Gaming and hospitality company Boyd Gaming (NYSE: BYD) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 6.9% year on year to $1.03 billion. Its non-GAAP profit of $1.87 per share was 12.2% above analysts’ consensus estimates.

Is now the time to buy Boyd Gaming? Find out by accessing our full research report, it’s free.

Boyd Gaming (BYD) Q2 CY2025 Highlights:

- Revenue: $1.03 billion vs analyst estimates of $980.9 million (6.9% year-on-year growth, 5.4% beat)

- Adjusted EPS: $1.87 vs analyst estimates of $1.67 (12.2% beat)

- Adjusted EBITDA: $329.4 million vs analyst estimates of $315.5 million (31.9% margin, 4.4% beat)

- Operating Margin: 23.4%, in line with the same quarter last year

- Market Capitalization: $6.8 billion

Keith Smith, President and Chief Executive Officer of Boyd Gaming, said: "Our Company delivered a strong performance in the second quarter, with broad-based growth across our operating segments, including our Online and Managed segments. We achieved our strongest property-level revenue and Adjusted EBITDAR growth in more than three years, with property-level margins once again exceeding 40%. This growth was supported by continued strength in play from our core customers, as well as improvements in retail play. Looking ahead, the recently announced transaction to sell our equity stake in FanDuel will further strengthen the Company's financial position as we continue to invest in our properties, pursue growth opportunities, return capital to shareholders and maintain a strong balance sheet – a strategy that continues to drive long-term shareholder value."

Company Overview

Run by the Boyd family, Boyd Gaming (NYSE: BYD) is a diversified operator of gaming entertainment properties across the United States, offering casino games, hotel accommodations, and dining.

