The past six months haven’t been great for 1-800-FLOWERS. It just made a new 52-week low of $6.23, and shareholders have lost 21.5% of their capital. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in 1-800-FLOWERS, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Despite the more favorable entry price, we're swiping left on 1-800-FLOWERS for now. Here are three reasons why we avoid FLWS and a stock we'd rather own.

Why Do We Think 1-800-FLOWERS Will Underperform?

Founded in 1976, 1-800-FLOWERS (NASDAQ: FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

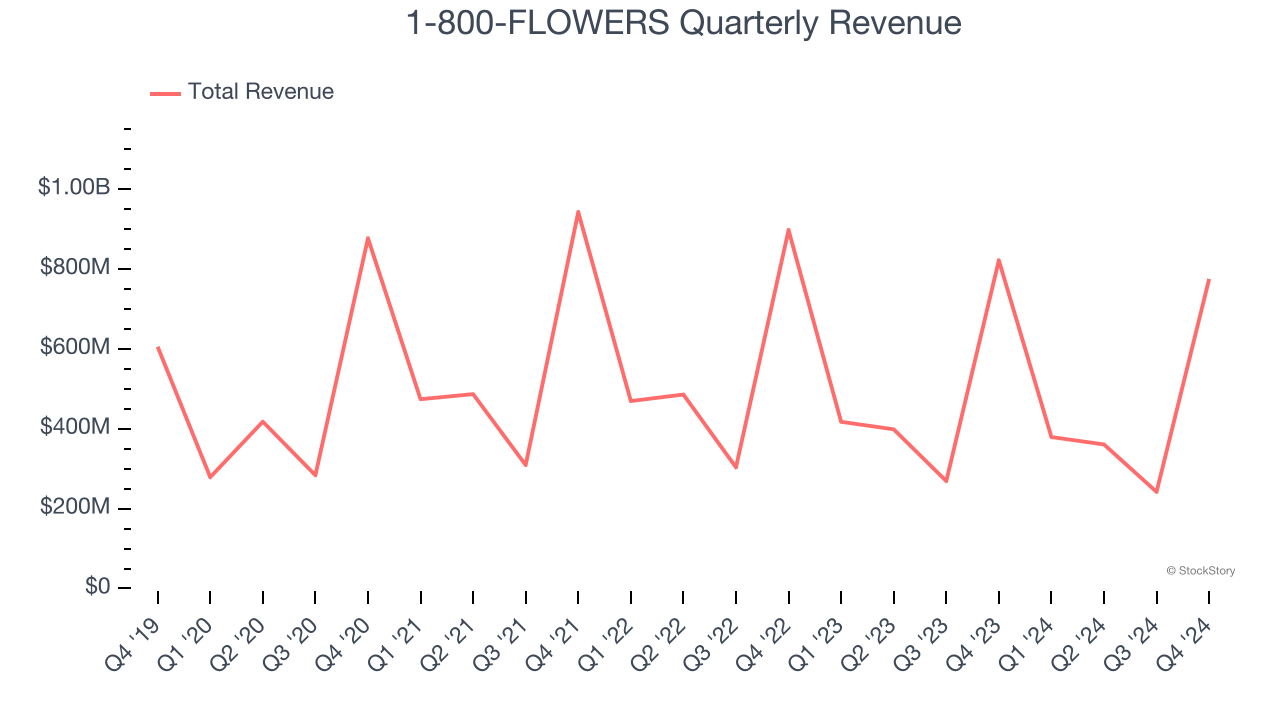

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, 1-800-FLOWERS grew its sales at a sluggish 6.2% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector.

