As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at education services stocks, starting with Perdoceo Education (NASDAQ: PRDO).

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

The 8 education services stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1.7% on average since the latest earnings results.

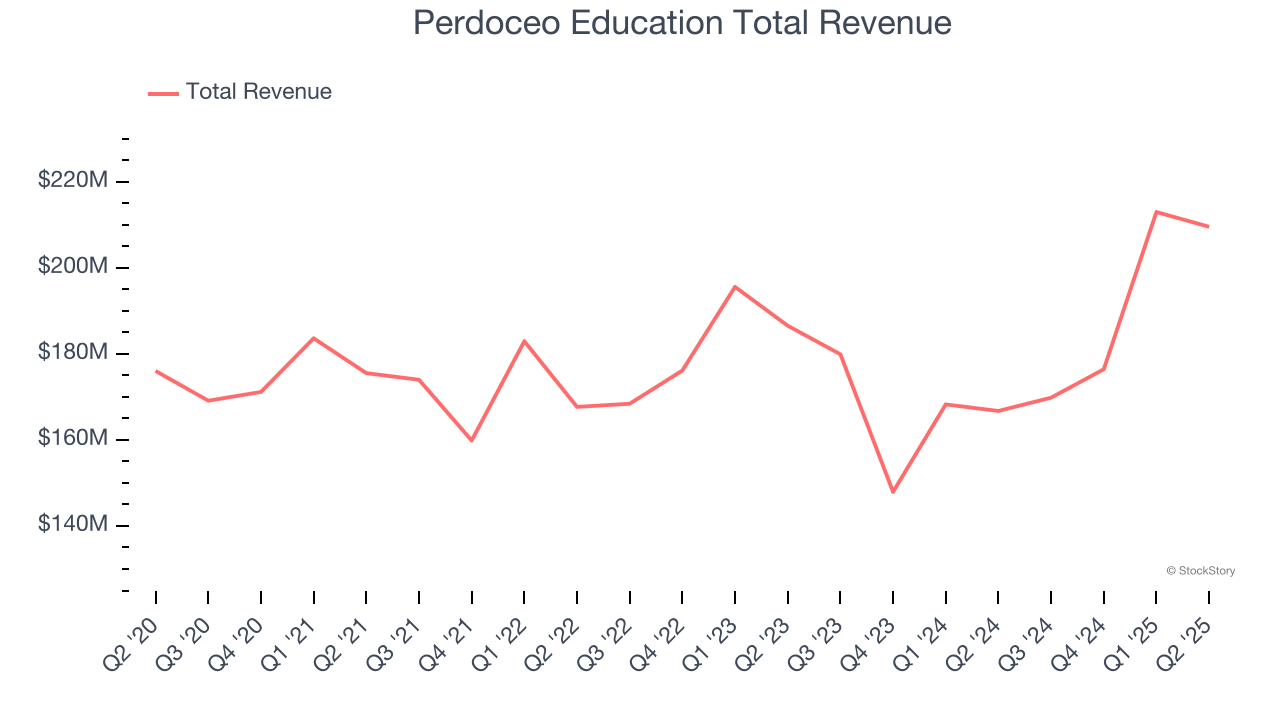

Perdoceo Education (NASDAQ: PRDO)

Formerly known as Career Education Corporation, Perdoceo Education (NASDAQ: PRDO) is an educational services company that specializes in postsecondary education.

Perdoceo Education reported revenues of $209.6 million, up 25.7% year on year. This print exceeded analysts’ expectations by 1.3%. Overall, it was a satisfactory quarter for the company with a decent beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations.

Perdoceo Education achieved the fastest revenue growth of the whole group. Unsurprisingly, the stock is up 11.3% since reporting and currently trades at $32.09.

Is now the time to buy Perdoceo Education? Access our full analysis of the earnings results here, it’s free.

