IonQ trades at $42.58 and has moved in lockstep with the market. Its shares have returned 7.7% over the last six months while the S&P 500 has gained 5.8%.

Is IONQ a buy right now? Find out in our full research report, it’s free.

Why Are We Positive On IONQ?

Founded by quantum physics pioneers from the University of Maryland and Duke University in 2015, IonQ (NYSE: IONQ) develops quantum computers that process information using trapped ions to solve complex computational problems beyond the capabilities of traditional computers.

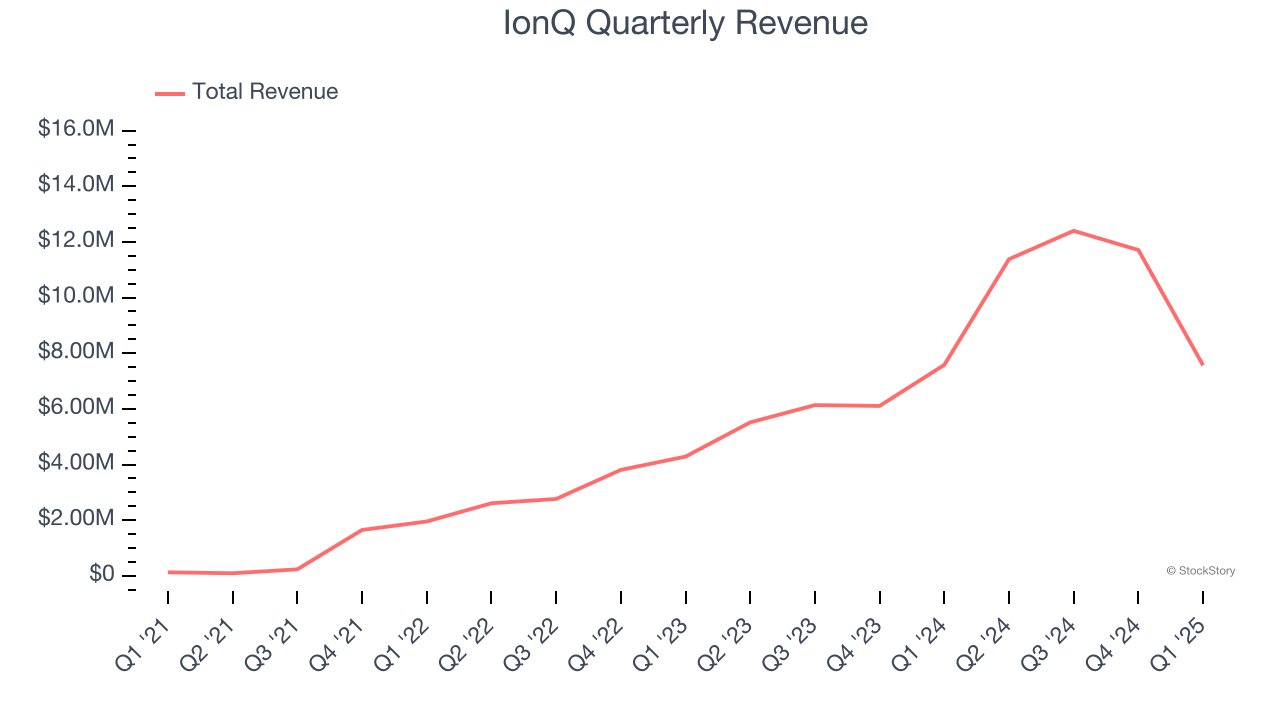

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, IonQ grew its sales at an incredible 318% compounded annual growth rate. Its growth beat the average business services company and shows its offerings resonate with customers.

