What a fantastic six months it’s been for Marqeta. Shares of the company have skyrocketed 53.8%, hitting $5.69. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Marqeta, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Marqeta Not Exciting?

Despite the momentum, we're sitting this one out for now. Here are two reasons why there are better opportunities than MQ and a stock we'd rather own.

1. Revenue Spiraling Downwards

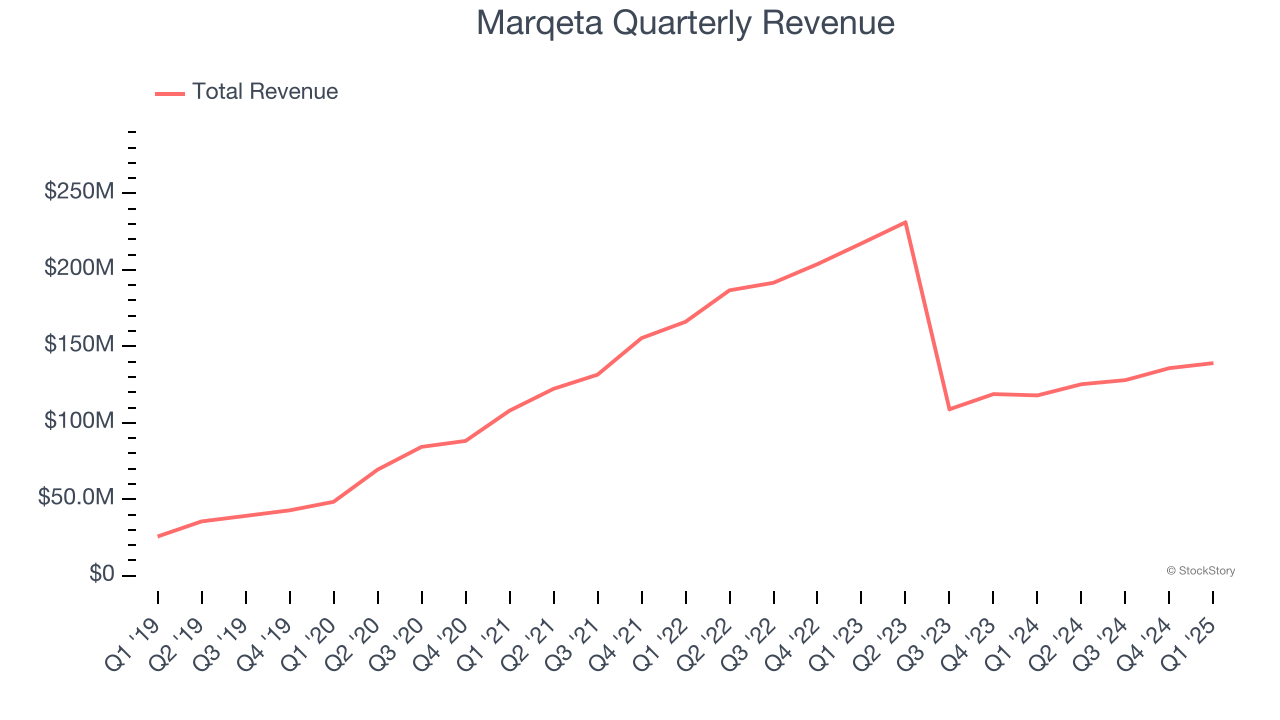

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Marqeta’s demand was weak and its revenue declined by 2.8% per year. This wasn’t a great result and is a sign of lacking business quality.

2. Low Gross Margin Hinders Flexibility

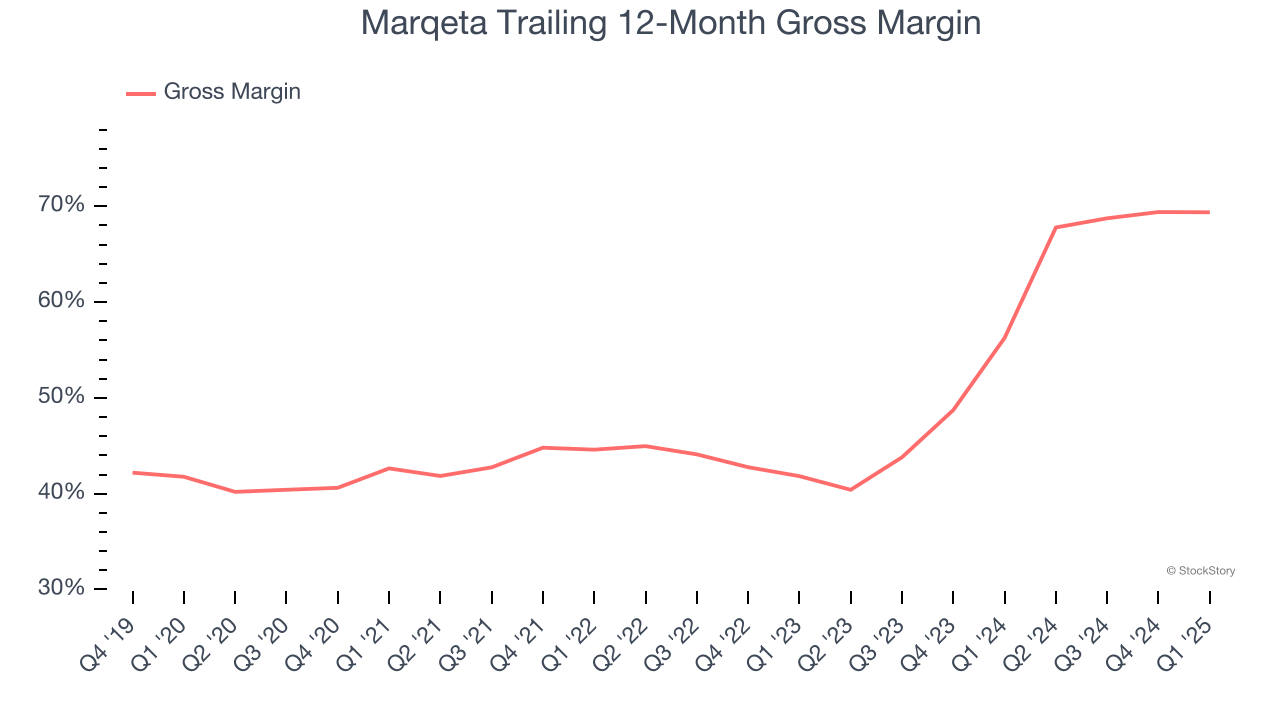

For software companies like Marqeta, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Marqeta’s gross margin is slightly below the average software company, giving it less room than its competitors to invest in areas such as product and sales. As you can see below, it averaged a 69.4% gross margin over the last year. That means Marqeta paid its providers a lot of money ($30.63 for every $100 in revenue) to run its business.

Final Judgment

Marqeta isn’t a terrible business, but it isn’t one of our picks. Following the recent rally, the stock trades at 4.7× forward price-to-sales (or $5.69 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Marqeta

Donald Trump’s April 2024 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.