Restaurant company Bloomin’ Brands (NASDAQ: BLMN) fell short of the market’s revenue expectations in Q4 CY2024, with sales falling 18.6% year on year to $972 million. Its non-GAAP profit of $0.22 per share was 39.7% below analysts’ consensus estimates.

Is now the time to buy Bloomin' Brands? Find out by accessing our full research report, it’s free.

Bloomin' Brands (BLMN) Q4 CY2024 Highlights:

- Revenue: $972 million vs analyst estimates of $1.08 billion (18.6% year-on-year decline, 9.9% miss)

- Adjusted EPS: $0.22 vs analyst expectations of $0.37 (39.7% miss)

- Adjusted EBITDA: $61.34 million vs analyst estimates of $100.1 million (6.3% margin, 38.7% miss)

- Adjusted EPS guidance for the upcoming financial year 2025 is $1.30 at the midpoint, missing analyst estimates by 26.5%

- Operating Margin: 1.7%, down from 4.8% in the same quarter last year

- Locations: 1,463 at quarter end, down from 1,480 in the same quarter last year

- Same-Store Sales fell 1.1% year on year, in line with the same quarter last year

- Market Capitalization: $1.01 billion

Company Overview

Owner of the iconic Australian-themed Outback Steakhouse, Bloomin’ Brands (NASDAQ: BLMN) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

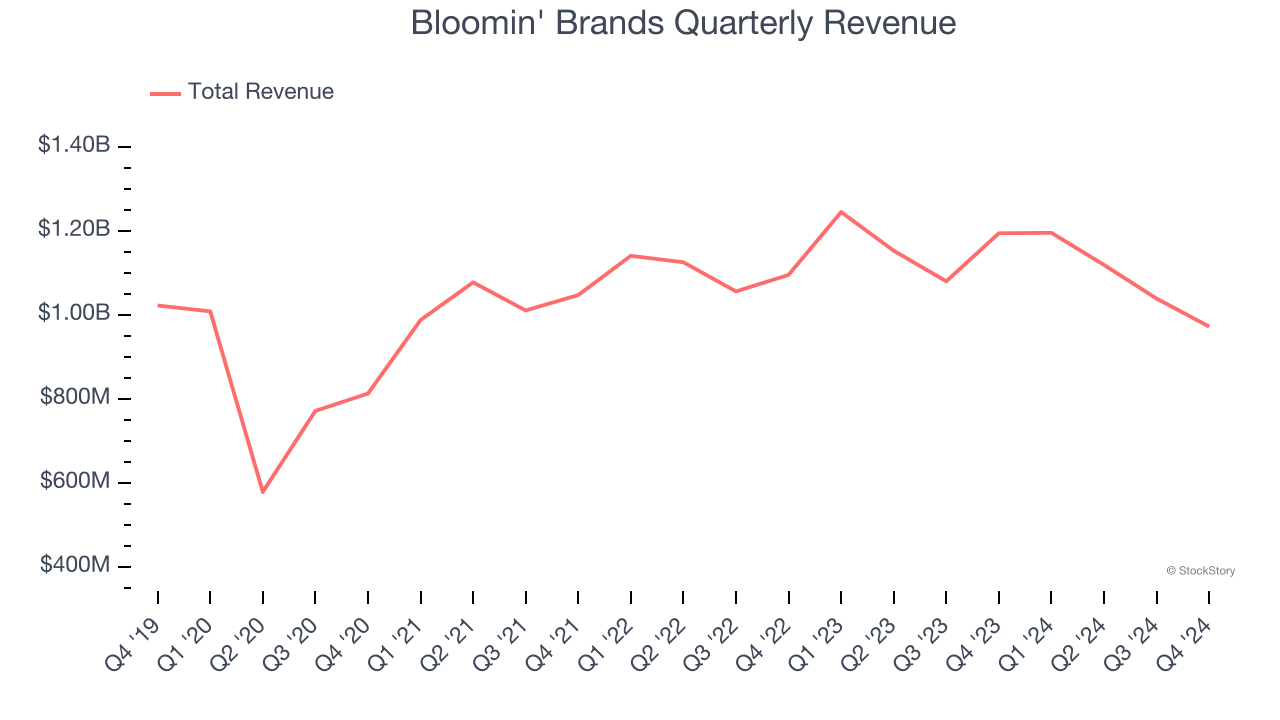

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years.

