Cable, internet, and telephone services provider Charter (NASDAQ: CHTR) met Wall Street’s revenue expectations in Q2 CY2025, but sales were flat year on year at $13.77 billion. Its GAAP profit of $9.18 per share was 5% below analysts’ consensus estimates.

Is now the time to buy Charter? Find out by accessing our full research report, it’s free.

Charter (CHTR) Q2 CY2025 Highlights:

- Revenue: $13.77 billion vs analyst estimates of $13.76 billion (flat year on year, in line)

- EPS (GAAP): $9.18 vs analyst expectations of $9.66 (5% miss)

- Adjusted EBITDA: $5.69 billion vs analyst estimates of $5.76 billion (41.4% margin, 1.2% miss)

- Operating Margin: 23.8%, in line with the same quarter last year

- Free Cash Flow Margin: 7.6%, down from 9.5% in the same quarter last year

- Internet Subscribers: 29.9 million, down 464,000 year on year

- Market Capitalization: $52.49 billion

"Our converged connectivity revenue grew by over 5% in the second quarter, with a long runway for growth," said Chris Winfrey, President and CEO of Charter.

Company Overview

Operating as Spectrum, Charter (NASDAQ: CHTR) is a leading telecommunications company offering cable television, high-speed internet, and voice services across the United States.

