Since December 2024, Stock Yards Bank has been in a holding pattern, posting a small loss of 3.8% while floating around $74.72.

Is now the time to buy SYBT? Find out in our full research report, it’s free.

Why Does SYBT Stock Spark Debate?

Founded in 1904 in Louisville and named after the city's historic livestock market district, Stock Yards Bancorp (NASDAQ: SYBT) operates a regional bank providing commercial banking, wealth management, and trust services across Kentucky, Indiana, and Ohio.

Two Positive Attributes:

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

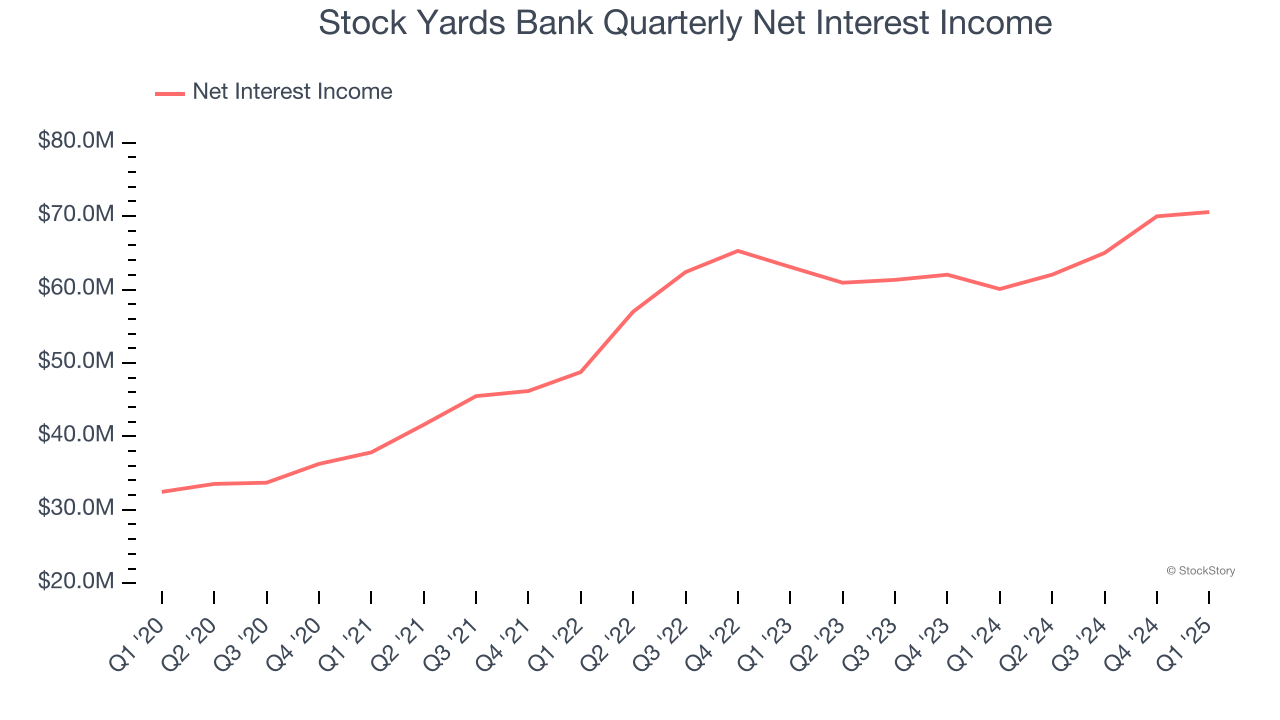

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

Stock Yards Bank’s net interest income has grown at a 17.3% annualized rate over the last four years, much better than the broader bank industry. Its growth was driven by an increase in its outstanding loans as its net interest margin, which represents how much a bank earns in relation to its outstanding loan book, was flat throughout that period.

