Snack food company J&J Snack Foods (NASDAQ: JJSF) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 4.1% year on year to $362.6 million. Its non-GAAP profit of $0.33 per share was 44.4% below analysts’ consensus estimates.

Is now the time to buy J&J Snack Foods? Find out by accessing our full research report, it’s free.

J&J Snack Foods (JJSF) Q4 CY2024 Highlights:

- "Our performance was impacted by a less favorable sales mix namely related to our bakery and churros business, along with input cost inflation that was not fully covered with price increases."

- Revenue: $362.6 million vs analyst estimates of $361.5 million (4.1% year-on-year growth, in line)

- Adjusted EPS: $0.33 vs analyst expectations of $0.59 (44.4% miss)

- Adjusted EBITDA: $25.25 million vs analyst estimates of $34.04 million (7% margin, 25.8% miss)

- Operating Margin: 1.7%, down from 2.8% in the same quarter last year

- Free Cash Flow Margin: 4.4%, down from 8.3% in the same quarter last year

- Market Capitalization: $2.67 billion

"J & J Snack Foods total net sales increased 4.1%, reflecting continued growth across all three business segments,” stated Dan Fachner, Chairman, President, and CEO.

Company Overview

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ: JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.59 billion in revenue over the past 12 months, J&J Snack Foods is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage. On the other hand, it can grow faster because it’s working from a smaller revenue base and has a longer runway of untapped store chains to sell into.

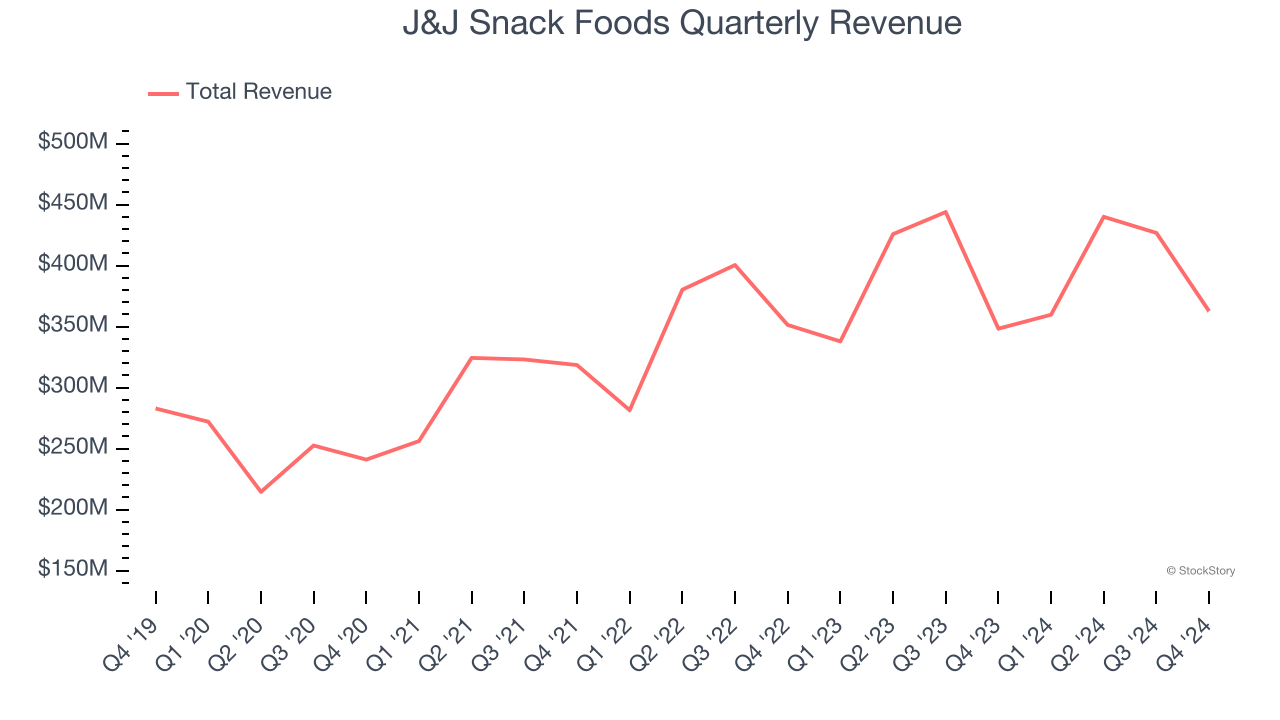

As you can see below, J&J Snack Foods’s sales grew at a decent 9.1% compounded annual growth rate over the last three years. This shows there was demand for its offerings, a useful starting point for our analysis.

