Luxury electric car manufacturer Lucid (NASDAQ: LCID) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 49.2% year on year to $234.5 million. Its GAAP loss of $0.22 per share was 15.7% above analysts’ consensus estimates.

Is now the time to buy Lucid? Find out by accessing our full research report, it’s free.

Lucid (LCID) Q4 CY2024 Highlights:

- Revenue: $234.5 million vs analyst estimates of $211.6 million (49.2% year-on-year growth, 10.8% beat)

- EPS (GAAP): -$0.22 vs analyst estimates of -$0.26 (15.7% beat)

- Adjusted EBITDA: -$577.3 million vs analyst estimates of -$598.1 million (-246% margin, 3.5% beat)

- Operating Margin: -313%, up from -469% in the same quarter last year

- Free Cash Flow was -$824.8 million compared to -$747.2 million in the same quarter last year

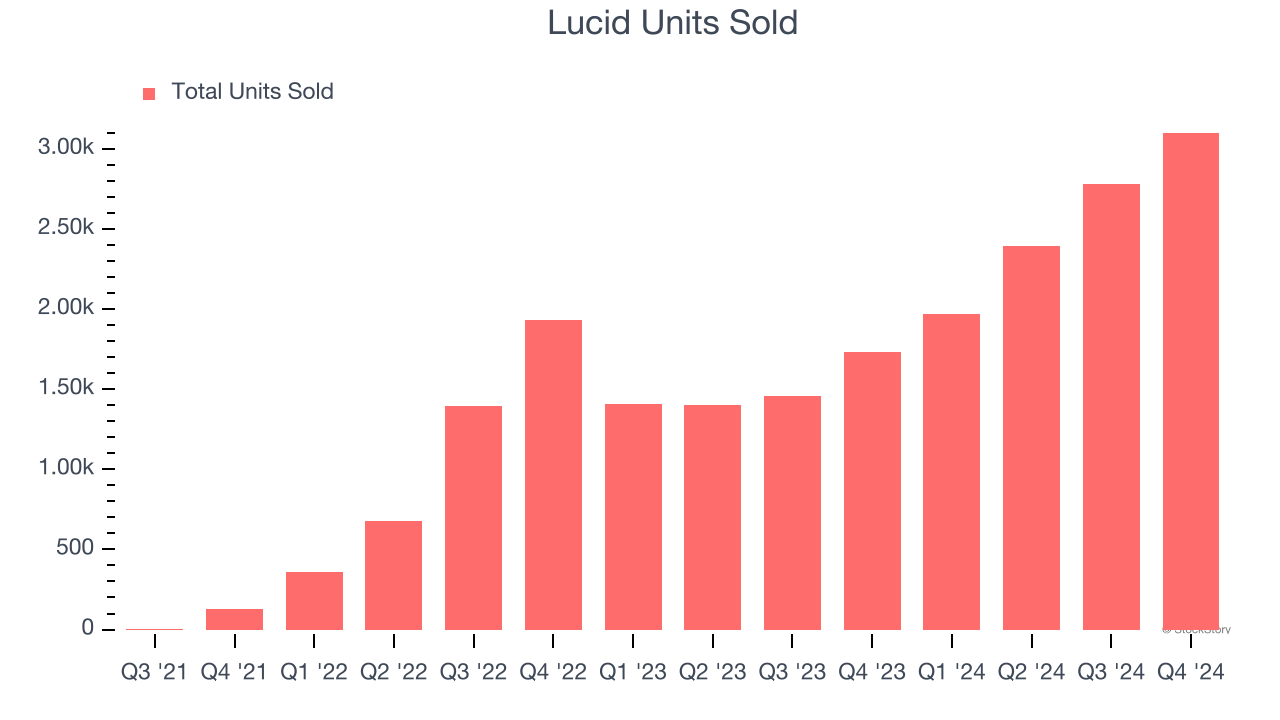

- Sales Volumes rose 79% year on year (-10.2% in the same quarter last year)

- Market Capitalization: $8.37 billion

"2024 was a transformational year for Lucid and I am honored to step into this role as Lucid enters the next phase of its journey," said Marc Winterhoff, Interim CEO.

