Diabetes technology company Tandem Diabetes Care (NASDAQ: TNDM) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 35% year on year to $282.6 million. The company expects next quarter’s revenue to be around $221.5 million, coming in 1.3% above analysts’ estimates. Its GAAP profit of $0.01 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Tandem Diabetes? Find out by accessing our full research report, it’s free.

Tandem Diabetes (TNDM) Q4 CY2024 Highlights:

- Revenue: $282.6 million vs analyst estimates of $250.5 million (35% year-on-year growth, 12.8% beat)

- EPS (GAAP): $0.01 vs analyst estimates of -$0.21 (significant beat)

- Adjusted EBITDA: $2.25 million vs analyst estimates of $13.5 million (0.8% margin, 83.3% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.00 billion at the midpoint, missing analyst estimates by 0.6% and implying 6.6% growth (vs 21.2% in FY2024)

- Operating Margin: -0.2%, up from -16.7% in the same quarter last year

- Sales Volumes rose 14.3% year on year (-11.3% in the same quarter last year)

- Market Capitalization: $2.19 billion

“2024 was a pivotal year for Tandem, as we returned to strong sales growth both in and outside of the United States, while delivering industry-leading customer satisfaction,” said John Sheridan, president and Chief Executive Officer.

Company Overview

Founded in 2008, Tandem Diabetes Care (NASDAQ: TNDM) develops advanced diabetes management solutions, focusing on user-friendly insulin pumps and integrated software.

Healthcare Technology for Patients

The consumer-focused healthcare technology industry aims to improve accessibility, affordability, and convenience for patients seeking healthcare services. These companies typically leverage digital platforms to offer services such as prescription discounts, telemedicine consultations, and wellness products. Their business models often benefit from recurring revenues via subscription plans or marketplace commissions. The primary advantages of this sector include the scalability of digital platforms and growing consumer demand for on-demand healthcare. However, challenges arise from heavy reliance on marketing to acquire and retain customers, evolving regulatory backdrops, and continuing to convince newer cohorts (especially older individuals who tend to have more healthcare needs) that healthcare can be accessed online. Looking ahead, the industry stands to gain from tailwinds such as increasing consumer comfort with telehealth, rising healthcare costs driving demand for cost-saving tools, and broader adoption of personalized, digital-first healthcare. Technological advancements, including AI-powered health assessments and seamless user experiences, are likely to further enhance growth prospects. Conversely, headwinds include heightened competition from large tech companies entering the healthcare space or large healthcare companies investing in digital technologies.