This quarter, J&J Snack Foods grew its revenue by 4.1% year on year, and its $362.6 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.7% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

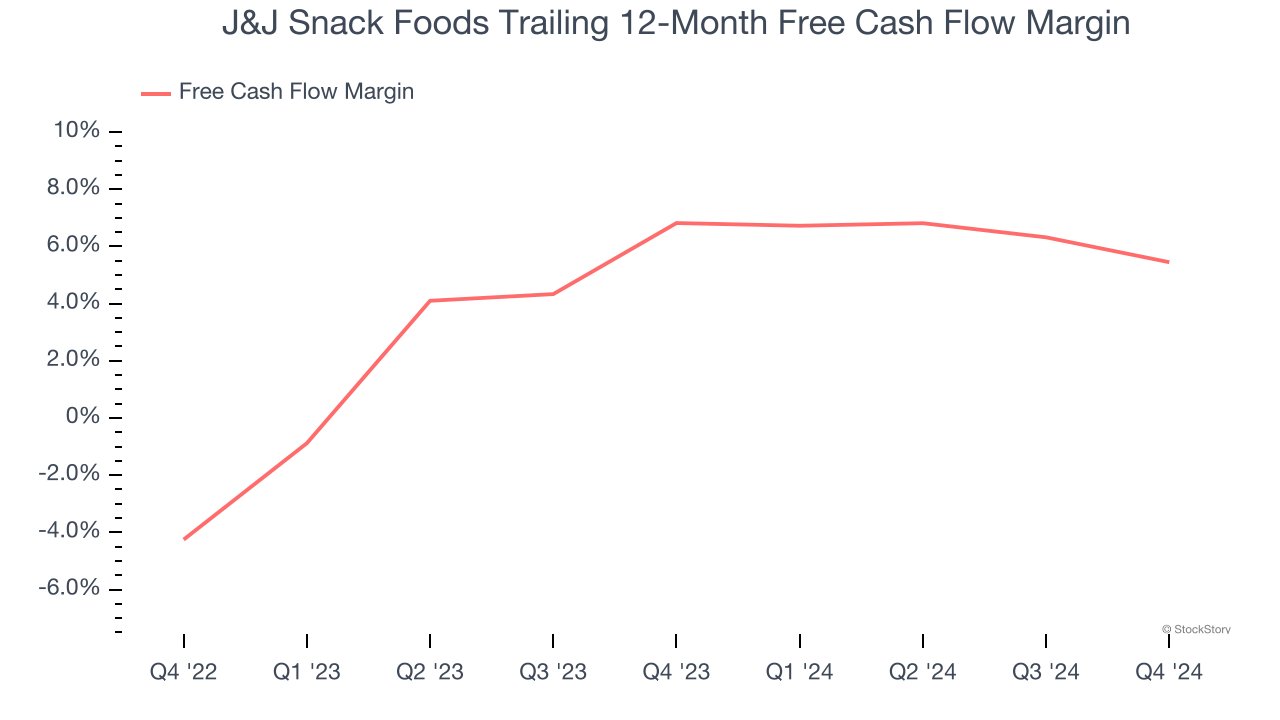

J&J Snack Foods has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.1% over the last two years, slightly better than the broader consumer staples sector.

Taking a step back, we can see that J&J Snack Foods’s margin dropped by 1.4 percentage points over the last year. If its declines continue, it could signal higher capital intensity.

J&J Snack Foods’s free cash flow clocked in at $16.1 million in Q4, equivalent to a 4.4% margin. The company’s cash profitability regressed as it was 3.9 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

Key Takeaways from J&J Snack Foods’s Q4 Results

We struggled to find many resounding positives in these results. Its gross margin fell short of Wall Street’s estimates, leading to a large EPS shortfall. The company stated that "our performance was impacted by a less favorable sales mix namely related to our bakery and churros business, along with input cost inflation that was not fully covered with price increases." Overall, this quarter could have been better. The stock traded down 4.3% to $127.21 immediately after reporting.

J&J Snack Foods may have had a tough quarter, but does that actually create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.