Online insurance comparison site EverQuote (NASDAQ: EVER) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 165% year on year to $147.5 million. On top of that, next quarter’s revenue guidance ($157.5 million at the midpoint) was surprisingly good and 14.3% above what analysts were expecting. Its GAAP profit of $0.33 per share was 67.9% above analysts’ consensus estimates.

Is now the time to buy EverQuote? Find out by accessing our full research report, it’s free.

EverQuote (EVER) Q4 CY2024 Highlights:

- Revenue: $147.5 million vs analyst estimates of $134 million (165% year-on-year growth, 10% beat)

- EPS (GAAP): $0.33 vs analyst estimates of $0.20 ($0.13 beat)

- Adjusted EBITDA: $18.92 million vs analyst estimates of $15.22 million (12.8% margin, 24.2% beat)

- Revenue Guidance for Q1 CY2025 is $157.5 million at the midpoint, above analyst estimates of $137.8 million

- EBITDA guidance for Q1 CY2025 is $20 million at the midpoint, above analyst estimates of $12.79 million

- Operating Margin: 8.2%, up from -12.1% in the same quarter last year

- Free Cash Flow Margin: 13.7%, down from 15.3% in the previous quarter

- Market Capitalization: $733.9 million

“I am proud of our remarkable team and our financial accomplishments in 2024. We grew revenue by 74% year-over-year to cross the $500 million mark for the first time, increased Adjusted EBITDA to almost $60 million, and finished the year with over $100 million of cash on the balance sheet, and no debt,” said Jayme Mendal, CEO of EverQuote.

Company Overview

Aiming to simplify a once complicated process, EverQuote (NASDAQ: EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Sales Growth

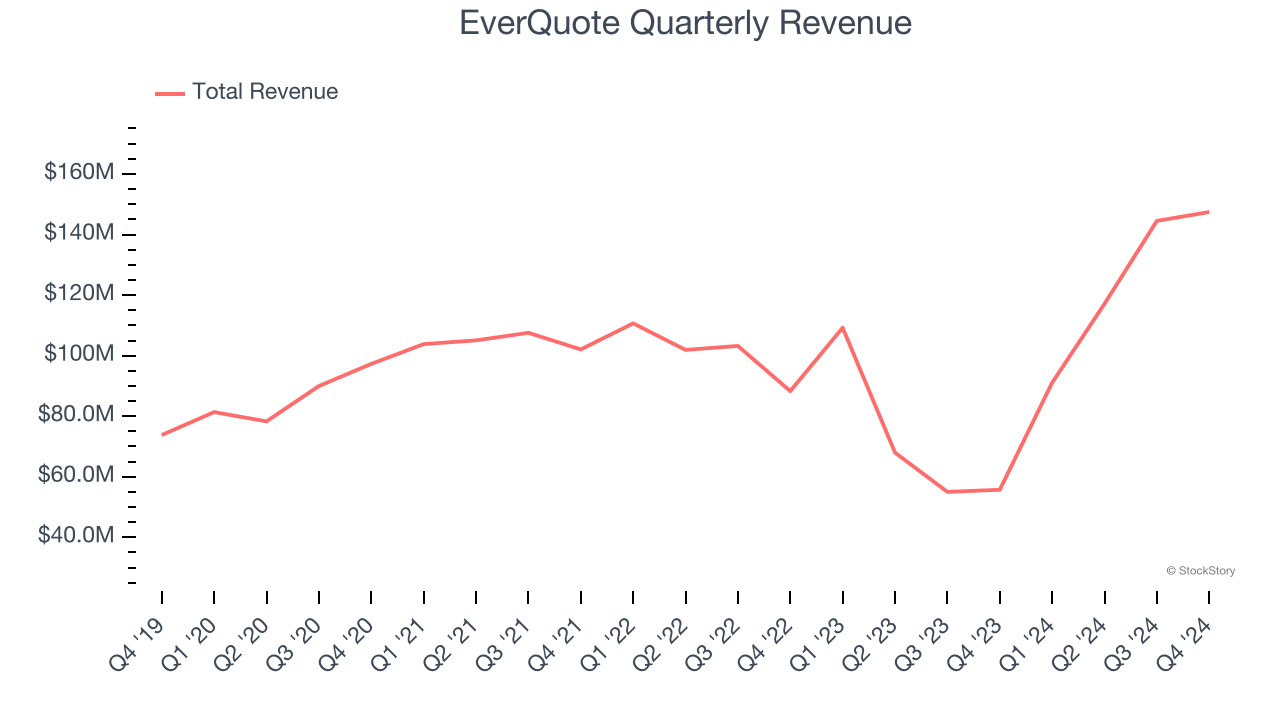

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, EverQuote grew its sales at a tepid 6.1% compounded annual growth rate. This fell short of our benchmark for the consumer internet sector and is a rough starting point for our analysis.