Sales Growth

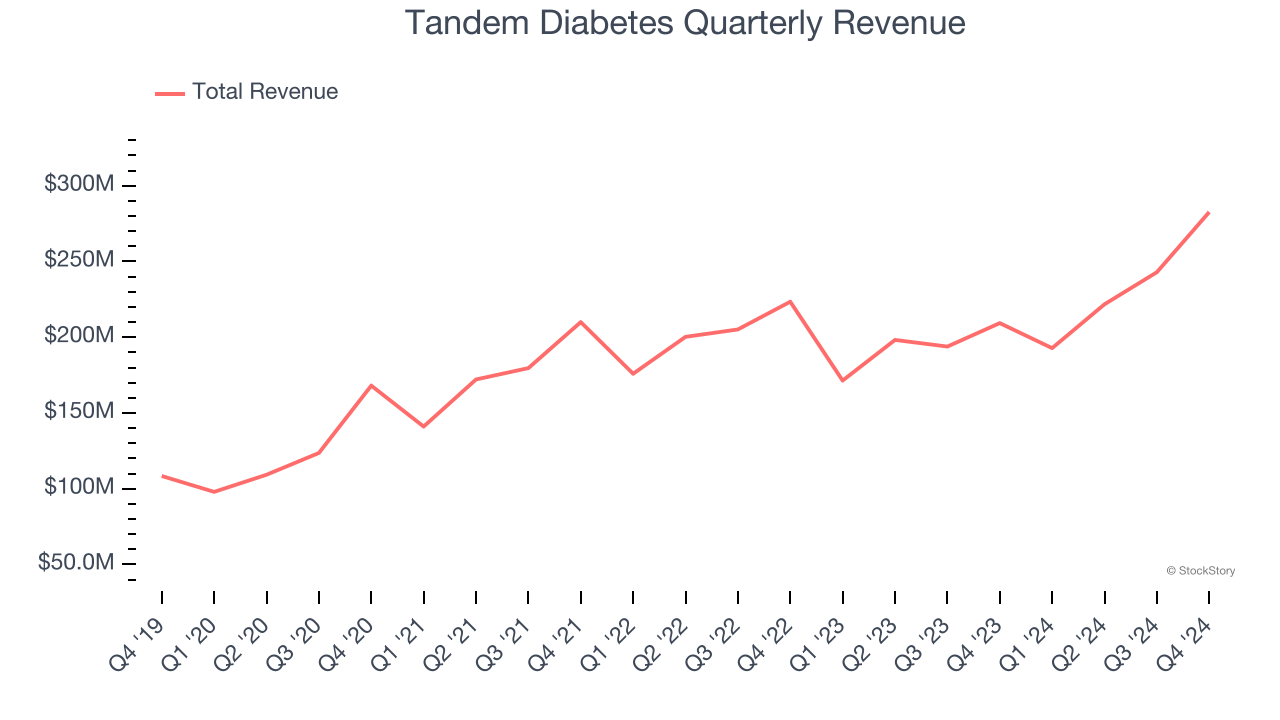

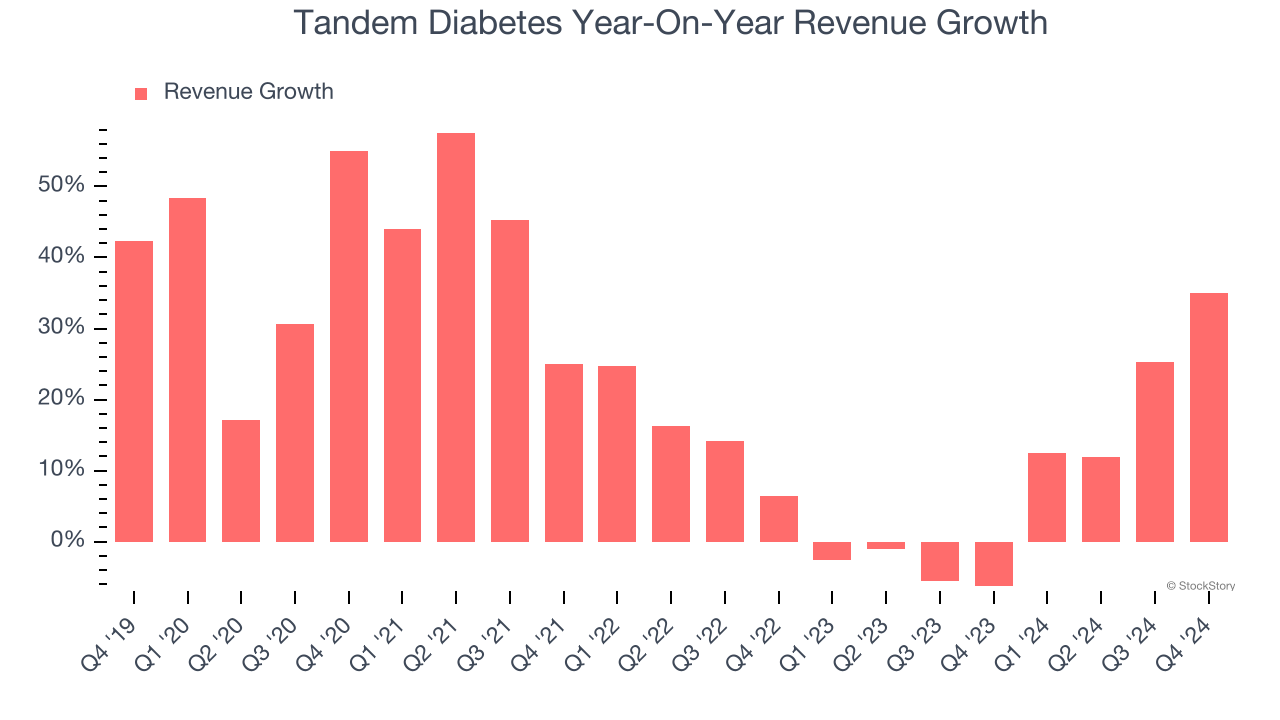

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Tandem Diabetes grew its sales at an excellent 21% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Tandem Diabetes’s annualized revenue growth of 8.1% over the last two years is below its five-year trend, but we still think the results were respectable.

