Flooring manufacturer Mohawk Industries (NYSE: MHK) beat Wall Street’s revenue expectations in Q4 CY2024, but sales were flat year on year at $2.64 billion. Its non-GAAP profit of $1.95 per share was 5.3% above analysts’ consensus estimates.

Is now the time to buy Mohawk Industries? Find out by accessing our full research report, it’s free.

Mohawk Industries (MHK) Q4 CY2024 Highlights:

- Revenue: $2.64 billion vs analyst estimates of $2.53 billion (flat year on year, 4.1% beat)

- Adjusted EPS: $1.95 vs analyst estimates of $1.85 (5.3% beat)

- Adjusted EBITDA: $310.4 million vs analyst estimates of $297.7 million (11.8% margin, 4.3% beat)

- Adjusted EPS guidance for Q1 CY2025 is $1.39 at the midpoint, below analyst estimates of $1.67

- Operating Margin: 4.6%, down from 6.4% in the same quarter last year

- Free Cash Flow Margin: 9%, up from 2.1% in the same quarter last year

- Market Capitalization: $7.63 billion

Commenting on the Company’s fourth quarter and full year, Chairman and CEO Jeff Lorberbaum stated, “Our fourth quarter results exceeded our expectations as sales actions, restructuring initiatives and productivity improvements benefited our performance. Additionally, the negative sales impact from U.S. hurricanes was limited to approximately $10 million. While residential demand remained soft in our markets, our product introductions last year and our marketing initiatives contributed to our sales performance around the globe.

Company Overview

Established in 1878, Mohawk Industries (NYSE: MHK) is a leading producer of floor-covering products for both residential and commercial applications.

