Funeral services company Carriage Services (NYSE: CSV) reported Q4 CY2024 results exceeding the market’s revenue expectations, but sales fell by 1.1% year on year to $97.7 million. On the other hand, the company’s full-year revenue guidance of $405 million at the midpoint came in 3.5% below analysts’ estimates. Its non-GAAP profit of $0.62 per share was 21.6% above analysts’ consensus estimates.

Is now the time to buy Carriage Services? Find out by accessing our full research report, it’s free.

Carriage Services (CSV) Q4 CY2024 Highlights:

- Revenue: $97.7 million vs analyst estimates of $96.72 million (1.1% year-on-year decline, 1% beat)

- Adjusted EPS: $0.62 vs analyst estimates of $0.51 (21.6% beat)

- Adjusted EBITDA: $29.3 million vs analyst estimates of $26.52 million (30% margin, 10.5% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $405 million at the midpoint, missing analyst estimates by 3.5% and implying 0.2% growth (vs 5.8% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $3.20 at the midpoint, beating analyst estimates by 14.1%

- EBITDA guidance for the upcoming financial year 2025 is $130.5 million at the midpoint, above analyst estimates of $127.3 million

- Operating Margin: 21.6%, down from 24.5% in the same quarter last year

- Free Cash Flow Margin: 9.1%, down from 13% in the same quarter last year

- Market Capitalization: $622.8 million

Carlos Quezada, Vice Chairman and CEO, stated, “We are thrilled to announce that our strategic execution at every level has delivered outstanding financial results for the full year 2024. While the fourth quarter saw reduced funeral home revenue—primarily due to tough year-over-year comparisons and the lower volumes we began experiencing in October—our overall performance remained strong.

Company Overview

Established in 1991, Carriage Services (NYSE: CSV) is a provider of funeral and cemetery services in the United States.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