Company Overview

Founded by a former Tesla Vice President, Lucid Group (NASDAQ: LCID) designs, manufactures, and sells luxury electric vehicles with long-range capabilities.

Automobile Manufacturing

Much capital investment and technical know-how are needed to manufacture functional, safe, and aesthetically pleasing automobiles for the mass market. Barriers to entry are therefore high, and auto manufacturers with economies of scale can boast strong economic moats. However, this doesn’t insulate them from new entrants, as electric vehicles (EVs) have entered the market and are upending it. This has forced established manufacturers to not only contend with emerging EV-first competitors but also decide how much they want to invest in these disruptive technologies, which will likely cannibalize their legacy offerings.

Sales Growth

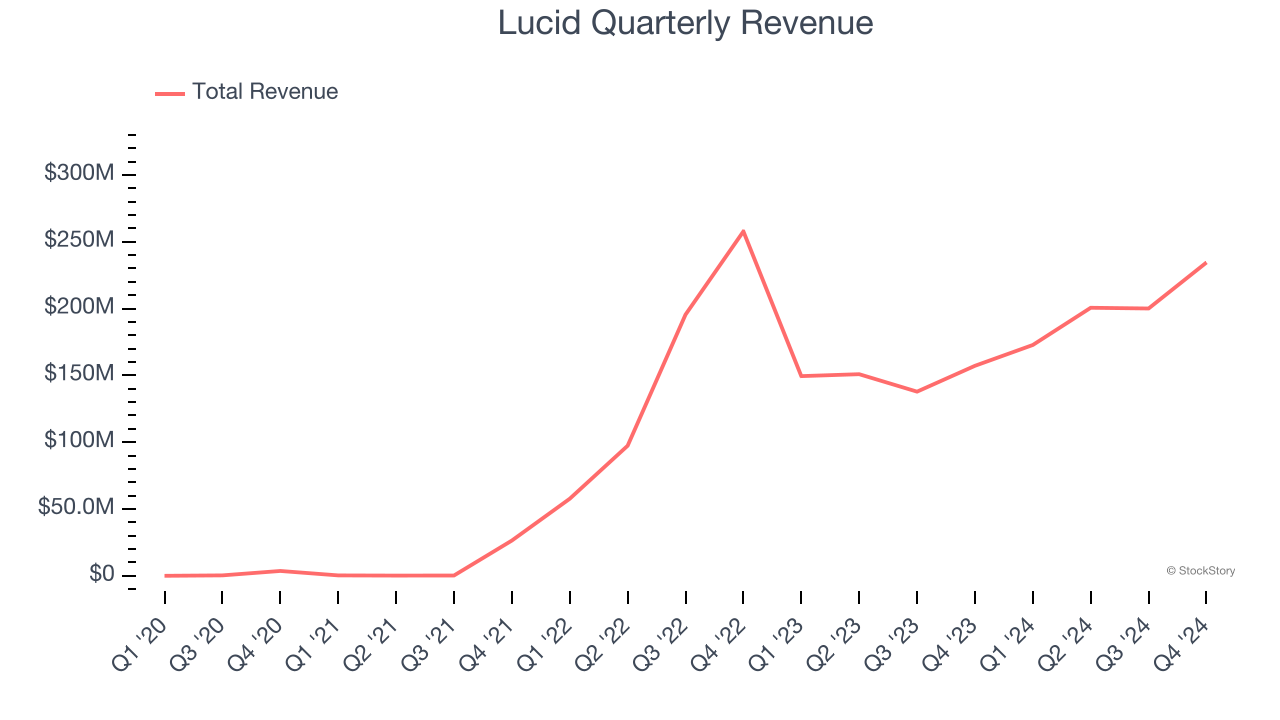

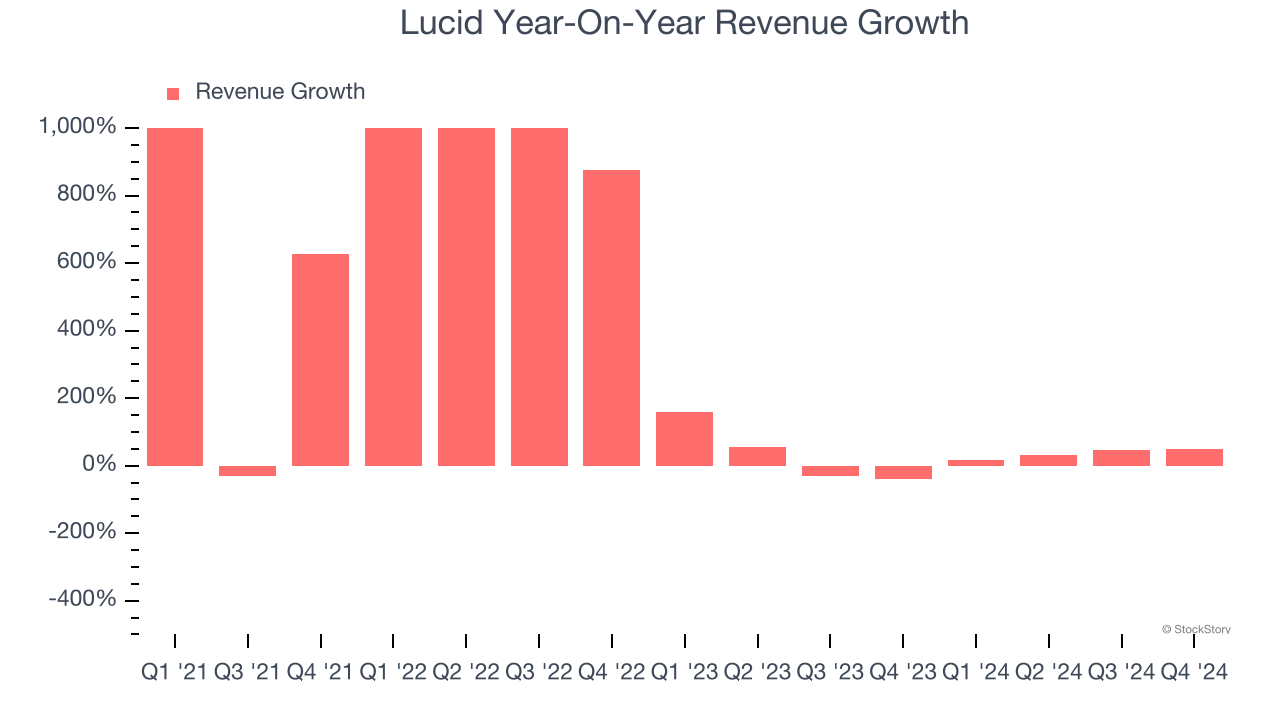

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Lucid’s 223% annualized revenue growth over the last four years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Lucid’s annualized revenue growth of 15.3% over the last two years is below its four-year trend, but we still think the results were good and suggest demand was strong.

We can better understand the company’s revenue dynamics by analyzing its number of units sold, which reached 3,099 in the latest quarter. Over the last two years, Lucid’s units sold grew by 53.1% annually. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Lucid reported magnificent year-on-year revenue growth of 49.2%, and its $234.5 million of revenue beat Wall Street’s estimates by 10.8%.

Looking ahead, sell-side analysts expect revenue to grow 46.3% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will spur better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Lucid’s high expenses have contributed to an average operating margin of negative 525% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Lucid’s operating margin rose over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

Lucid’s operating margin was negative 313% this quarter. The company's consistent lack of profits raise a flag.