With $4.32 billion in revenue over the past 12 months, Bloomin' Brands is one of the larger restaurant chains in the industry and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because there are only a finite of number places to build restaurants, making it harder to find incremental growth. To accelerate system-wide sales, Bloomin' Brands must lean into newer chains.

As you can see below, Bloomin' Brands struggled to increase demand as its $4.32 billion of sales for the trailing 12 months was close to its revenue five years ago (we compare to 2019 to normalize for COVID-19 impacts). This was mainly because it didn’t open many new restaurants.

This quarter, Bloomin' Brands missed Wall Street’s estimates and reported a rather uninspiring 18.6% year-on-year revenue decline, generating $972 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 5.8% over the next 12 months, a deceleration versus the last five years. This projection doesn't excite us and implies its menu offerings will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Restaurant Performance

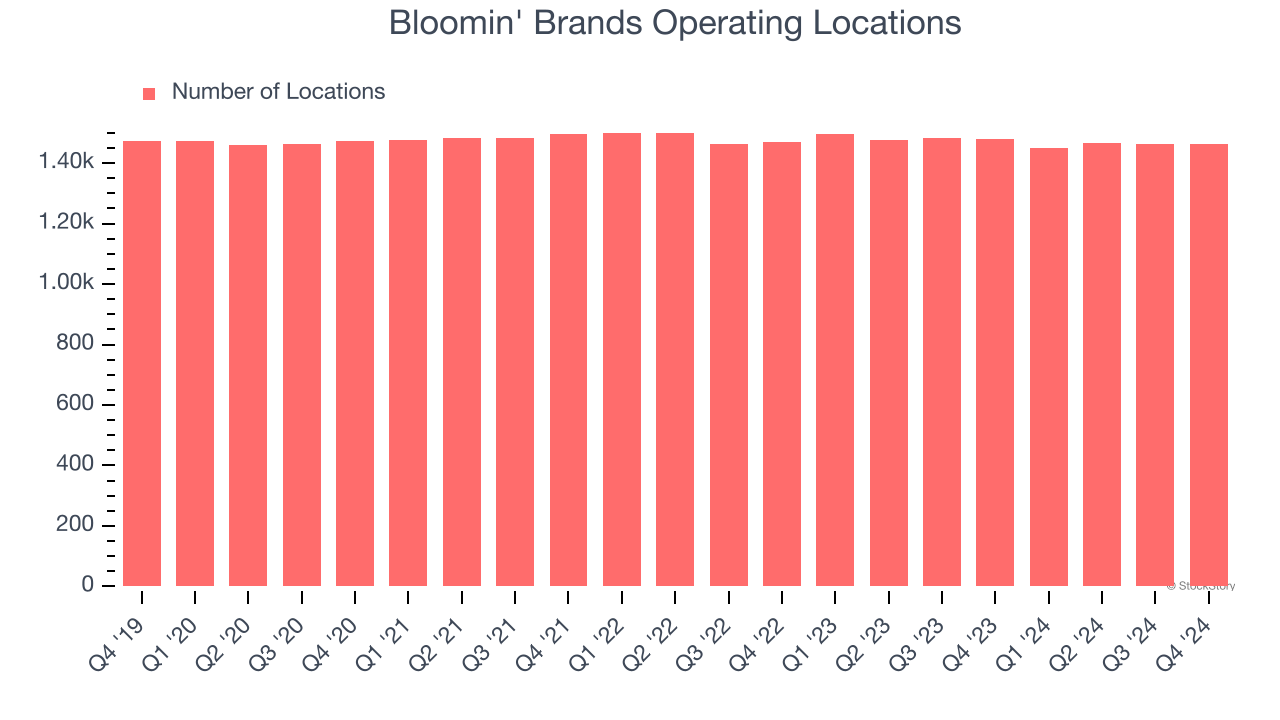

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Bloomin' Brands operated 1,463 locations in the latest quarter, and over the last two years, has kept its restaurant count flat while other restaurant businesses have opted for growth.

