Let’s dig into the relative performance of PagerDuty (NYSE: PD) and its peers as we unravel the now-completed Q1 software development earnings season.

As legendary VC investor Marc Andreessen says, "Software is eating the world", and it touches virtually every industry. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming.

The 11 software development stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 8.1% on average since the latest earnings results.

PagerDuty (NYSE: PD)

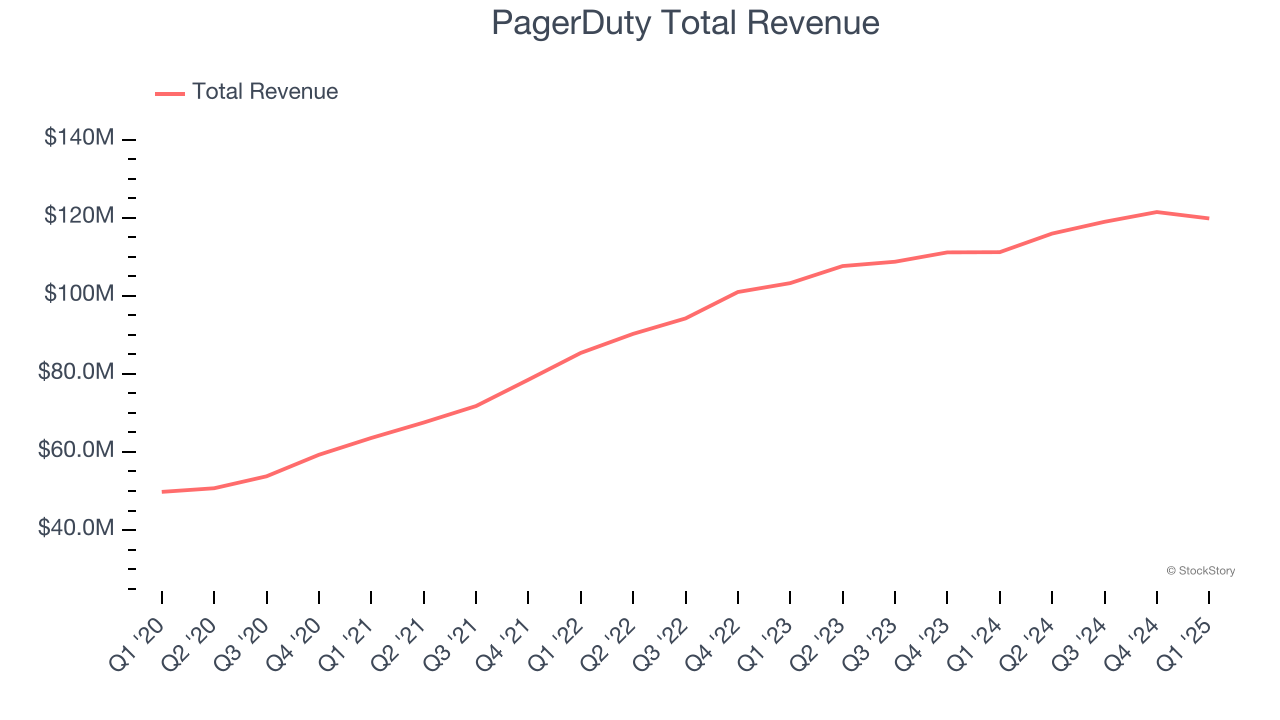

Started by three former Amazon engineers, PagerDuty (NYSE: PD) is a software-as-a-service platform that helps companies respond to IT incidents fast and make sure that any downtime is minimized.

PagerDuty reported revenues of $119.8 million, up 7.8% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with accelerating customer growth but EPS guidance for next quarter missing analysts’ expectations significantly.

PagerDuty delivered the weakest full-year guidance update of the whole group. The company added 133 customers to reach a total of 15,247. Unsurprisingly, the stock is down 10.5% since reporting and currently trades at $14.42.

Is now the time to buy PagerDuty? Access our full analysis of the earnings results here, it’s free.