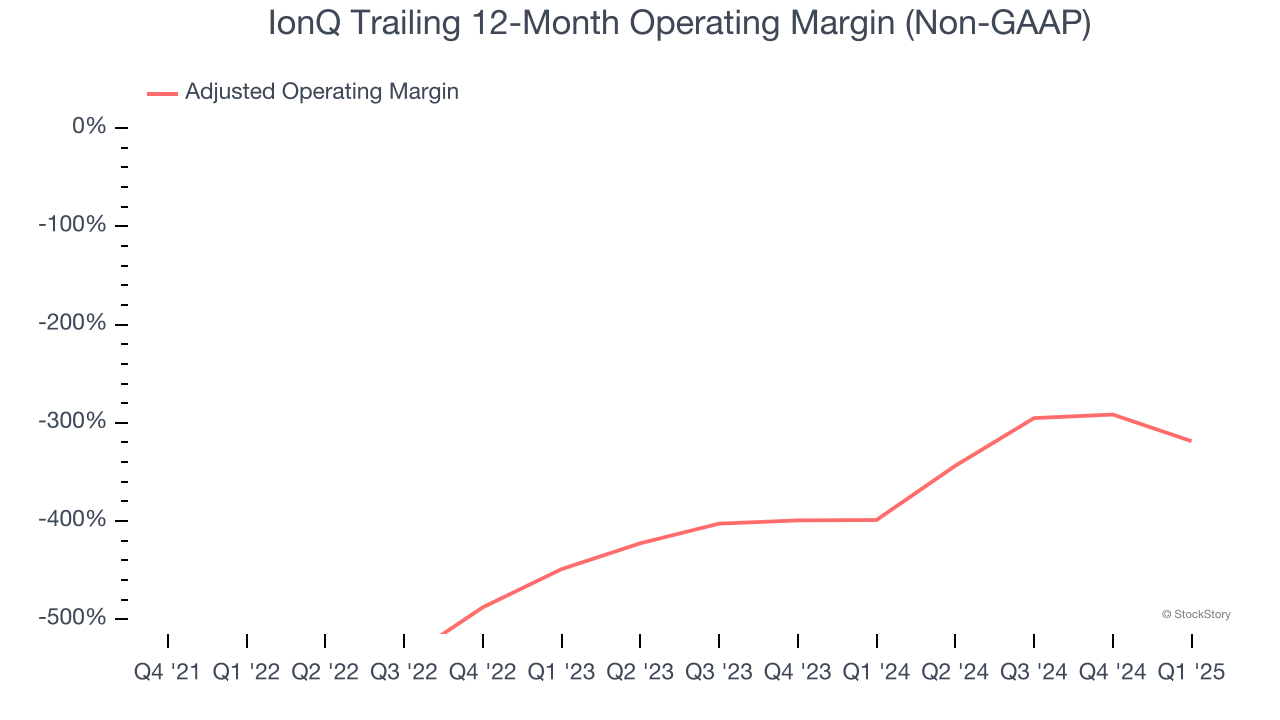

2. Adjusted Operating Margin Rising, Profits Up

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

IonQ’s adjusted operating margin rose over the last five years, as its sales growth gave it operating leverage. Although its adjusted operating margin for the trailing 12 months was negative 319%, we’re confident it can one day reach sustainable profitability.

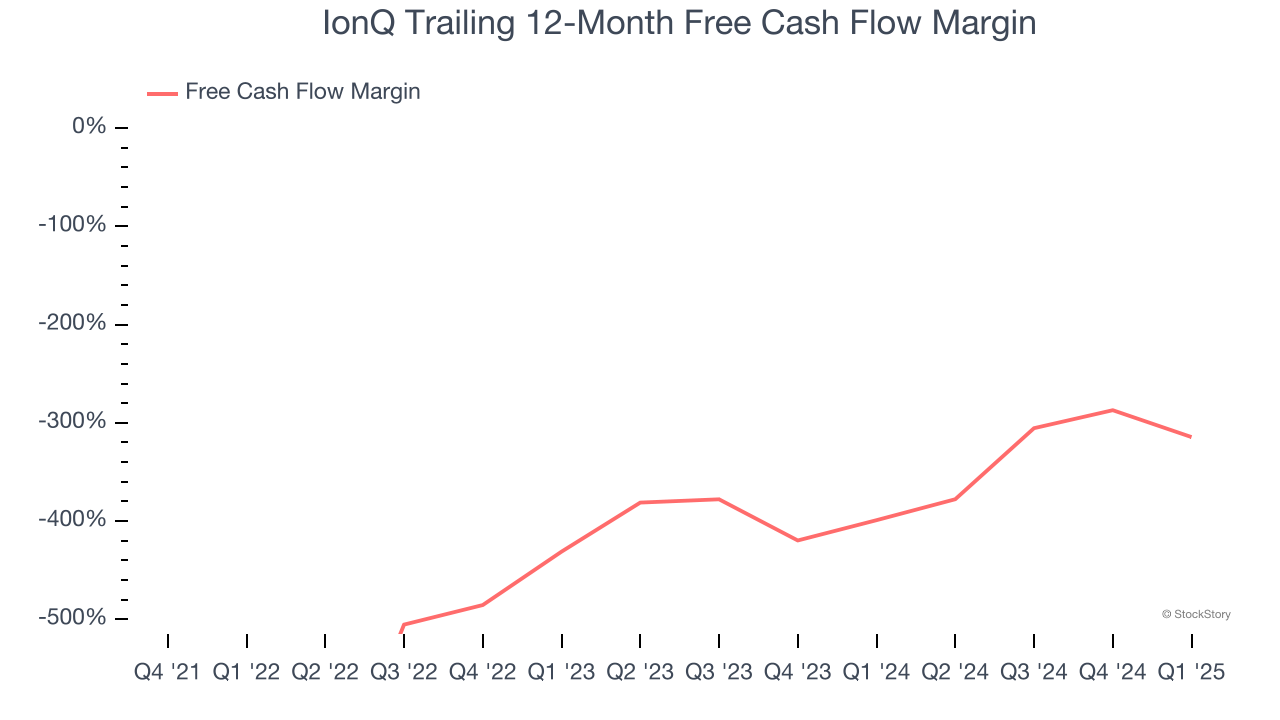

3. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, IonQ’s margin expanded over the last five years. IonQ’s free cash flow margin for the trailing 12 months was negative 314%, and continued increases could help it achieve long-term cash profitability.

Final Judgment

These are just a few reasons why IonQ is a cream-of-the-crop business services company, but at $42.58 per share (or a forward price-to-sales ratio of 94.7×), is now the right time to buy the stock? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than IonQ

When Trump unveiled his aggressive tariff plan in April 2025 markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.