Biopharma company Corcept Therapeutics (NASDAQ: CORT) fell short of the market’s revenue expectations in Q4 CY2024, but sales rose 34.3% year on year to $181.9 million. On the other hand, the company’s full-year revenue guidance of $925 million at the midpoint came in 8.2% above analysts’ estimates. Its GAAP profit of $0.26 per share was 39% below analysts’ consensus estimates.

Is now the time to buy Corcept? Find out by accessing our full research report, it’s free.

Corcept (CORT) Q4 CY2024 Highlights:

- Revenue: $181.9 million vs analyst estimates of $198.7 million (34.3% year-on-year growth, 8.5% miss)

- EPS (GAAP): $0.26 vs analyst expectations of $0.43 (39% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $925 million at the midpoint, beating analyst estimates by 8.2% and implying 37% growth (vs 40% in FY2024)

- Operating Margin: 13.9%, down from 23.4% in the same quarter last year

- Market Capitalization: $6.42 billion

Company Overview

Founded in 1998, Corcept Therapeutics (NASDAQ: CORT) develops and commercializes medications for the treatment of severe metabolic, oncologic, and psychiatric disorders associated with cortisol dysregulation.

Branded Pharmaceuticals

The branded pharmaceutical industry relies on a high-cost, high-reward business model, driven by substantial investments in research and development to create innovative, patent-protected drugs. Successful products can generate significant revenue streams over their patent life, and the larger a roster of drugs, the stronger a moat a company enjoys. However, the business model is inherently risky, with high failure rates during clinical trials, lengthy regulatory approval processes, and intense competition from generic and biosimilar manufacturers once patents expire. These challenges, combined with scrutiny over drug pricing, create a complex operating environment. Looking ahead, the industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

