Infrastructure design software provider Bentley Systems (NASDAQ: BSY) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 12.6% year on year to $349.8 million. On the other hand, the company’s full-year revenue guidance of $1.48 billion at the midpoint came in 1.5% below analysts’ estimates. Its non-GAAP profit of $0.21 per share was in line with analysts’ consensus estimates.

Is now the time to buy Bentley? Find out by accessing our full research report, it’s free.

Bentley (BSY) Q4 CY2024 Highlights:

- Revenue: $349.8 million vs analyst estimates of $350.4 million (12.6% year-on-year growth, in line)

- Adjusted EPS: $0.21 vs analyst estimates of $0.22 (in line)

- Adjusted Operating Income: $91.48 million vs analyst estimates of $98.42 million (26.1% margin, 7.1% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.48 billion at the midpoint, missing analyst estimates by 1.5% and implying 9% growth (vs 10.2% in FY2024)

- Operating Margin: 17.6%, up from 12.2% in the same quarter last year

- Free Cash Flow Margin: 21.7%, down from 25.1% in the previous quarter

- Net Revenue Retention Rate: 110%, up from 109% in the previous quarter

- Annual Recurring Revenue: $1.28 billion at quarter end, up 9.2% year on year

- Market Capitalization: $14.39 billion

CEO Nicholas Cumins said, “Our year-over-year ARR growth on a constant-currency basis was 12% in 24Q4 (12.5% excluding China). The global demand environment remains robust across sectors and geographies, and our users continue to be optimistic about end market conditions. We entered this year well aligned with their priorities and well positioned to continue our strong performance in 2025 and beyond.

Company Overview

Founded by brothers Keith and Barry Bentley, Bentley Systems (NASDAQ: BSY) offers a software-as-a-service platform that addresses the lifecycle of infrastructure projects such as road networks, tunnel systems, and wastewater facilities.

Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

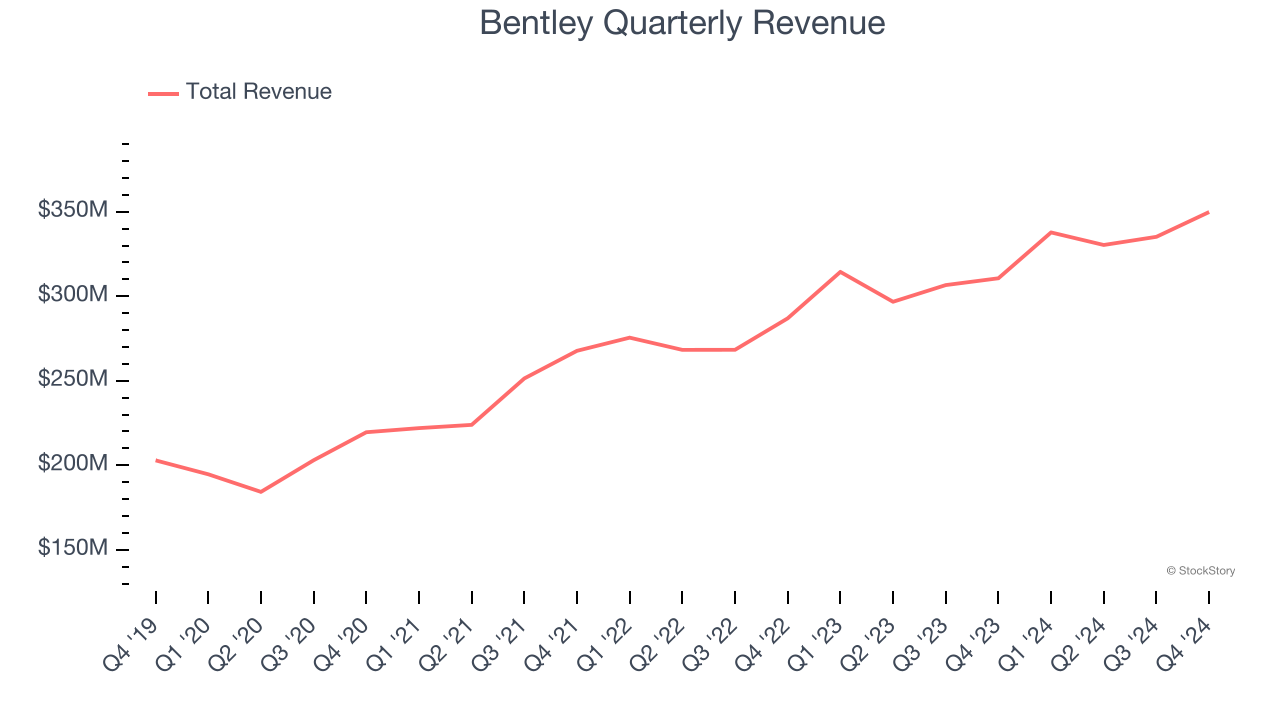

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Bentley grew its sales at a 11.9% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, Bentley’s year-on-year revenue growth was 12.6%, and its $349.8 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 10.4% over the next 12 months, similar to its three-year rate. Despite the slowdown, this projection is above average for the sector and suggests the market is forecasting some success for its newer products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

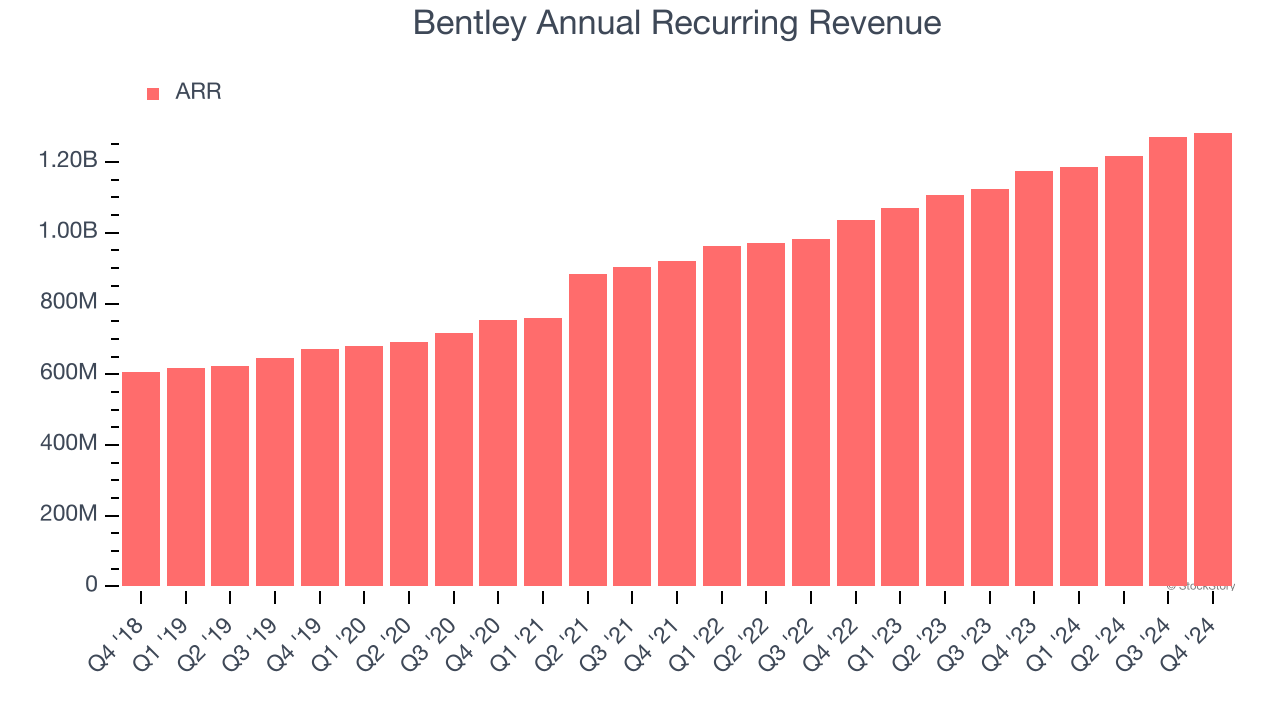

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Bentley’s ARR punched in at $1.28 billion in Q4, and over the last four quarters, its growth slightly outpaced the sector as it averaged 10.7% year-on-year increases. This performance aligned with its total sales growth and shows the company is securing longer-term commitments. Its growth also contributes positively to Bentley’s revenue predictability, a trait long-term investors typically prefer.

