Looking back on broadcasting stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including E.W. Scripps (NASDAQ: SSP) and its peers.

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

The 7 broadcasting stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.5% while next quarter’s revenue guidance was in line.

Luckily, broadcasting stocks have performed well with share prices up 18.6% on average since the latest earnings results.

E.W. Scripps (NASDAQ: SSP)

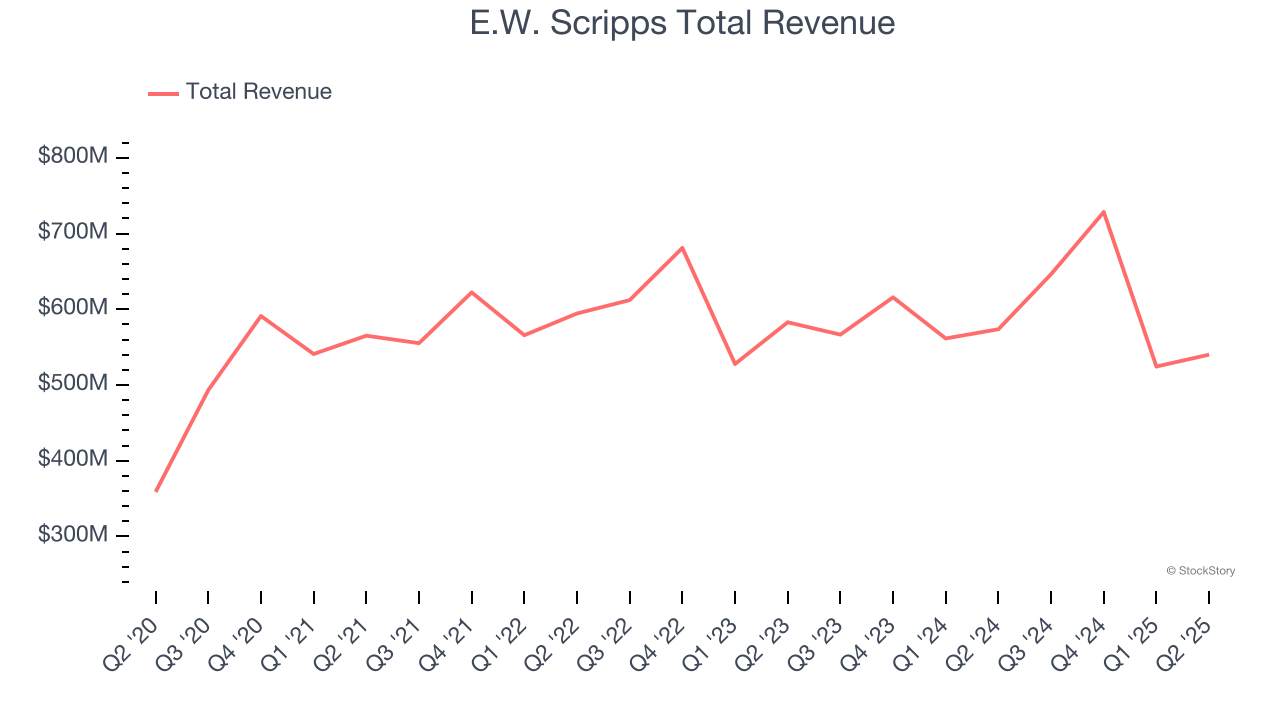

Founded as a chain of daily newspapers, E.W. Scripps (NASDAQ: SSP) is a diversified media enterprise operating a range of local television stations, national networks, and digital media platforms.

E.W. Scripps reported revenues of $540.1 million, down 5.8% year on year. This print fell short of analysts’ expectations by 0.8%. Overall, it was a mixed quarter for the company with a solid beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ EPS estimates.

E.W. Scripps delivered the weakest performance against analyst estimates of the whole group. Interestingly, the stock is up 5.5% since reporting and currently trades at $2.97.

Is now the time to buy E.W. Scripps? Access our full analysis of the earnings results here, it’s free.

