Insurance giant Allstate (NYSE: ALL) will be reporting results this Wednesday after the bell. Here’s what to look for.

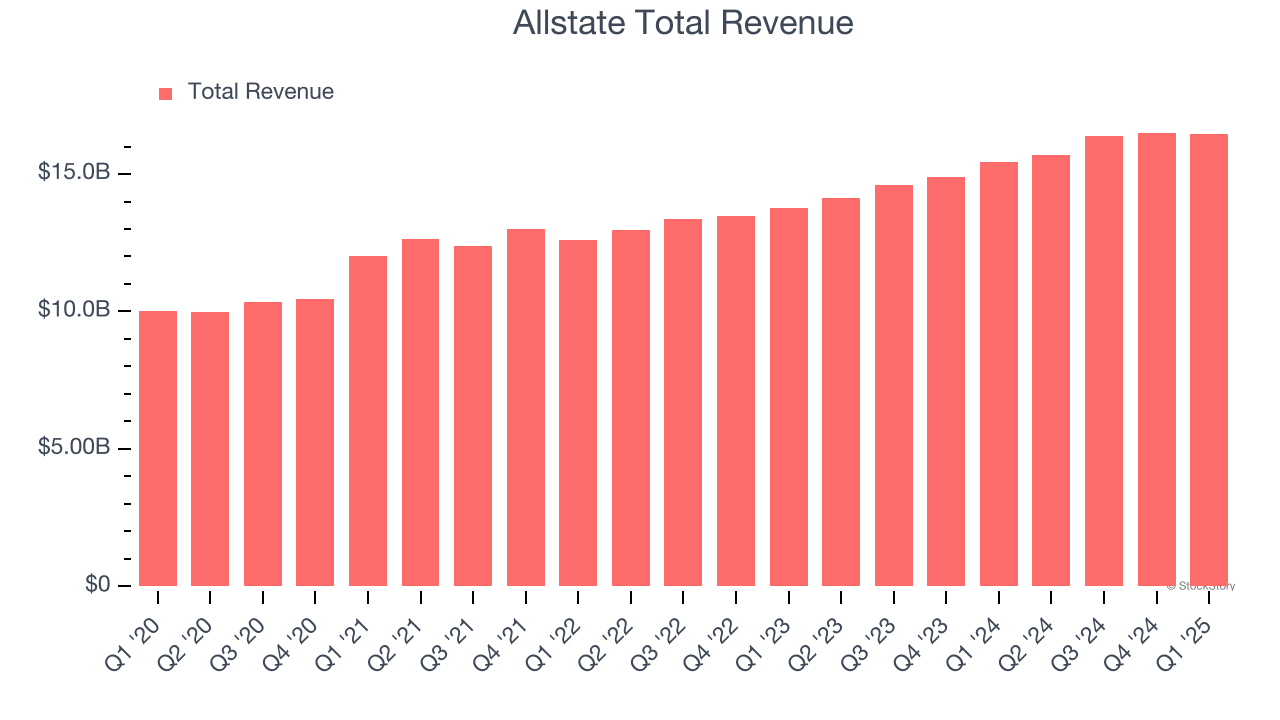

Allstate beat analysts’ revenue expectations by 0.6% last quarter, reporting revenues of $16.45 billion, up 6.7% year on year. It was a strong quarter for the company, with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ net premiums earned estimates.

Is Allstate a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Allstate’s revenue to grow 6.7% year on year to $16.74 billion, slowing from the 11.1% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $3.26 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Allstate has a history of exceeding Wall Street’s expectations, beating revenue estimates every single time over the past two years by 2% on average.

Looking at Allstate’s peers in the property & casualty insurance segment, some have already reported their Q2 results, giving us a hint as to what we can expect. Stewart Information Services delivered year-on-year revenue growth of 20.1%, beating analysts’ expectations by 9.2%, and First American Financial reported revenues up 14.2%, topping estimates by 4.9%. Stewart Information Services traded up 10.3% following the results while First American Financial was also up 3.5%.

Read our full analysis of Stewart Information Services’s results here and First American Financial’s results here.

The euphoria surrounding Trump’s November win lit a fire under major indices, but potential tariffs have caused the market to do a 180 in 2025. While some of the property & casualty insurance stocks have shown solid performance in this choppy environment, the group has generally underperformed, with share prices down 4.3% on average over the last month. Allstate is down 4.2% during the same time and is heading into earnings with an average analyst price target of $228.59 (compared to the current share price of $192.90).

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.