Earnings Per Share

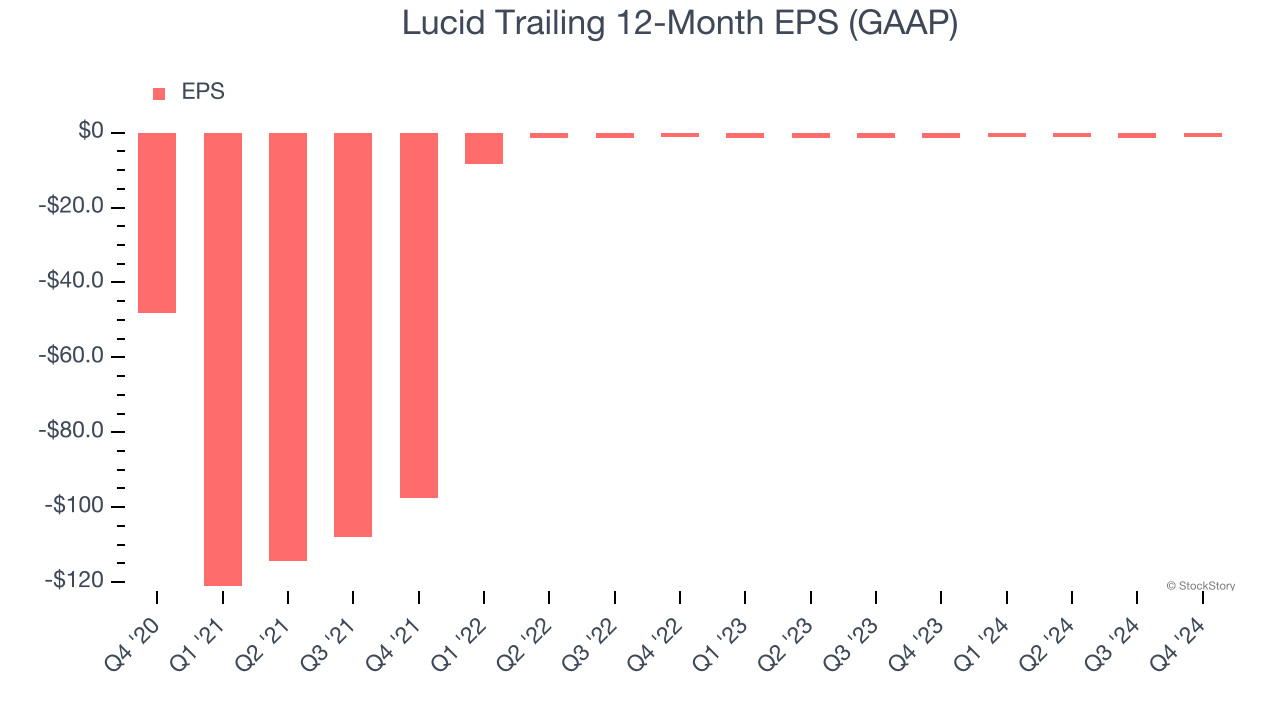

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Lucid’s full-year earnings are still negative, it reduced its losses and improved its EPS by 59.7% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Lucid, its two-year annual EPS declines of 9.6% mark a reversal from its (seemingly) healthy four-year trend. These shorter-term results weren’t ideal, but given it was successful in other measures of financial health, we’re hopeful Lucid can return to earnings growth in the future.

In Q4, Lucid reported EPS at negative $0.22, up from negative $0.29 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Lucid to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.27 will advance to negative $0.93.

Key Takeaways from Lucid’s Q4 Results

We were impressed by how significantly Lucid blew past analysts’ vehicles delivered, revenue, EPS, and EBITDA expectations this quarter. Zooming out, we think this quarter featured some important positives. The stock traded up 7.3% to $2.80 immediately following the results.

Indeed, Lucid had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.