Healthcare services company Agilon Health (NYSE: AGL) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 44.2% year on year to $1.52 billion. On the other hand, next quarter’s revenue guidance of $1.5 billion was less impressive, coming in 12% below analysts’ estimates. Its GAAP loss of $0.26 per share was 14.8% below analysts’ consensus estimates.

Is now the time to buy agilon health? Find out by accessing our full research report, it’s free.

agilon health (AGL) Q4 CY2024 Highlights:

- Revenue: $1.52 billion vs analyst estimates of $1.52 billion (44.2% year-on-year growth, in line)

- EPS (GAAP): -$0.26 vs analyst expectations of -$0.23 (14.8% miss)

- Adjusted EBITDA: -$83.97 million vs analyst estimates of -$69.92 million (-5.5% margin, 20.1% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $5.93 billion at the midpoint, missing analyst estimates by 5.4% and implying -2.2% growth (vs 40.7% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is -$75 million at the midpoint, below analyst estimates of -$50.33 million

- Operating Margin: -7.1%, up from -15.6% in the same quarter last year

- Free Cash Flow was $13.15 million, up from -$65.1 million in the same quarter last year

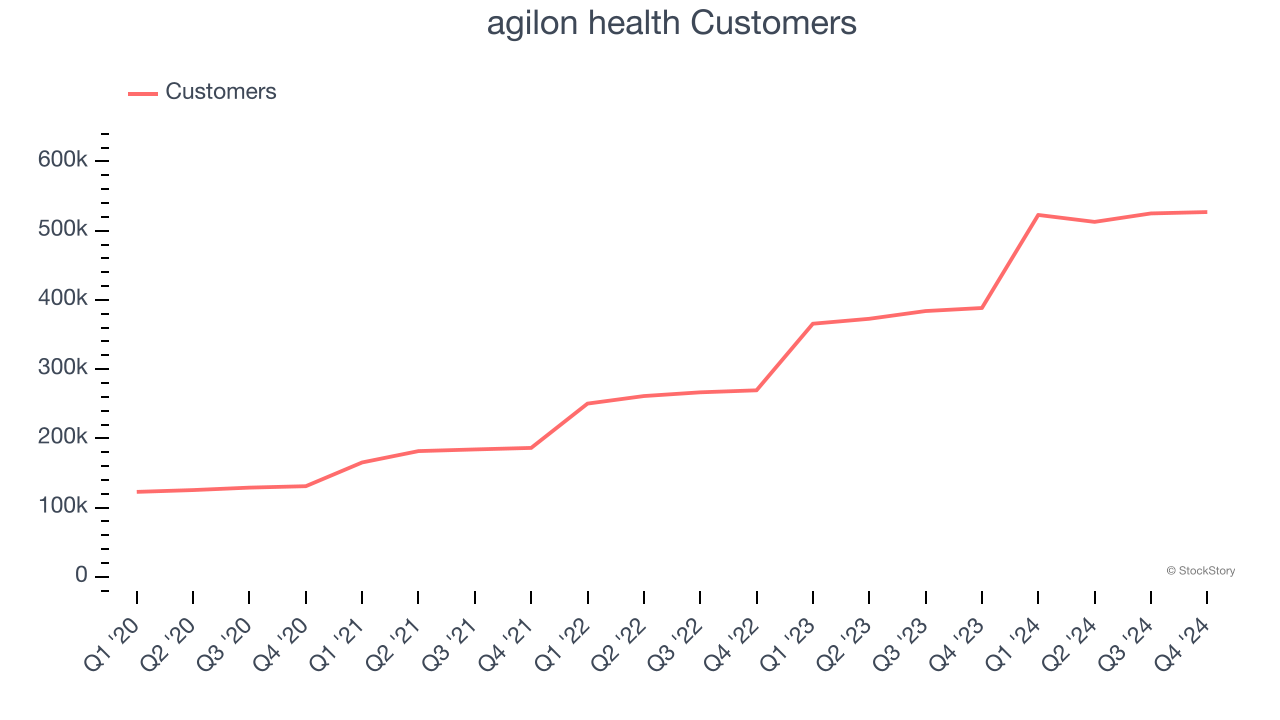

- Customers: 527,000, up from 525,000 in the previous quarter

- Market Capitalization: $1.5 billion

“While the underlying strength of our model continues to deliver significant value to patients, payors, and our PCP partners, we are still managing through a challenging Medicare Advantage environment.” said Steve Sell, CEO.

Company Overview

Founded in 2016, Agilon Health (NYSE: AGL) is a healthcare services company that partners with primary care physicians to enhance patient care and improve health outcomes with a focus on seniors and older individuals.