2. Outstanding Long-Term EPS Growth

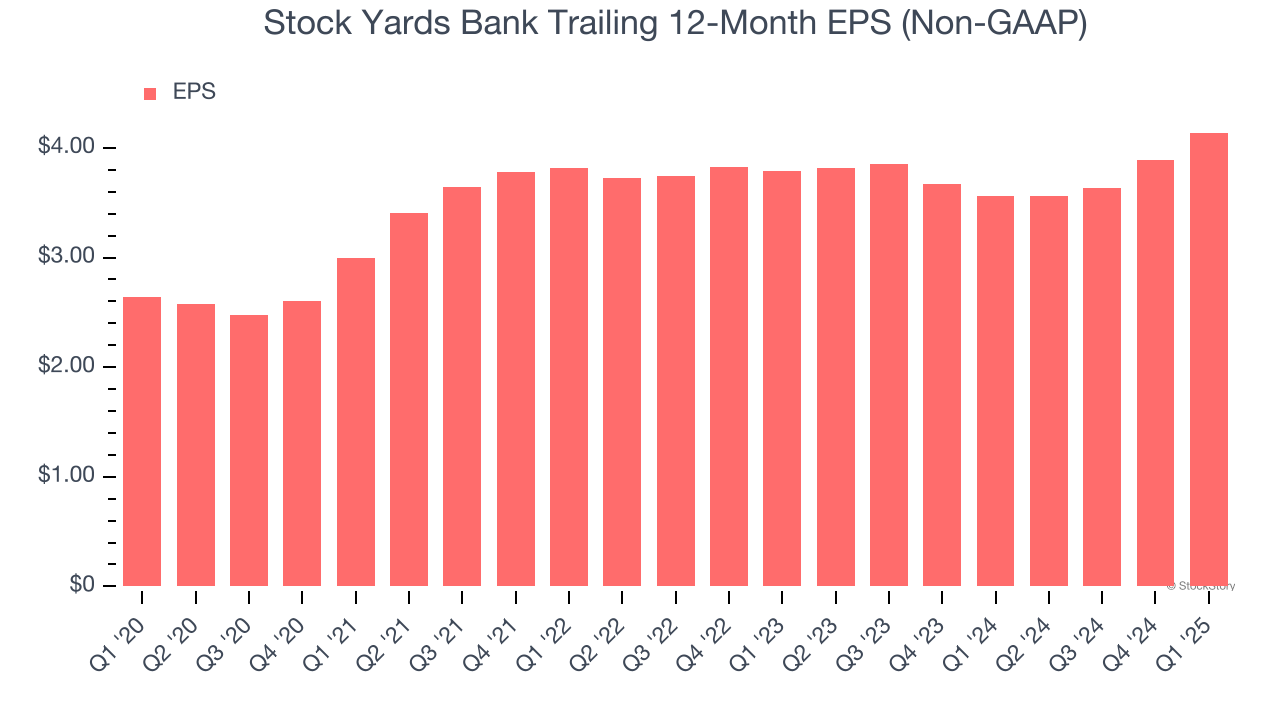

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Stock Yards Bank’s EPS grew at a spectacular 9.4% compounded annual growth rate over the last five years. This performance was better than most bank businesses.

One Reason to be Careful:

Lackluster Revenue Growth

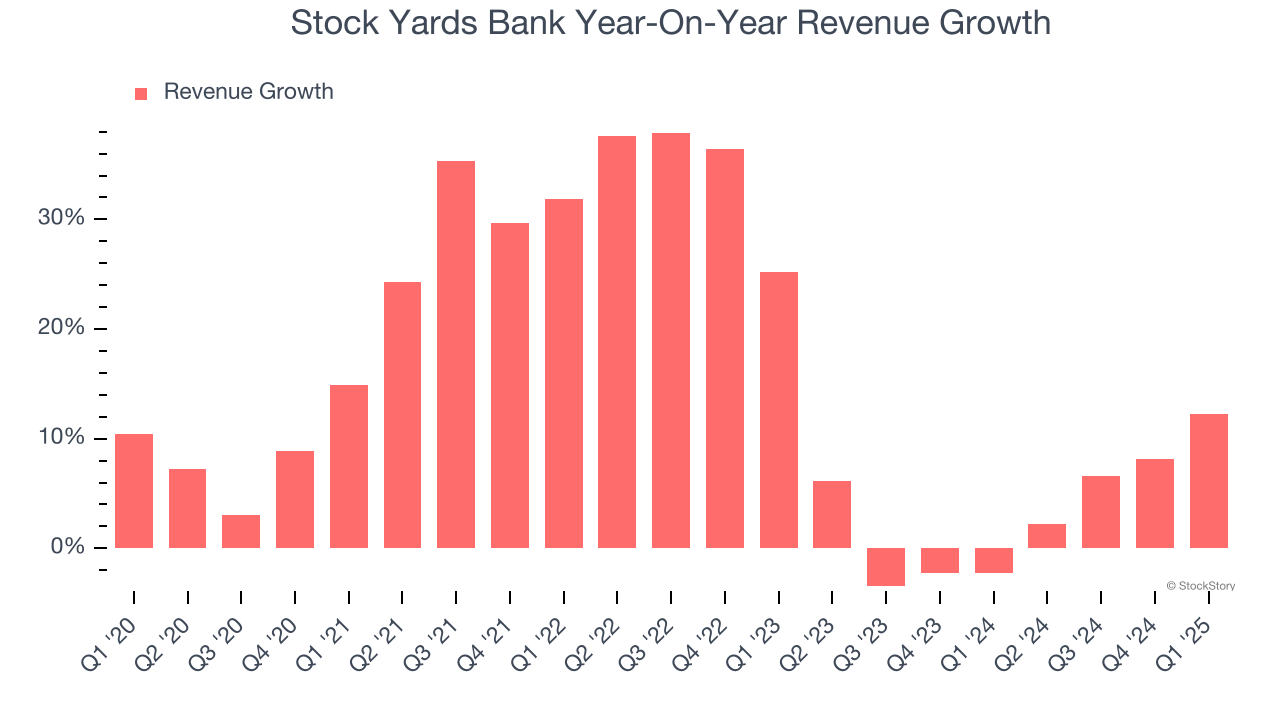

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, inflation readings, and industry trends. Stock Yards Bank’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 3.3% over the last two years was well below its five-year trend.

Final Judgment

Stock Yards Bank’s merits more than compensate for its flaws, but at $74.72 per share (or 2.1× forward P/B), is now the right time to buy the stock? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.