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

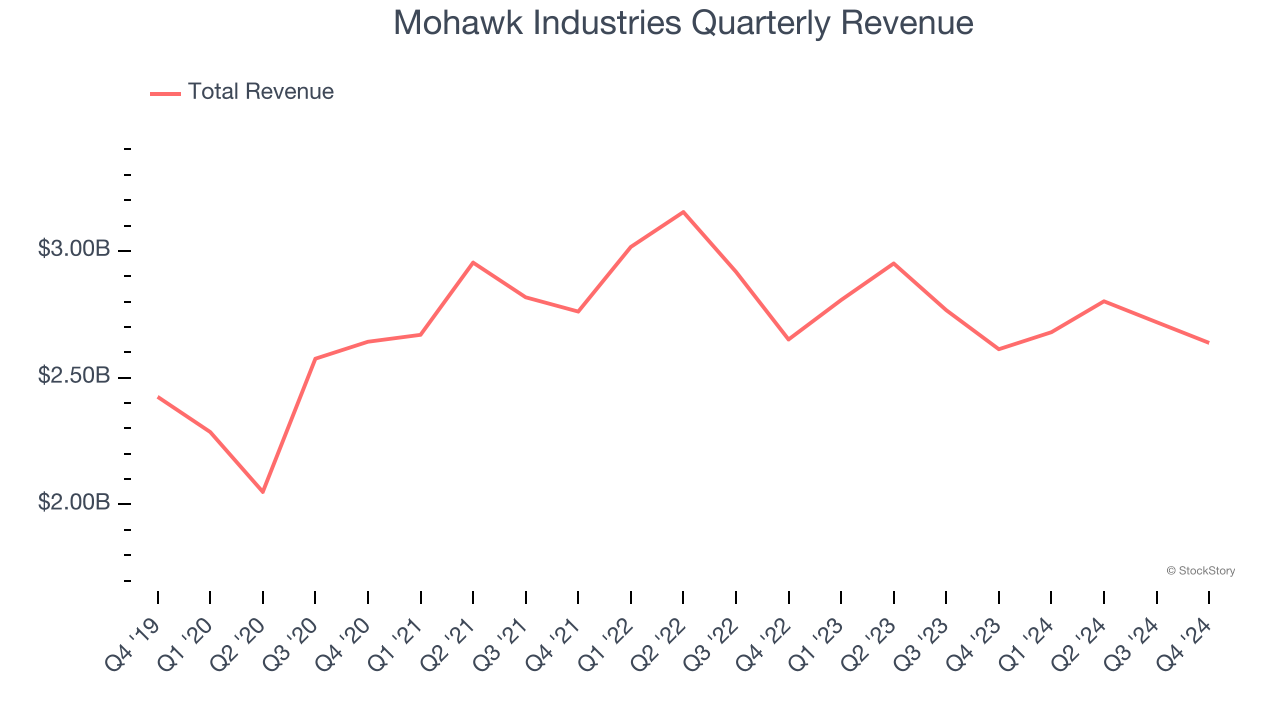

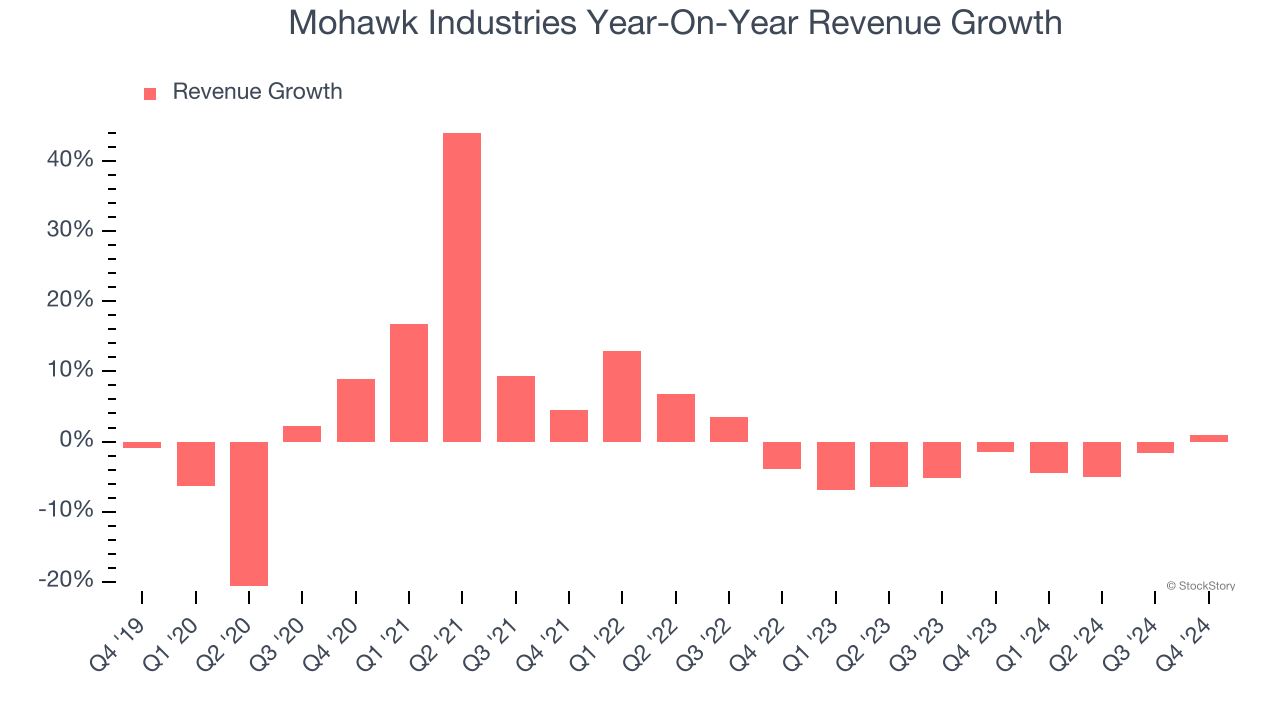

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Mohawk Industries grew its sales at a weak 1.7% compounded annual growth rate. This was below our standards and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Mohawk Industries’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.9% annually.

