Healthcare services provider AdaptHealth Corp. (NASDAQ: AHCO) reported Q4 CY2024 results exceeding the market’s revenue expectations, but sales were flat year on year at $856.6 million. On the other hand, the company’s full-year revenue guidance of $3.29 billion at the midpoint came in 1.2% below analysts’ estimates. Its GAAP profit of $0.34 per share was 34.8% above analysts’ consensus estimates.

Is now the time to buy AdaptHealth? Find out by accessing our full research report, it’s free.

AdaptHealth (AHCO) Q4 CY2024 Highlights:

- Revenue: $856.6 million vs analyst estimates of $828.9 million (flat year on year, 3.3% beat)

- EPS (GAAP): $0.34 vs analyst estimates of $0.25 (34.8% beat)

- Adjusted EBITDA: $200.6 million vs analyst estimates of $176 million (23.4% margin, 14% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $3.29 billion at the midpoint, missing analyst estimates by 1.2% and implying 0.9% growth (vs 2% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $690 million at the midpoint, above analyst estimates of $684.1 million

- Operating Margin: 11.4%, up from -25.4% in the same quarter last year

- Free Cash Flow Margin: 8.5%, similar to the same quarter last year

- Market Capitalization: $1.13 billion

“Over the course of the second half of 2024, we continued to make progress on our five areas of focus, which include our One Adapt initiative, accelerating the application of AI and automation, increasing our clinical relevance, delivering organic growth, and strengthening our balance sheet,” said Suzanne Foster, Chief Executive Officer of AdaptHealth.

Company Overview

Founded in 2012, AdaptHealth Corp. (NASDAQ: AHCO) provides home medical equipment and related services, specializing in respiratory therapy, diabetes management supplies, mobility products.

Senior Health, Home Health & Hospice

The senior health, home care, and hospice care industries provide essential services to aging populations and patients with chronic or terminal conditions. These companies benefit from stable, recurring revenue driven by relationships with patients and families that can extend many months or even years. However, the labor-intensive nature of the business makes it vulnerable to rising labor costs and staffing shortages, while profitability is constrained by reimbursement rates from Medicare, Medicaid, and private insurers. Looking ahead, the industry is positioned for tailwinds from an aging population, increasing chronic disease prevalence, and a growing preference for personalized in-home care. Advancements in remote monitoring and telehealth are expected to enhance efficiency and care delivery. However, headwinds such as labor shortages, wage inflation, and regulatory uncertainty around reimbursement could pose challenges. Investments in digitization and technology-driven care will be critical for long-term success.