Revenue Growth

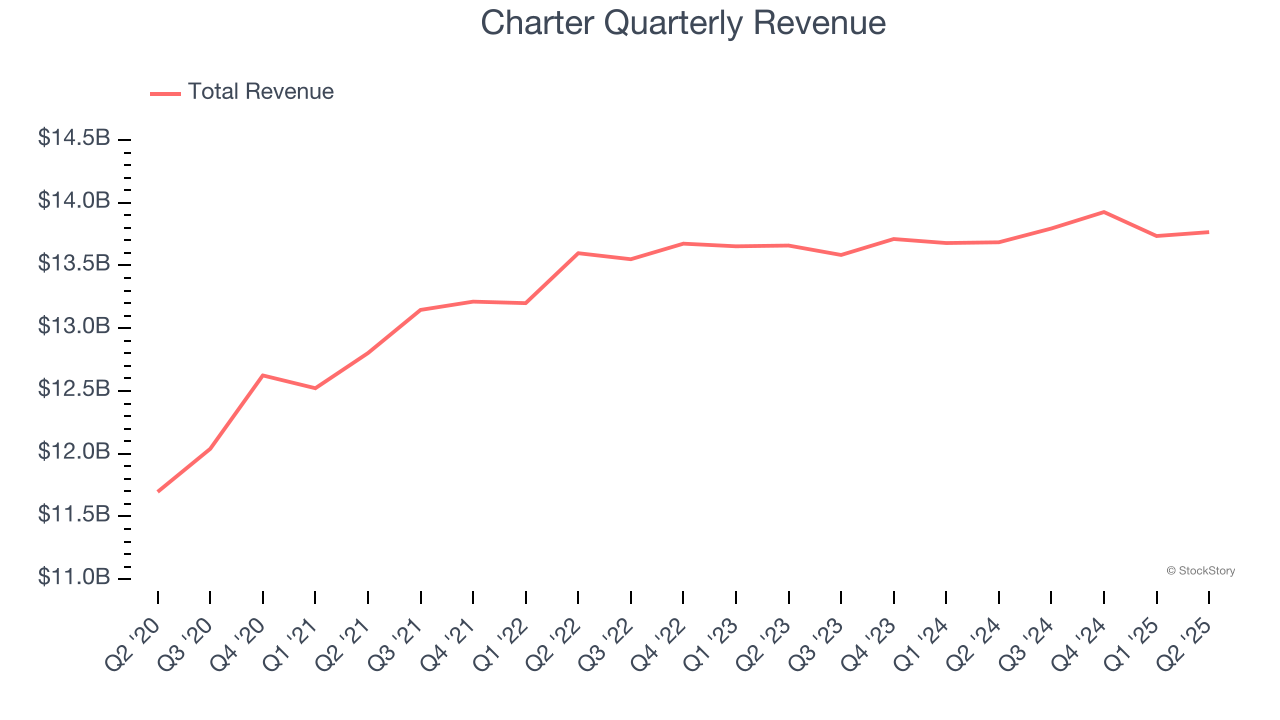

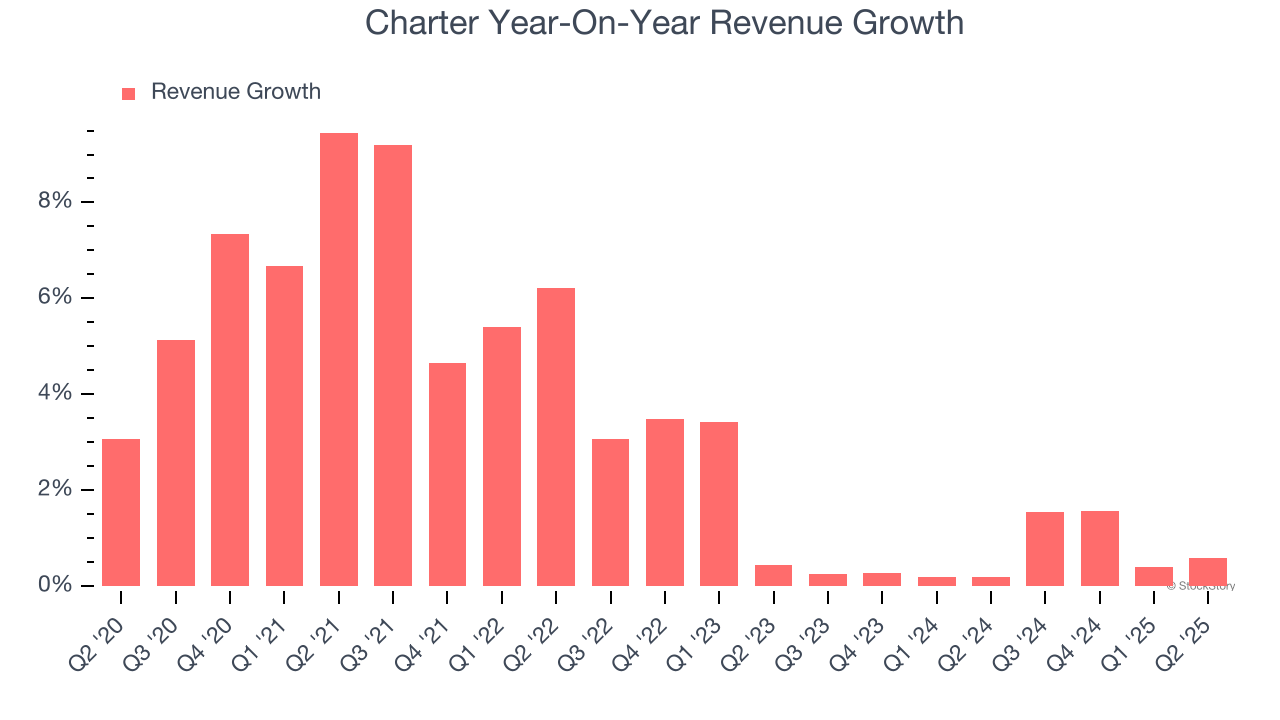

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Charter grew its sales at a sluggish 3.4% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Charter’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