This quarter, Mohawk Industries’s $2.64 billion of revenue was flat year on year but beat Wall Street’s estimates by 4.1%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

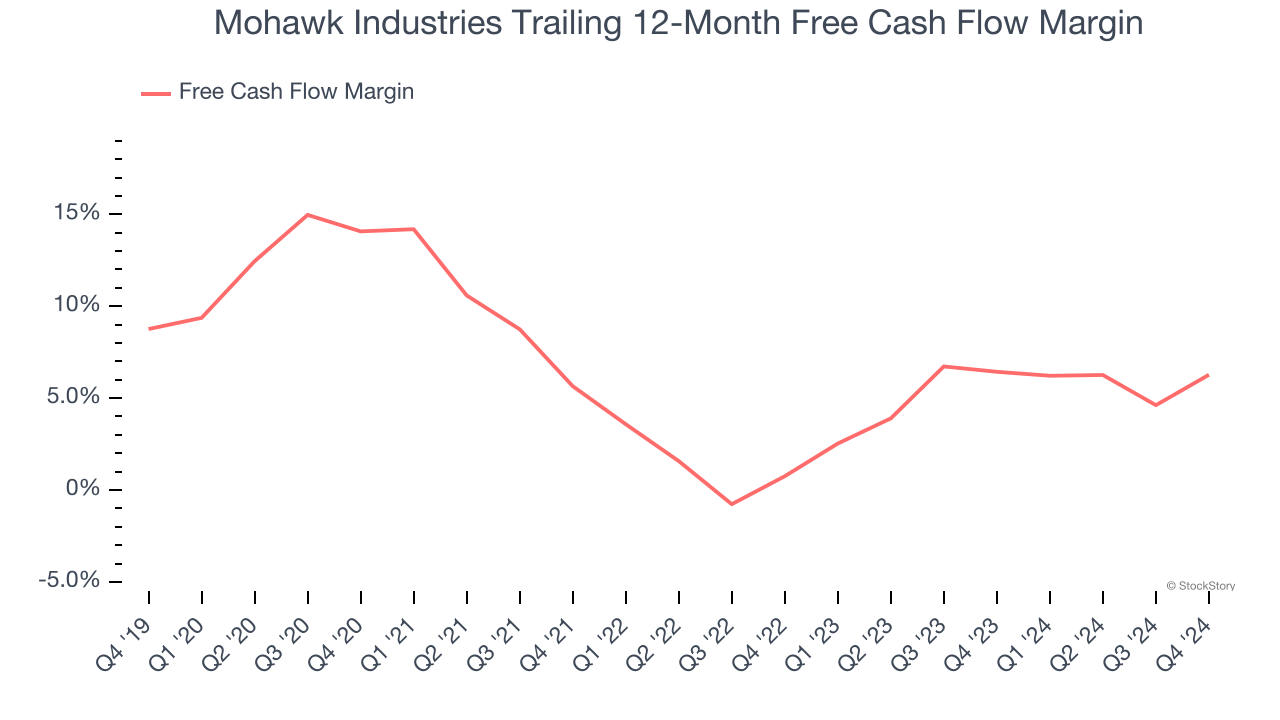

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Mohawk Industries has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.4%, subpar for a consumer discretionary business.

Mohawk Industries’s free cash flow clocked in at $236.2 million in Q4, equivalent to a 9% margin. This result was good as its margin was 6.8 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict Mohawk Industries’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 6.3% for the last 12 months will increase to 11.2%, giving it more flexibility for investments, share buybacks, and dividends.

Key Takeaways from Mohawk Industries’s Q4 Results

We enjoyed seeing Mohawk Industries exceed analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed significantly. Overall, this was a weaker quarter. The stock remained flat at $123.20 immediately after reporting.

So do we think Mohawk Industries is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.