Sales Growth

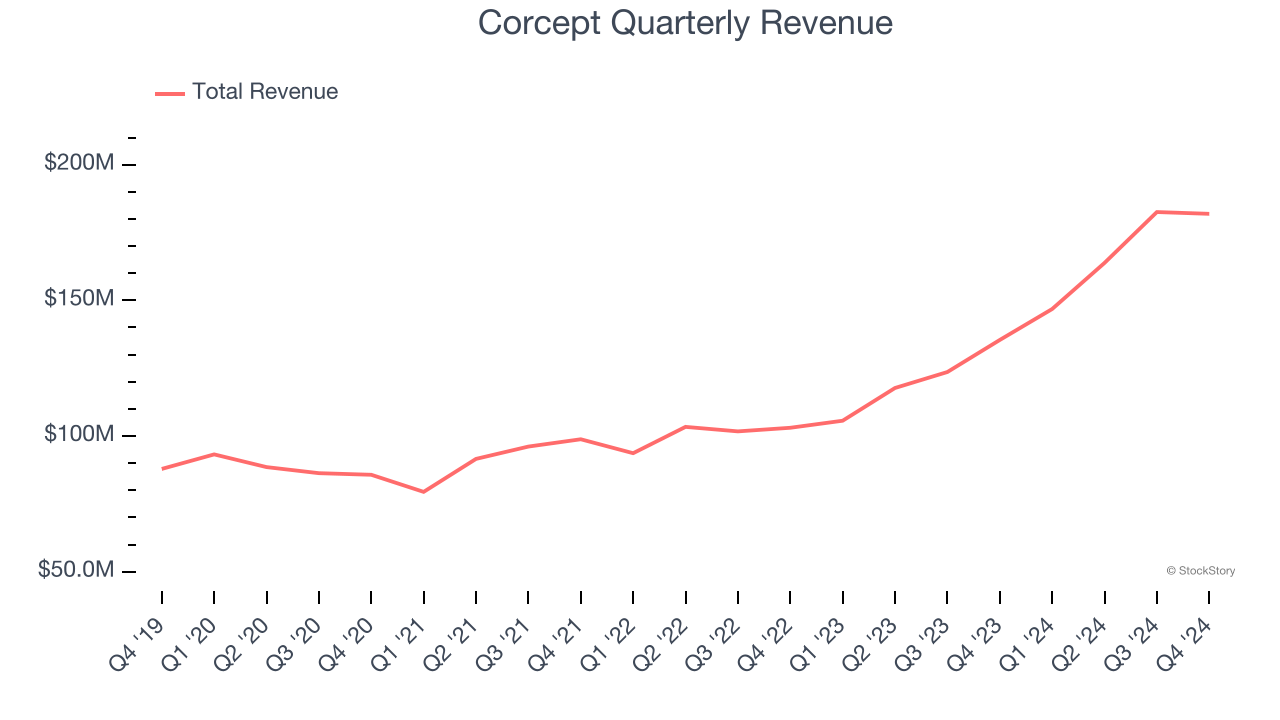

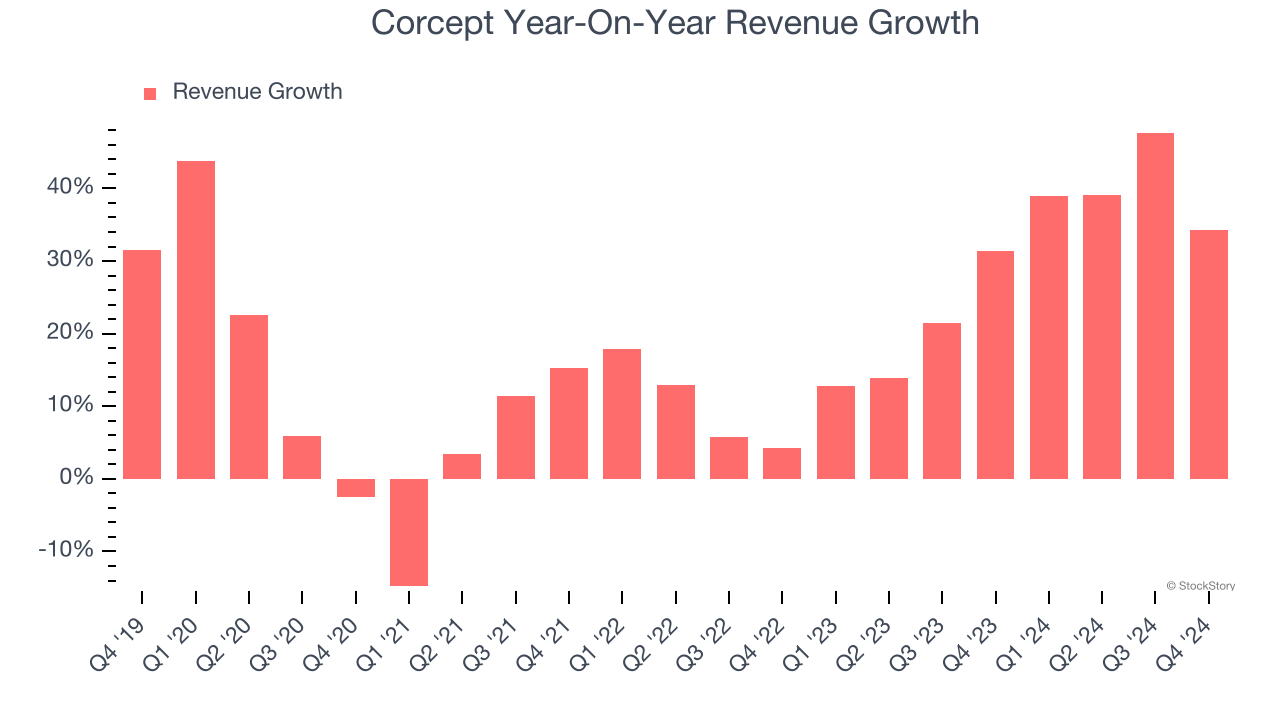

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Corcept grew its sales at an impressive 17.1% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Corcept’s annualized revenue growth of 29.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Corcept pulled off a wonderful 34.3% year-on-year revenue growth rate, but its $181.9 million of revenue fell short of Wall Street’s rosy estimates.

Looking ahead, sell-side analysts expect revenue to grow 24.7% over the next 12 months, a deceleration versus the last two years. Still, this projection is noteworthy and suggests the market sees success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