Outpatient & Specialty Care

The outpatient and specialty care industry delivers targeted medical services in non-hospital settings that are often cost-effective compared to inpatient alternatives. This means that they are more desired as rising healthcare costs and ways to combat them become more and more top-of-mind. Outpatient and specialty care providers boast revenue streams that are stable due to the recurring nature of treatment for chronic conditions and long-term patient relationships. However, their reliance on government reimbursement programs like Medicare means stroke-of-the-pen risk. Additionally, scaling a network of facilities can be capital-intensive with uneven return profiles amid competition from integrated healthcare systems. Looking ahead, the industry is positioned to grow as demand for outpatient services expands, driven by aging populations, a rising prevalence of chronic diseases, and a shift toward value-based care models. Tailwinds include advancements in medical technology that support more complex procedures in outpatient settings and the increasing focus on preventive care, which can be aided by data and AI. However, headwinds such as reimbursement rate cuts, labor shortages, and the financial strain of digitization may temper growth.

Sales Growth

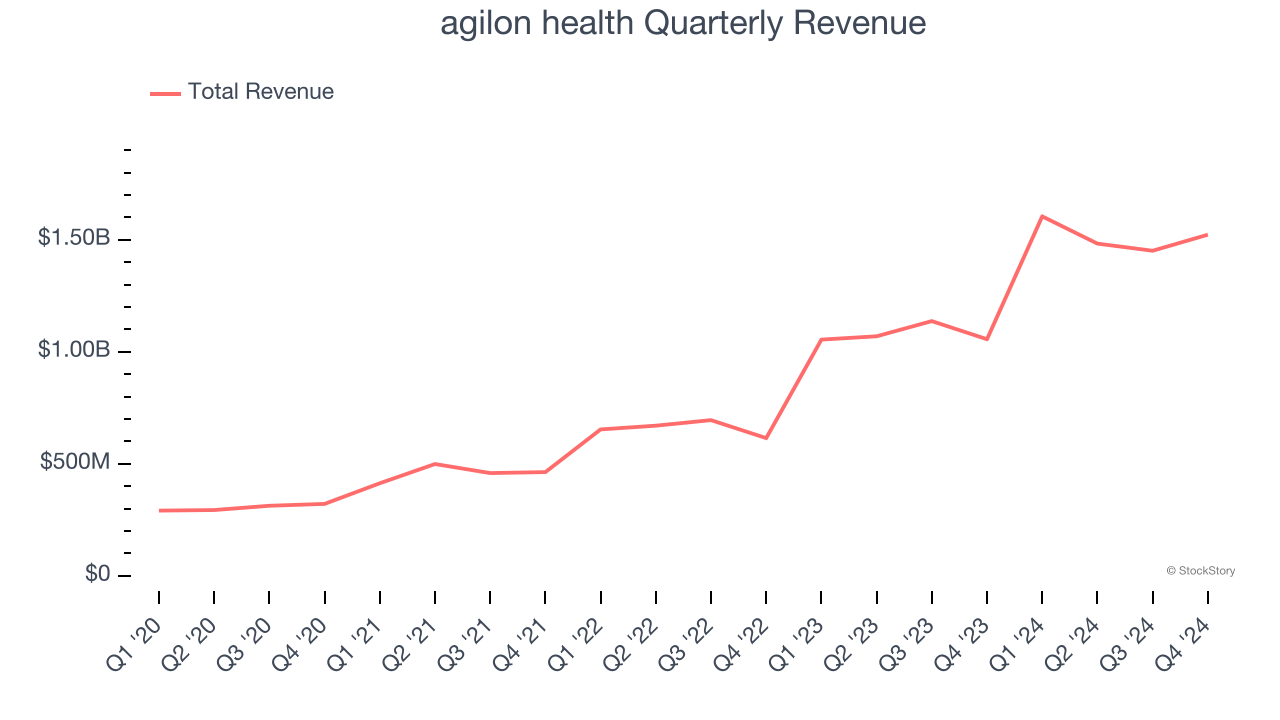

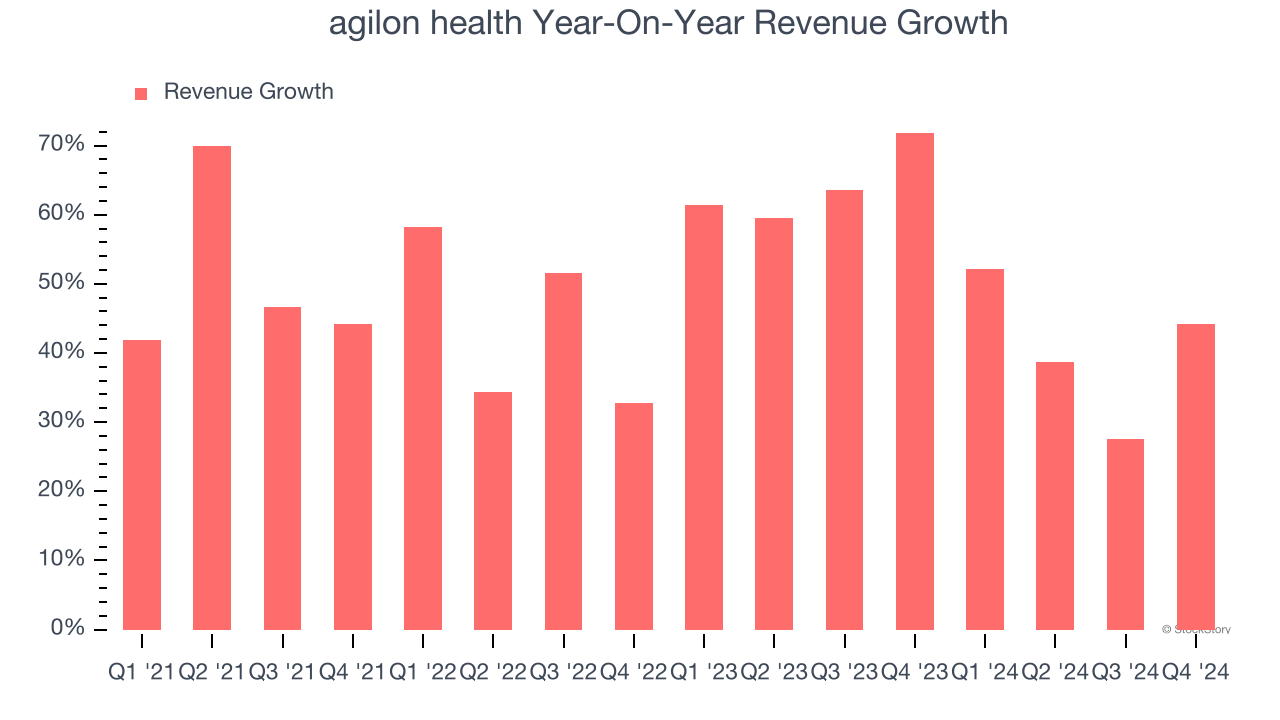

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last four years, agilon health grew its sales at an incredible 49.3% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a stretched historical view may miss new innovations or demand cycles. agilon health’s annualized revenue growth of 51.7% over the last two years is above its four-year trend, suggesting its demand was strong and recently accelerated.

agilon health also reports its number of customers, which reached 527,000 in the latest quarter. Over the last two years, agilon health’s customer base averaged 41.2% year-on-year growth. Because this number is lower than its revenue growth, we can see the average customer spent more money each year on the company’s products and services.

This quarter, agilon health’s year-on-year revenue growth of 44.2% was magnificent, and its $1.52 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 6.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.9% over the next 12 months, a deceleration versus the last two years. Still, this projection is above average for the sector and indicates the market sees some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