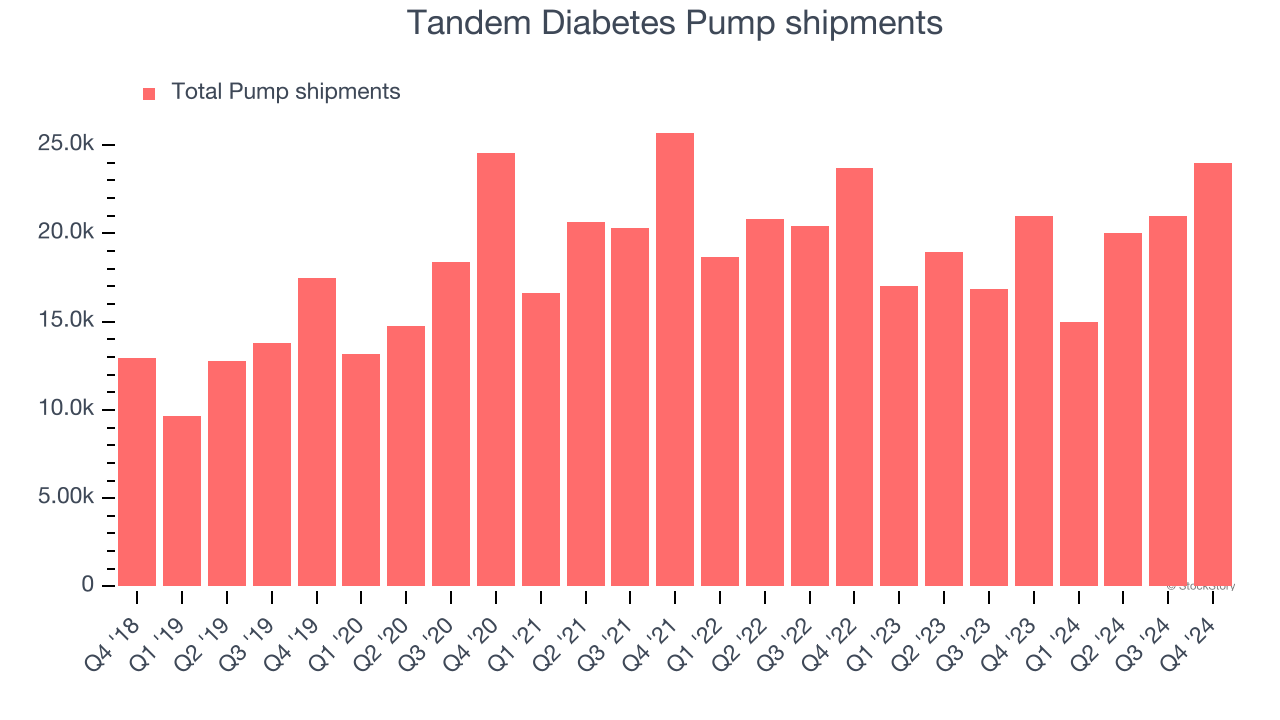

Tandem Diabetes also reports its number of pump shipments, which reached 24,000 in the latest quarter. Over the last two years, Tandem Diabetes’s pump shipments averaged 1.7% year-on-year declines. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Tandem Diabetes reported wonderful year-on-year revenue growth of 35%, and its $282.6 million of revenue exceeded Wall Street’s estimates by 12.8%. Company management is currently guiding for a 14.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.1% over the next 12 months, similar to its two-year rate. This