Home improvement retailer Lowe’s (NYSE: LOW) reported Q4 CY2024 results beating Wall Street’s revenue expectations, but sales were flat year on year at $18.55 billion. On the other hand, the company’s full-year revenue guidance of $84 billion at the midpoint came in 0.9% below analysts’ estimates. Its GAAP profit of $1.99 per share was 8.5% above analysts’ consensus estimates.

Is now the time to buy Lowe's? Find out by accessing our full research report, it’s free.

Lowe's (LOW) Q4 CY2024 Highlights:

- Revenue: $18.55 billion vs analyst estimates of $18.29 billion (flat year on year, 1.5% beat)

- EPS (GAAP): $1.99 vs analyst estimates of $1.83 (8.5% beat)

- Adjusted EBITDA: $2.28 billion vs analyst estimates of $2.22 billion (12.3% margin, 2.5% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $84 billion at the midpoint, missing analyst estimates by 0.9% and implying 0.4% growth (vs -2.9% in FY2024)

- EPS (GAAP) guidance for the upcoming financial year 2025 is $12.28 at the midpoint, missing analyst estimates by 2.4%

- Operating Margin: 9.9%, in line with the same quarter last year

- Free Cash Flow Margin: 2%, similar to the same quarter last year

- Locations: 1,748 at quarter end, up from 1,746 in the same quarter last year

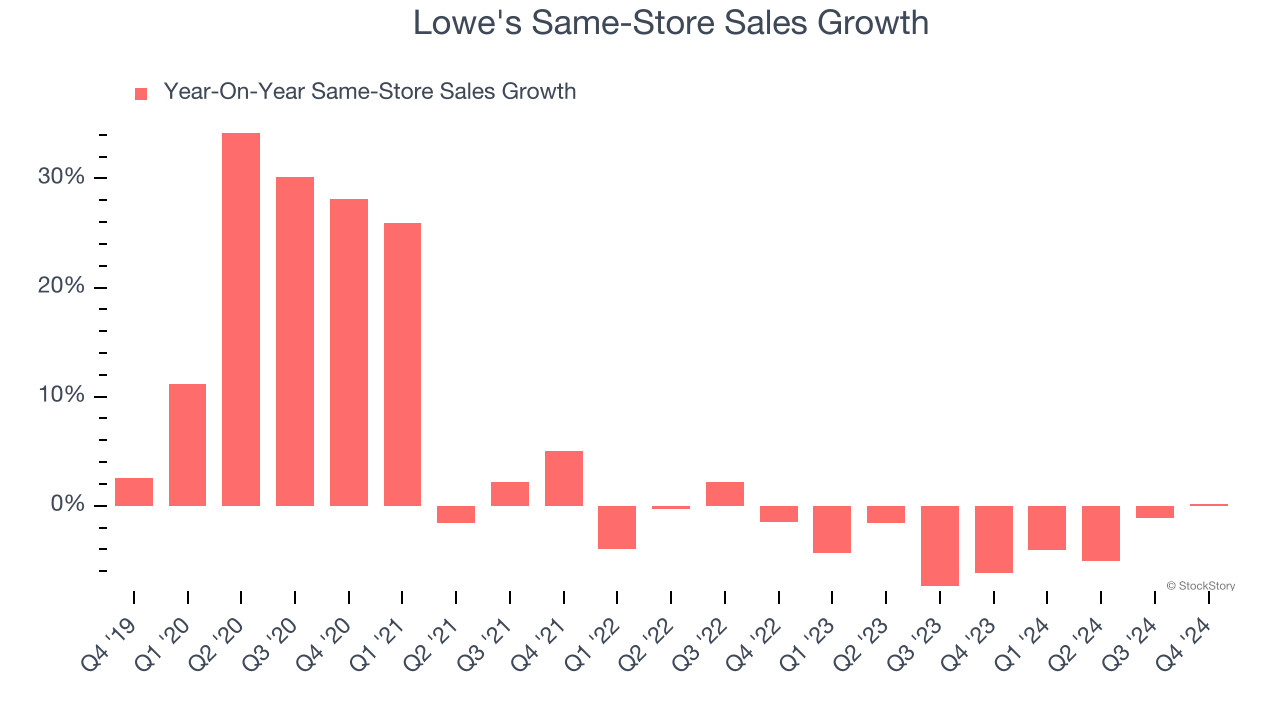

- Same-Store Sales were flat year on year, breaking streak of multiples quarters of declines (-6.2% in the same quarter last year)

- Market Capitalization: $136.9 billion

"Our results this quarter were once again better-than-expected, as we continue to gain traction with our Total Home strategic initiatives," said Marvin R. Ellison, Lowe's chairman, president and CEO.

