Packaging Corporation of America (NYSE: PKG) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 8.2% year on year to $2.14 billion. Its GAAP profit of $2.26 per share was 2% above analysts’ consensus estimates.

Is now the time to buy Packaging Corporation of America? Find out by accessing our full research report, it’s free.

Packaging Corporation of America (PKG) Q1 CY2025 Highlights:

- Revenue: $2.14 billion vs analyst estimates of $2.11 billion (8.2% year-on-year growth, 1.5% beat)

- EPS (GAAP): $2.26 vs analyst estimates of $2.22 (2% beat)

- Adjusted EBITDA: $421.1 million vs analyst estimates of $415.3 million (19.7% margin, 1.4% beat)

- EPS (GAAP) guidance for Q2 CY2025 is $2.41 at the midpoint, missing analyst estimates by 6.6%

- Operating Margin: 13.1%, up from 9.9% in the same quarter last year

- Sales Volumes rose 7.6% year on year, in line with the same quarter last year

- Market Capitalization: $16.26 billion

Commenting on reported results, Mark W. Kowlzan, Chairman and CEO, said, “A new first quarter revenue record was achieved to begin the new year. In the Packaging segment we had excellent implementation of our previously announced price increases and, although we began to see some pullback in the middle of the quarter related to the uncertainty created by global trade tensions, box demand was solid and exceeded a very strong comparative period in last year’s first quarter. Outstanding operational performance and scheduled outage execution at our mills delivered record first quarter containerboard production to meet this demand, and we ended the quarter at targeted inventory levels. Our Paper segment continued to achieve impressive margins with both volume and prices slightly above original estimates. Across the Company, continued emphasis on operational efficiency, cost reduction initiatives, and capital project execution helped minimize the persistent inflation we see throughout most of our cost structure.”

Company Overview

Founded in 1959, Packaging Corporation of America (NYSE: PKG) produces containerboard and corrugated packaging products as well as displays and package protection.

Industrial Packaging

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

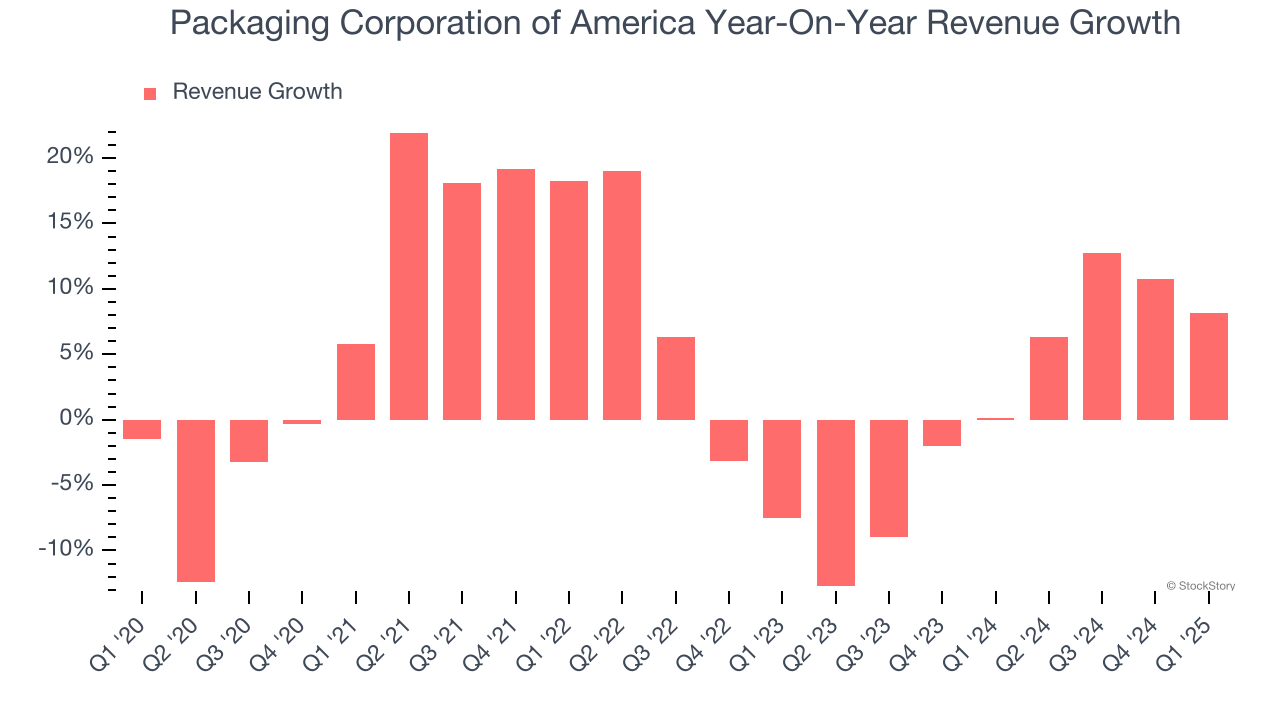

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Packaging Corporation of America grew its sales at a sluggish 4.3% compounded annual growth rate. This was below our standard for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Packaging Corporation of America’s recent performance shows its demand has slowed as its annualized revenue growth of 1.4% over the last two years was below its five-year trend.