Sales Growth

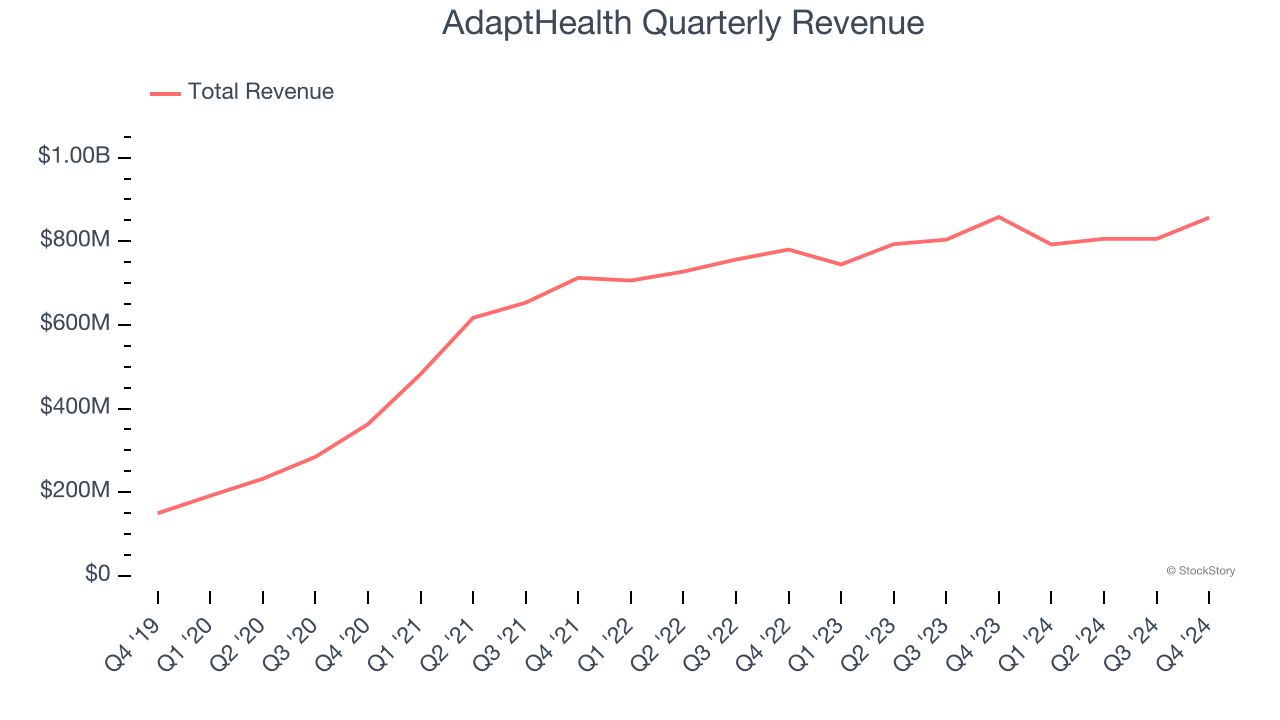

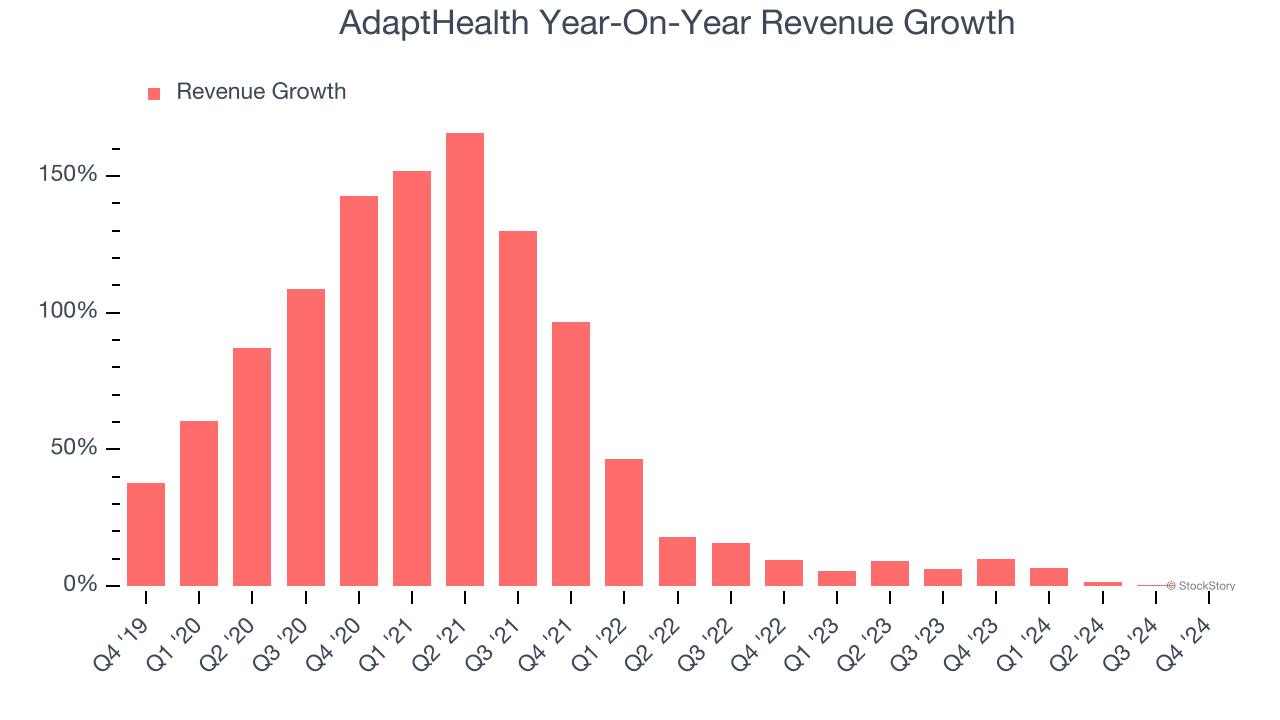

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, AdaptHealth grew its sales at an incredible 43.8% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. AdaptHealth’s recent history shows its demand slowed significantly as its annualized revenue growth of 4.8% over the last two years is well below its five-year trend.