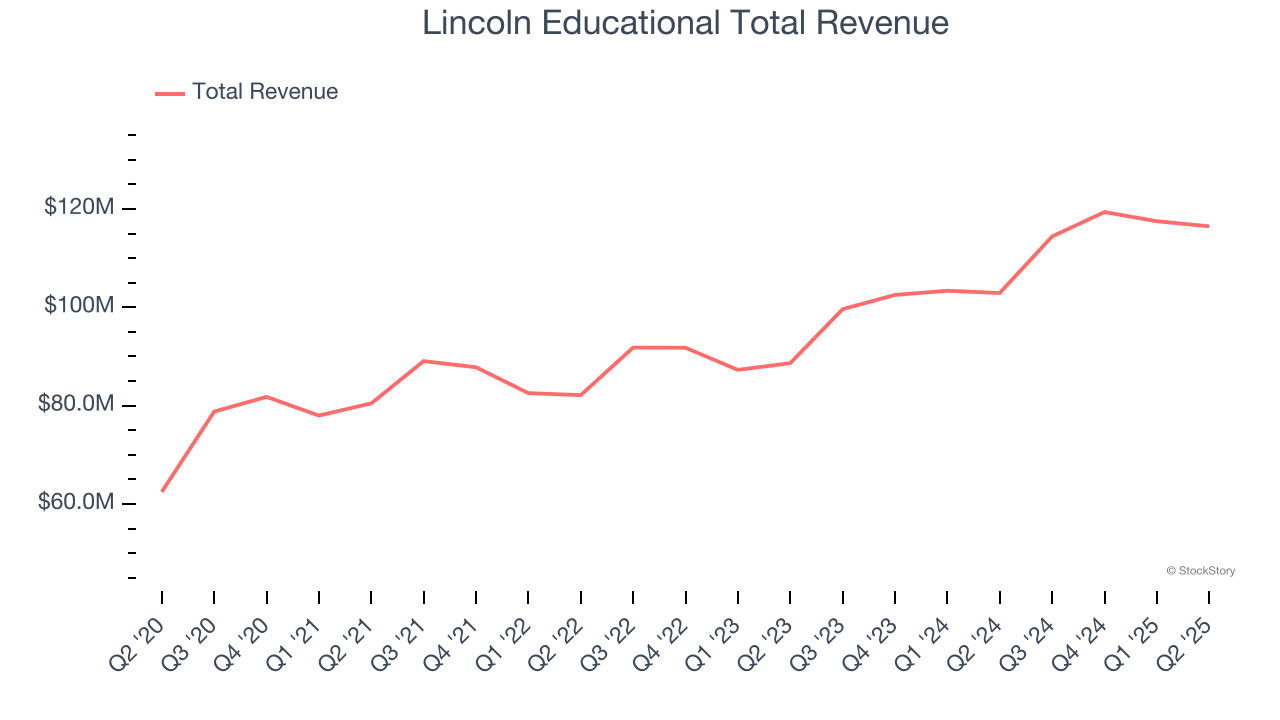

Best Q2: Lincoln Educational (NASDAQ: LINC)

Established in 1946, Lincoln Educational (NASDAQ: LINC) is a provider of specialized technical training in the United States, offering career-oriented programs to provide practical skills required in the workforce.

Lincoln Educational reported revenues of $116.5 million, up 13.2% year on year, outperforming analysts’ expectations by 0.5%. The business had a very strong quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 16.8% since reporting. It currently trades at $19.74.

Is now the time to buy Lincoln Educational? Access our full analysis of the earnings results here, it’s free.

Strategic Education (NASDAQ: STRA)

Formed through the merger of Strayer Education and Capella Education in 2018, Strategic Education (NASDAQ: STRA) is a career-focused higher education provider.

Strategic Education reported revenues of $321.5 million, up 2.9% year on year, falling short of analysts’ expectations by 0.6%. Still, it was a satisfactory quarter as it posted a decent beat of analysts’ EBITDA estimates.

Strategic Education delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is flat since the results and currently trades at $78.76.

Read our full analysis of Strategic Education’s results here.

Universal Technical Institute (NYSE: UTI)

Founded in 1965, Universal Technical Institute (NYSE: UTI) is a leading provider of technical training programs, specializing in automotive, diesel, collision repair, motorcycle, and marine technicians.

Universal Technical Institute reported revenues of $204.3 million, up 15.1% year on year. This print beat analysts’ expectations by 2%. It was a very strong quarter as it also logged a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

Universal Technical Institute had the weakest full-year guidance update among its peers. The stock is down 23.1% since reporting and currently trades at $25.70.

Read our full, actionable report on Universal Technical Institute here, it’s free.

Adtalem (NYSE: ATGE)

Formerly known as DeVry Education Group, Adtalem Global Education (NYSE: ATGE) is a global provider of workforce solutions and educational services.

Adtalem reported revenues of $457.1 million, up 11.5% year on year. This number surpassed analysts’ expectations by 4%. Overall, it was a strong quarter as it also produced full-year revenue guidance beating analysts’ expectations and full-year EPS guidance topping analysts’ expectations.

Adtalem delivered the biggest analyst estimates beat among its peers. The stock is up 8.3% since reporting and currently trades at $129.19.

Read our full, actionable report on Adtalem here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.