projection is above average for the sector and implies its newer products and services will help maintain its recent top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

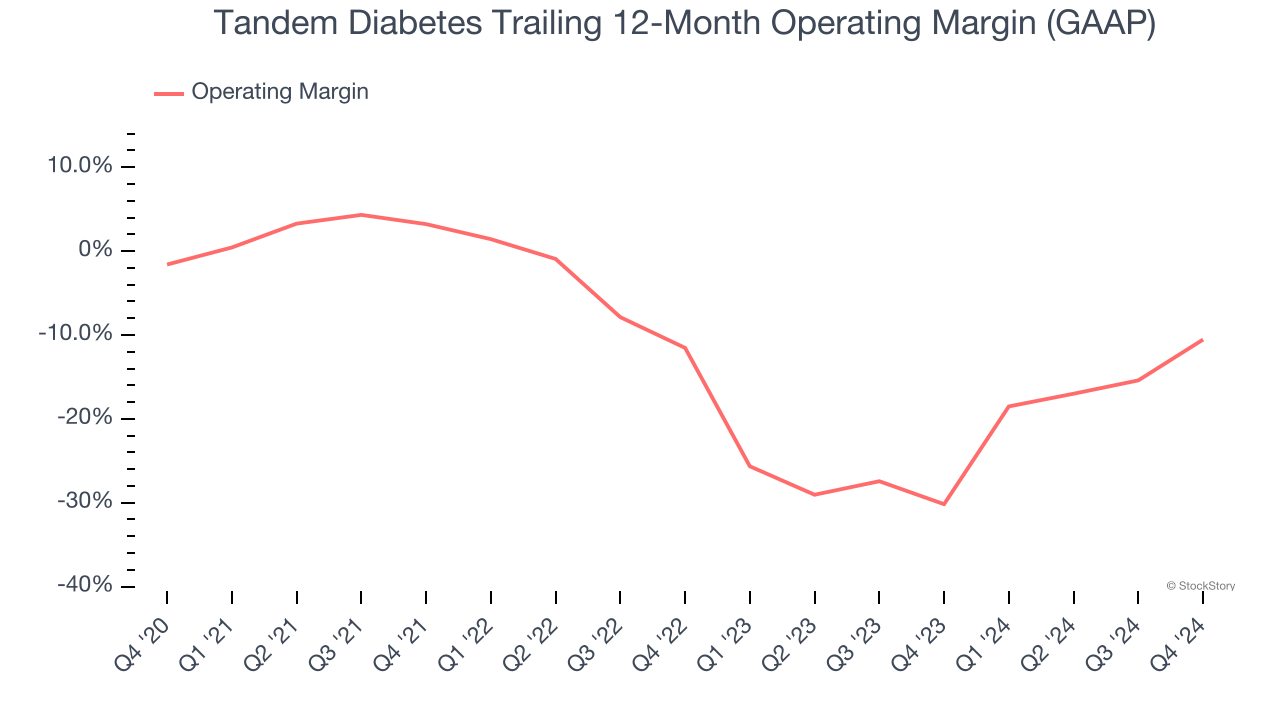

Although Tandem Diabetes broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 11% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Tandem Diabetes’s operating margin decreased by 8.9 percentage points over the last five years. A silver lining is that on a two-year basis, its margin has stabilized. Still, shareholders will want to see Tandem Diabetes become more profitable in the future.