This quarter, AdaptHealth’s $856.6 million of revenue was flat year on year but beat Wall Street’s estimates by 3.3%.

Looking ahead, sell-side analysts expect revenue to grow 1.9% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

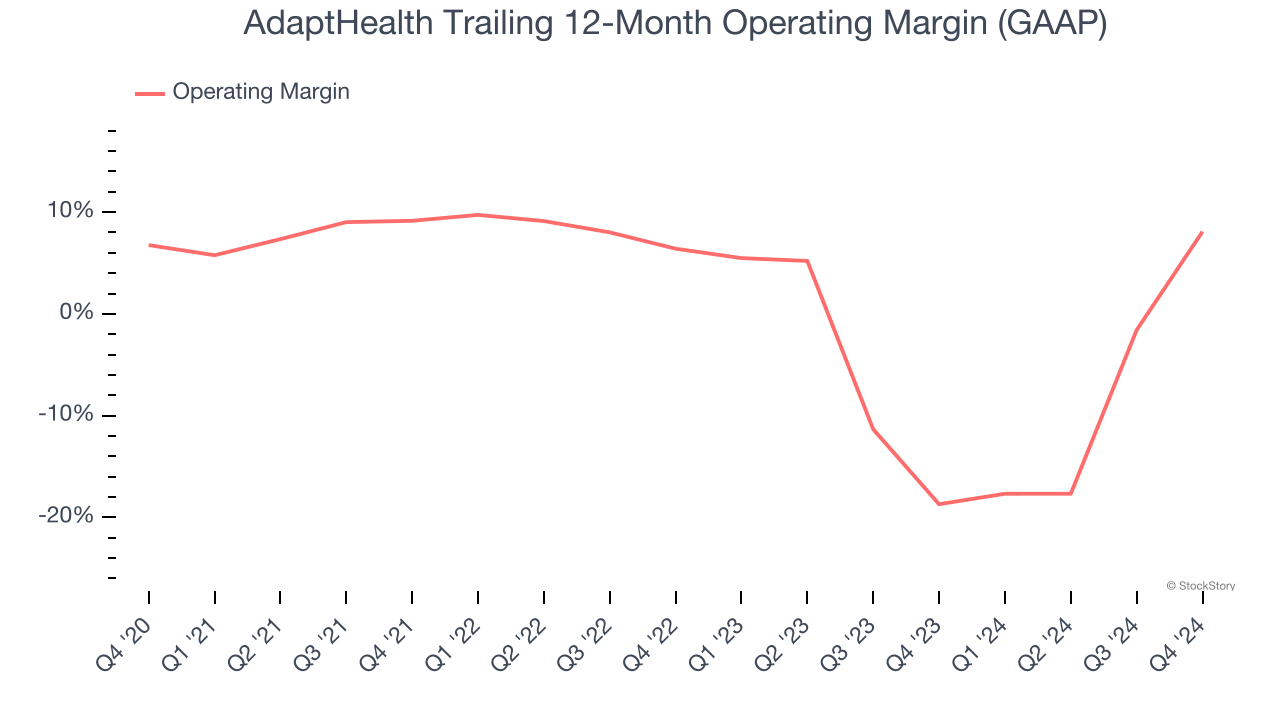

AdaptHealth was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.2% was weak for a healthcare business.

