Over the past six months, BD’s shares (currently trading at $224.85) have posted a disappointing 5.9% loss, well below the S&P 500’s 5.1% gain. This might have investors contemplating their next move.

Is there a buying opportunity in BD, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even with the cheaper entry price, we're cautious about BD. Here are three reasons why there are better opportunities than BDX and a stock we'd rather own.

Why Is BD Not Exciting?

Founded in 1897, Becton, Dickinson and Company (NYSE: BDX) is a medical technology company that manufactures and sells a wide range of medical devices, instrument systems, and laboratory chemicals.

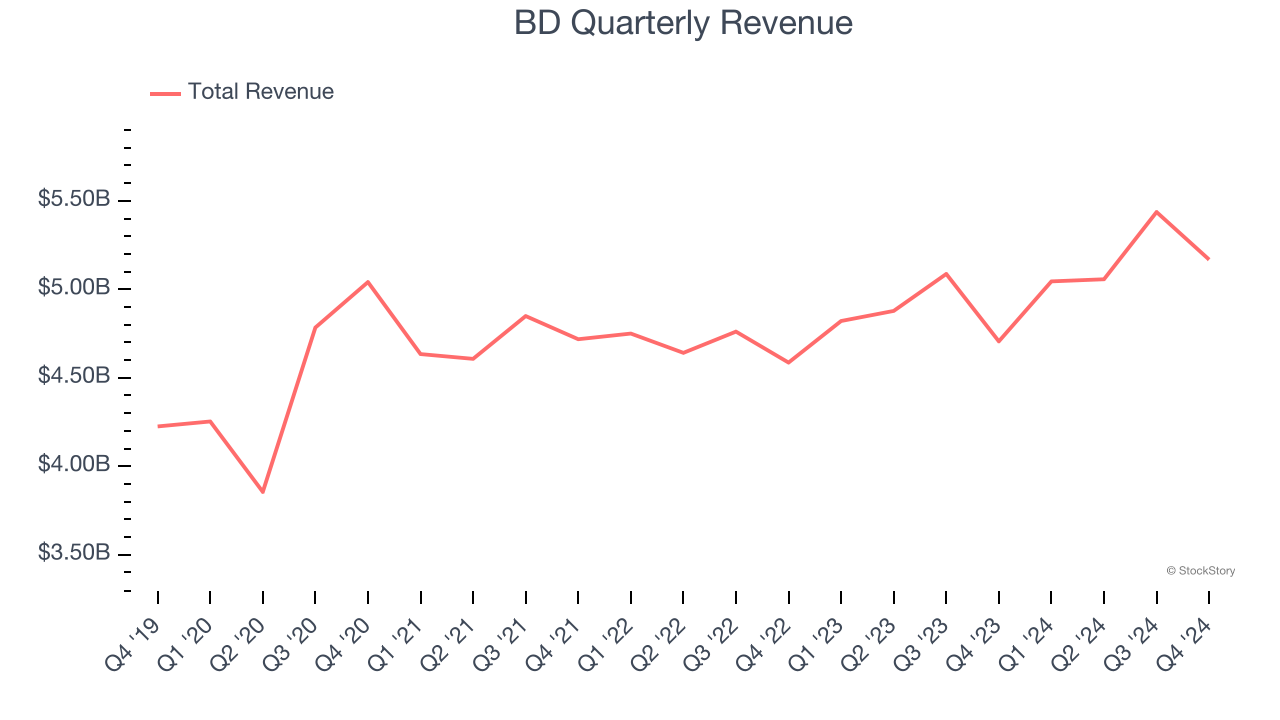

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, BD grew its sales at a tepid 3.6% compounded annual growth rate. This fell short of our benchmark for the healthcare sector.