Sales Growth

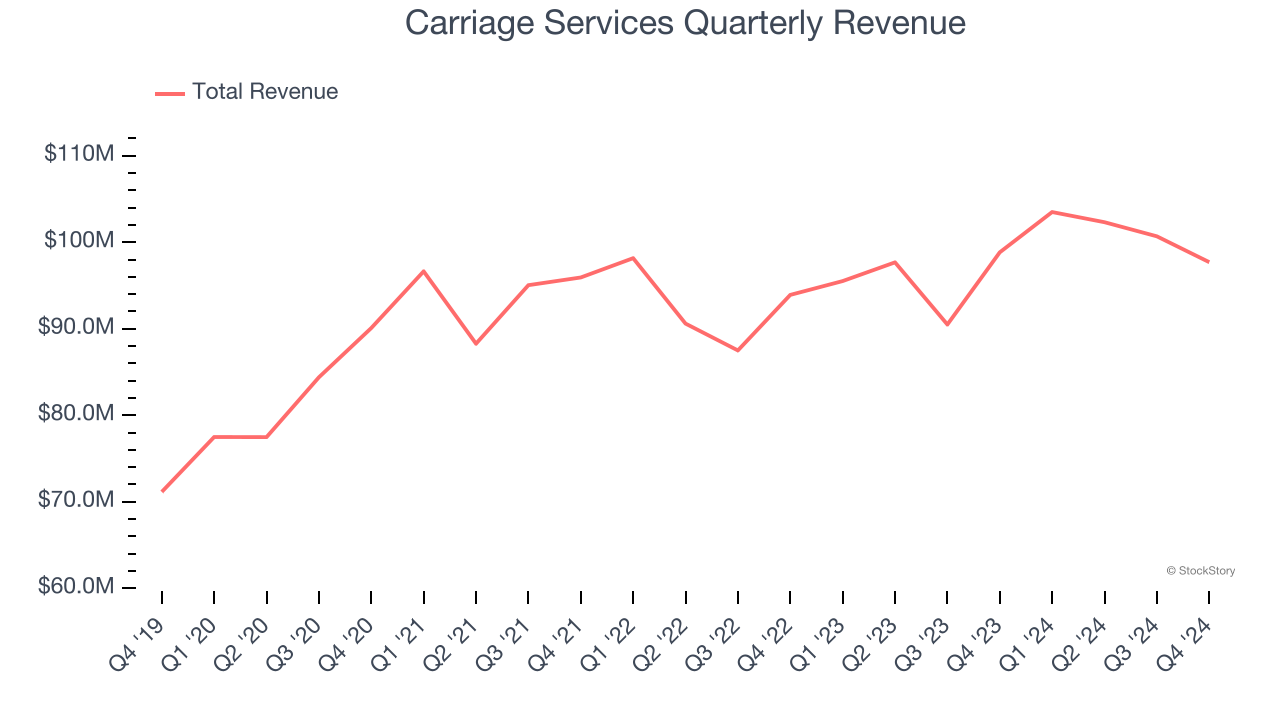

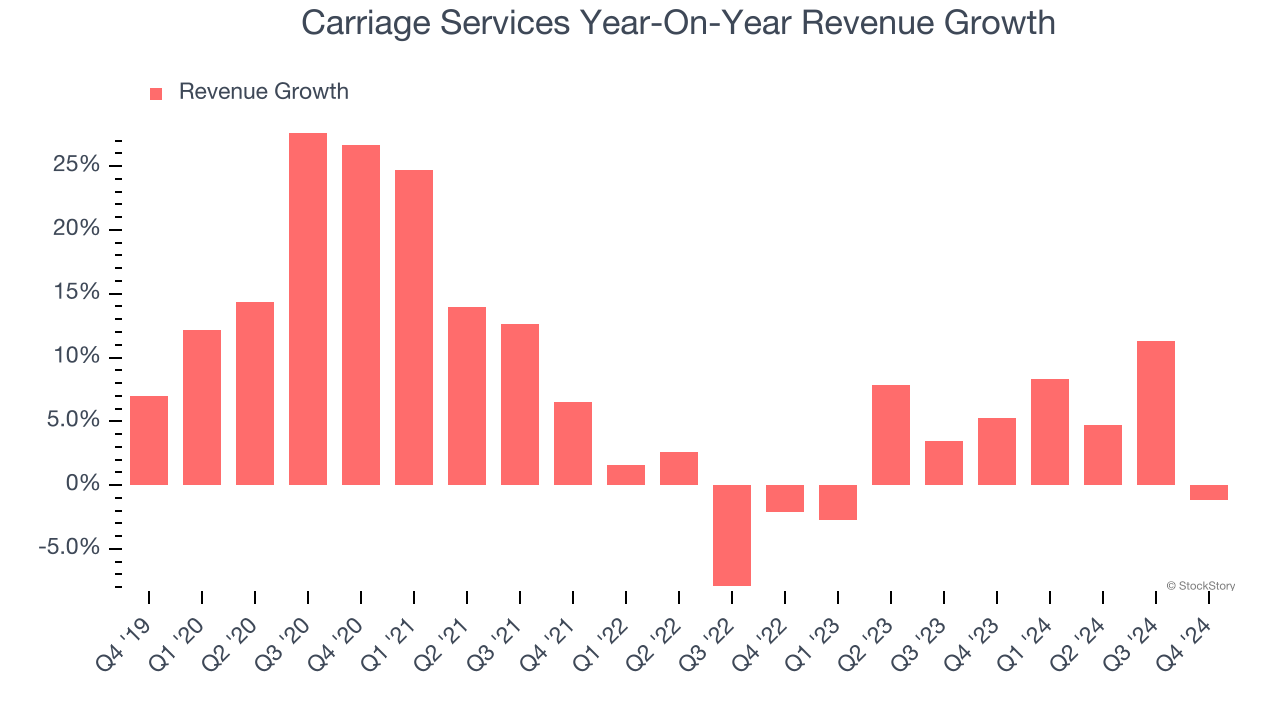

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Carriage Services’s 8.1% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Carriage Services’s recent history shows its demand slowed as its annualized revenue growth of 4.5% over the last two years is below its five-year trend.

