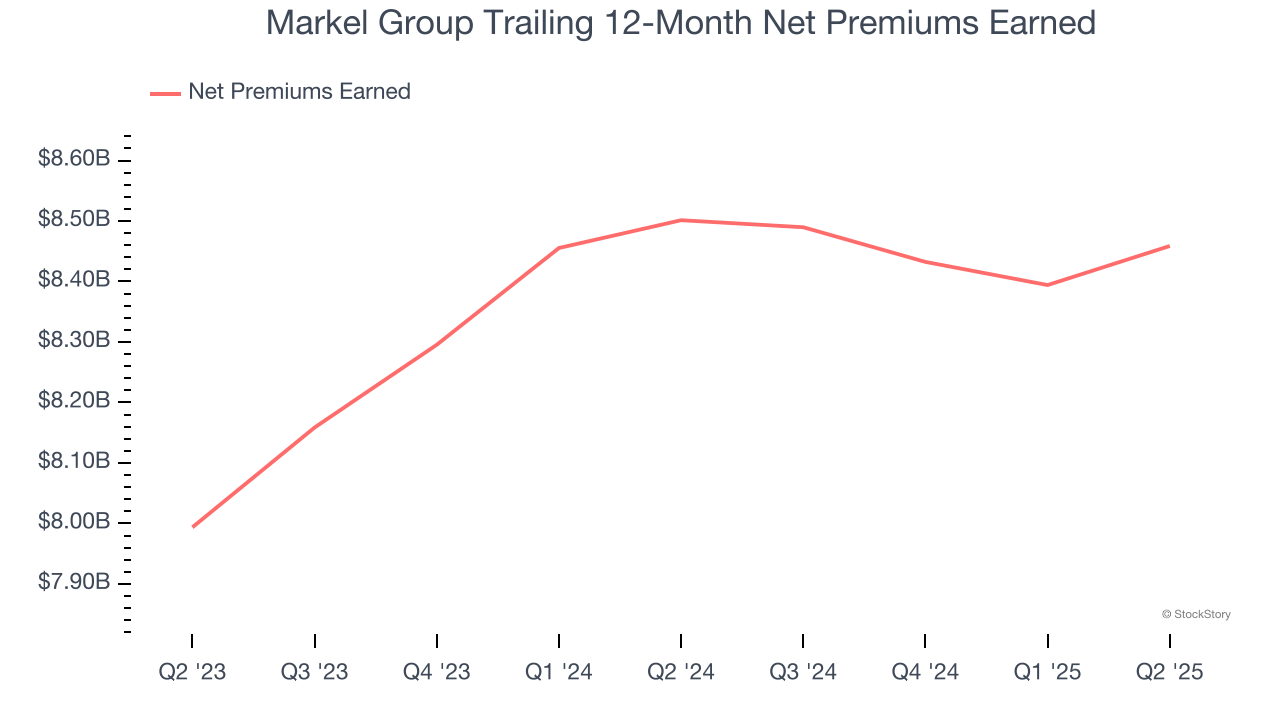

1. Net Premiums Earned Point to Soft Demand

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore net of what’s ceded to reinsurers as a risk mitigation and transfer strategy.

Markel Group’s net premiums earned has grown at a 2.9% annualized rate over the last two years, much worse than the broader insurance industry and slower than its total revenue.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Markel Group’s revenue to drop by 6.4%, a decrease from its 4.5% annualized growth for the past two years. This projection is underwhelming and implies its products and services will face some demand challenges.

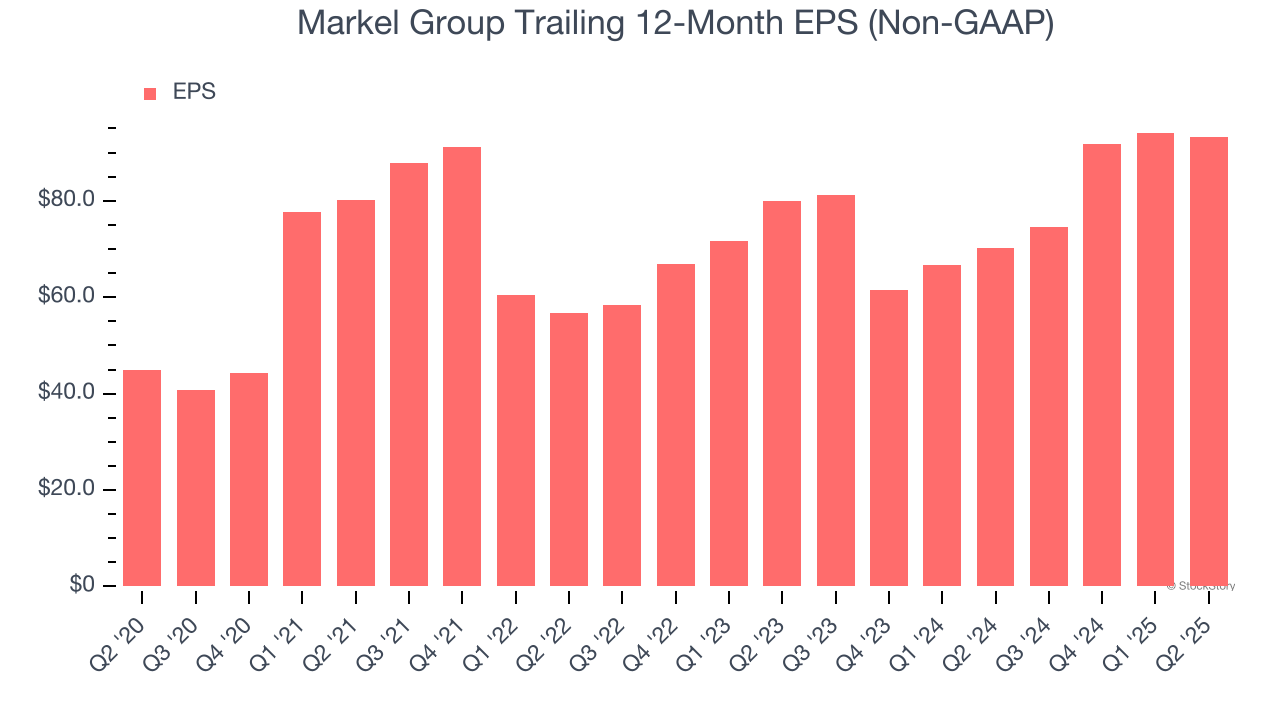

3. Recent EPS Growth Below Our Standards

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Markel Group’s EPS grew at a weak 8% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 4.5% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

Markel Group isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 1.4× forward P/B (or $1,928 per share). This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment. We’d suggest looking at one of our top software and edge computing picks.

Stocks We Like More Than Markel Group

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.