Fresh produce company Fresh Del Monte (NYSE: FDP) missed Wall Street’s revenue expectations in Q4 CY2024, with sales flat year on year at $1.01 billion. Its non-GAAP profit of $0.26 per share was 29.7% below analysts’ consensus estimates.

Is now the time to buy Fresh Del Monte Produce? Find out by accessing our full research report, it’s free.

Fresh Del Monte Produce (FDP) Q4 CY2024 Highlights:

- Revenue: $1.01 billion vs analyst estimates of $1.03 billion (flat year on year, 2% miss)

- Adjusted EPS: $0.26 vs analyst expectations of $0.37 ($0.12 miss)

- Adjusted EBITDA: $35.2 million vs analyst estimates of $48.7 million (3.5% margin, 27.7% miss)

- Operating Margin: 3%, up from 1.2% in the same quarter last year

- Free Cash Flow was -$22.3 million compared to -$19.2 million in the same quarter last year

- Market Capitalization: $1.48 billion

"Our full-year 2024 results reflect the effectiveness of our strategic focus and operational improvements. This success, achieved despite facing several challenges in 2024, was primarily driven by the exceptional performance of our fresh and value-added products segment, particularly pineapples, avocados, and fresh-cut fruit, which continue to fuel our growth and deliver strong gross margins for the Company,” said Mohammad Abu-Ghazaleh, Fresh Del Monte’s Chairman and Chief Executive Officer.

Company Overview

Translating to "of the mountain" in Spanish, Fresh Del Monte (NYSE: FDP) is a leader in providing high-quality, sustainably grown fresh fruits and vegetables.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years.

With $4.28 billion in revenue over the past 12 months, Fresh Del Monte Produce carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

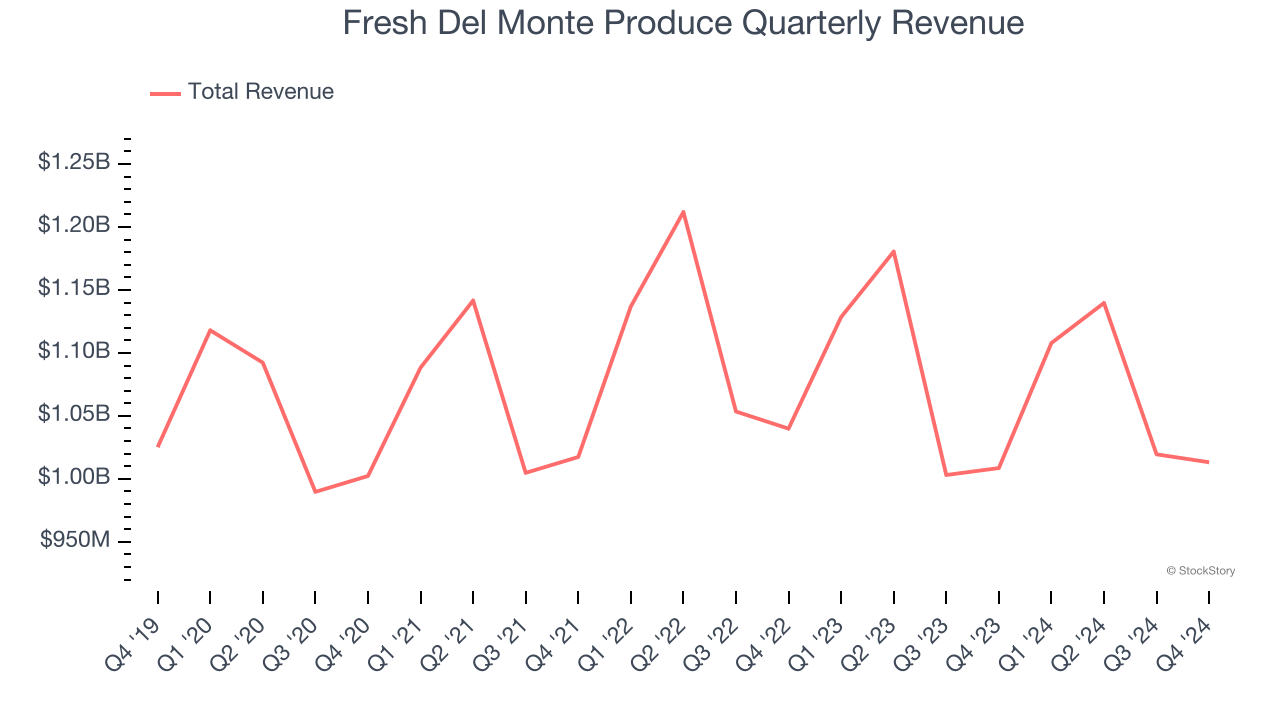

As you can see below, Fresh Del Monte Produce struggled to increase demand as its $4.28 billion of sales for the trailing 12 months was close to its revenue three years ago. This shows demand was soft, a tough starting point for our analysis.