This quarter, EverQuote reported magnificent year-on-year revenue growth of 165%, and its $147.5 million of revenue beat Wall Street’s estimates by 10%. Company management is currently guiding for a 73% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16% over the next 12 months, an acceleration versus the last three years. This projection is admirable and implies its newer products and services will fuel better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

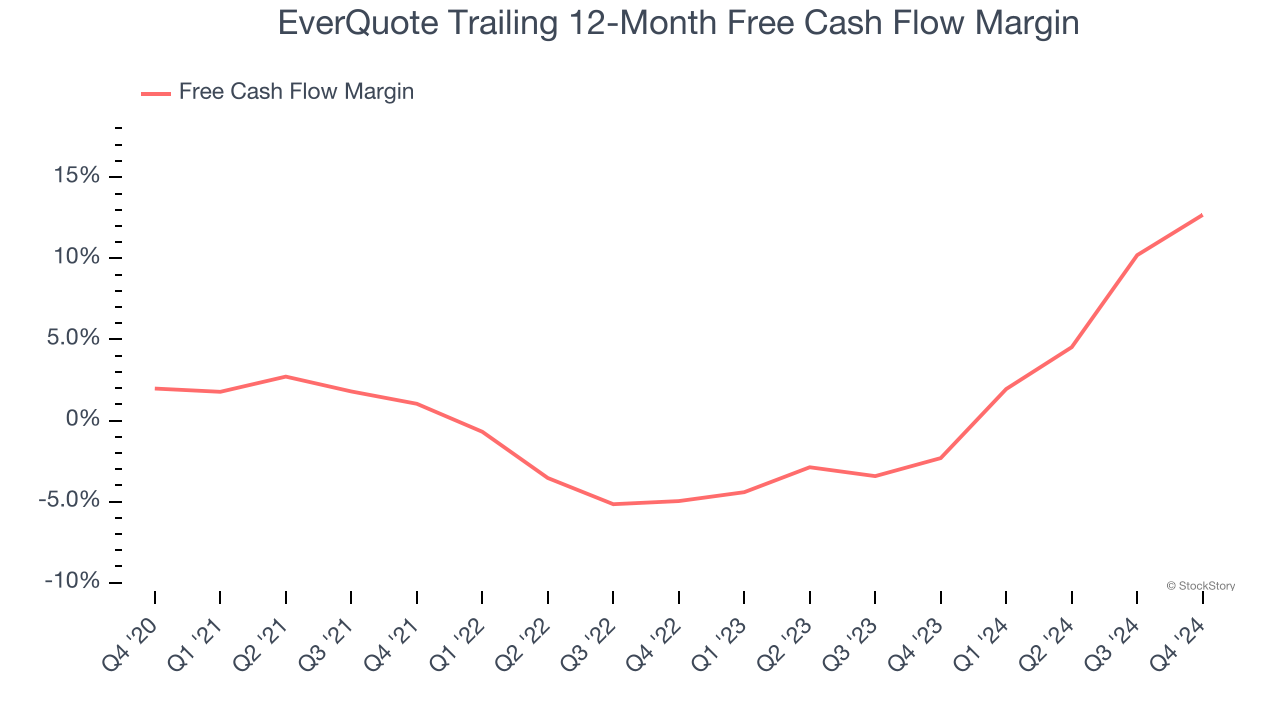

EverQuote has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.2% over the last two years, slightly better than the broader consumer internet sector.

Taking a step back, we can see that EverQuote’s margin expanded by 11.6 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

EverQuote’s free cash flow clocked in at $20.13 million in Q4, equivalent to a 13.7% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

Key Takeaways from EverQuote’s Q4 Results

We were impressed by EverQuote’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited that both its revenue and EBITDA outperformed Wall Street’s estimates by a wide margin this quarter. Zooming out, we think this was a solid quarter. The stock traded up 9.1% to $21.99 immediately after reporting.

Sure, EverQuote had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.