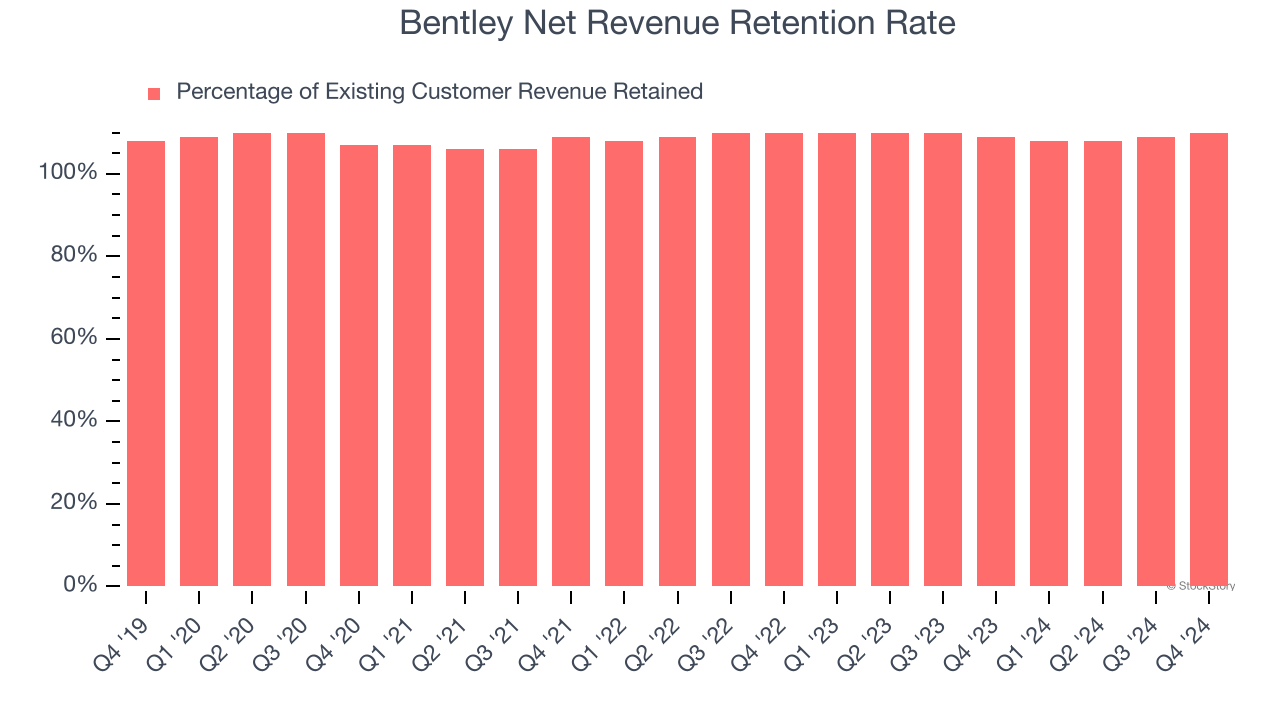

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Bentley’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 109% in Q4. This means Bentley would’ve grown its revenue by 8.8% even if it didn’t win any new customers over the last 12 months.

Bentley has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

Key Takeaways from Bentley’s Q4 Results

Revenue was just in line and operating profit missed. Also, full-year revenue guidance came in slightly below Wall Street estimates. Overall, this was a softer quarter. The stock traded down 1.6% to $44.97 immediately after reporting.

Bentley didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.