Revenue Growth

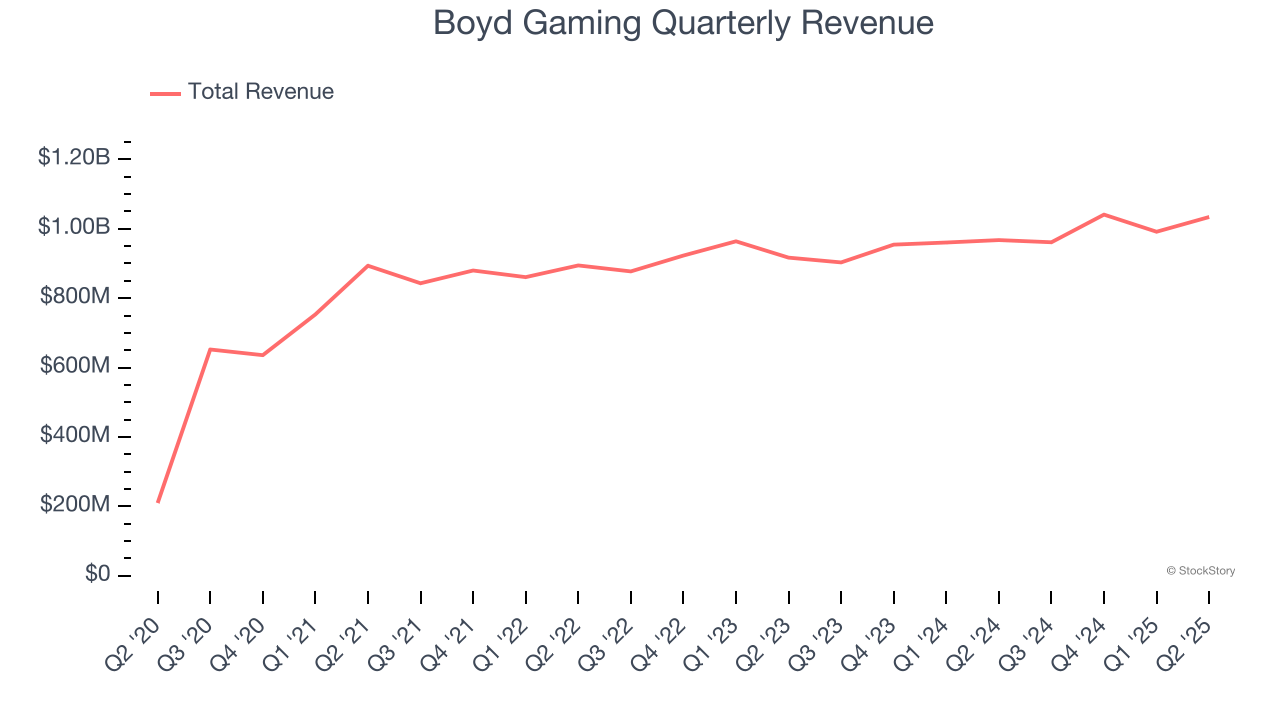

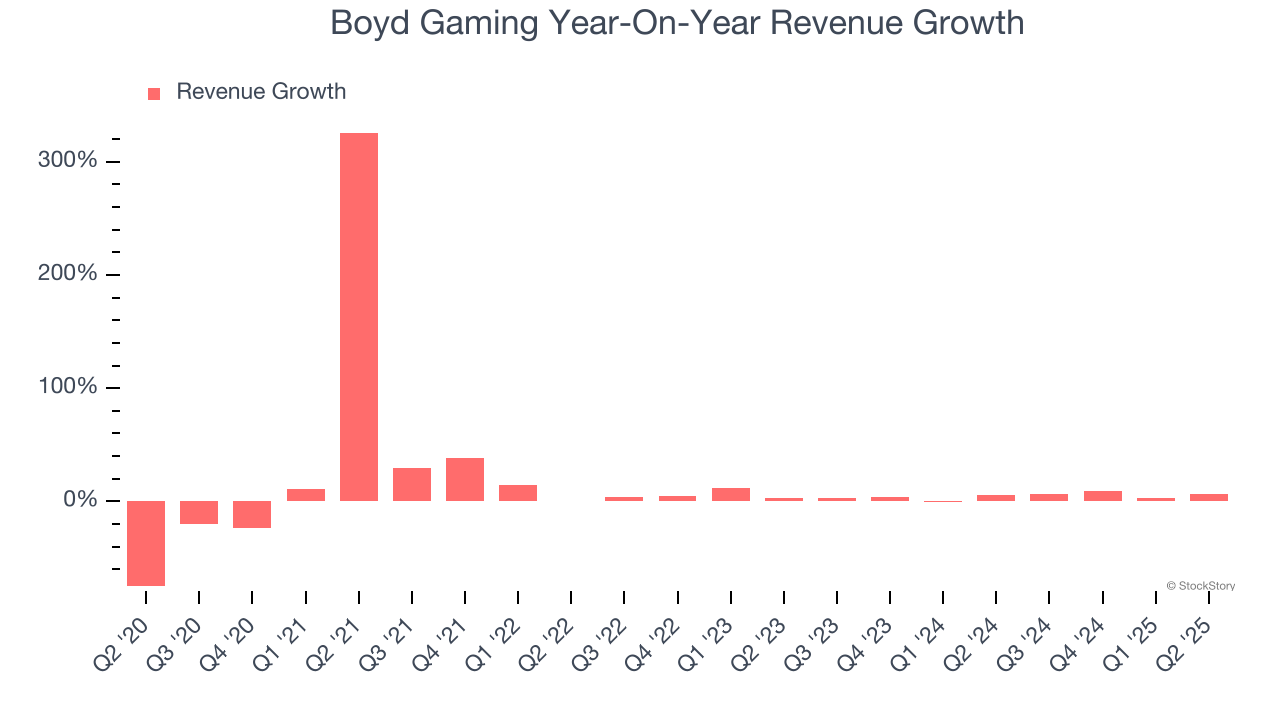

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Boyd Gaming grew its sales at a tepid 9.6% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Boyd Gaming’s recent performance shows its demand has slowed as its annualized revenue growth of 4.6% over the last two years was below its five-year trend. Note that COVID hurt Boyd Gaming’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Gaming and Non-Gaming, which are 64.9% and 16.7% of revenue. Over the last two years, Boyd Gaming’s Gaming revenue (casino games) was flat while its Non-Gaming revenue (hotel, food, beverage) averaged 10.2% year-on-year growth.

This quarter, Boyd Gaming reported year-on-year revenue growth of 6.9%, and its $1.03 billion of revenue exceeded Wall Street’s estimates by 5.4%.

Looking ahead, sell-side analysts expect revenue to decline by 4.3% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