Company Overview

Founded in North Carolina as Lowe's North Wilkesboro Hardware, the company is a home improvement retailer that sells everything from paint to tools to building materials.

Home Improvement Retailer

Home improvement retailers serve the maintenance and repair needs of do-it-yourself homeowners as well as professional contractors. Home is where the heart is, so any homeowner will want to keep that home in good shape by maintaining the yard, fixing leaks, or improving lighting fixtures, for example. Home improvement stores win with depth and breadth of product, in-store consultations for customers who need help, and services that cater to professionals. It is hard for non-focused retailers and e-commerce competitors to match these. However, the research, convenience, and prices of online platforms means they can’t be fully written off, either.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $83.67 billion in revenue over the past 12 months, Lowe's is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth.

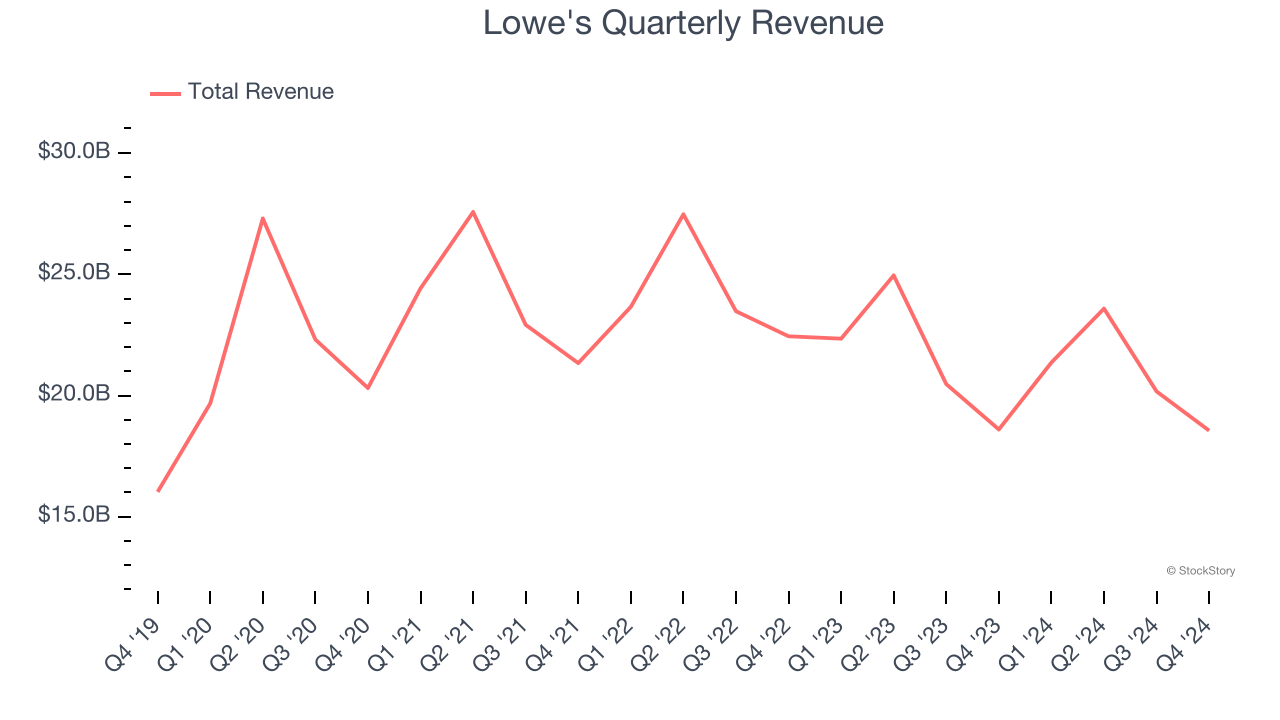

As you can see below, Lowe’s sales grew at a sluggish 3% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it closed stores.

