Optical retailer National Vision (NYSE: EYE) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 3.9% year on year to $437.3 million. The company’s full-year revenue guidance of $1.93 billion at the midpoint came in 2% above analysts’ estimates. Its non-GAAP loss of $0.04 per share was in line with analysts’ consensus estimates.

Is now the time to buy National Vision? Find out by accessing our full research report, it’s free.

National Vision (EYE) Q4 CY2024 Highlights:

- Revenue: $437.3 million vs analyst estimates of $434.8 million (3.9% year-on-year growth, 0.6% beat)

- Adjusted EPS: -$0.04 vs analyst estimates of -$0.05 (in line)

- Adjusted EBITDA: $25.81 million vs analyst estimates of $24.25 million (5.9% margin, 6.4% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.93 billion at the midpoint, beating analyst estimates by 2% and implying 5.7% growth (vs 3.8% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $0.58 at the midpoint, beating analyst estimates by 9%

- Operating Margin: -5.8%, down from -2.9% in the same quarter last year

- Free Cash Flow was -$1.74 million compared to -$13.05 million in the same quarter last year

- Locations: 1,240 at quarter end, down from 1,413 in the same quarter last year

- Same-Store Sales rose 2.6% year on year (6.3% in the same quarter last year)

- Market Capitalization: $900.9 million

“Fiscal 2024 was an important year for National Vision as we took decisive steps to strengthen our foundation and accelerate our transformation,” said Reade Fahs, National Vision's CEO.

Company Overview

Operating under multiple brands, National Vision (NYSE: EYE) sells optical products such as eyeglasses and provides optical services such as eye exams.

Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Sales Growth

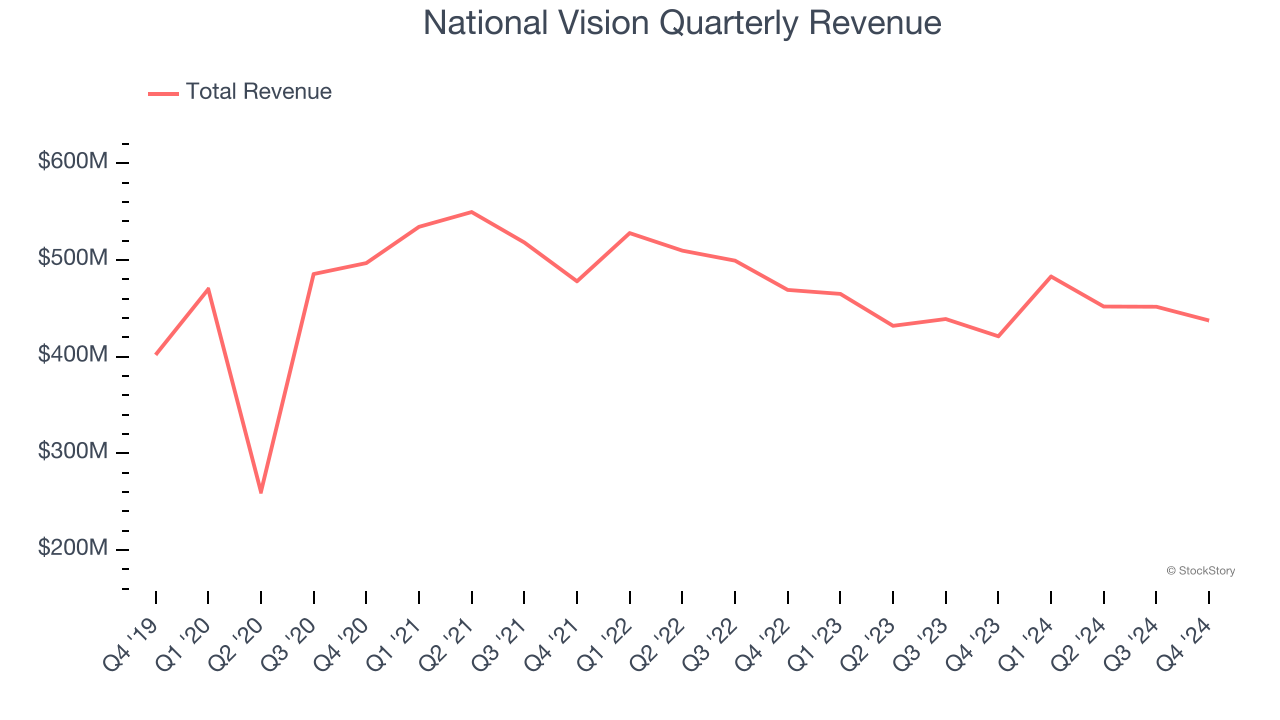

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $1.82 billion in revenue over the past 12 months, National Vision is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, National Vision’s sales grew at a sluggish 1.1% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it closed stores.

This quarter, National Vision reported modest year-on-year revenue growth of 3.9% but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months, an acceleration versus the last five years. This projection is above the sector average and implies its newer products will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Store Performance

Number of Stores

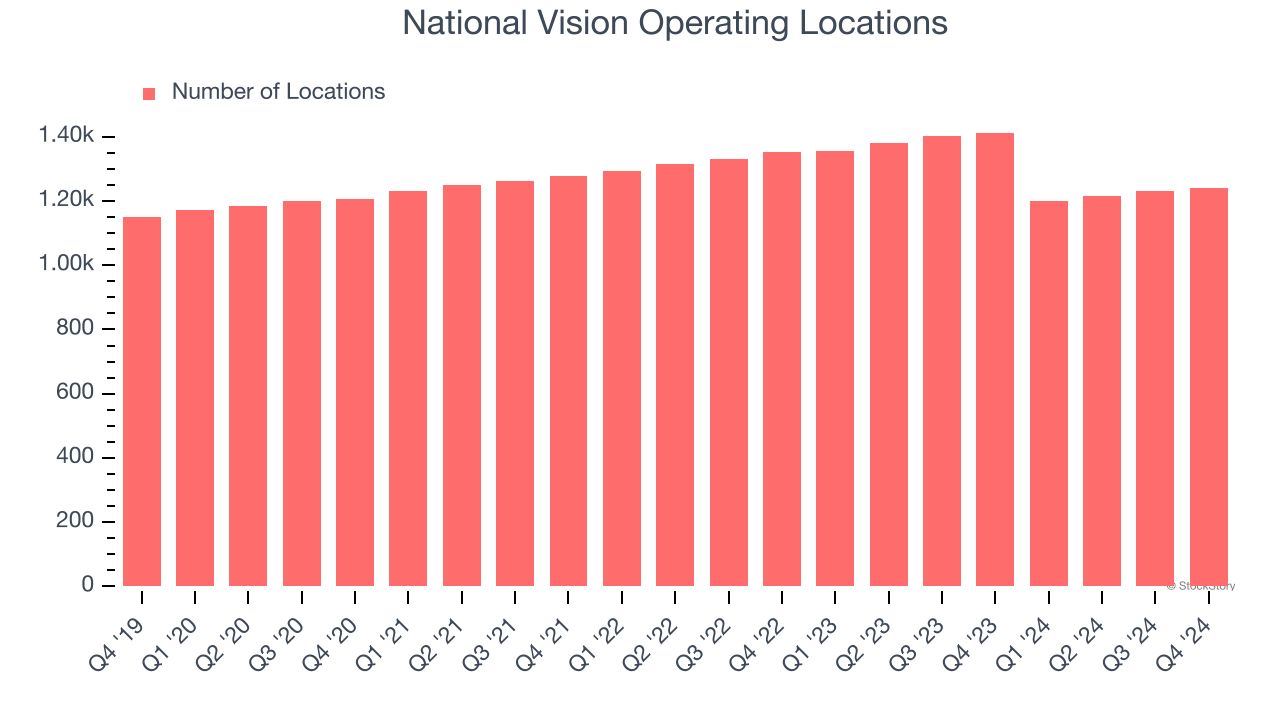

A retailer’s store count often determines how much revenue it can generate.

