Pacific Premier Bancorp has gotten torched over the last six months - since December 2024, its stock price has dropped 25.2% to $20.59 per share. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Pacific Premier Bancorp, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Pacific Premier Bancorp Will Underperform?

Despite the more favorable entry price, we're cautious about Pacific Premier Bancorp. Here are three reasons why there are better opportunities than PPBI and a stock we'd rather own.

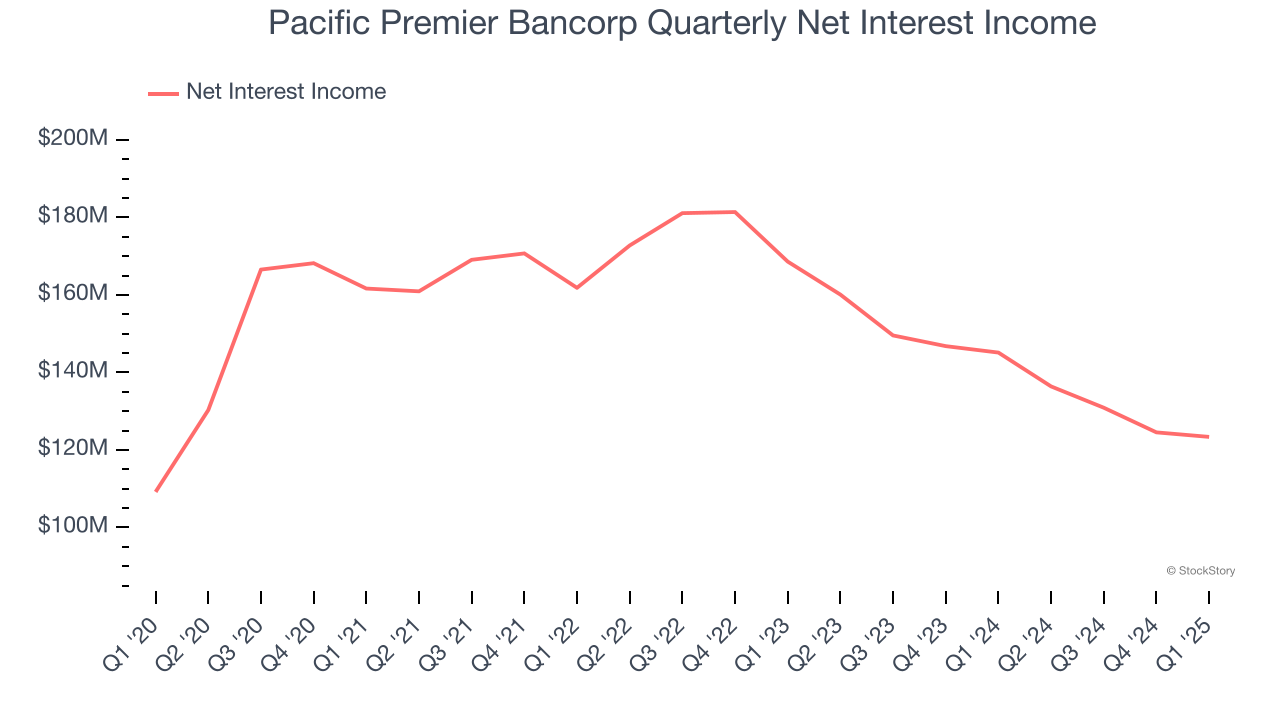

1. Declining Net Interest Income Reflects Loan Book Weakness

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

Pacific Premier Bancorp’s net interest income has declined by 4.8% annually over the last four years, much worse than the broader bank industry. This was driven by a decrease in its net interest margin, which represents how much a bank earns in relation to its outstanding loans, as its loan book increased throughout that period.

