Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Portillo's (NASDAQ: PTLO) and the best and worst performers in the traditional fast food industry.

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

The 14 traditional fast food stocks we track reported a slower Q1. As a group, revenues missed analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 4.5% on average since the latest earnings results.

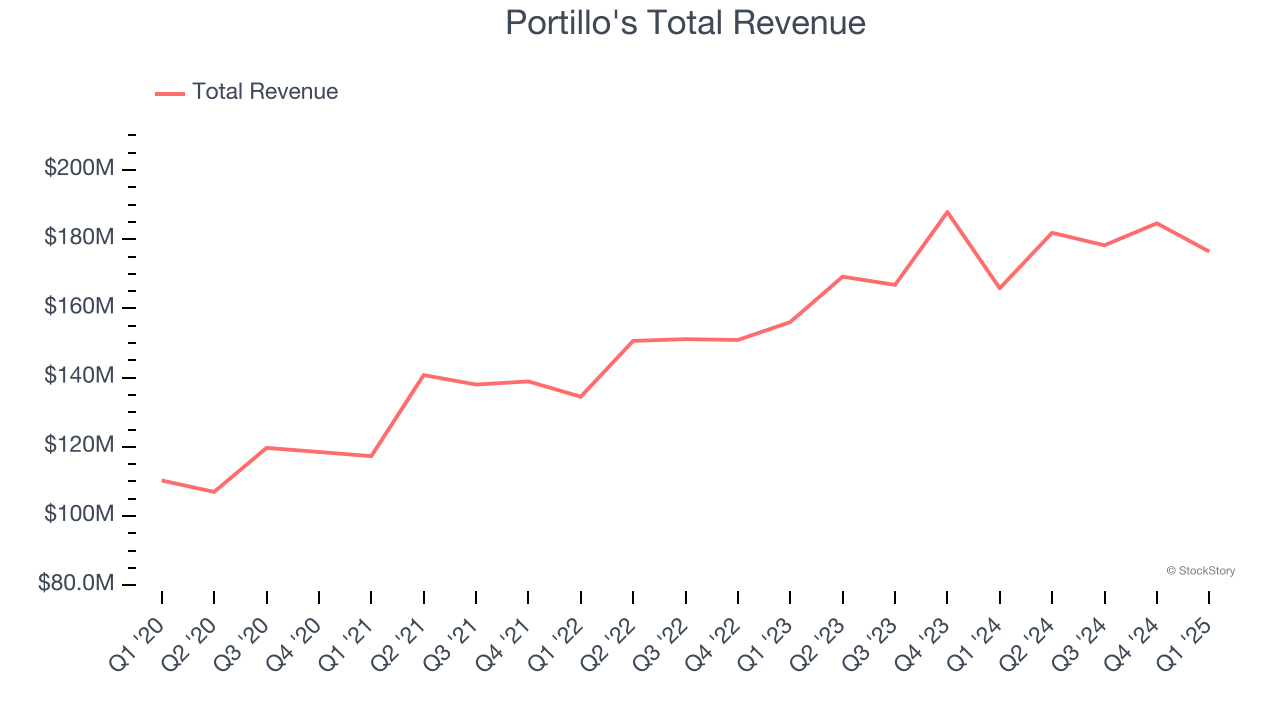

Portillo's (NASDAQ: PTLO)

Begun as a Chicago hot dog stand in 1963, Portillo’s (NASDAQ: PTLO) is a casual restaurant chain that serves Chicago-style hot dogs and beef sandwiches as well as fries and shakes.

Portillo's reported revenues of $176.4 million, up 6.4% year on year. This print fell short of analysts’ expectations by 2.4%. Overall, it was a mixed quarter for the company with a solid beat of analysts’ same-store sales estimates but a significant miss of analysts’ EBITDA estimates.

“We’re proud of how our team performed through challenging macro conditions in Q1, driven by the launch of Portillo’s Perks and our marketing efforts,” said Michael Osanloo, President and Chief Executive Officer of Portillo’s.

Interestingly, the stock is up 11.2% since reporting and currently trades at $11.56.

Read our full report on Portillo's here, it’s free.

