Mexican fast-food chain Chipotle (NYSE: CMG) missed Wall Street’s revenue expectations in Q2 CY2025 as sales rose 3% year on year to $3.06 billion. Its non-GAAP profit of $0.33 per share was in line with analysts’ consensus estimates.

Is now the time to buy Chipotle? Find out by accessing our full research report, it’s free.

Chipotle (CMG) Q2 CY2025 Highlights:

- Revenue: $3.06 billion vs analyst estimates of $3.11 billion (3% year-on-year growth, 1.5% miss)

- Adjusted EPS: $0.33 vs analyst estimates of $0.33 (in line)

- 2025 Guidance: "About flat full year comparable restaurant sales", lowered from previous outlook of "sales growth in the low single digit range"

- Operating Margin: 18.2%, down from 19.7% in the same quarter last year

- Free Cash Flow Margin: 13.1%, down from 14.2% in the same quarter last year

- Same-Store Sales fell 4% year on year (11.1% in the same quarter last year)

- Market Capitalization: $70.57 billion

"We are seeing momentum build as we rolled out our summer marketing initiatives and as our comparisons ease," said Scott Boatwright, Chief Executive Officer, Chipotle.

Company Overview

Born from a desire to offer quick meals with fresh, flavorful ingredients, Chipotle (NYSE: CMG) is a fast-food chain known for its healthy, Mexican-inspired cuisine and customizable dishes.

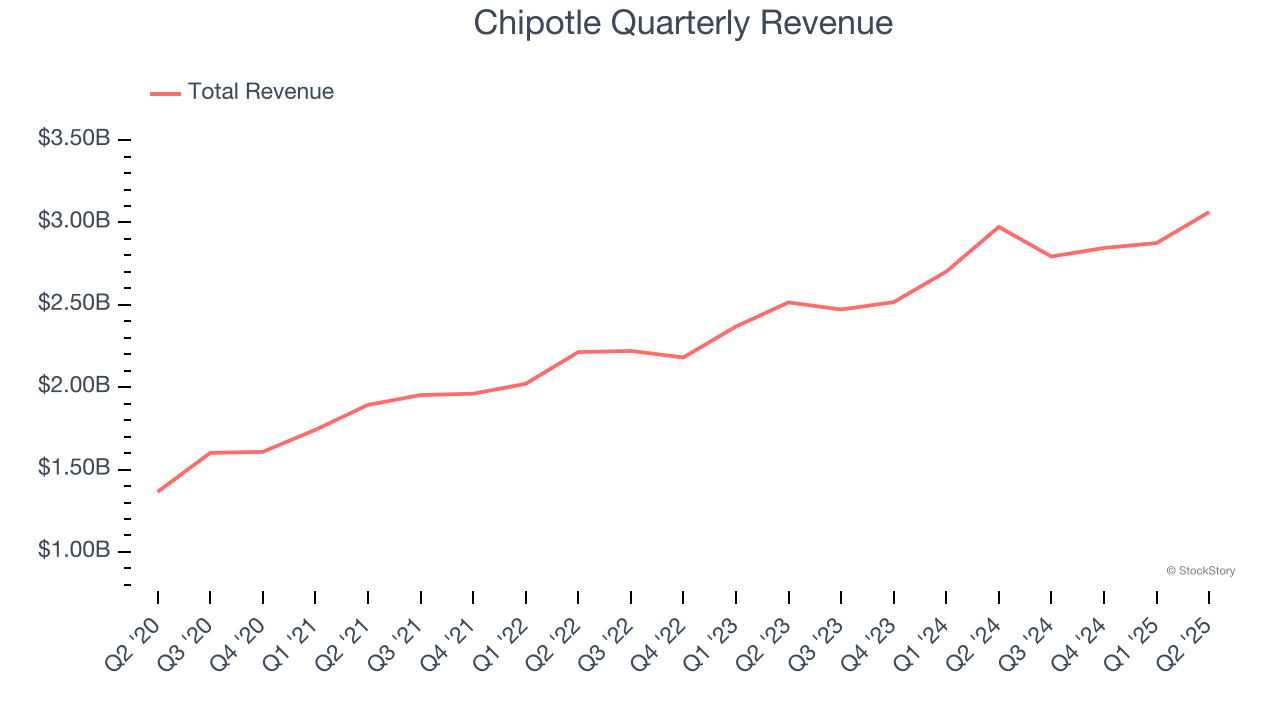

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $11.58 billion in revenue over the past 12 months, Chipotle is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. Its scale also gives it negotiating leverage with suppliers, enabling it to source its ingredients at a lower cost.

