As the Q1 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the large-format grocery & general merchandise retailer industry, including Target (NYSE: TGT) and its peers.

Big-box retailers operate large stores that sell groceries and general merchandise at highly competitive prices. Because of their scale and resulting purchasing power, these big-box retailers–with annual sales in the tens to hundreds of billions of dollars–are able to get attractive volume discounts and sell at often the lowest prices. While e-commerce is a threat, these retailers have been able to weather the storm by either providing a unique in-store shopping experience or by reinvesting their hefty profits into omnichannel investments.

The 4 large-format grocery & general merchandise retailer stocks we track reported a mixed Q1. As a group, revenues missed analysts’ consensus estimates by 0.7% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Weakest Q1: Target (NYSE: TGT)

With a higher focus on style and aesthetics compared to other large general merchandise retailers, Target (NYSE: TGT) serves the suburban consumer who is looking for a wide range of products under one roof.

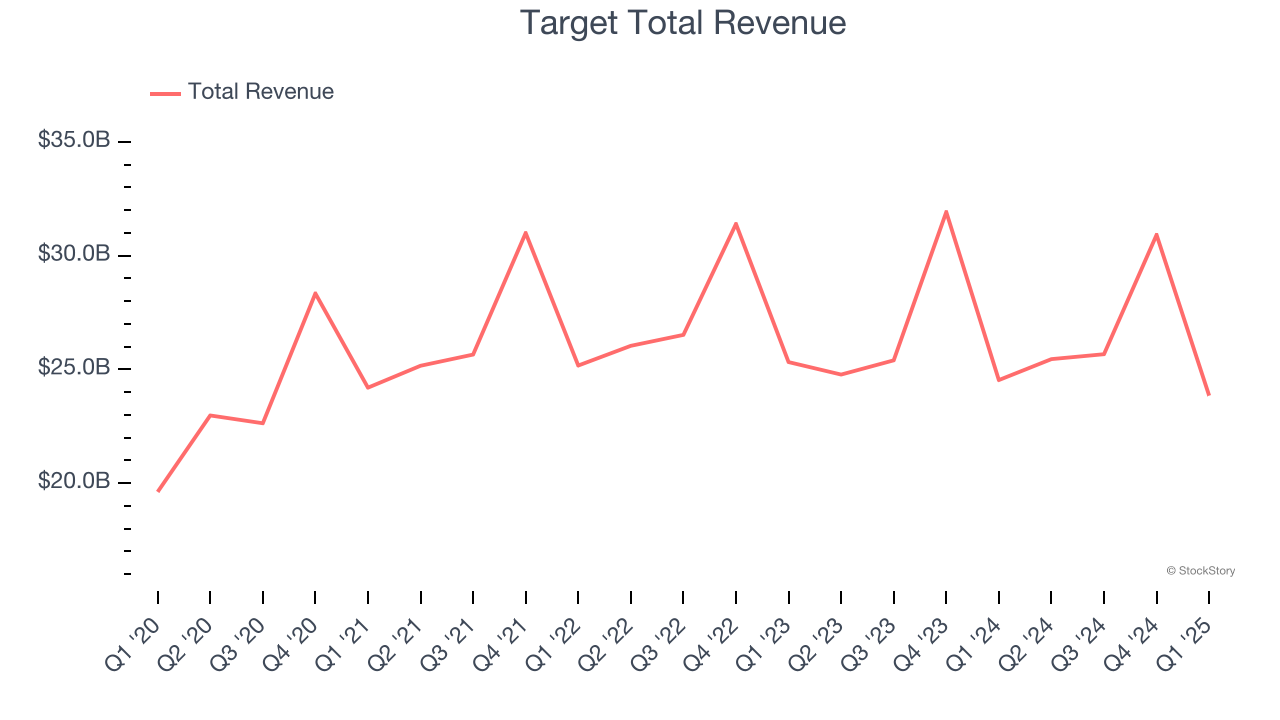

Target reported revenues of $23.85 billion, down 2.8% year on year. This print fell short of analysts’ expectations by 2%. Overall, it was a disappointing quarter for the company with full-year EPS guidance missing analysts’ expectations and a significant miss of analysts’ EBITDA estimates.

"In the first quarter, our team navigated a highly challenging environment and focused on delivering the outstanding assortment, experience and value guests expect from Target," said Brian Cornell, chair and chief executive officer of Target Corporation.

Target delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Interestingly, the stock is up 6% since reporting and currently trades at $104.10.

Read our full report on Target here, it’s free.