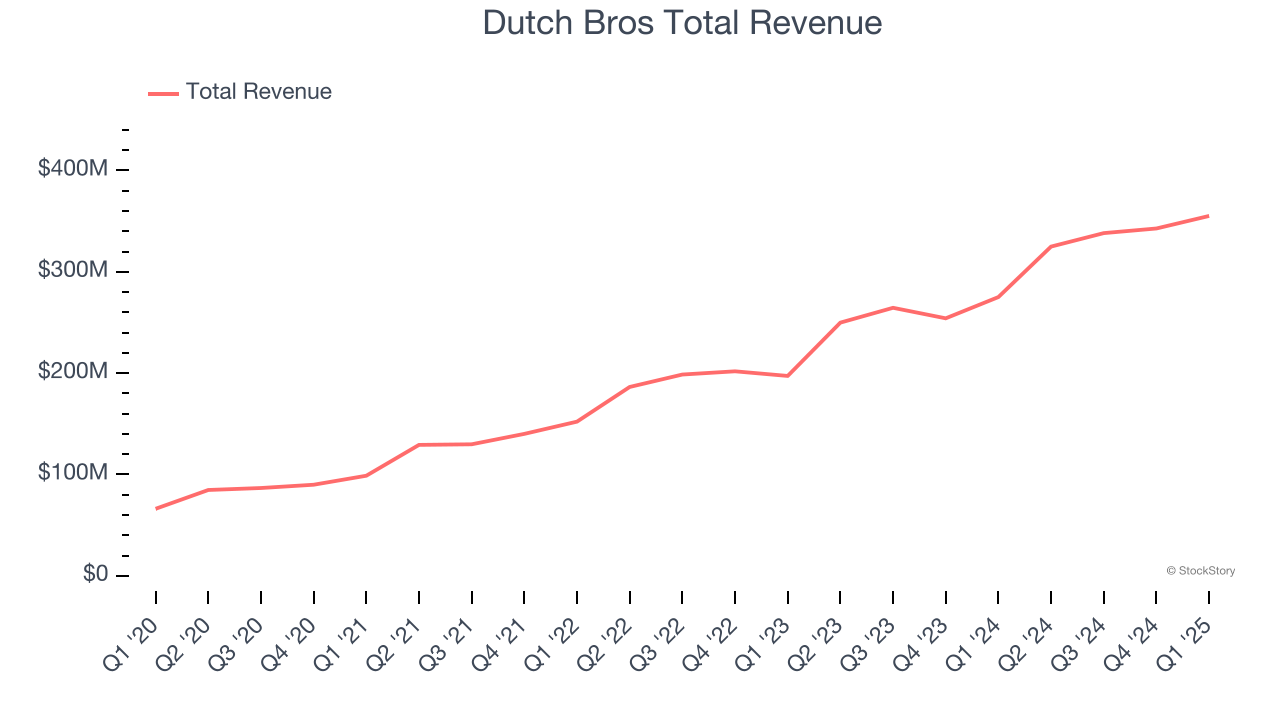

Best Q1: Dutch Bros (NYSE: BROS)

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE: BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Dutch Bros reported revenues of $355.2 million, up 29.1% year on year, outperforming analysts’ expectations by 3%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ EPS estimates.

Dutch Bros achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 6.3% since reporting. It currently trades at $62.83.

Is now the time to buy Dutch Bros? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Arcos Dorados (NYSE: ARCO)

Translating to “Golden Arches” in Spanish, Arcos Dorados (NYSE: ARCO) is the master franchisee of the McDonald's brand in Latin America and the Caribbean, responsible for its operations and growth in over 20 countries.

Arcos Dorados reported revenues of $1.08 billion, flat year on year, falling short of analysts’ expectations by 3.6%. It was a disappointing quarter as it posted a significant miss of analysts’ same-store sales estimates and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 11.2% since the results and currently trades at $7.25.

Read our full analysis of Arcos Dorados’s results here.

Papa John's (NASDAQ: PZZA)

Founded by the eclectic John “Papa John” Schnatter, Papa John’s (NASDAQ: PZZA) is a globally recognized pizza delivery and carryout chain known for “better ingredients” and “better pizza”.

Papa John's reported revenues of $518.3 million, flat year on year. This print surpassed analysts’ expectations by 0.6%. More broadly, it was a mixed quarter as it also recorded a narrow beat of analysts’ same-store sales estimates but a significant miss of analysts’ EBITDA estimates.

The stock is up 37.7% since reporting and currently trades at $45.90.

Read our full, actionable report on Papa John's here, it’s free.

Jack in the Box (NASDAQ: JACK)

Delighting customers since its inception in 1951, Jack in the Box (NASDAQ: JACK) is a distinctive fast-food chain known for its bold flavors, innovative menu items, and quirky marketing.

Jack in the Box reported revenues of $336.7 million, down 7.8% year on year. This number lagged analysts' expectations by 1.4%. Overall, it was a slower quarter as it also logged a slight miss of analysts’ same-store sales estimates.

The stock is down 2.6% since reporting and currently trades at $25.

Read our full, actionable report on Jack in the Box here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.