This quarter, Fresh Del Monte Produce’s $1.01 billion of revenue was flat year on year, falling short of Wall Street’s estimates.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

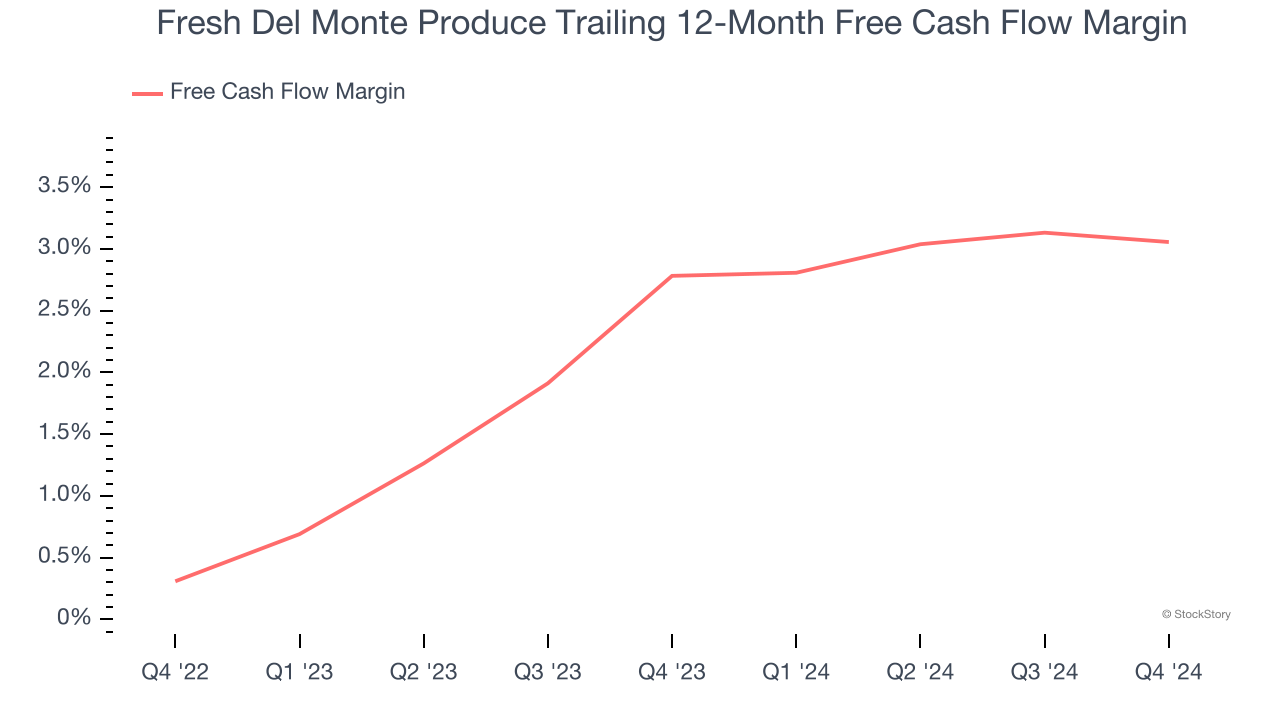

Fresh Del Monte Produce has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.9%, subpar for a consumer staples business.

Taking a step back, we can see that Fresh Del Monte Produce failed to improve its margin over the last year. Its unexciting margin and trend likely have shareholders hoping for a change.

Fresh Del Monte Produce burned through $22.3 million of cash in Q4, equivalent to a negative 2.2% margin. The company’s cash burn was similar to its $19.2 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

Key Takeaways from Fresh Del Monte Produce’s Q4 Results

We struggled to find many positives in these results. Its EBITDA missed significantly and its gross margin fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $30.69 immediately following the results.

The latest quarter from Fresh Del Monte Produce’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.