Medical device company Artivion (NYSE: AORT) missed Wall Street’s revenue expectations in Q4 CY2024 as sales rose 3.9% year on year to $97.31 million. The company’s full-year revenue guidance of $427.5 million at the midpoint came in 0.6% below analysts’ estimates. Its non-GAAP loss of $0 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Artivion? Find out by accessing our full research report, it’s free.

Artivion (AORT) Q4 CY2024 Highlights:

- Revenue: $97.31 million vs analyst estimates of $101.2 million (3.9% year-on-year growth, 3.8% miss)

- Adjusted EPS: $0.00 vs analyst estimates of $0.04 ($0.04 miss)

- Adjusted EBITDA: $17.61 million vs analyst estimates of $17.37 million (18.1% margin, 1.4% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $427.5 million at the midpoint, missing analyst estimates by 0.6% and implying 10% growth (vs 9.9% in FY2024)

- Operating Margin: 2.7%, in line with the same quarter last year

- Free Cash Flow Margin: 9%, down from 11.2% in the same quarter last year

- Market Capitalization: $1.18 billion

"2024 was an excellent year for Artivion, marked by robust revenue and adjusted EBITDA growth, which enabled us to deliver positive free cash flow while making significant strides in key clinical and regulatory initiatives. Revenue growth in the fourth quarter was driven by year-over-year growth in On-X of 10%, stent grafts of 10%, and BioGlue of 8% all compared to the fourth quarter of 2023. On a constant currency basis, year-over-year, On-X, stent grafts, and BioGlue grew 10%, 8%, and 7%, respectively. We also saw continued revenue strength in Latin America which grew 26% both in the fourth quarter and for the full year 2024 on a constant currency basis compared to last year." said Pat Mackin, Chairman, President, and Chief Executive Officer.

Company Overview

Founded in 1992, Artivion (NYSE: AORT) develops and manufactures medical devices and biomaterials for the treatment of cardiovascular diseases, with a focus on aortic valve replacement, vascular surgery, and cardiac surgery.

Medical Devices & Supplies - Cardiology, Neurology, Vascular

The medical devices and supplies industry, particularly in the fields of cardiology, neurology, and vascular care, benefits from a business model that balances innovation with relatively predictable revenue streams. These companies focus on developing life-saving devices such as stents, pacemakers, neurostimulation implants, and vascular access tools, which address critical and often chronic conditions. The recurring need for these devices, coupled with growing global demand for advanced treatments, provides stability and opportunities for long-term growth. However, the industry faces hurdles such as high research and development costs, rigorous regulatory approval processes, and reliance on reimbursement from healthcare systems, which can exert downward pressure on pricing. Looking ahead, the industry is positioned to benefit from tailwinds such as aging populations (which tend to have higher rates of disease) and technological advancements like minimally invasive procedures and connected devices that improve patient monitoring and outcomes. Innovations in robotic-assisted surgery and AI-driven diagnostics are also expected to accelerate adoption and expand treatment capabilities. However, potential headwinds include pricing pressures stemming from value-based care models and continued complexity changing from navigating regulatory frameworks that may prioritize further lowering healthcare costs.

