Over the past six months, Prosperity Bancshares’s stock price fell to $66.55. Shareholders have lost 16.8% of their capital, which is disappointing considering the S&P 500 has climbed by 5.4%. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Prosperity Bancshares, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Prosperity Bancshares Not Exciting?

Even with the cheaper entry price, we're swiping left on Prosperity Bancshares for now. Here are three reasons why there are better opportunities than PB and a stock we'd rather own.

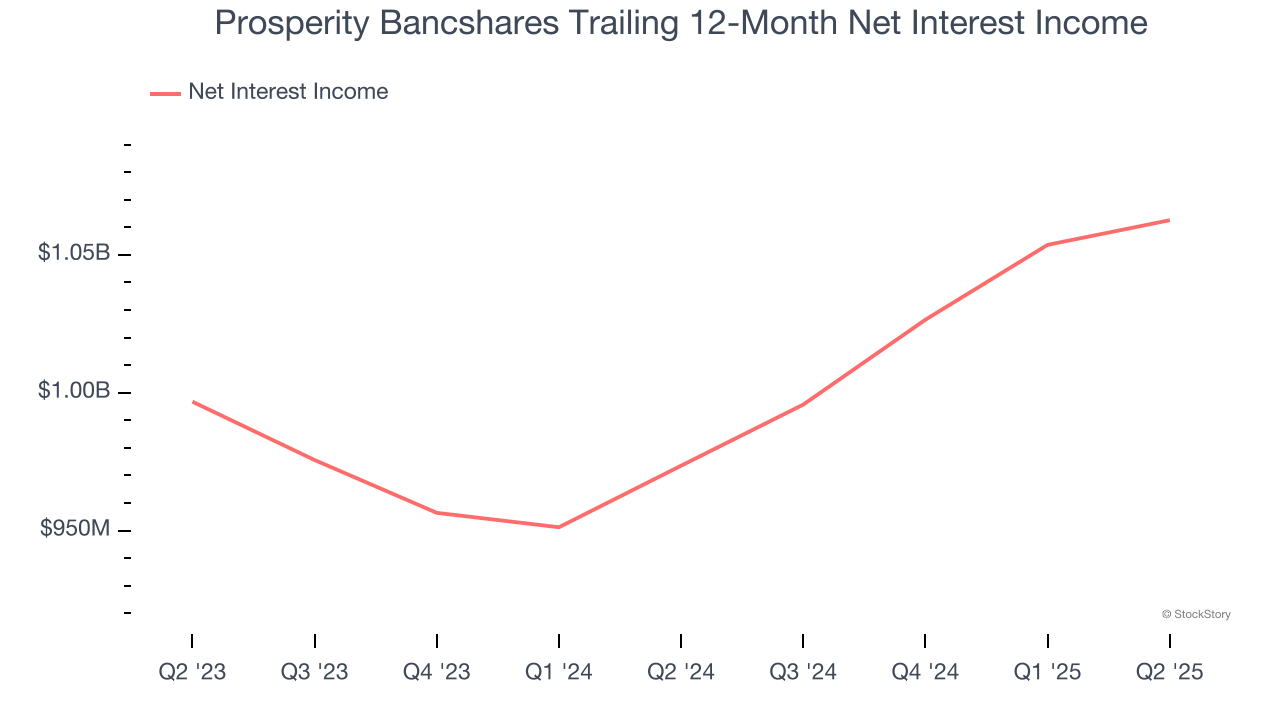

1. Net Interest Income Hits a Plateau

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

Prosperity Bancshares’s net interest income was flat over the last five years, much worse than the broader bank industry. This shows that lending underperformed its other business lines. This was driven by an increasing loan book and falling net interest margin, which represents how much a bank earns in relation to its outstanding loans.