As you can see below, Chipotle grew its sales at an impressive 14.3% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Chipotle’s revenue grew by 3% year on year to $3.06 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 12.7% over the next 12 months, a slight deceleration versus the last six years. We still think its growth trajectory is attractive given its scale and suggests the market is baking in success for its menu offerings.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Restaurant Performance

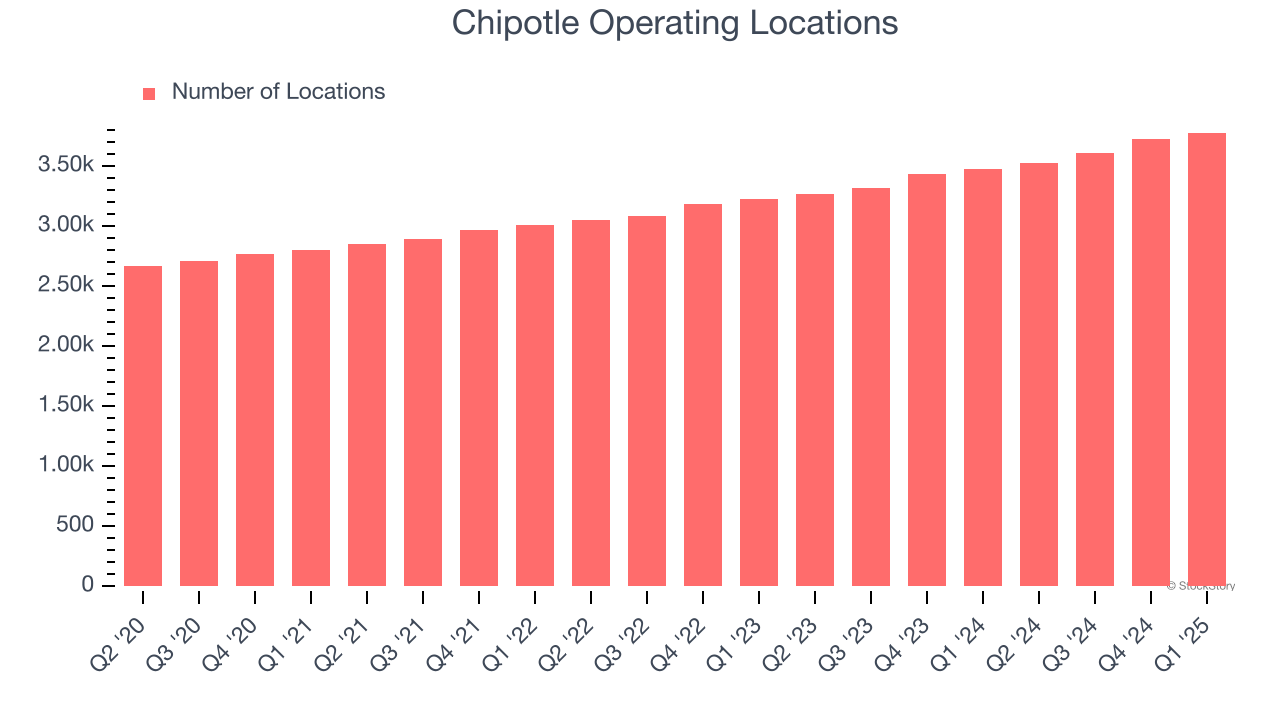

Number of Restaurants

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Over the last two years, Chipotle opened new restaurants at a rapid clip by averaging 8.2% annual growth, among the fastest in the restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Note that Chipotle reports its restaurant count intermittently, so some data points are missing in the chart below.