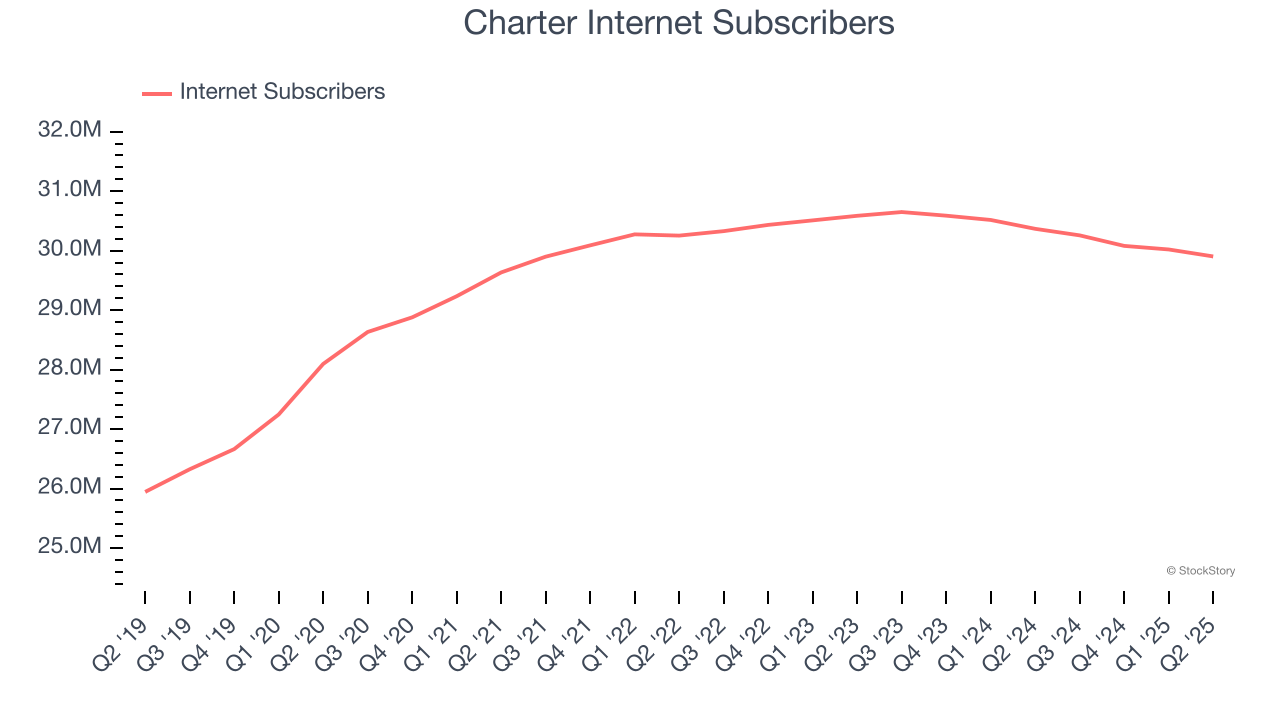

Charter also discloses its number of internet subscribers and video subscribers, which clocked in at 29.9 million and 12.63 million in the latest quarter. Over the last two years, Charter’s internet subscribers were flat while its video subscribers averaged 7.6% year-on-year declines.

This quarter, Charter’s $13.77 billion of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection is underwhelming and implies its newer products and services will not lead to better top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

