In a sliding market, Butterfield Bank has defied the odds, trading up to $42.41 per share. Its 11.5% gain since December 2024 has outpaced the S&P 500’s 1.6% drop. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is it too late to buy NTB? Find out in our full research report, it’s free.

Why Does Butterfield Bank Spark Debate?

Founded in 1784 as one of the oldest banks in the Western Hemisphere, Butterfield Bank (NYSE: NTB) provides banking, wealth management, and trust services to individuals and businesses in select offshore financial centers including Bermuda, Cayman Islands, and the Channel Islands.

Two Positive Attributes:

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

Butterfield Bank’s net interest income has grown at a 30.8% annualized rate over the last four years, much better than the broader bank industry.

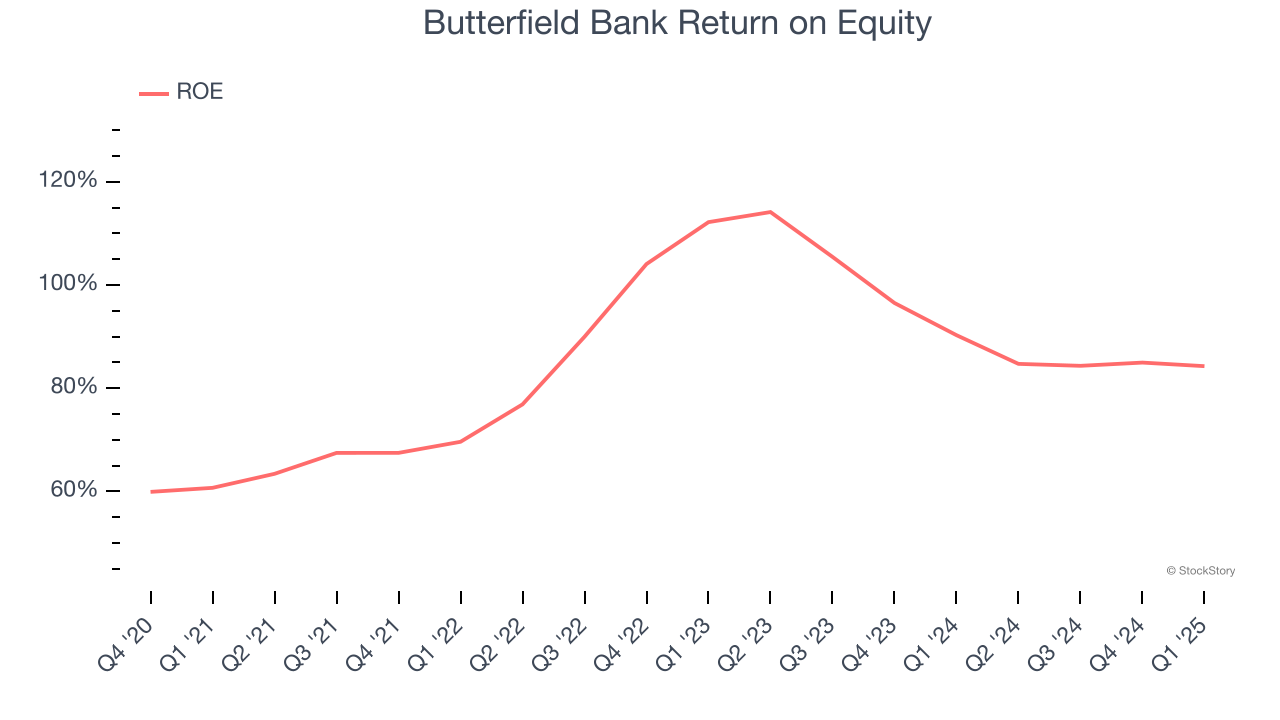

2. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Butterfield Bank has averaged an ROE of 20.9%, exceptional for a company operating in a sector where the average shakes out around 7.5% and those putting up 15%+ are greatly admired. This shows Butterfield Bank has a strong competitive moat.

One Reason to be Careful:

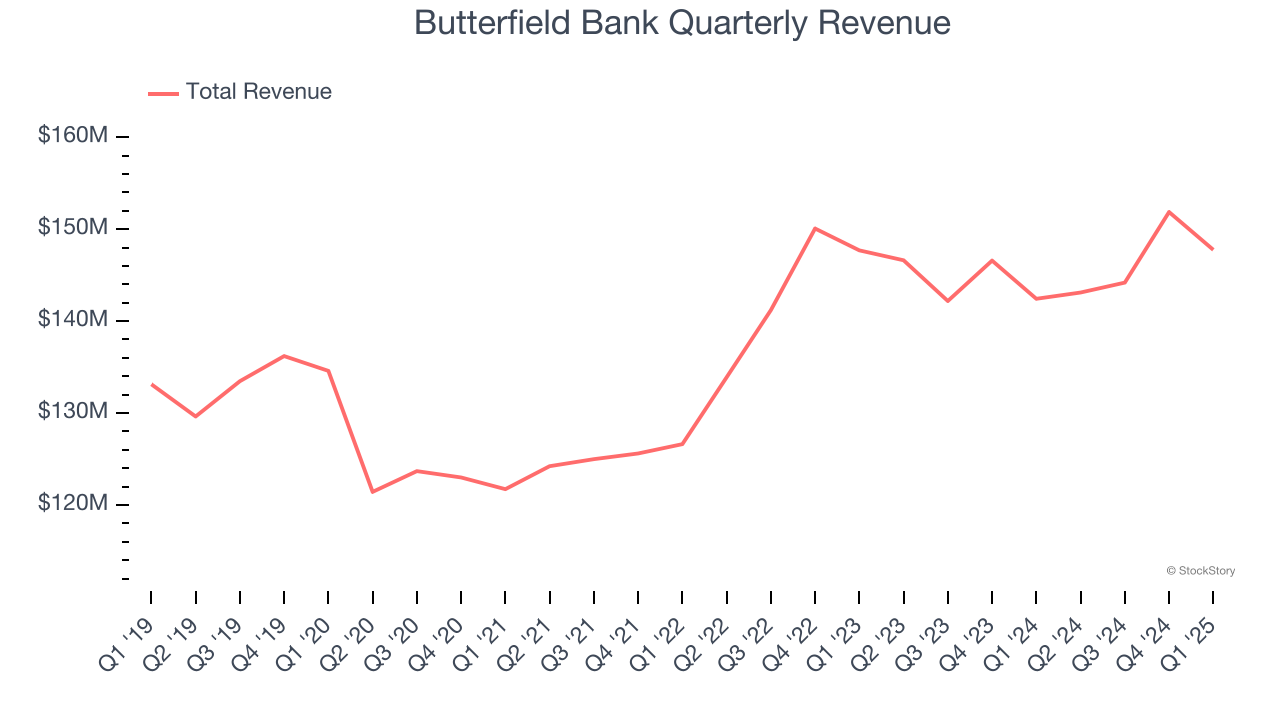

Long-Term Revenue Growth Disappoints

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees.

Unfortunately, Butterfield Bank’s 1.9% annualized revenue growth over the last five years was tepid. This wasn’t a great result, but there are still things to like about Butterfield Bank.

Final Judgment

Butterfield Bank’s positive characteristics outweigh the negatives, and with its shares topping the market in recent months, the stock trades at 1.5× forward P/B (or $42.41 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.