Best Q1: BJ's (NYSE: BJ)

Appealing to the budget-conscious individual shopping for a household, BJ’s Wholesale Club (NYSE: BJ) is a membership-only retail chain that sells groceries, appliances, electronics, and household items, often in bulk quantities.

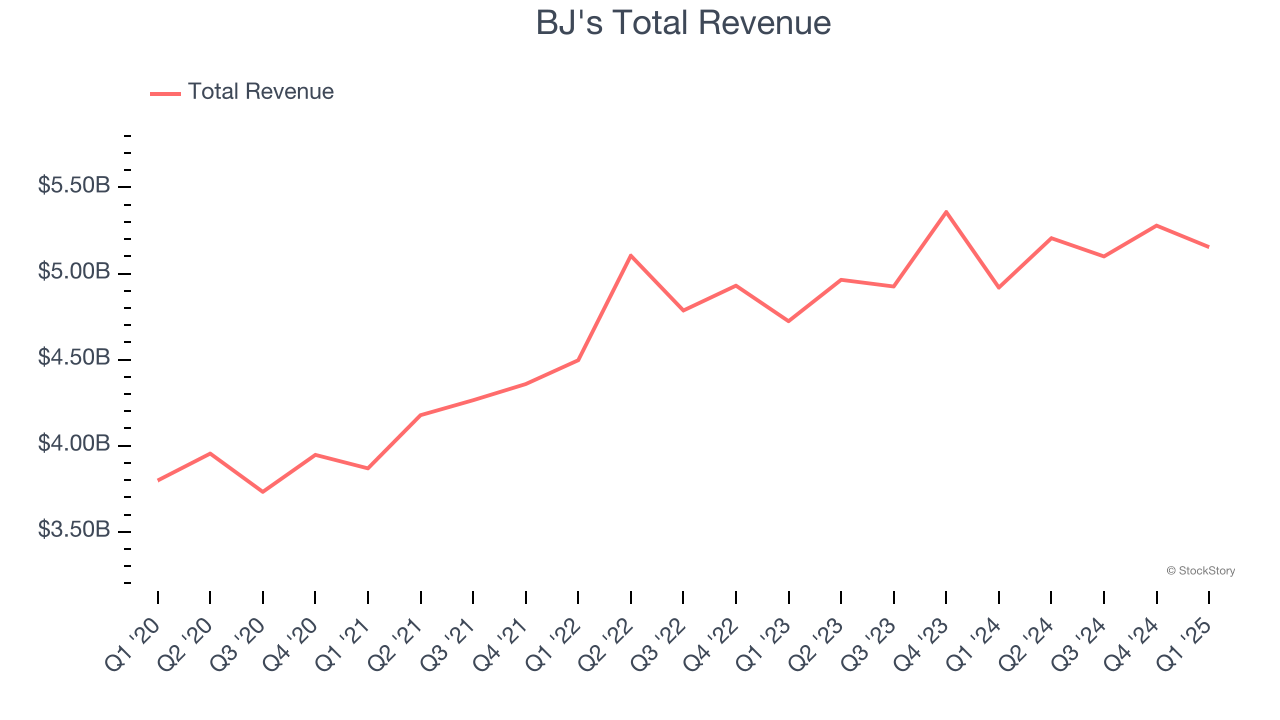

BJ's reported revenues of $5.15 billion, up 4.8% year on year, falling short of analysts’ expectations by 0.6%. However, the business still had a strong quarter with a solid beat of analysts’ EBITDA and EPS estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 8.5% since reporting. It currently trades at $107.44.

Is now the time to buy BJ's? Access our full analysis of the earnings results here, it’s free.

Walmart (NYSE: WMT)

Known for its large-format Supercenters, Walmart (NYSE: WMT) is a retail pioneer that serves a budget-conscious consumer who is looking for a wide range of products under one roof.

Walmart reported revenues of $165.6 billion, up 2.5% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted a solid beat of analysts’ gross margin estimates but full-year EPS guidance missing analysts’ expectations.

Interestingly, the stock is up 7.3% since the results and currently trades at $103.87.

Read our full analysis of Walmart’s results here.

Costco (NASDAQ: COST)

Designed to be a one-stop shop for the suburban consumer, Costco (NASDAQ: COST) is a membership-only retail chain that sells groceries, apparel, toys, and household items, often in bulk quantities.

Costco reported revenues of $63.21 billion, up 8% year on year. This result met analysts’ expectations. It was a satisfactory quarter as it also produced an impressive beat of analysts’ gross margin estimates.

Costco scored the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is down 1.9% since reporting and currently trades at $988.48.

Read our full, actionable report on Costco here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.