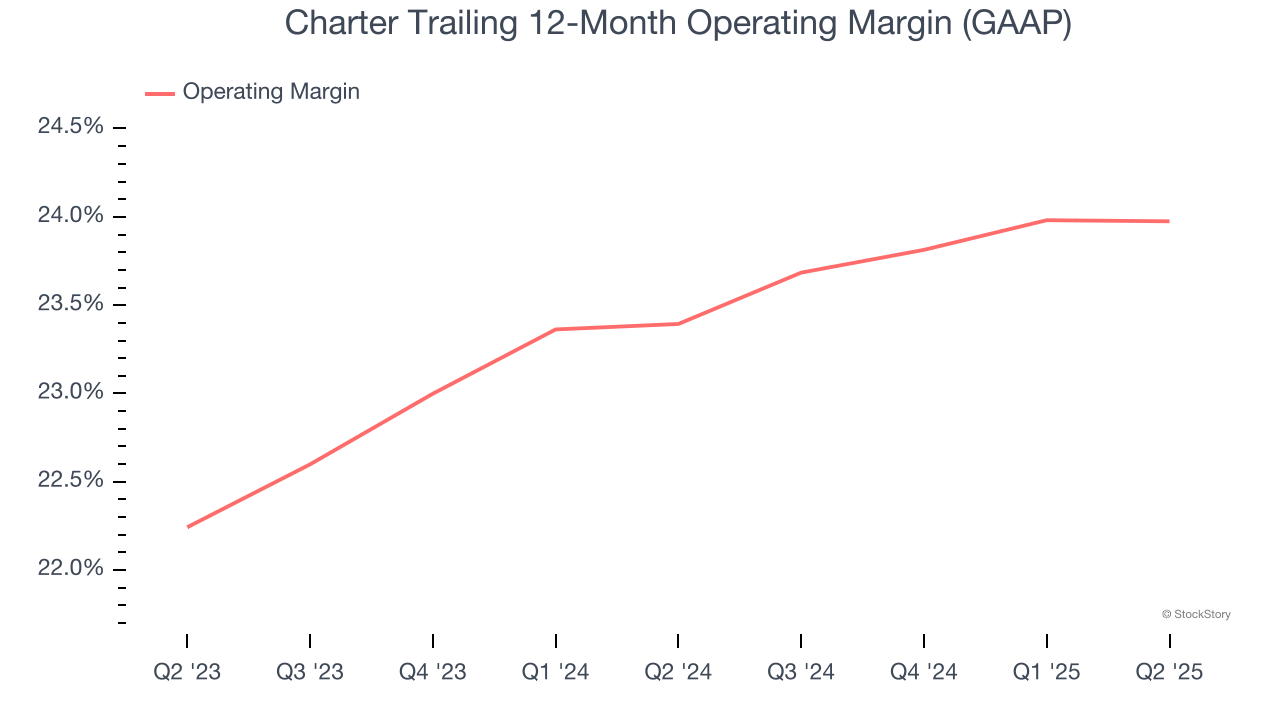

Operating Margin

Charter’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 23.7% over the last two years. This profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

This quarter, Charter generated an operating margin profit margin of 23.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

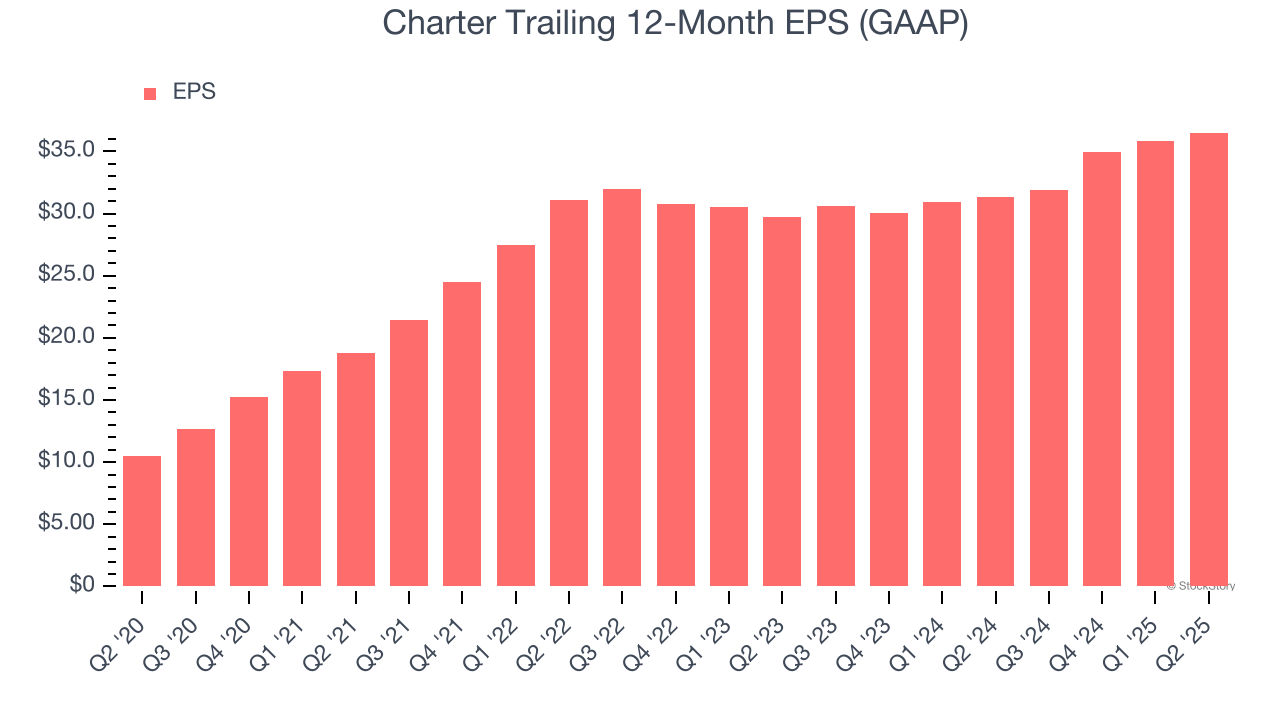

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Charter’s EPS grew at an astounding 28.3% compounded annual growth rate over the last five years, higher than its 3.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q2, Charter reported EPS at $9.18, up from $8.49 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Charter’s full-year EPS of $36.51 to grow 12.7%.

Key Takeaways from Charter’s Q2 Results

We struggled to find many positives in these results as its EPS and EBITDA missed. Overall, this quarter could have been better. The stock traded down 8.1% to $349 immediately following the results.

Charter’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.