Over the past six months, Rush Enterprises’s shares (currently trading at $49.85) have posted a disappointing 16.9% loss while the S&P 500 was down 2.1%. This might have investors contemplating their next move.

Is there a buying opportunity in Rush Enterprises, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Rush Enterprises Will Underperform?

Despite the more favorable entry price, we're swiping left on Rush Enterprises for now. Here are three reasons why we avoid RUSHA and a stock we'd rather own.

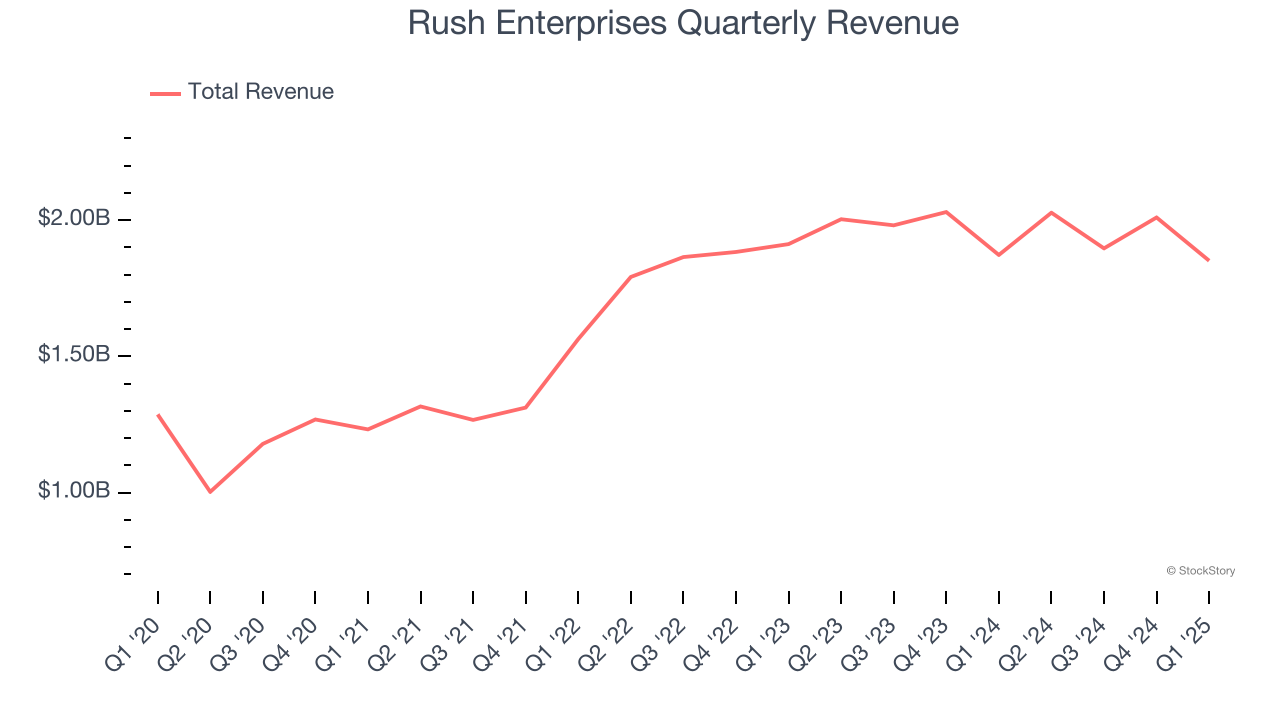

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Rush Enterprises grew its sales at a mediocre 6.3% compounded annual growth rate. This was below our standard for the industrials sector.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Rush Enterprises’s revenue to drop by 1.5%, a decrease from its 2.2% annualized growth for the past two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

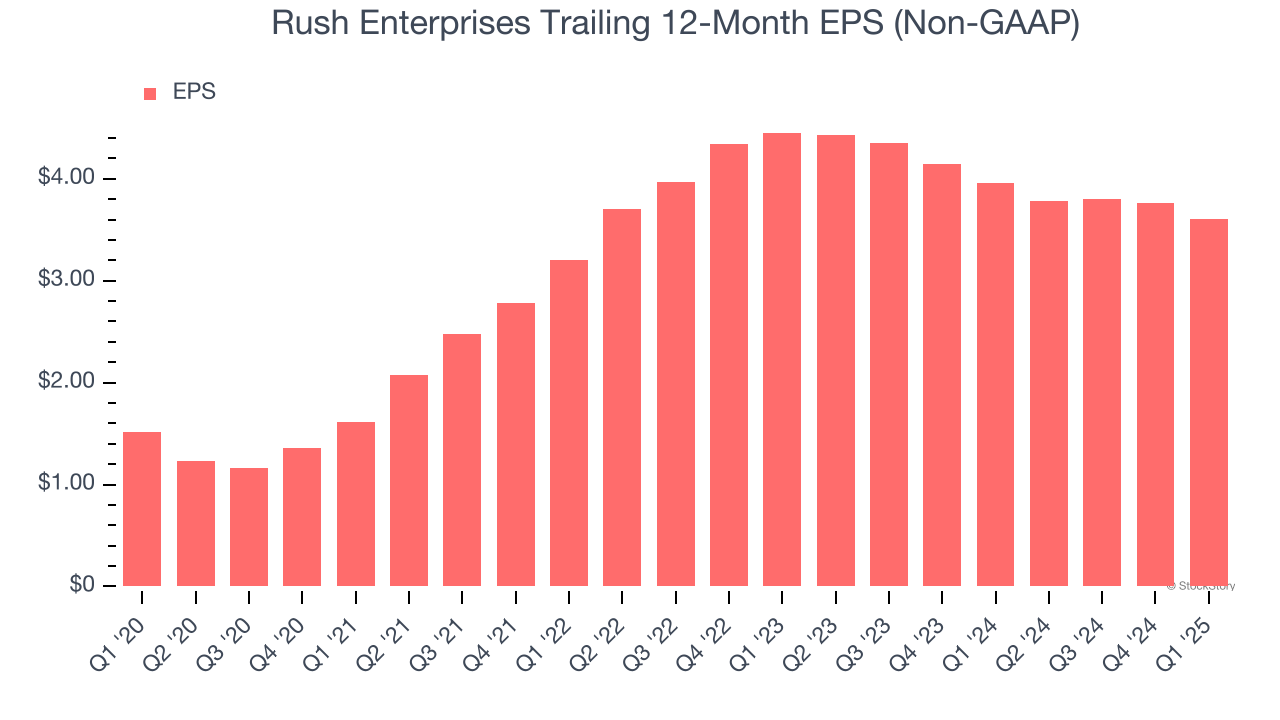

3. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Rush Enterprises, its EPS declined by 10% annually over the last two years while its revenue grew by 2.2%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Rush Enterprises falls short of our quality standards. After the recent drawdown, the stock trades at 8× forward EV-to-EBITDA (or $49.85 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now. We’d suggest looking at one of our top software and edge computing picks.

Stocks We Like More Than Rush Enterprises

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.