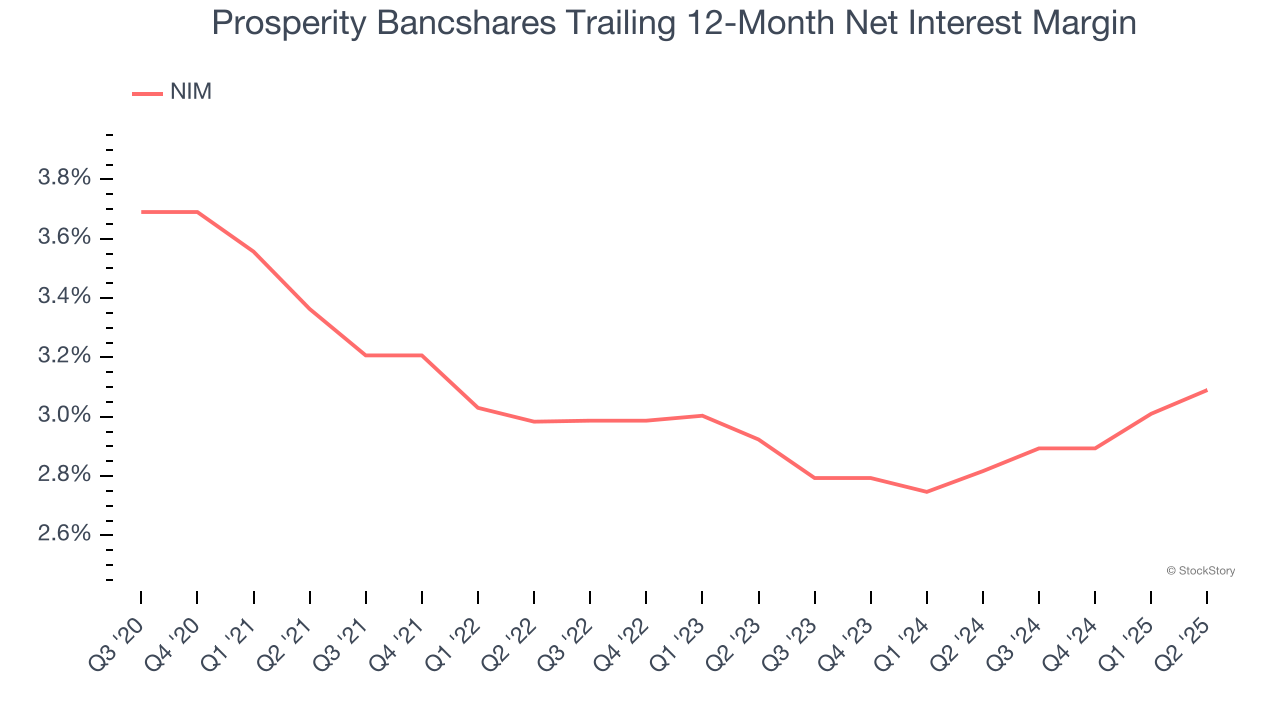

2. Low Net Interest Margin Reveals Weak Loan Book Profitability

The net interest margin (NIM) is a key profitability indicator that measures the difference between what a bank earns on its loans and what it pays on its deposits. This metric measures how efficiently one can generate income from its core lending activities.

Over the past two years, we can see that Prosperity Bancshares’s net interest margin averaged a weak 3%, indicating the company has weak loan book economics.

3. High Interest Expenses Increase Risk

Leverage is core to the bank’s business model (loans funded by deposits) and to ensure their stability, regulators require certain levels of capital and liquidity, focusing on a bank’s Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a bank holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all banks must maintain a Tier 1 capital ratio greater than 4.5% On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, banks generally must maintain a 7-10% ratio at minimum.

Over the last two years, Prosperity Bancshares has averaged a Tier 1 capital ratio of 16%, which is considered unsafe in the event of a black swan or if macro or market conditions suddenly deteriorate. For this reason alone, we will be crossing it off our shopping list.

Final Judgment

Prosperity Bancshares isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 0.8× forward P/B (or $66.55 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2024 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.