What a brutal six months it’s been for Plug Power. The stock has dropped 47.4% and now trades at $1.29, rattling many shareholders. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Plug Power, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Plug Power Will Underperform?

Even with the cheaper entry price, we're cautious about Plug Power. Here are three reasons why we avoid PLUG and a stock we'd rather own.

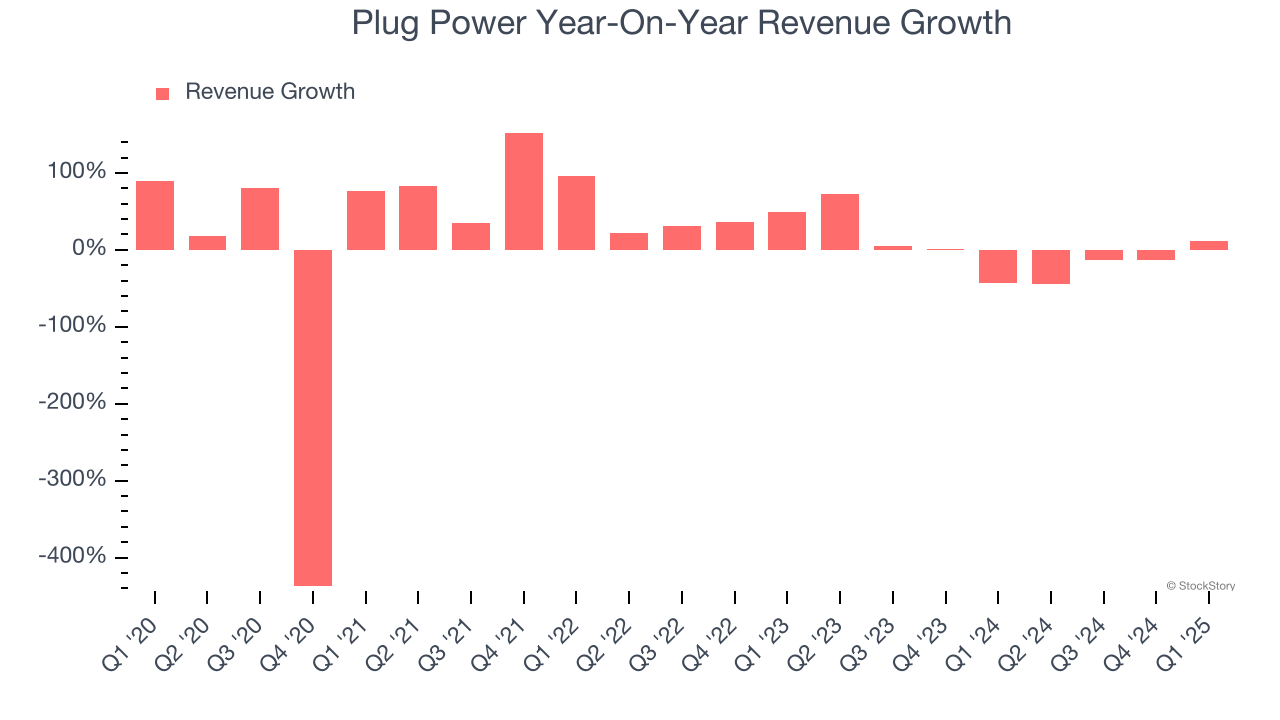

1. Revenue Tumbling Downwards

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Plug Power’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 8.7% over the last two years. Plug Power isn’t alone in its struggles as the Renewable Energy industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

2. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Plug Power’s margin dropped meaningfully over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because it’s already burning cash. If the longer-term trend returns, it could signal it’s in the middle of a big investment cycle. Plug Power’s free cash flow margin for the trailing 12 months was negative 140%.

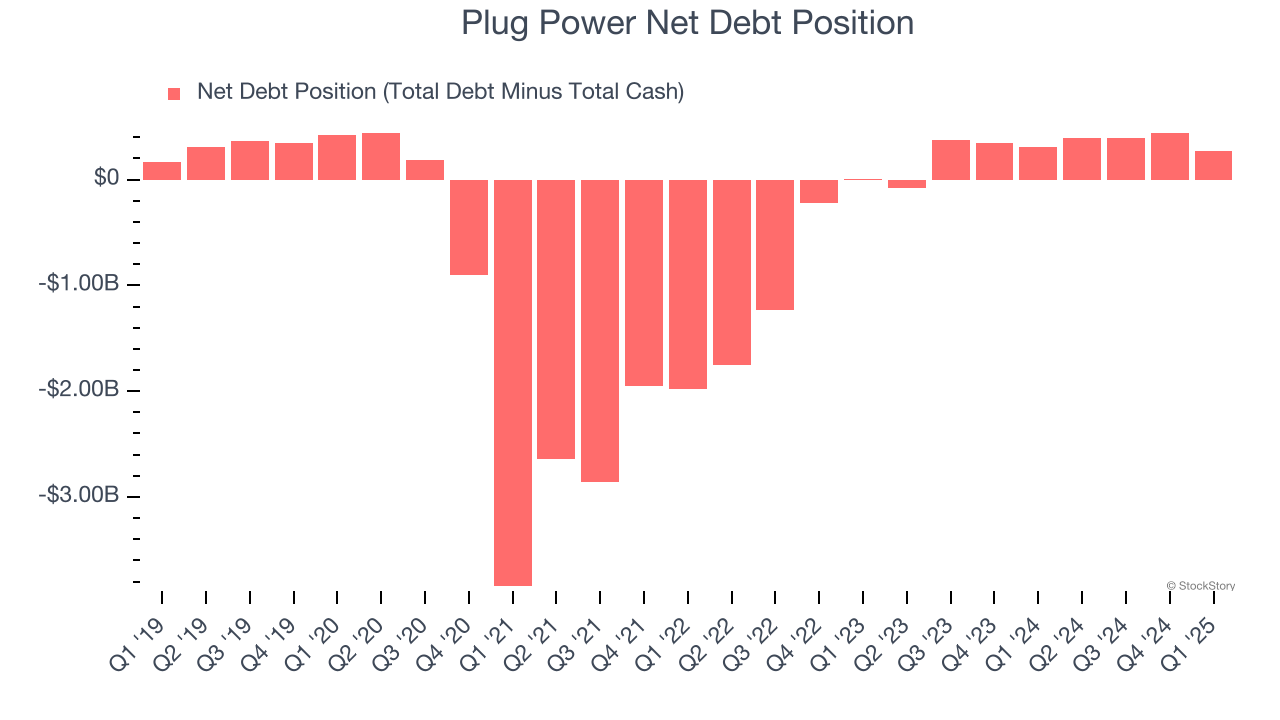

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Plug Power burned through $901.4 million of cash over the last year, and its $564 million of debt exceeds the $295.8 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Plug Power’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Plug Power until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

Plug Power falls short of our quality standards. After the recent drawdown, the stock trades at $1.29 per share (or a forward price-to-sales ratio of 1.5×). The market typically values companies like Plug Power based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Plug Power

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.