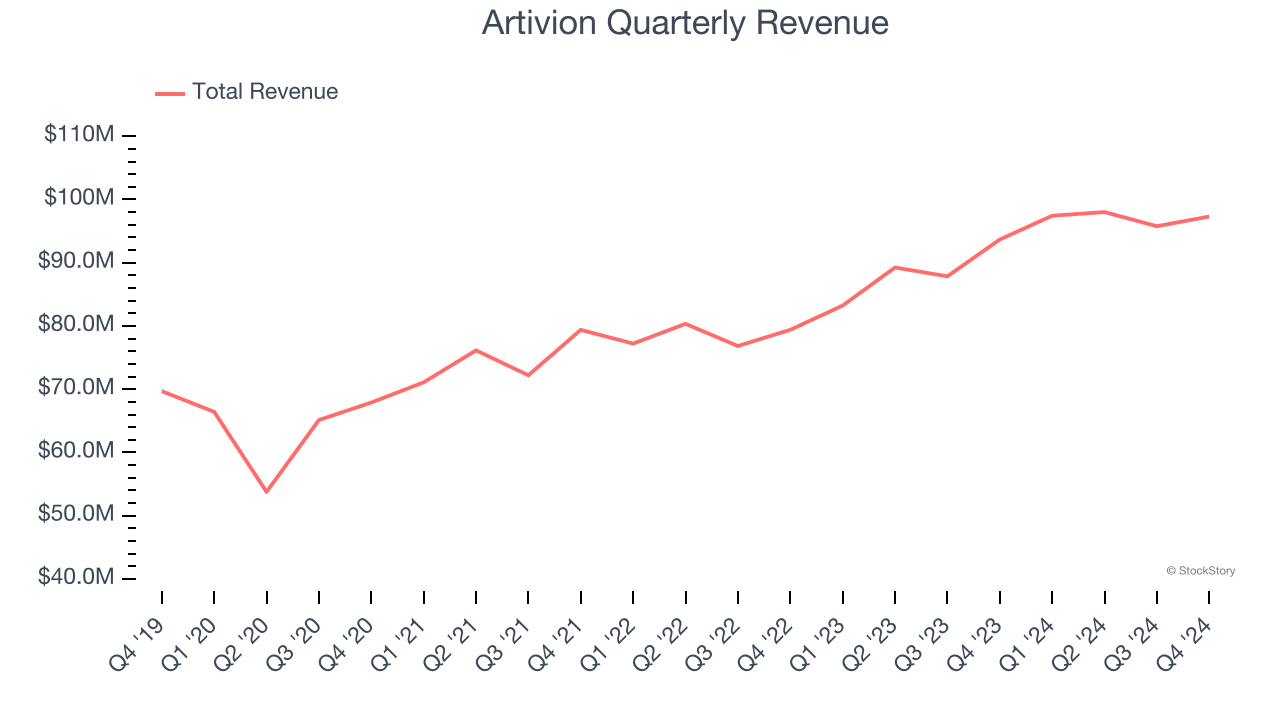

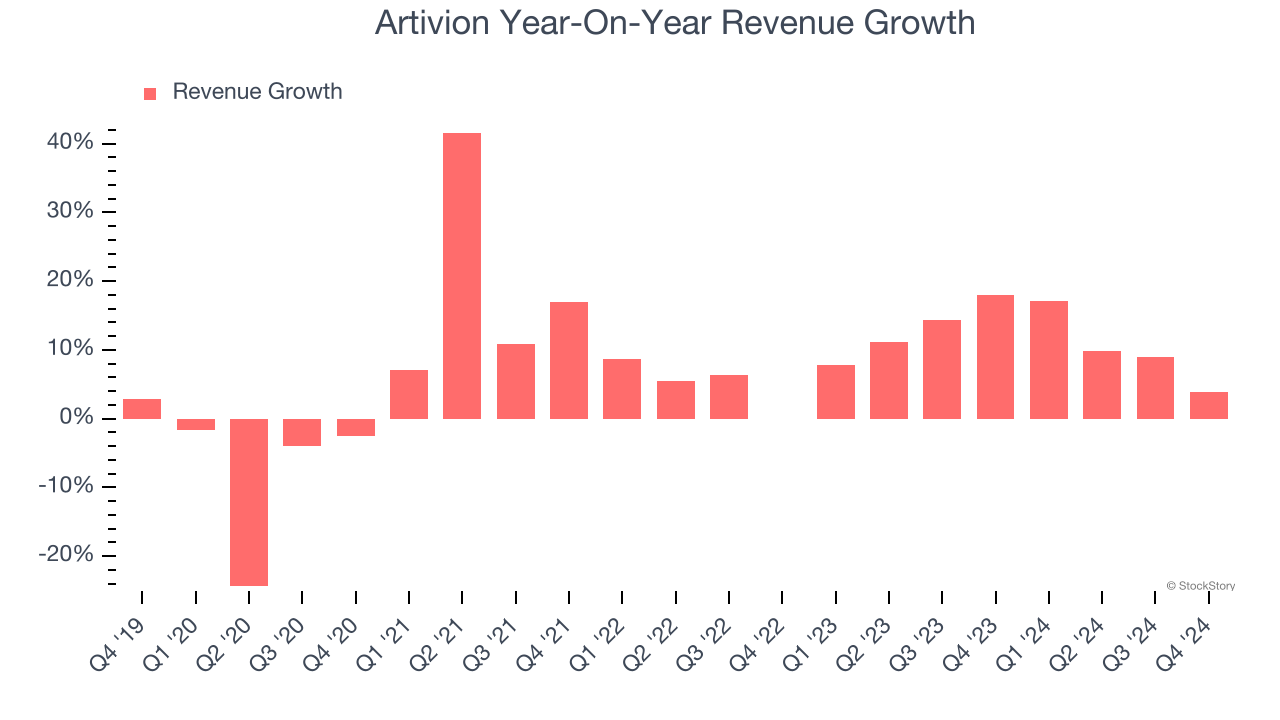

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Artivion’s 7.1% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the healthcare sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Artivion’s annualized revenue growth of 11.3% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Artivion’s revenue grew by 3.9% year on year to $97.31 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 11.1% over the next 12 months, similar to its two-year rate. This projection is healthy and suggests the market is baking in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