Best Q1: Fastly (NYSE: FSLY)

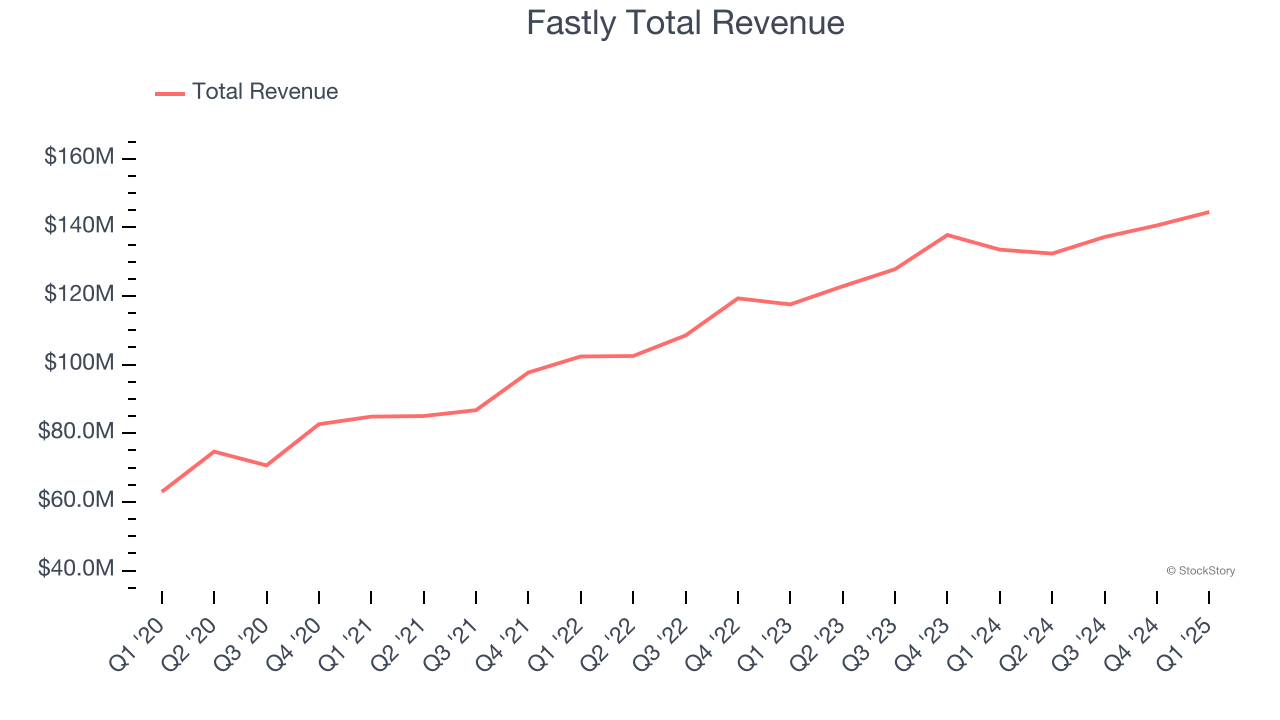

Founded in 2011, Fastly (NYSE: FSLY) provides content delivery and edge cloud computing services, enabling enterprises and developers to deliver fast, secure, and scalable digital content and experiences.

Fastly reported revenues of $144.5 million, up 8.2% year on year, outperforming analysts’ expectations by 4.8%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates.

Fastly delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 17.5% since reporting. It currently trades at $7.06.

Is now the time to buy Fastly? Access our full analysis of the earnings results here, it’s free.

Cloudflare (NYSE: NET)

Founded by two grad students of Harvard Business School, Cloudflare (NYSE: NET) is a software-as-a-service platform that helps improve the security, reliability, and loading times of internet applications.

Cloudflare reported revenues of $479.1 million, up 26.5% year on year, exceeding analysts’ expectations by 2.1%. Still, it was a mixed quarter as it posted EPS guidance for next quarter missing analysts’ expectations.

Interestingly, the stock is up 37.3% since the results and currently trades at $171.

Read our full analysis of Cloudflare’s results here.

Bandwidth (NASDAQ: BAND)

Started in 1999 by David Morken who was later joined by Henry Kaestner as co-founder in 2001, Bandwidth (NASDAQ: BAND) provides thousands of customers with a software platform that uses its own global network to provide phone numbers, voice, and text connectivity.

Bandwidth reported revenues of $174.2 million, up 1.9% year on year. This result topped analysts’ expectations by 3.1%. More broadly, it was a satisfactory quarter as it also produced an impressive beat of analysts’ EBITDA estimates.

Bandwidth had the slowest revenue growth among its peers. The stock is up 10.4% since reporting and currently trades at $13.57.

Read our full, actionable report on Bandwidth here, it’s free.

Akamai (NASDAQ: AKAM)

Founded in 1999 by two engineers from MIT, Akamai (NASDAQ: AKAM) provides software for organizations to efficiently deliver web content to their customers.

Akamai reported revenues of $1.02 billion, up 2.9% year on year. This print was in line with analysts’ expectations. It was a strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and EPS guidance for next quarter topping analysts’ expectations.

Akamai had the weakest performance against analyst estimates among its peers. The stock is down 9.1% since reporting and currently trades at $77.77.

Read our full, actionable report on Akamai here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.