This quarter, Carriage Services’s revenue fell by 1.1% year on year to $97.7 million but beat Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 5.7% over the next 12 months, similar to its two-year rate. Although this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

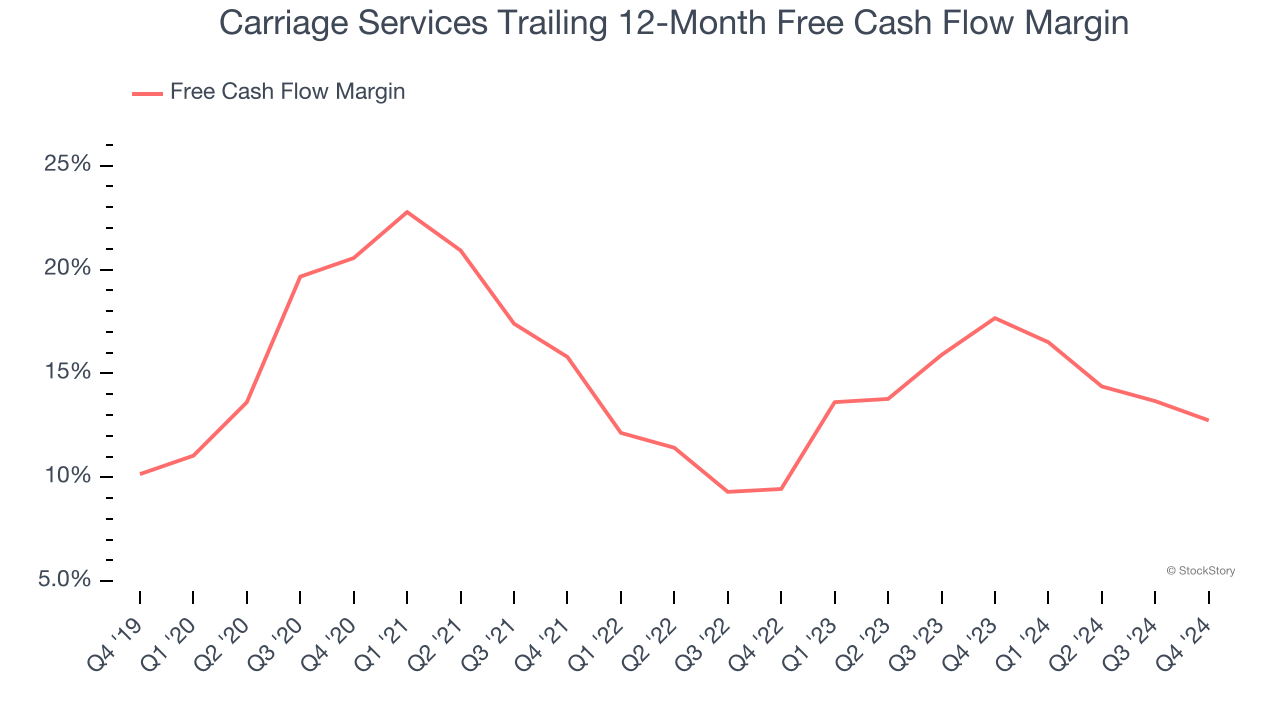

Carriage Services has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 15.1% over the last two years, better than the broader consumer discretionary sector.

Carriage Services’s free cash flow clocked in at $8.9 million in Q4, equivalent to a 9.1% margin. The company’s cash profitability regressed as it was 3.8 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from Carriage Services’s Q4 Results

Revenue, EBITDA, and EPS beat. While full-year revenue guidance missed, full-year EBITDA and EPS guidance were ahead of expectations. Overall, this quarter was quite solid. The stock traded up 2.3% to $42.10 immediately after reporting.

Big picture, is Carriage Services a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.