Best Q2: FOX (NASDAQ: FOXA)

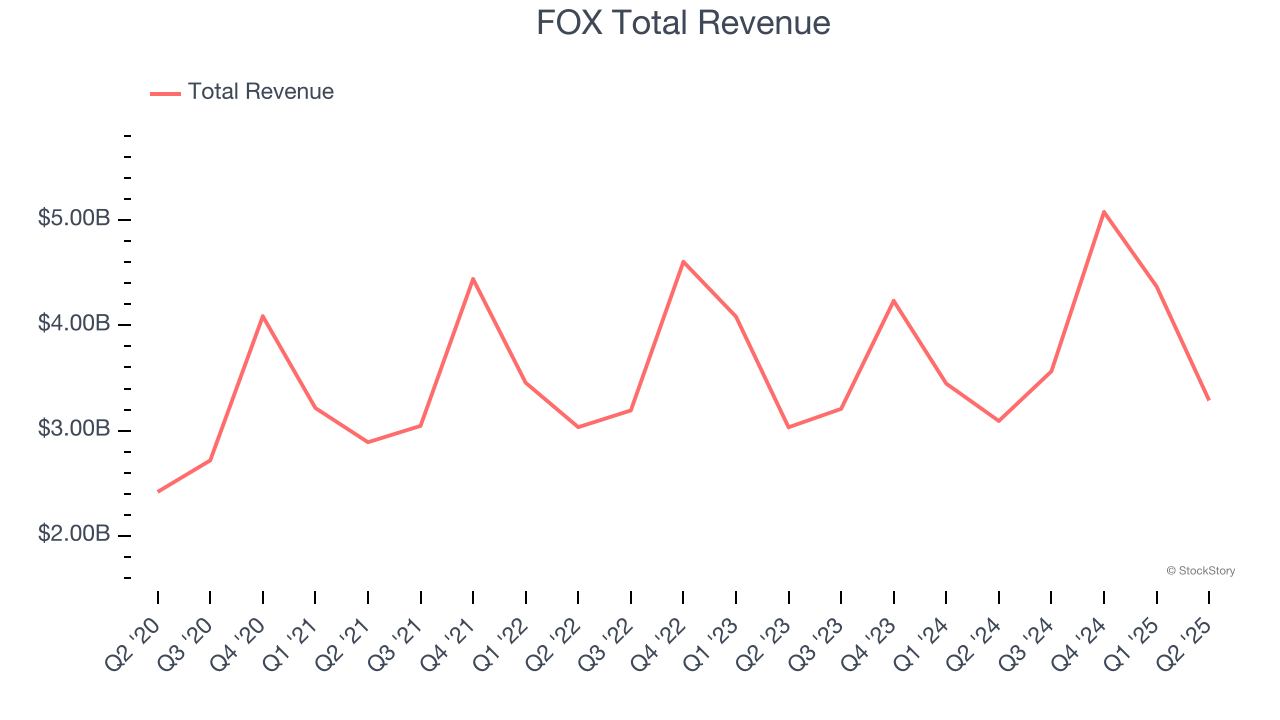

Founded in 1915, Fox (NASDAQ: FOXA) is a diversified media company, operating prominent cable news, television broadcasting, and digital media platforms.

FOX reported revenues of $3.29 billion, up 6.3% year on year, outperforming analysts’ expectations by 5.5%. The business had a stunning quarter with a solid beat of analysts’ adjusted operating income and EPS estimates.

FOX delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems content with the results as the stock is up 3.6% since reporting. It currently trades at $59.12.

Is now the time to buy FOX? Access our full analysis of the earnings results here, it’s free.

iHeartMedia (NASDAQ: IHRT)

Occasionally featuring celebrity hosts like Ryan Seacrest on its shows, iHeartMedia (NASDAQ: IHRT) is a leading multimedia company renowned for its extensive network of radio stations, digital platforms, and live events across the globe.

iHeartMedia reported revenues of $933.7 million, flat year on year, exceeding analysts’ expectations by 2.4%. Still, it was a slower quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Interestingly, the stock is up 43.7% since the results and currently trades at $2.30.

Read our full analysis of iHeartMedia’s results here.

AMC Networks (NASDAQ: AMCX)

Originally the joint-venture of four cable television companies, AMC Networks (NASDAQ: AMCX) is a broadcaster producing a diverse range of television shows and movies.

AMC Networks reported revenues of $600 million, down 4.1% year on year. This result topped analysts’ expectations by 3%. It was an exceptional quarter as it also logged an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ EBITDA estimates.

The stock is up 20.7% since reporting and currently trades at $7.24.

Read our full, actionable report on AMC Networks here, it’s free.

Paramount (NASDAQ: PARA)

Owner of Spongebob Squarepants and formerly known as ViacomCBS, Paramount Global (NASDAQ: PARA) is a major media conglomerate offering television, film production, and digital content across various global platforms.

Paramount reported revenues of $6.85 billion, flat year on year. This number was in line with analysts’ expectations. Overall, it was a very strong quarter as it also recorded a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 12.1% since reporting and currently trades at $11.04.

Read our full, actionable report on Paramount here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.