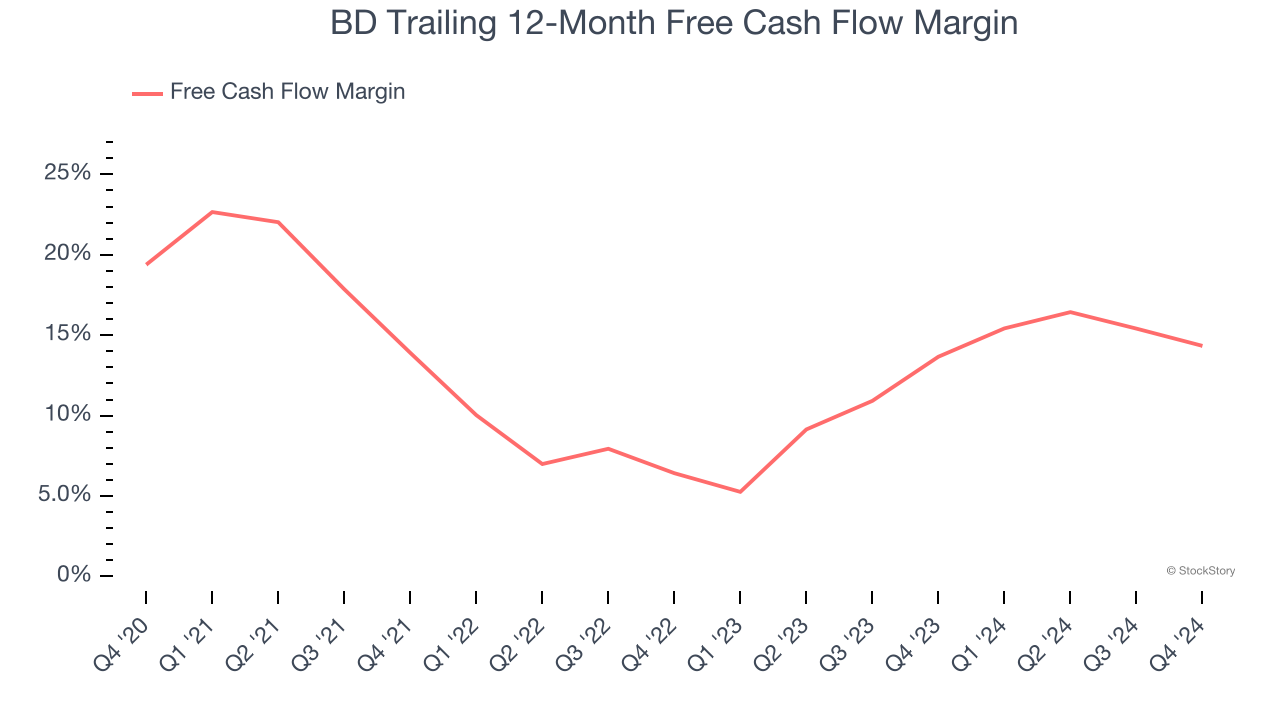

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, BD’s margin dropped by 5.1 percentage points over the last five years. If its declines continue, it could signal higher capital intensity. BD’s free cash flow margin for the trailing 12 months was 14.3%.

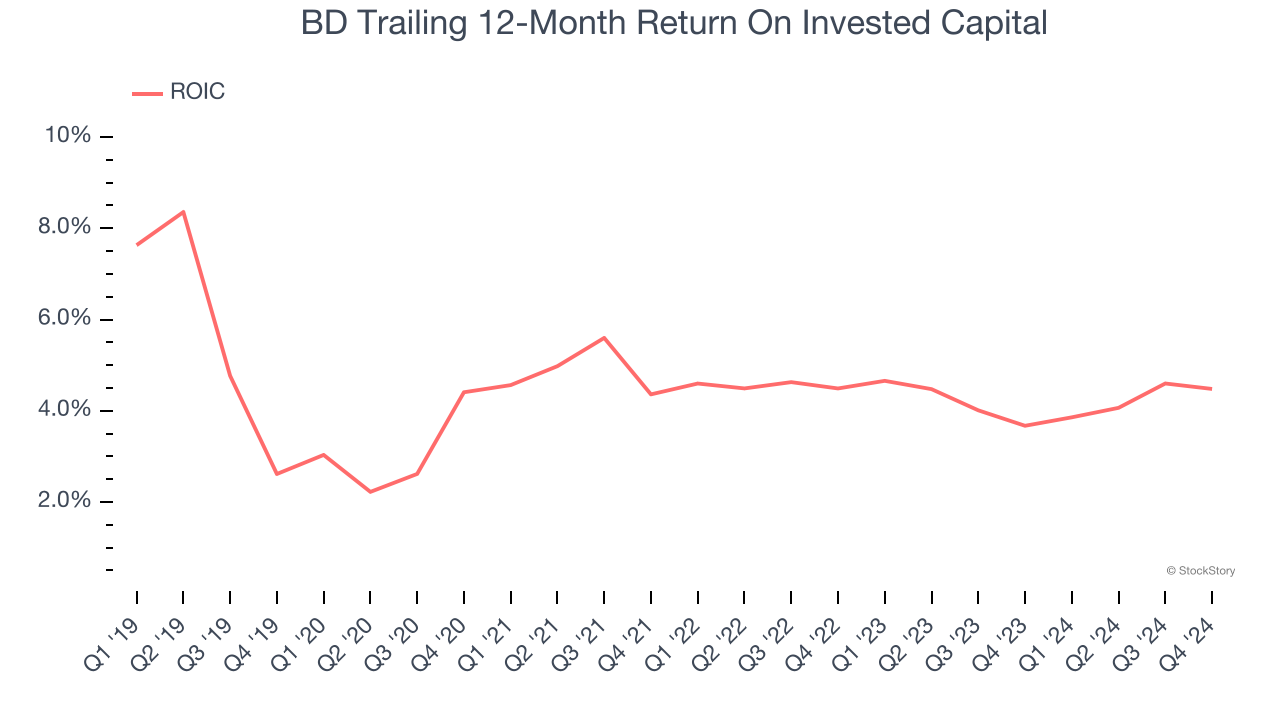

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

BD historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.3%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

Final Judgment

BD isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 15.3× forward price-to-earnings (or $224.85 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of BD

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.