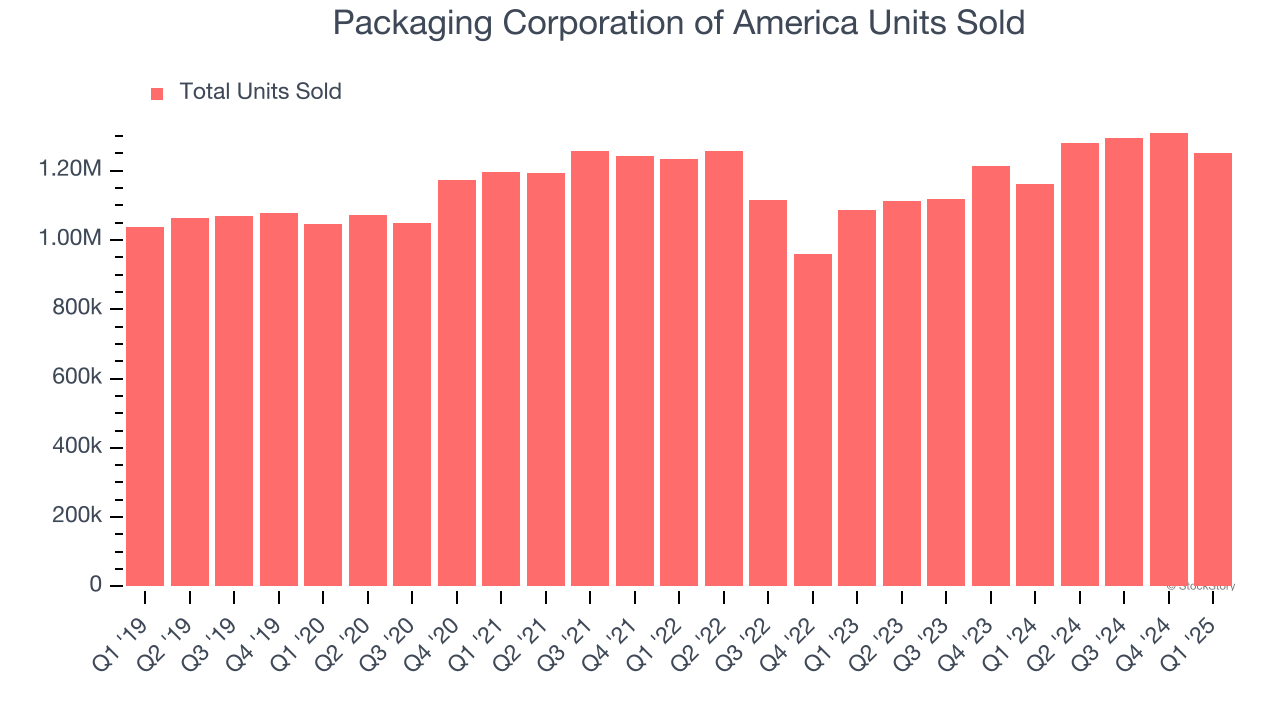

Packaging Corporation of America also reports its number of units sold, which reached 1.25 million in the latest quarter. Over the last two years, Packaging Corporation of America’s units sold averaged 8.5% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Packaging Corporation of America reported year-on-year revenue growth of 8.2%, and its $2.14 billion of revenue exceeded Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

