Mexican fast-food chain Chipotle (NYSE: CMG) will be announcing earnings results tomorrow afternoon. Here’s what you need to know.

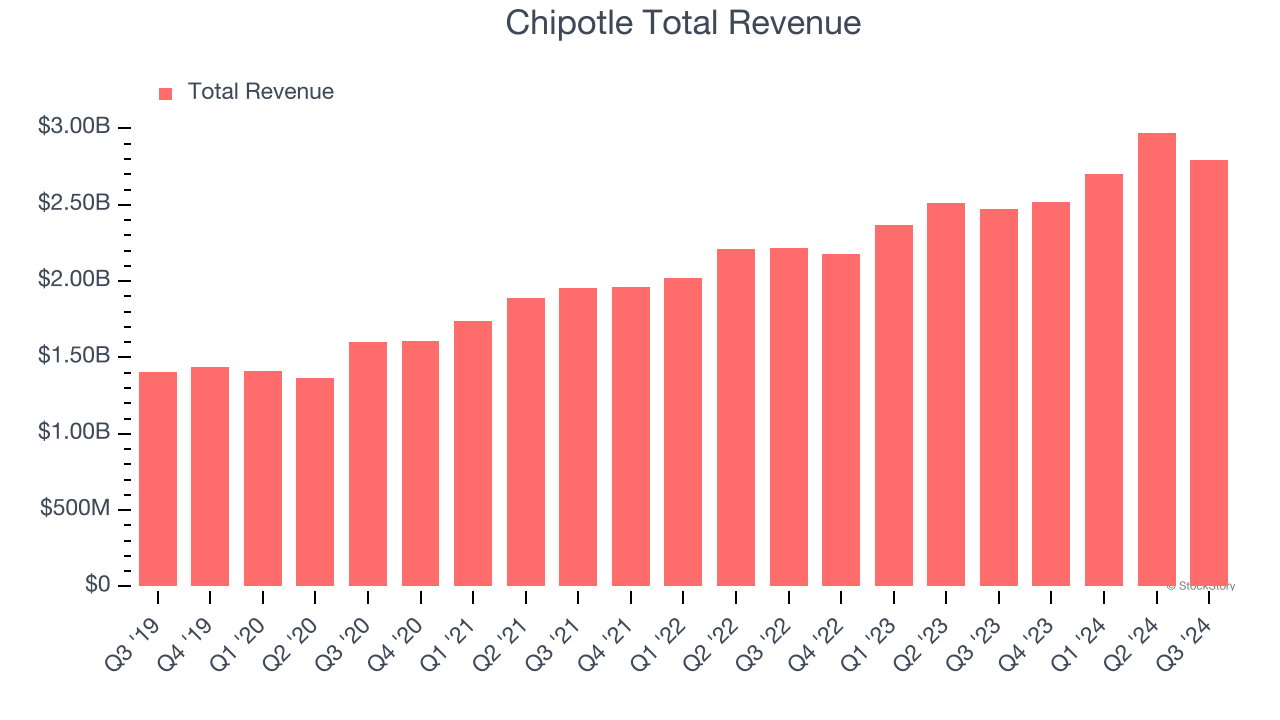

Chipotle missed analysts’ revenue expectations by 0.8% last quarter, reporting revenues of $2.79 billion, up 13% year on year. It was a mixed quarter for the company, with a narrow beat of analysts’ EBITDA estimates but same-store sales in line with analysts’ estimates.

Is Chipotle a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Chipotle’s revenue to grow 13.3% year on year to $2.85 billion, slowing from the 15.4% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.25 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Chipotle has missed Wall Street’s revenue estimates four times over the last two years.

Looking at Chipotle’s peers in the restaurants segment, some have already reported their Q4 results, giving us a hint as to what we can expect. Brinker International delivered year-on-year revenue growth of 26.5%, beating analysts’ expectations by 9.6%, and Kura Sushi reported revenues up 25.2%, topping estimates by 4.7%. Brinker International traded up 18% following the results while Kura Sushi was down 11.8%.

Read our full analysis of Brinker International’s results here and Kura Sushi’s results here.

There has been positive sentiment among investors in the restaurants segment, with share prices up 6.3% on average over the last month. Chipotle is down 4.1% during the same time and is heading into earnings with an average analyst price target of $66.31 (compared to the current share price of $56.60).

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefiting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.