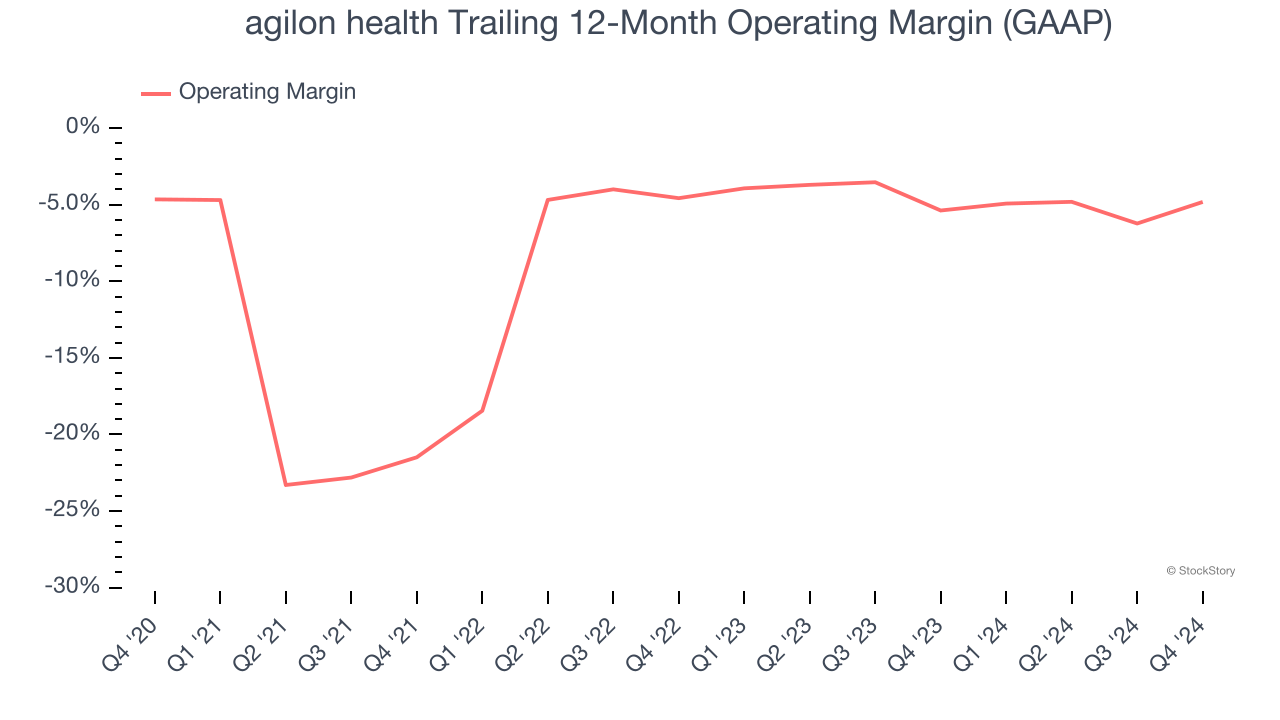

agilon health’s high expenses have contributed to an average operating margin of negative 6.8% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, agilon health’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, which doesn’t help its cause.

This quarter, agilon health generated a negative 7.1% operating margin.

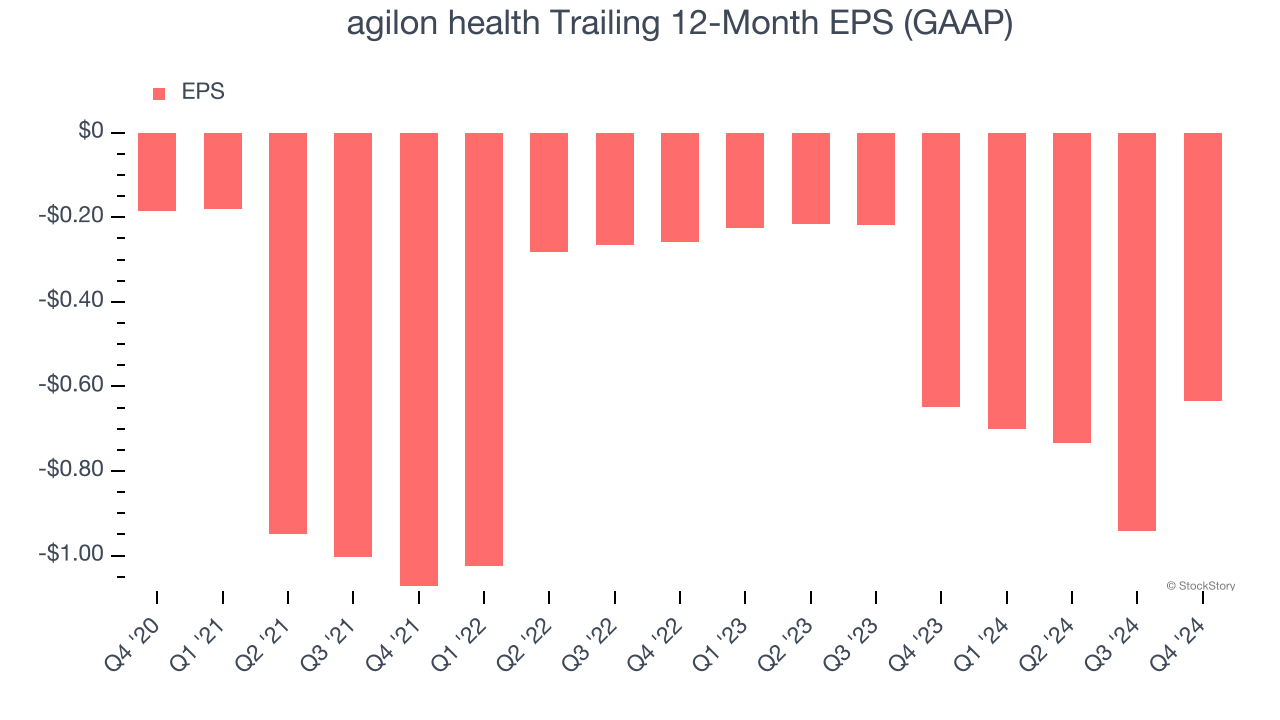

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

agilon health’s earnings losses deepened over the last four years as its EPS dropped 36.1% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

In Q4, agilon health reported EPS at negative $0.26, up from negative $0.57 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast agilon health’s full-year EPS of negative $0.64 will reach break even.

Key Takeaways from agilon health’s Q4 Results

We struggled to find many positives in these results as its EPS and EBITDA missed. Its full-year revenue and EBITDA guidance also fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 16.9% to $3.01 immediately following the results.

agilon health underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.