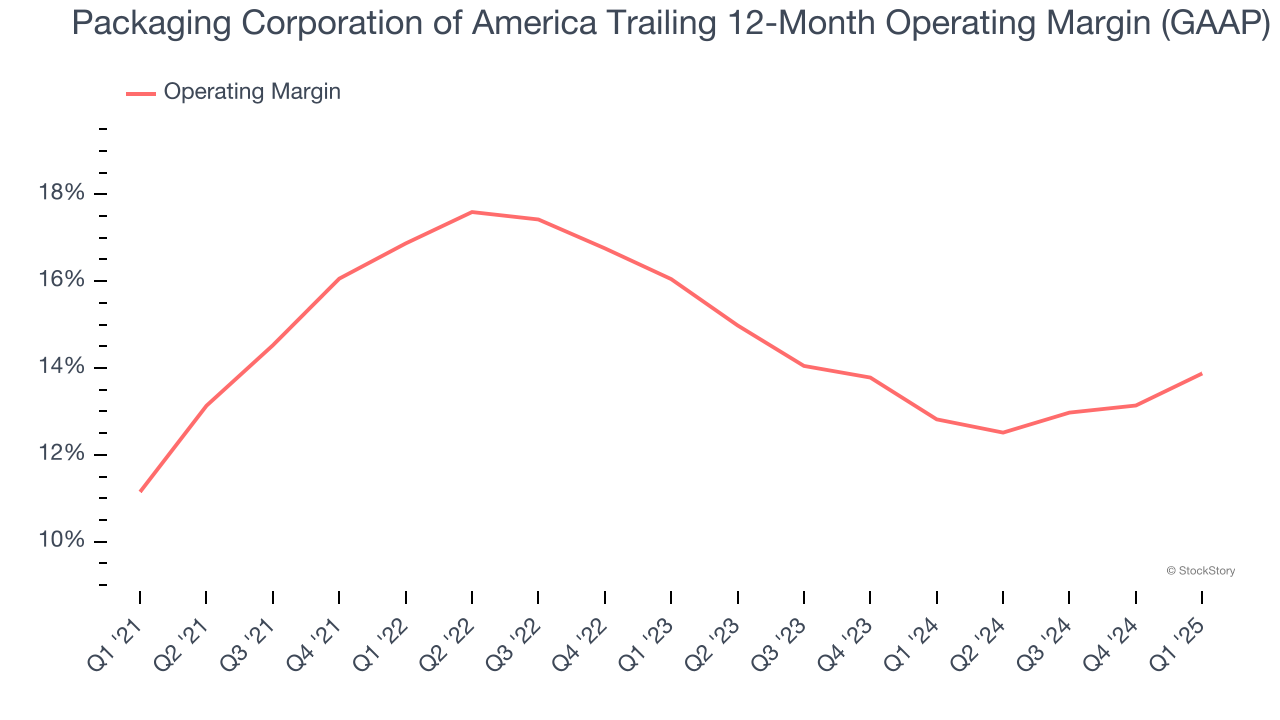

Operating Margin

Packaging Corporation of America has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Packaging Corporation of America’s operating margin rose by 2.7 percentage points over the last five years, as its sales growth gave it operating leverage. Its expansion was impressive, especially when considering most Industrial Packaging peers saw their margins plummet.

In Q1, Packaging Corporation of America generated an operating profit margin of 13.1%, up 3.2 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