In Q4, Tandem Diabetes generated a negative 0.2% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

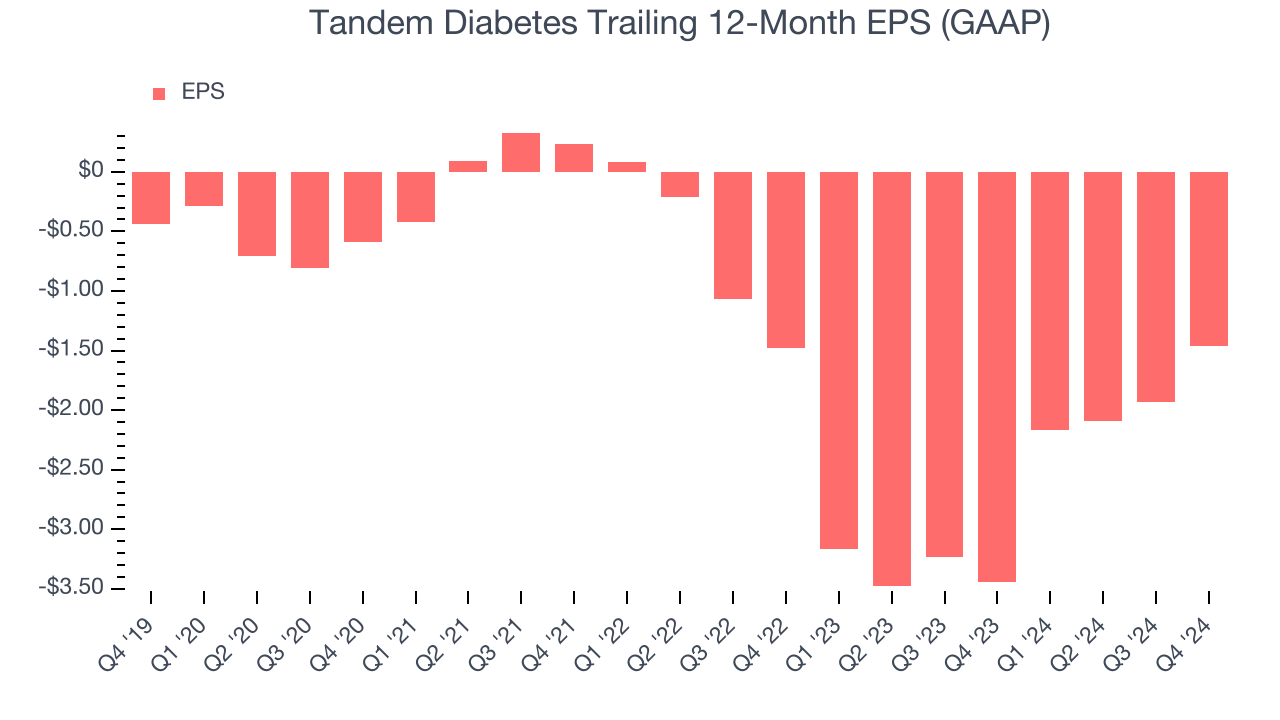

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Tandem Diabetes’s earnings losses deepened over the last five years as its EPS dropped 27.2% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Tandem Diabetes’s low margin of safety could leave its stock price susceptible to large downswings.

In Q4, Tandem Diabetes reported EPS at $0.01, up from negative $0.46 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Tandem Diabetes to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.46 will advance to negative $1.18.

Key Takeaways from Tandem Diabetes’s Q4 Results

We were impressed by how significantly Tandem Diabetes blew past analysts’ revenue and EPS expectations this quarter. On the other hand, its sales volume missed along with its EBITDA and full-year revenue guidance. Overall, this quarter was mixed. The market seemed to focus on the negatives, and the stock traded down 11.2% to $29.84 immediately after reporting.

So should you invest in Tandem Diabetes right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.