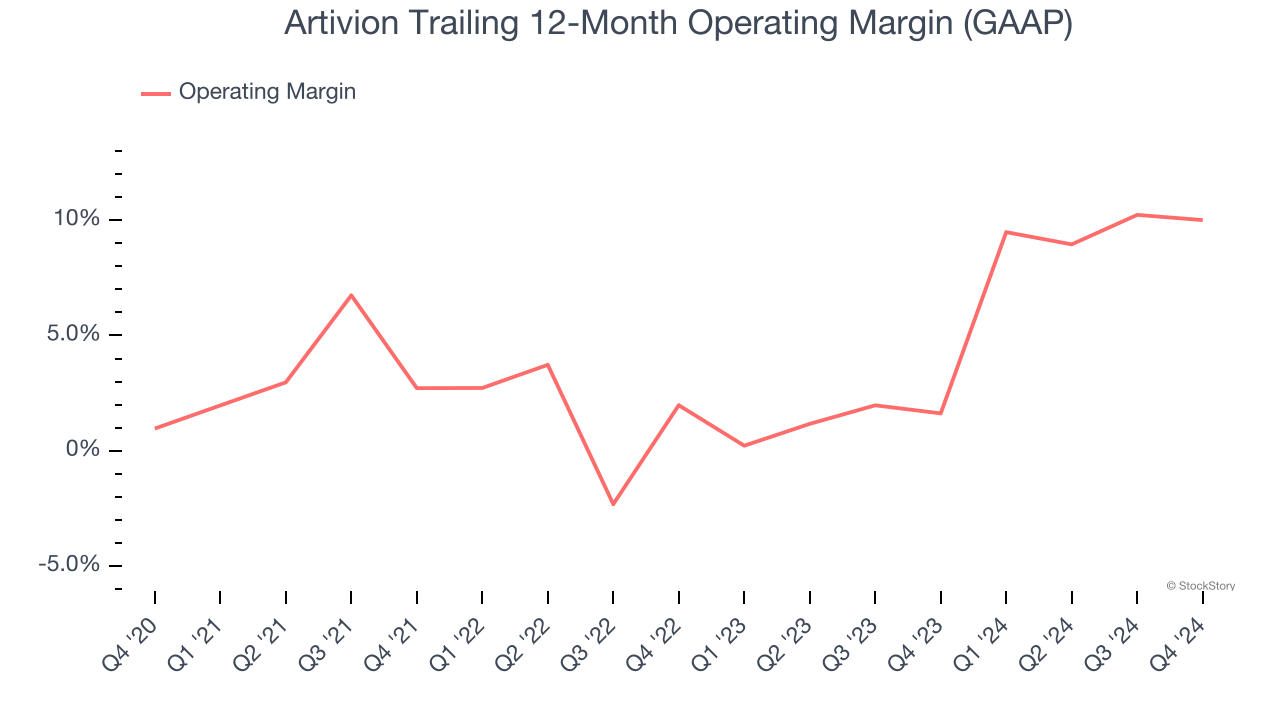

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Artivion was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.8% was weak for a healthcare business.

On the plus side, Artivion’s operating margin rose by 9 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 8 percentage points on a two-year basis.