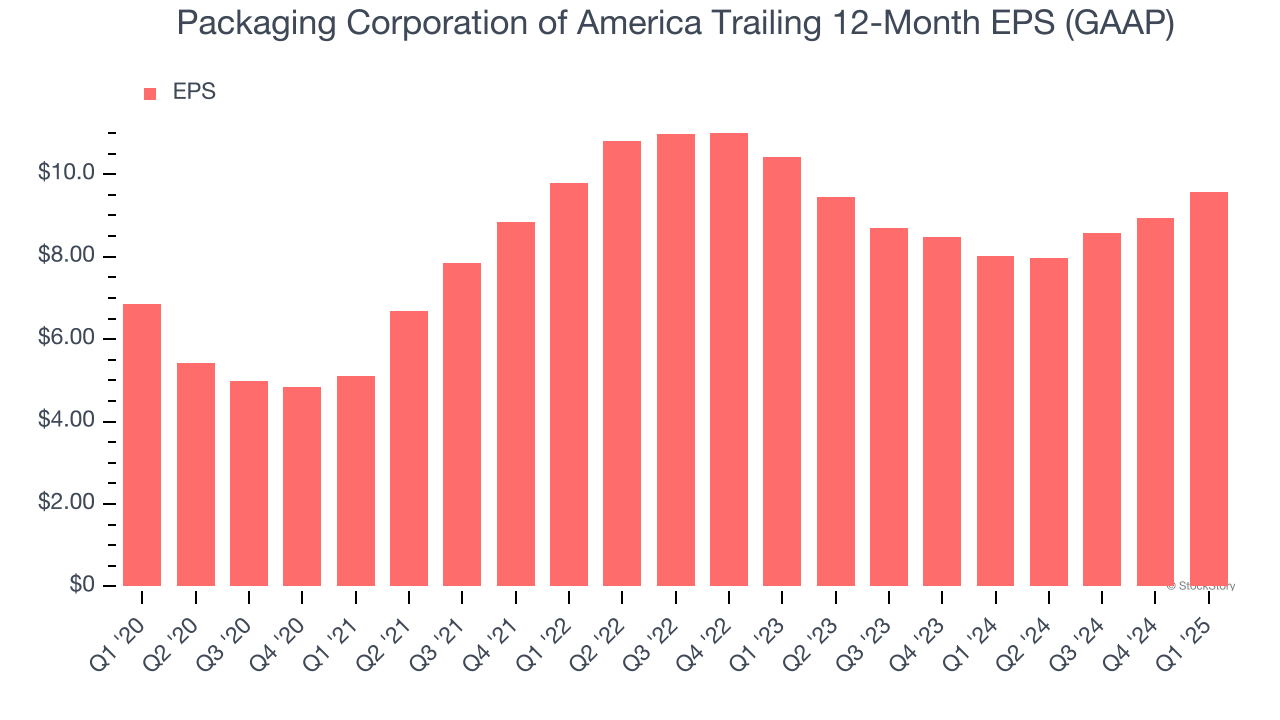

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Packaging Corporation of America’s EPS grew at an unimpressive 6.9% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 4.3% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

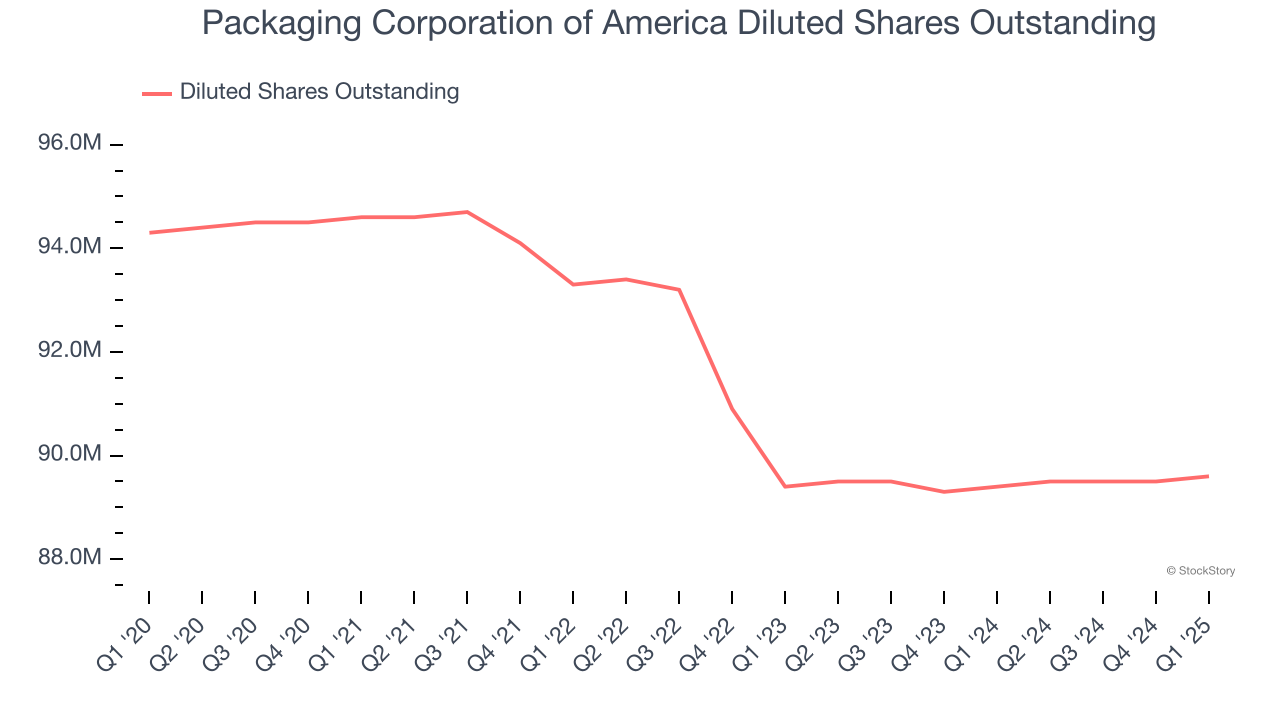

Diving into the nuances of Packaging Corporation of America’s earnings can give us a better understanding of its performance. As we mentioned earlier, Packaging Corporation of America’s operating margin expanded by 2.7 percentage points over the last five years. On top of that, its share count shrank by 5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Packaging Corporation of America, its two-year annual EPS declines of 4.2% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q1, Packaging Corporation of America reported EPS at $2.26, up from $1.63 in the same quarter last year. This print beat analysts’ estimates by 2%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Packaging Corporation of America’s Q1 Results

We enjoyed seeing Packaging Corporation of America beat analysts’ sales volume expectations this quarter. We were also happy its revenue, EPS, and EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed significantly. Overall, we think this was still a solid quarter with some key areas of upside. The guidance seems to be driving the move, and shares traded down 8.1% to $171.30 immediately following the results.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.