On the plus side, AdaptHealth’s operating margin rose by 1.3 percentage points over the last five years, as its sales growth gave it operating leverage. The company’s two-year trajectory shows its performance was mostly driven by its recent improvements.

This quarter, AdaptHealth generated an operating profit margin of 11.4%, up 36.8 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

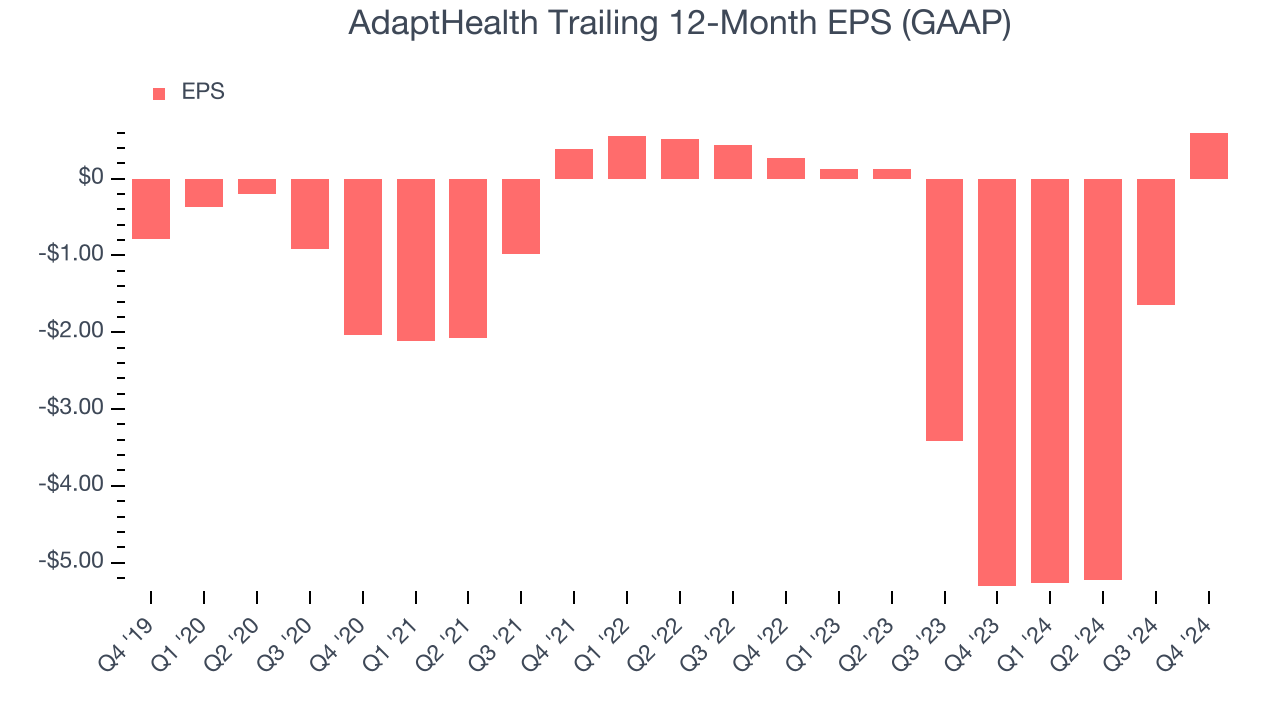

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

AdaptHealth’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, AdaptHealth reported EPS at $0.34, up from negative $1.91 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects AdaptHealth’s full-year EPS of $0.60 to grow 44.6%.

Key Takeaways from AdaptHealth’s Q4 Results

We were impressed that AdaptHealth beat revenue expectations, leading to EPS exceeding Wall Street's expectations handily. While full-year revenue guidance slightly missed, full-year EBITDA guidance beat. Overall, this quarter had some key positives. The stock traded up 8.2% to $9.25 immediately after reporting.

AdaptHealth may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.