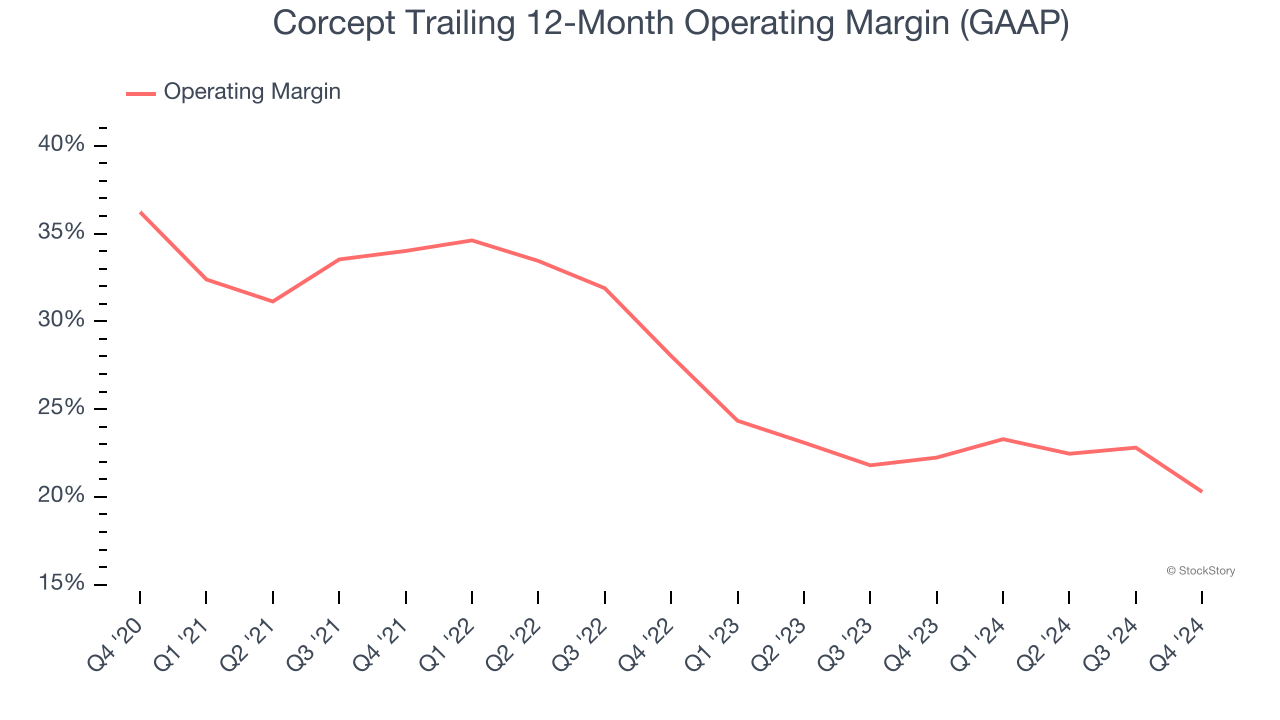

Corcept has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 26.7%.

Analyzing the trend in its profitability, Corcept’s operating margin decreased by 15.9 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 7.7 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Corcept generated an operating profit margin of 13.9%, down 9.5 percentage points year on year. This contraction shows it was recently less efficient because its expenses grew faster than its revenue.

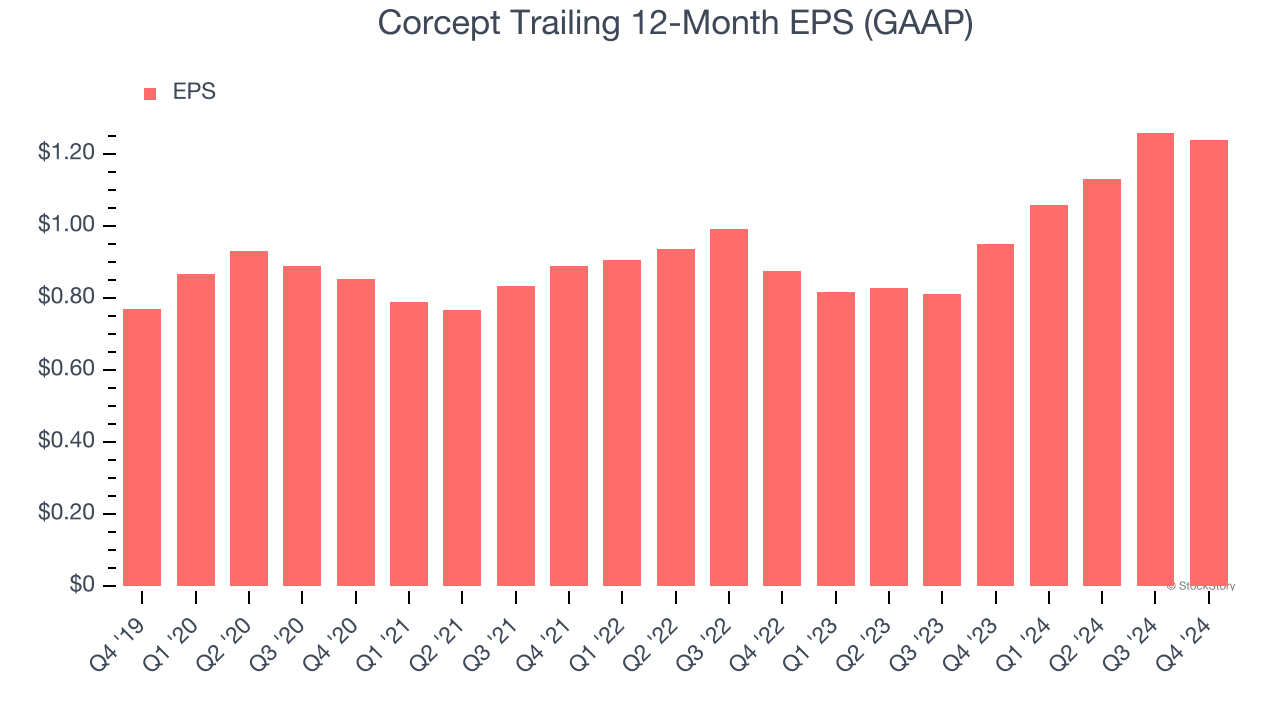

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Corcept’s EPS grew at a remarkable 10% compounded annual growth rate over the last five years. However, this performance was lower than its 17.1% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into Corcept’s earnings to better understand the drivers of its performance. As we mentioned earlier, Corcept’s operating margin declined by 15.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Corcept reported EPS at $0.26, down from $0.28 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Corcept’s full-year EPS of $1.24 to grow 70.6%.

Key Takeaways from Corcept’s Q4 Results

We were impressed by Corcept’s optimistic full-year revenue guidance, which blew past analysts’ expectations. On the other hand, its revenue missed significantly and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $63.25 immediately after reporting.

The latest quarter from Corcept’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.