National Vision listed 1,240 locations in the latest quarter and has generally closed its stores over the last two years, averaging 3.5% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

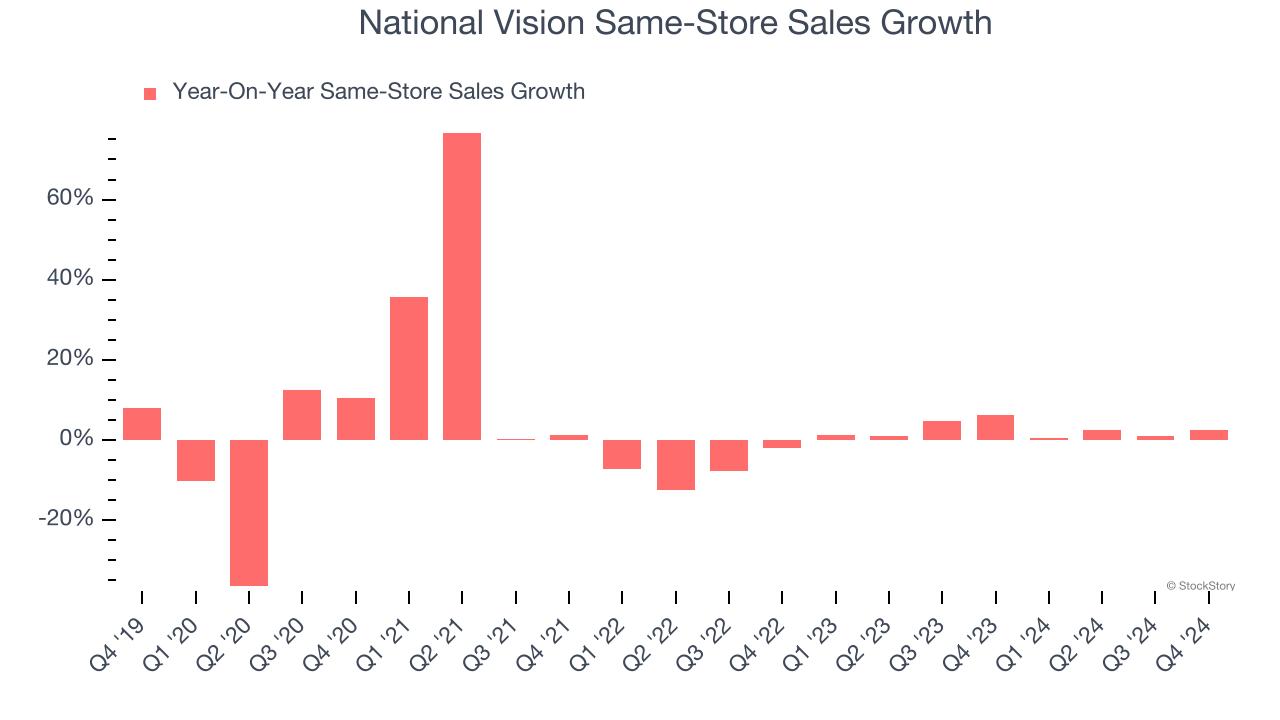

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

National Vision’s demand rose over the last two years and slightly outpaced the industry. On average, the company’s same-store sales have grown by 2.5% per year. Given its declining store base over the same period, this performance stems from a mixture of higher e-commerce sales and increased foot traffic at existing locations (closing stores can sometimes boost same-store sales).

In the latest quarter, National Vision’s same-store sales rose 2.6% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from National Vision’s Q4 Results

Revenue beat slightly and EPS was just in line. On a much more exciting note, we were impressed by National Vision’s optimistic full-year revenue and EPS guidance, both of which exceeded analysts’ expectations. This outlook is lifting shares, and the stock traded up 17.9% to $13.50 immediately after reporting.

National Vision put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.