Over the last six months, Columbia Banking System’s shares have sunk to $25.88, producing a disappointing 7% loss - a stark contrast to the S&P 500’s 5.2% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Columbia Banking System, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Columbia Banking System Not Exciting?

Even with the cheaper entry price, we don't have much confidence in Columbia Banking System. Here are two reasons why you should be careful with COLB and a stock we'd rather own.

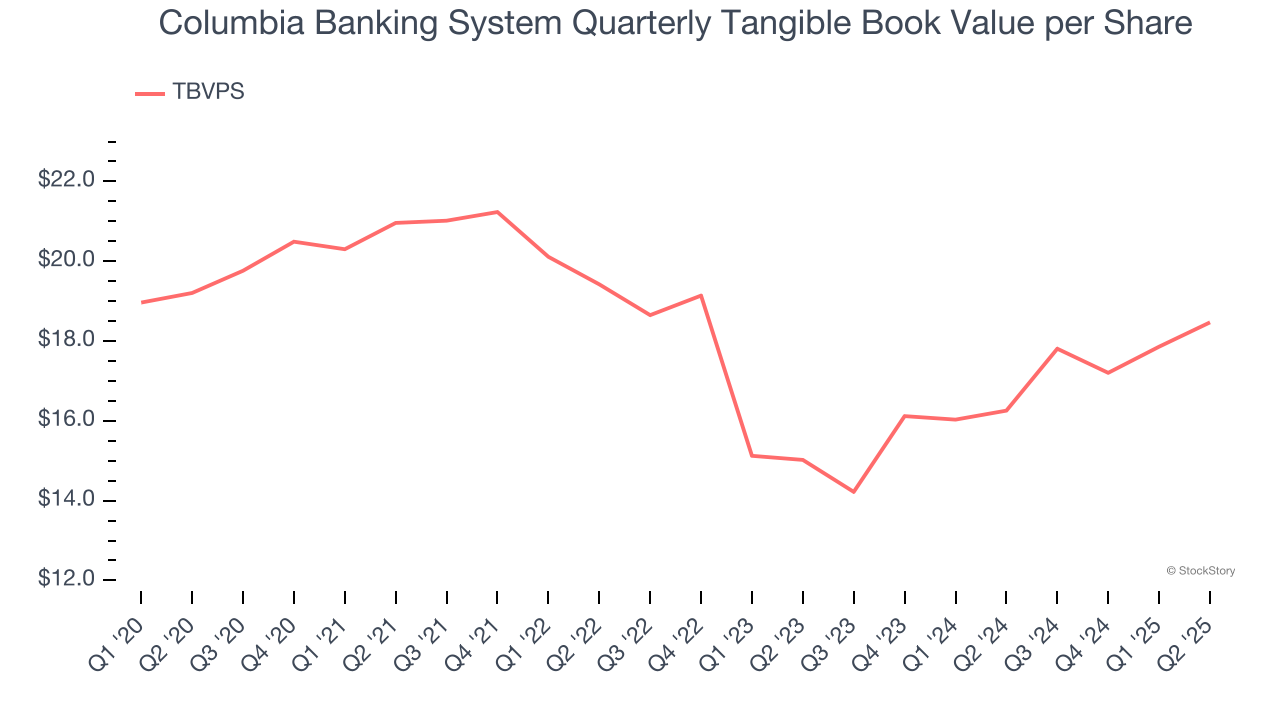

1. TBVPS Growth Demonstrates Strong Asset Foundation

Tangible book value per share (TBVPS) serves as a key indicator of a bank’s financial strength, representing the hard assets available to shareholders after removing intangible assets that could evaporate during financial distress.

Although Columbia Banking System’s TBVPS was flat over the last five years. the good news is that its growth has recently accelerated as TBVPS grew at a decent 10.9% annual clip over the past two years (from $15.02 to $18.47 per share).

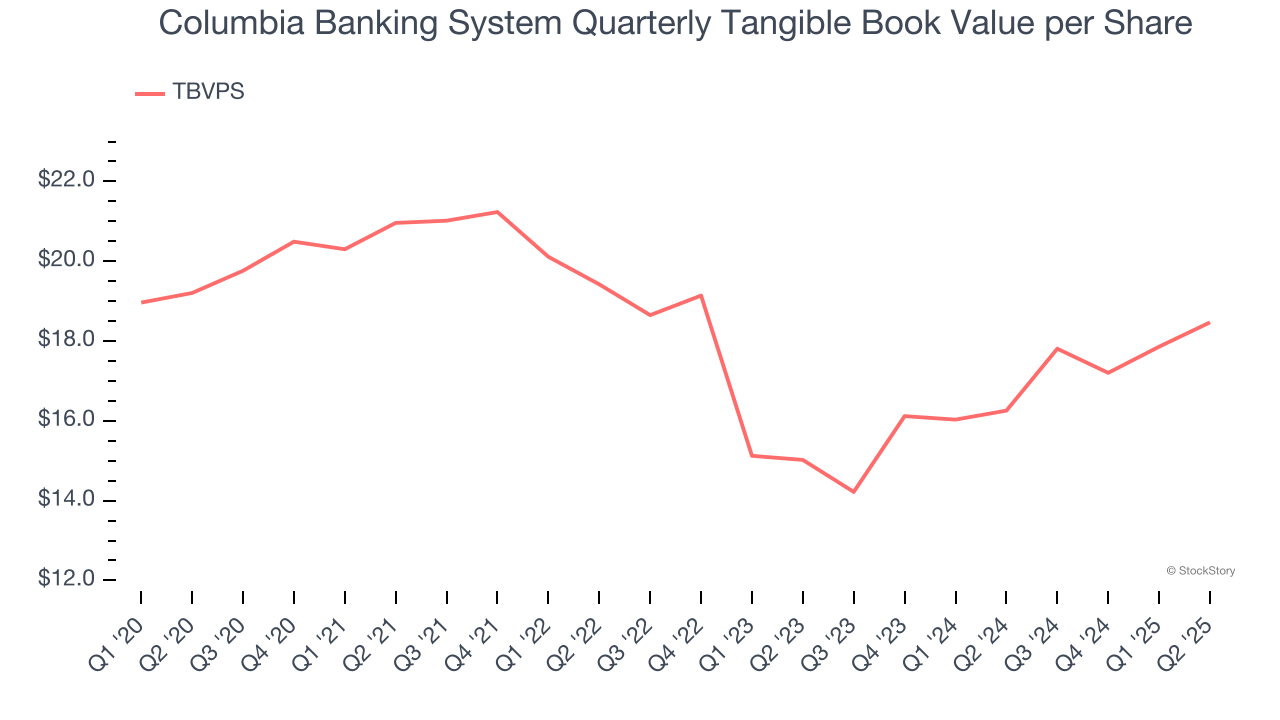

2. Projected TBVPS Growth Is Slim

The key to tangible book value per share (TBVPS) growth is a bank’s ability to earn consistent returns on its assets that exceed its funding costs and credit losses.

Over the next 12 months, Consensus estimates call for Columbia Banking System’s TBVPS to grow by 3.8% to $19.17, paltry growth rate.

Final Judgment

Columbia Banking System isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 1× forward P/B (or $25.88 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Like More Than Columbia Banking System

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.