Clothing company Kontoor Brands (NYSE: KTB) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 4.4% year on year to $699.3 million. On the other hand, the company’s full-year revenue guidance of $2.66 billion at the midpoint came in 0.7% below analysts’ estimates. Its non-GAAP profit of $1.38 per share was 2.2% above analysts’ consensus estimates.

Is now the time to buy Kontoor Brands? Find out by accessing our full research report, it’s free.

Kontoor Brands (KTB) Q4 CY2024 Highlights:

- Revenue: $699.3 million vs analyst estimates of $698.3 million (4.4% year-on-year growth, in line)

- Adjusted EPS: $1.38 vs analyst estimates of $1.35 (2.2% beat)

- Adjusted EBITDA: $113 million vs analyst estimates of $113.7 million (16.2% margin, 0.6% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $2.66 billion at the midpoint, missing analyst estimates by 0.7% and implying 2% growth (vs 0% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $5.25 at the midpoint, missing analyst estimates by 2.3%

- Operating Margin: 12.1%, in line with the same quarter last year

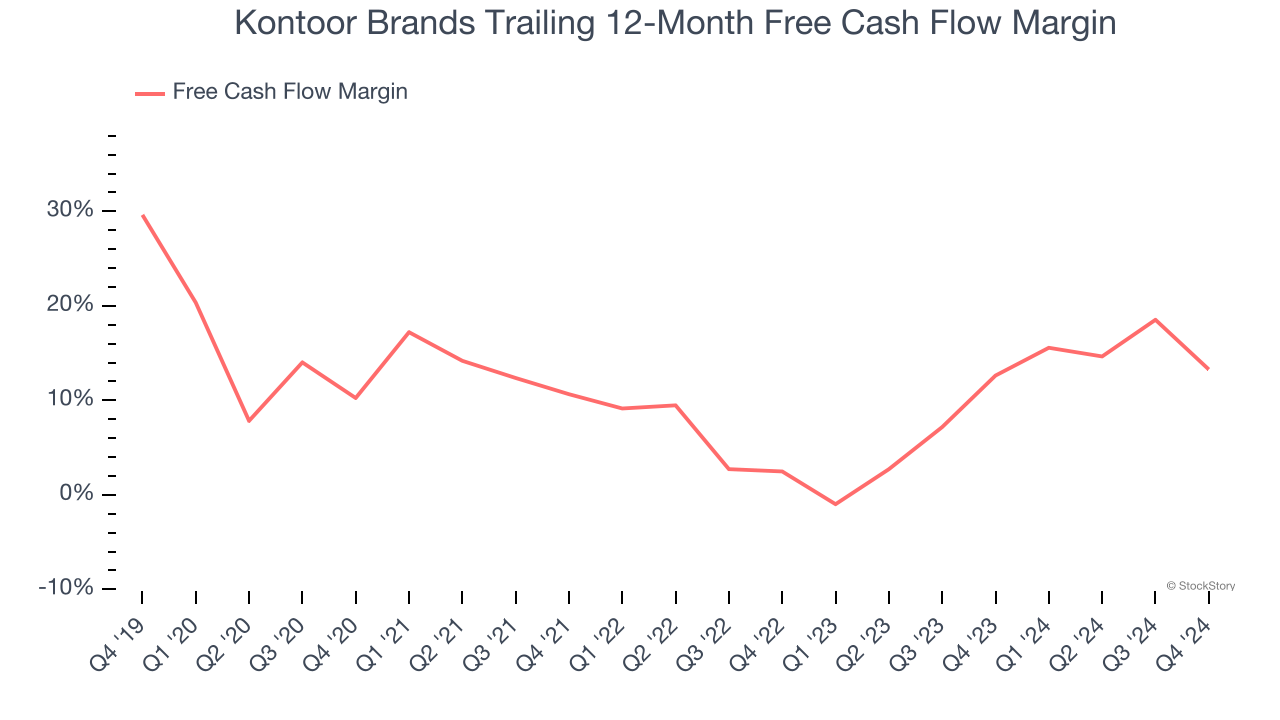

- Free Cash Flow Margin: 10.3%, down from 30.3% in the same quarter last year

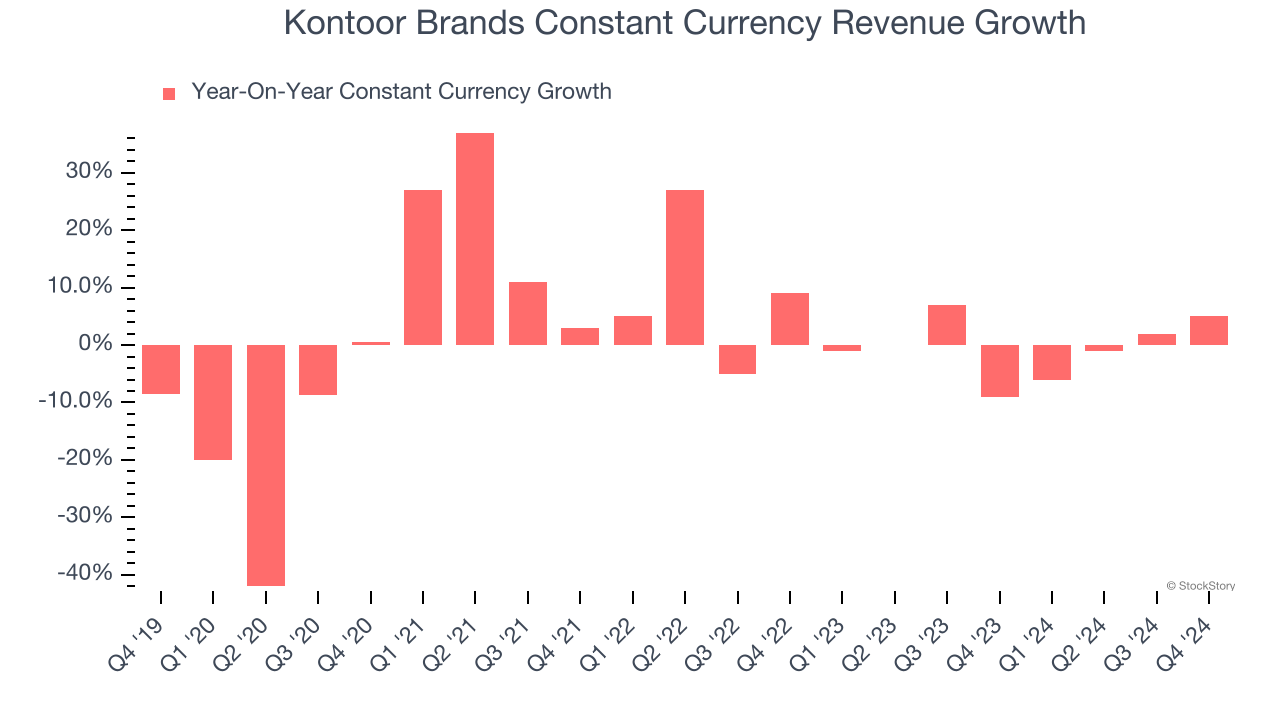

- Constant Currency Revenue rose 5% year on year (-9% in the same quarter last year)

- Market Capitalization: $4.75 billion

“2024 was a landmark year for Kontoor driven by continued market share gains, accelerating business fundamentals, increasing capital allocation optionality, and strong returns for our shareholders,” said Scott Baxter, President, Chief Executive Officer and Chairman of the Board of Directors.

Company Overview

Founded in 2019 after separating from VF Corporation, Kontoor Brands (NYSE: KTB) is a clothing company known for its high-quality denim products.

Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

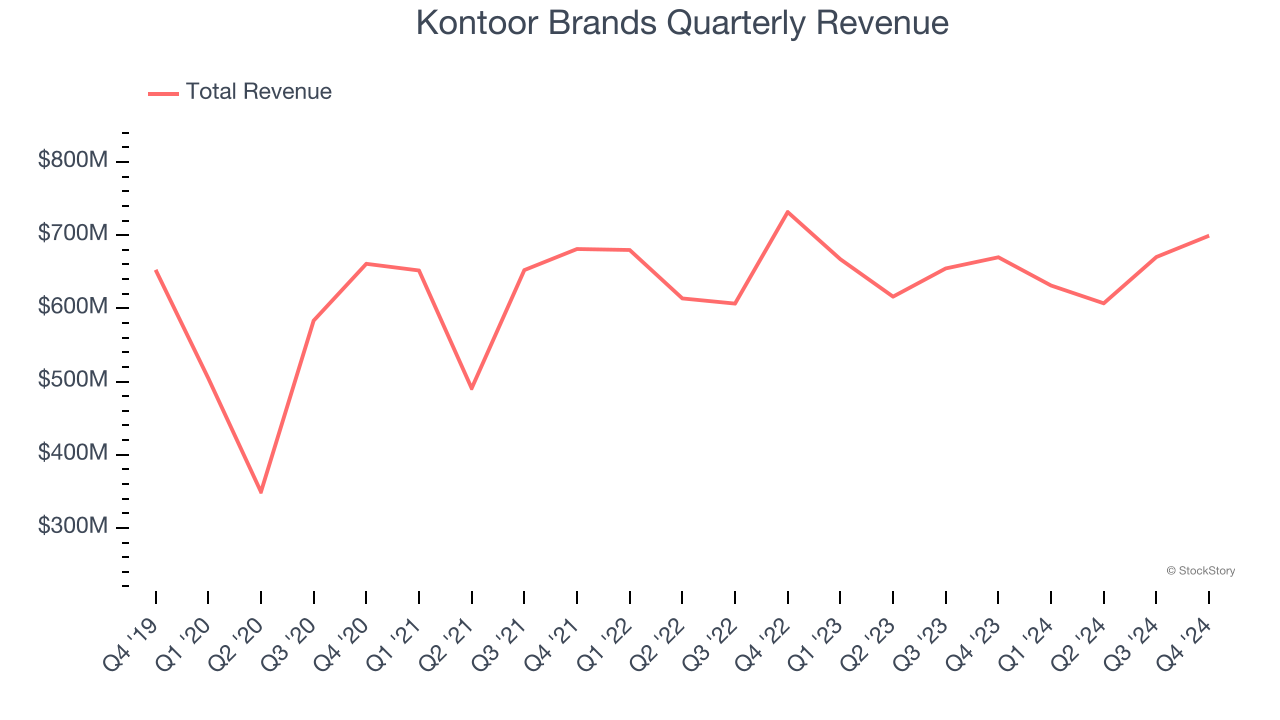

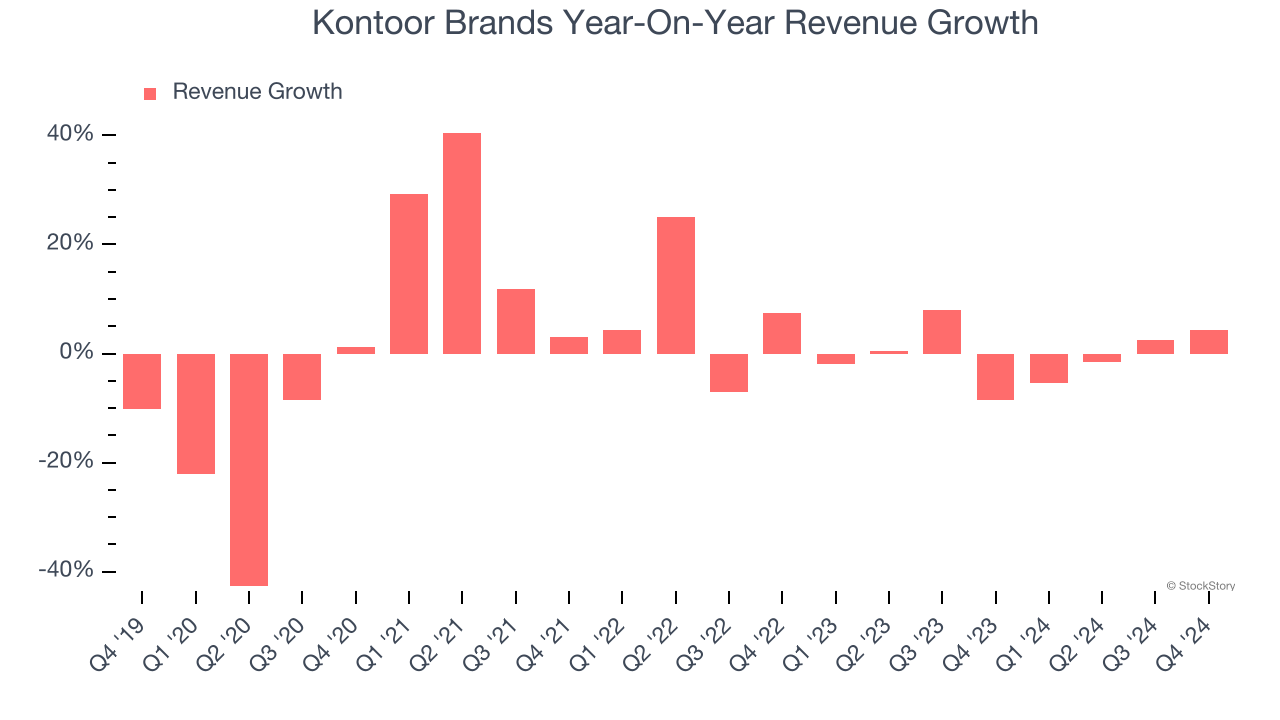

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Kontoor Brands struggled to consistently increase demand as its $2.61 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of lacking business quality.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Just like its five-year trend, Kontoor Brands’s revenue over the last two years was flat, suggesting it is in a slump.

Kontoor Brands also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales were flat. Because this number aligns with its normal revenue growth, we can see Kontoor Brands’s foreign exchange rates have been steady.

This quarter, Kontoor Brands grew its revenue by 4.4% year on year, and its $699.3 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Kontoor Brands has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.9% over the last two years, slightly better than the broader consumer discretionary sector.

Kontoor Brands’s free cash flow clocked in at $71.69 million in Q4, equivalent to a 10.3% margin. The company’s cash profitability regressed as it was 20.1 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from Kontoor Brands’s Q4 Results

It was good to see Kontoor Brands beat analysts’ EPS expectations this quarter. On the other hand, its full-year revenue and EPS guidance missed. Overall, this was a weaker quarter. The stock traded down 3.9% to $82.84 immediately following the results.

So do we think Kontoor Brands is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.