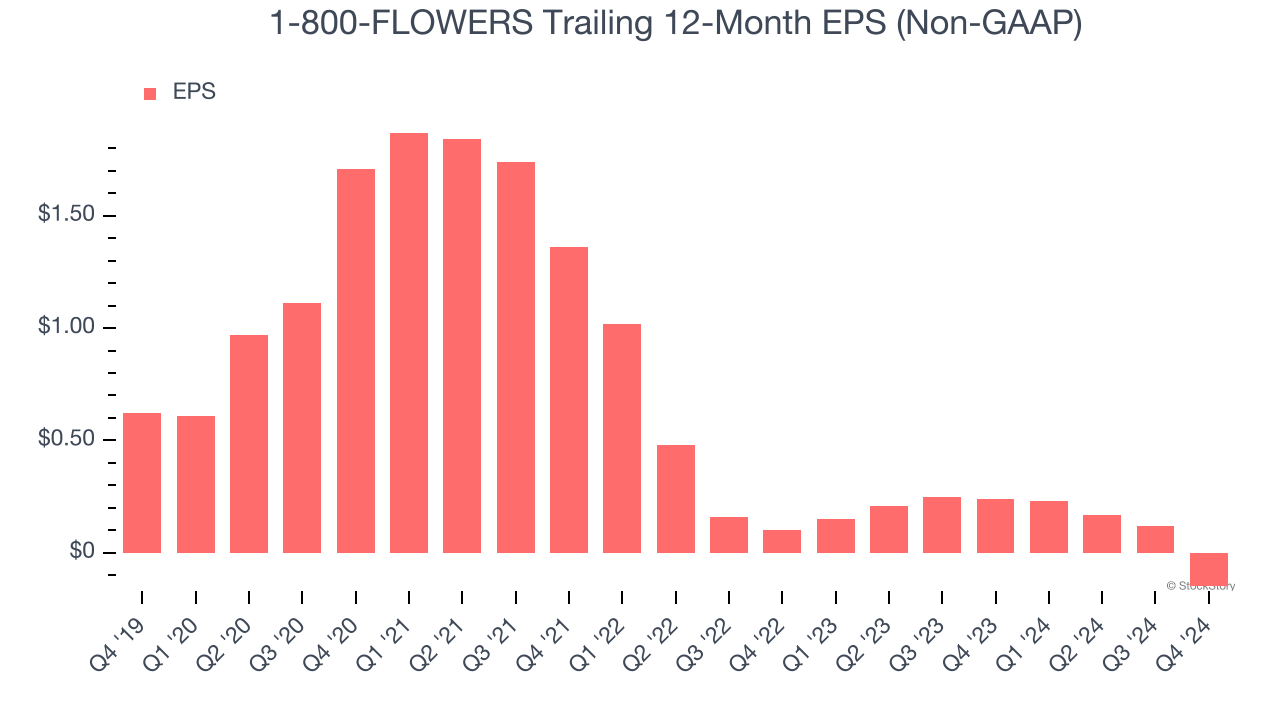

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for 1-800-FLOWERS, its EPS declined by 17.5% annually over the last five years while its revenue grew by 6.2%. This tells us the company became less profitable on a per-share basis as it expanded.

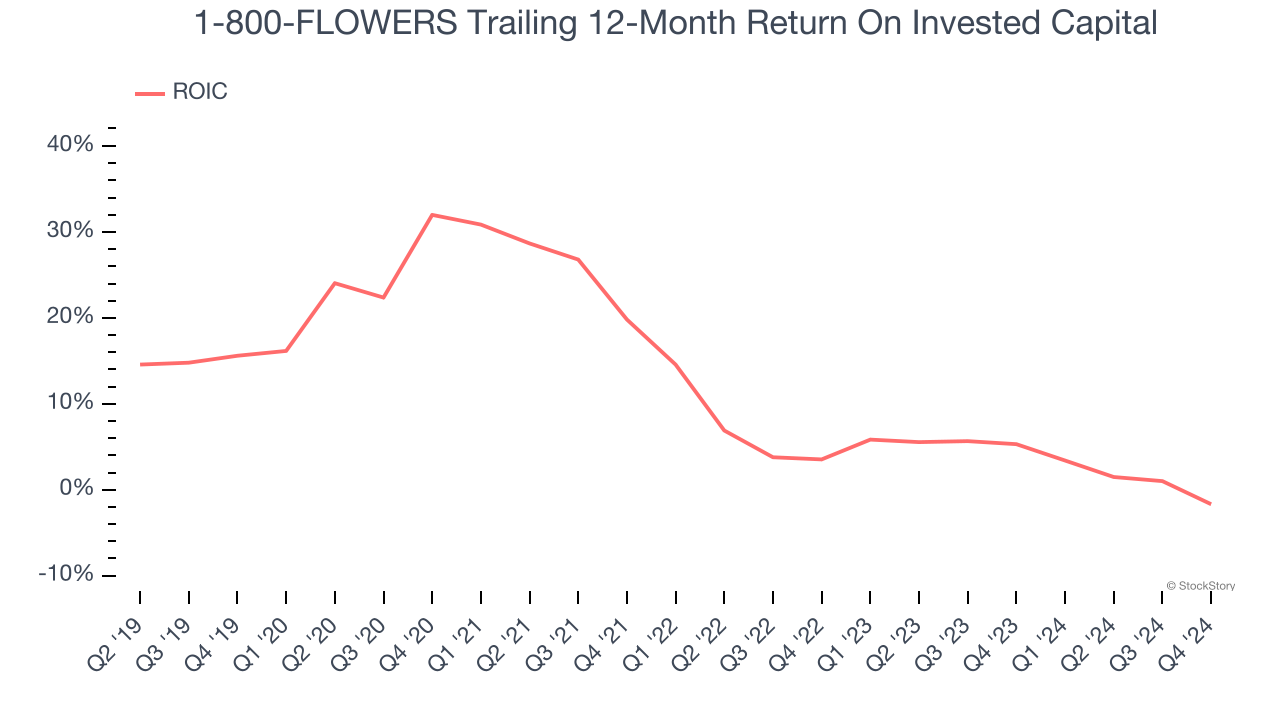

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, 1-800-FLOWERS’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

We see the value of companies helping consumers, but in the case of 1-800-FLOWERS, we’re out. Following the recent decline, the stock trades at 20.7× forward price-to-earnings (or $6.23 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better investments elsewhere. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than 1-800-FLOWERS

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.