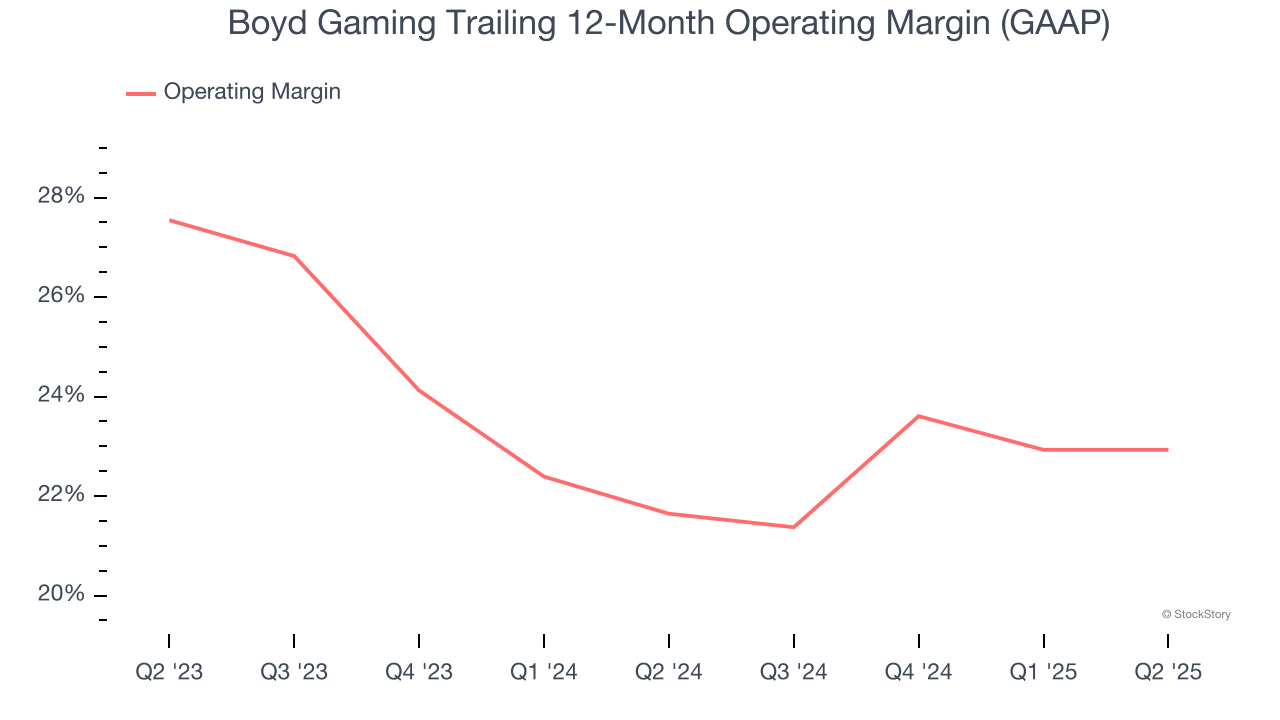

Boyd Gaming’s operating margin has risen over the last 12 months and averaged 22.3% over the last two years. On top of that, its profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

This quarter, Boyd Gaming generated an operating margin profit margin of 23.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

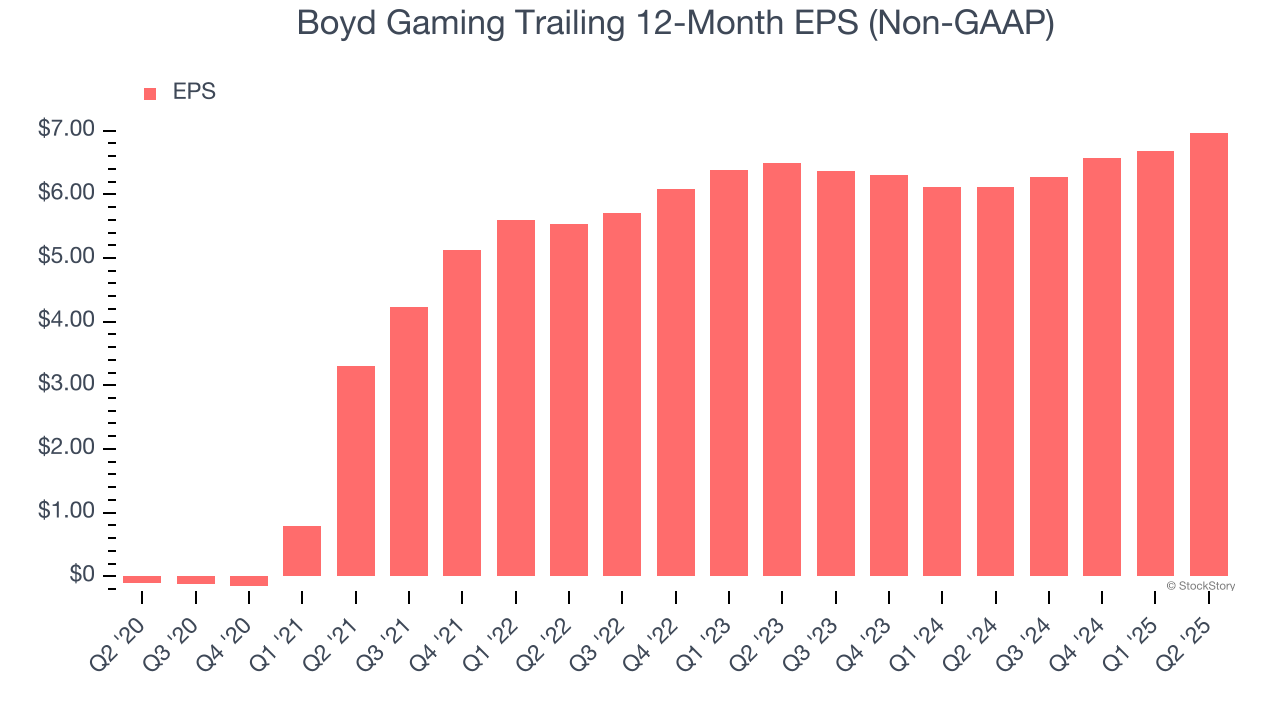

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Boyd Gaming’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q2, Boyd Gaming reported EPS at $1.87, up from $1.58 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Boyd Gaming’s full-year EPS of $6.97 to shrink by 4.6%.

Key Takeaways from Boyd Gaming’s Q2 Results

We enjoyed seeing Boyd Gaming beat analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its Gaming revenue missed. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 1.6% to $83.85 immediately after reporting.

Boyd Gaming may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.