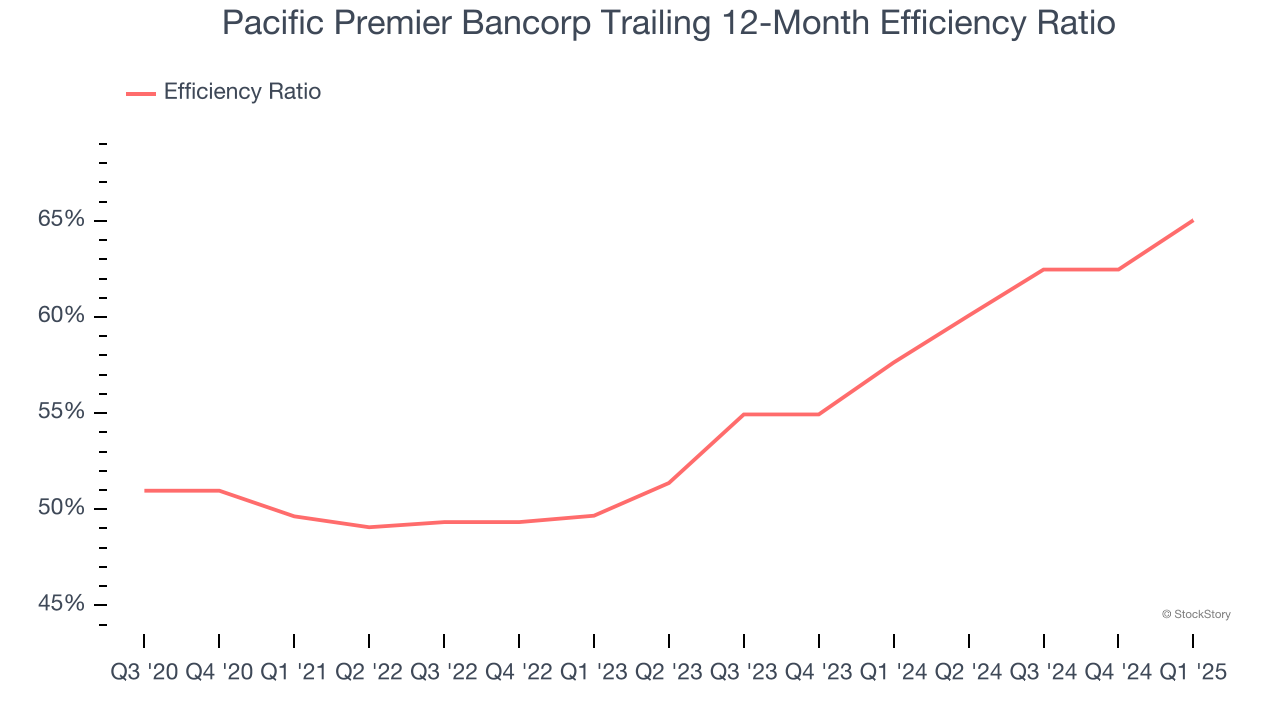

2. Deteriorating Efficiency Ratio

The underlying profitability of top-line growth determines the actual bottom-line impact. Banking institutions measure this dynamic using the efficiency ratio, which is calculated by dividing non-interest expenses like personnel, facilities, technology, and marketing by total revenue.

Investors place greater emphasis on efficiency ratio movements than absolute values, understanding that expense structures reflect revenue mix variations. Lower ratios represent better operational performance since they show banks generating more revenue per dollar of expense.

Over the last four years, Pacific Premier Bancorp’s efficiency ratio has swelled by 15.4 percentage points, hitting 65% for the past 12 months. Said differently, the company’s expenses have increased at a faster rate than revenue, which is usually a bad sign in mature industries (the exception is a high-growth company that reinvests its profits in attractive ventures).

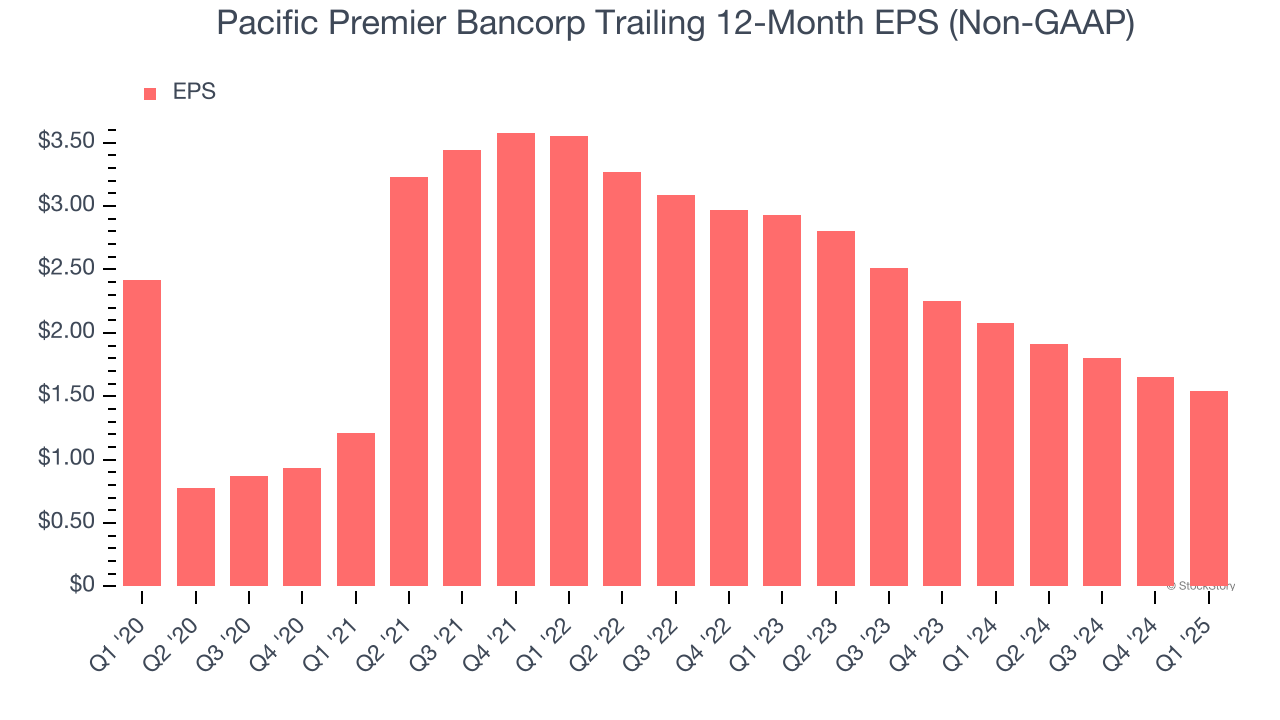

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Pacific Premier Bancorp, its EPS declined by 8.6% annually over the last five years while its revenue grew by 4.4%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Pacific Premier Bancorp doesn’t pass our quality test. After the recent drawdown, the stock trades at 0.7× forward P/B (or $20.59 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d recommend looking at one of our top digital advertising picks.

Stocks We Like More Than Pacific Premier Bancorp

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.