This quarter, Lowe’s $18.55 billion of revenue was flat year on year but beat Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months, a slight deceleration versus the last five years. This projection is underwhelming and implies its products will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

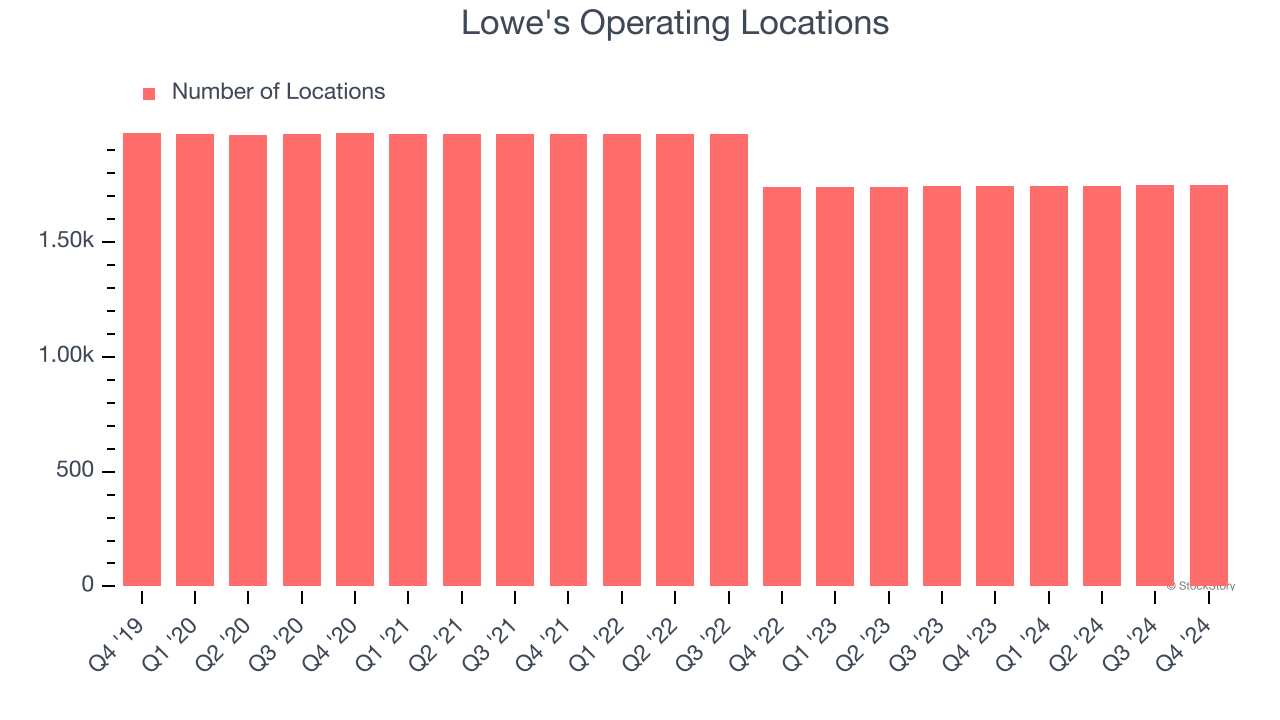

Lowe's listed 1,748 locations in the latest quarter and has generally closed its stores over the last two years, averaging 4.2% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Lowe’s demand has been shrinking over the last two years as its same-store sales have averaged 3.7% annual declines. This performance isn’t ideal, and Lowe's is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Lowe’s year on year same-store sales were flat. This performance was a well-appreciated turnaround from its historical levels, showing the business is improving.

Key Takeaways from Lowe’s Q4 Results

It was good to see Lowe's narrowly top analysts’ revenue expectations this quarter on flat same-store sales, which broke a streak of multiple quarters of same-store sales declines. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its full-year revenue and EPS guidance fell slightly short of Wall Street’s estimates. The market seems to be forgiving this mediocre guidance amid a shaky consumer backdrop where consumer confidence is falling and the home buying market remains stagnant. The stock traded up 2.3% to $248.03 immediately after reporting.

Big picture, is Lowe's a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.