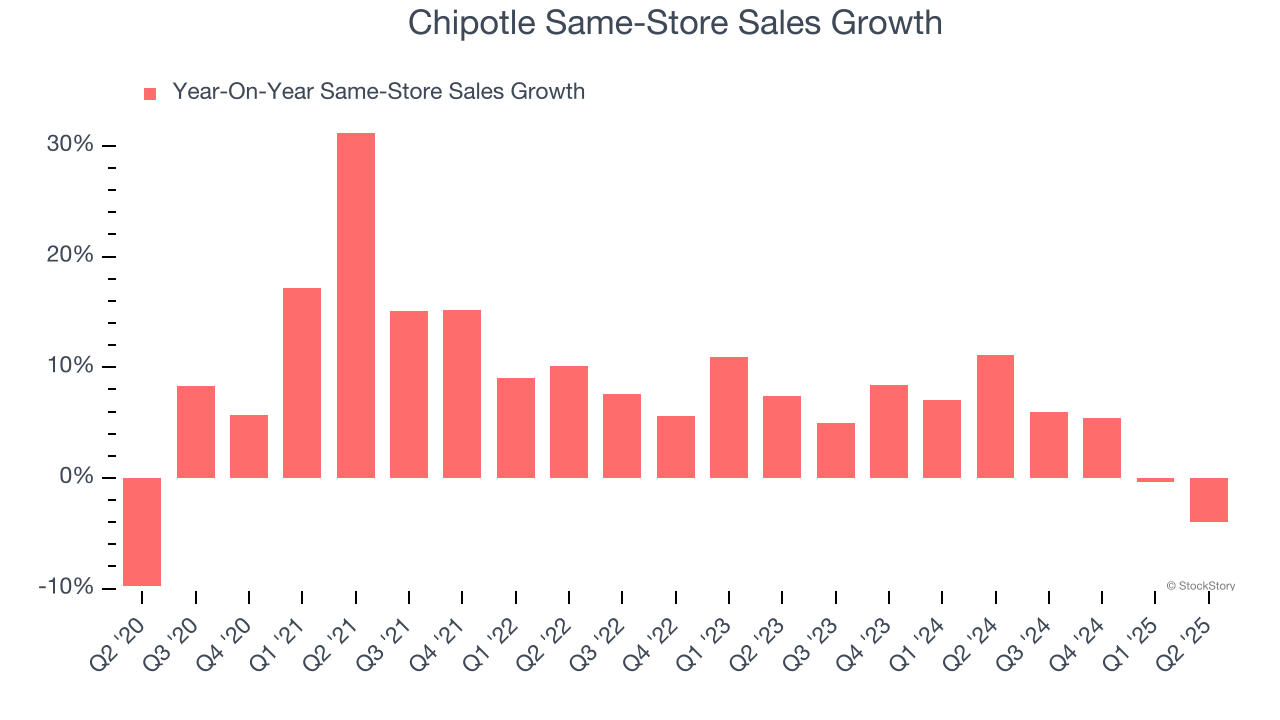

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

Chipotle has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 4.8%. This performance suggests its rollout of new restaurants is beneficial for shareholders. We like this backdrop because it gives Chipotle multiple ways to win: revenue growth can come from new restaurants or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Chipotle’s same-store sales fell by 4% year on year. This decline was a reversal from its historical levels. A one quarter hiccup shouldn’t deter you from investing in a business, and we’ll be monitoring the company to see how things progress.

Key Takeaways from Chipotle’s Q2 Results

We struggled to find many positives in these results. Its revenue slightly missed and its same-store sales fell slightly short of Wall Street’s estimates. Looking ahead, the company lowered full-year same-store sales guidance, expecting "about flat full year comparable restaurant sales", lowered from previous outlook of "sales growth in the low single digit range". Overall, this quarter could have been better. The stock traded down 10.7% to $47.20 immediately following the results.

Chipotle underperformed this quarter, but does that create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.