Shareholders of Skyworks Solutions would probably like to forget the past six months even happened. The stock dropped 32.8% and now trades at $67.26. This may have investors wondering how to approach the situation.

Is now the time to buy Skyworks Solutions, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even though the stock has become cheaper, we don't have much confidence in Skyworks Solutions. Here are three reasons why SWKS doesn't excite us and a stock we'd rather own.

Why Do We Think Skyworks Solutions Will Underperform?

Result of a merger of Alpha Industries and the wireless communications division of Conexant, Skyworks Solutions (NASDAQ: SWKS) is a designer and manufacturer of chips used in smartphones, autos, and industrial applications to amplify, filter, and process wireless signals.

1. Long-Term Revenue Growth Disappoints

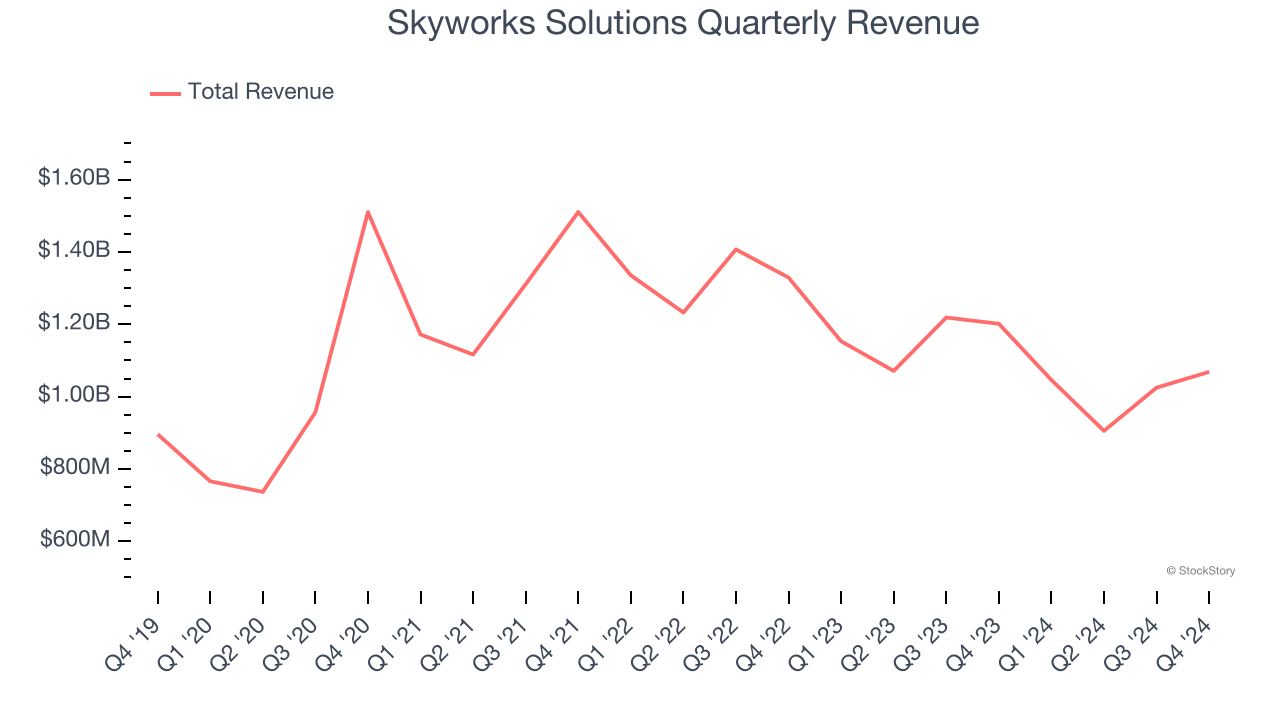

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Skyworks Solutions grew its sales at a sluggish 4.1% compounded annual growth rate. This fell short of our benchmark for the semiconductor sector. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Skyworks Solutions’s revenue to drop by 8.7%. Although this projection is better than its two-year trend, it's hard to get excited about a company that is struggling with demand.

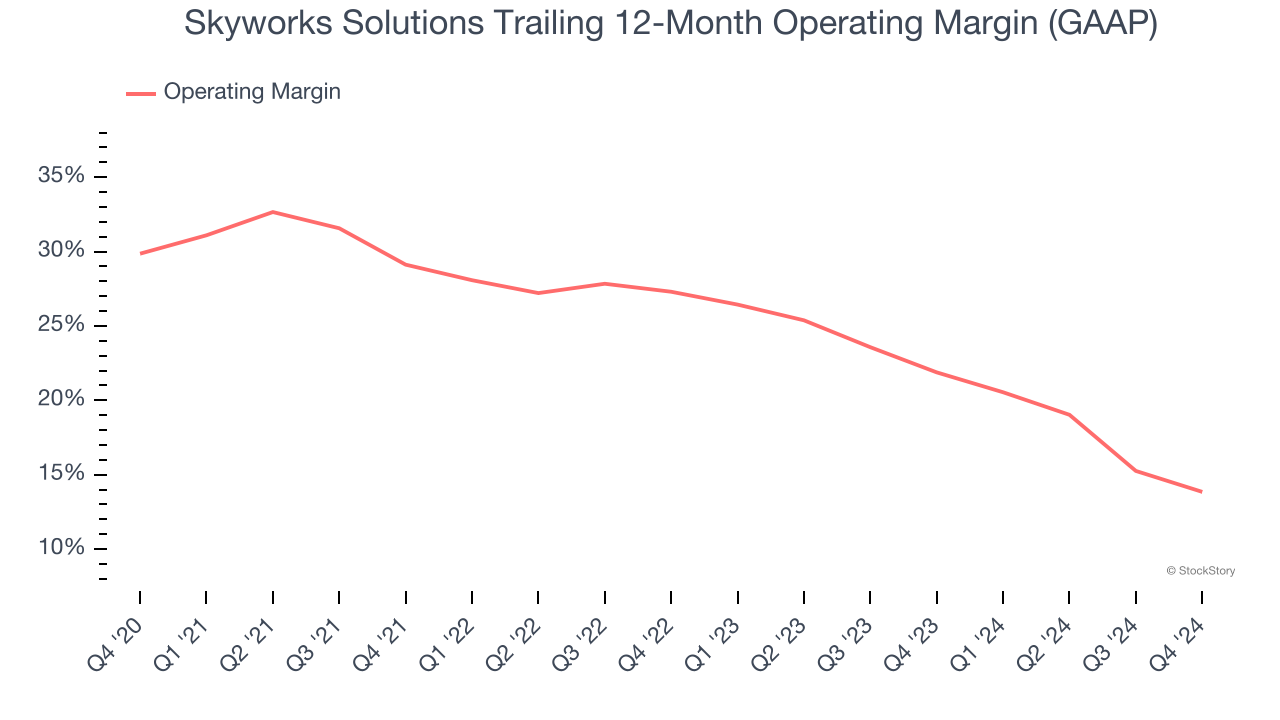

3. Shrinking Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Analyzing the trend in its profitability, Skyworks Solutions’s operating margin decreased by 16 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 13.8%.

Final Judgment

Skyworks Solutions falls short of our quality standards. After the recent drawdown, the stock trades at 12.6× forward price-to-earnings (or $67.26 per share). At this valuation, there’s a lot of good news priced in - you can find better investment opportunities elsewhere. We’d recommend looking at the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Skyworks Solutions

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.