When a chain doesn’t open many new restaurants, it usually means there’s stable demand for its meals and it’s focused on improving operational efficiency to increase profitability.

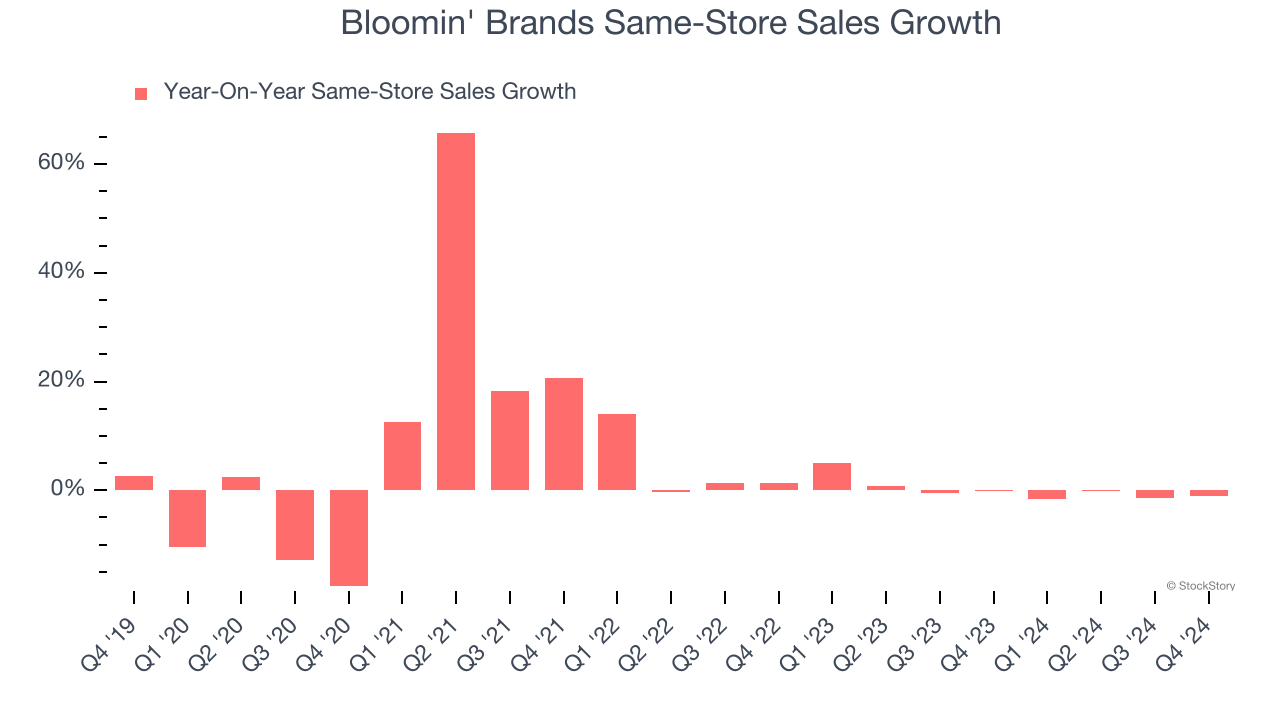

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

Bloomin' Brands’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and we’d be skeptical if Bloomin' Brands starts opening new restaurants to artificially boost revenue growth.

In the latest quarter, Bloomin' Brands’s same-store sales fell by 1.1% year on year. This decline was a reversal from its historical levels.

Key Takeaways from Bloomin' Brands’s Q4 Results

We struggled to find many positives in these results. Its full-year EPS guidance missed significantly and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5.1% to $11.29 immediately after reporting.

Bloomin' Brands’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.