In Q4, Artivion generated an operating profit margin of 2.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

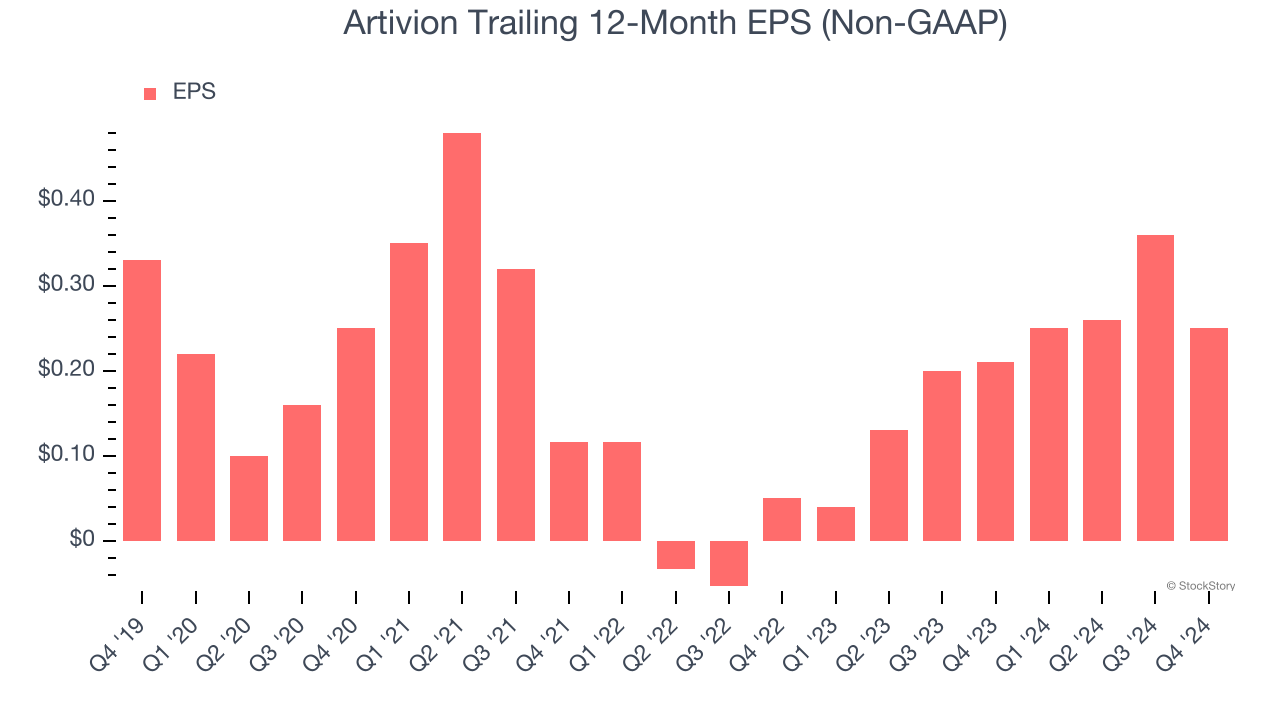

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Artivion, its EPS declined by 5.4% annually over the last five years while its revenue grew by 7.1%. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

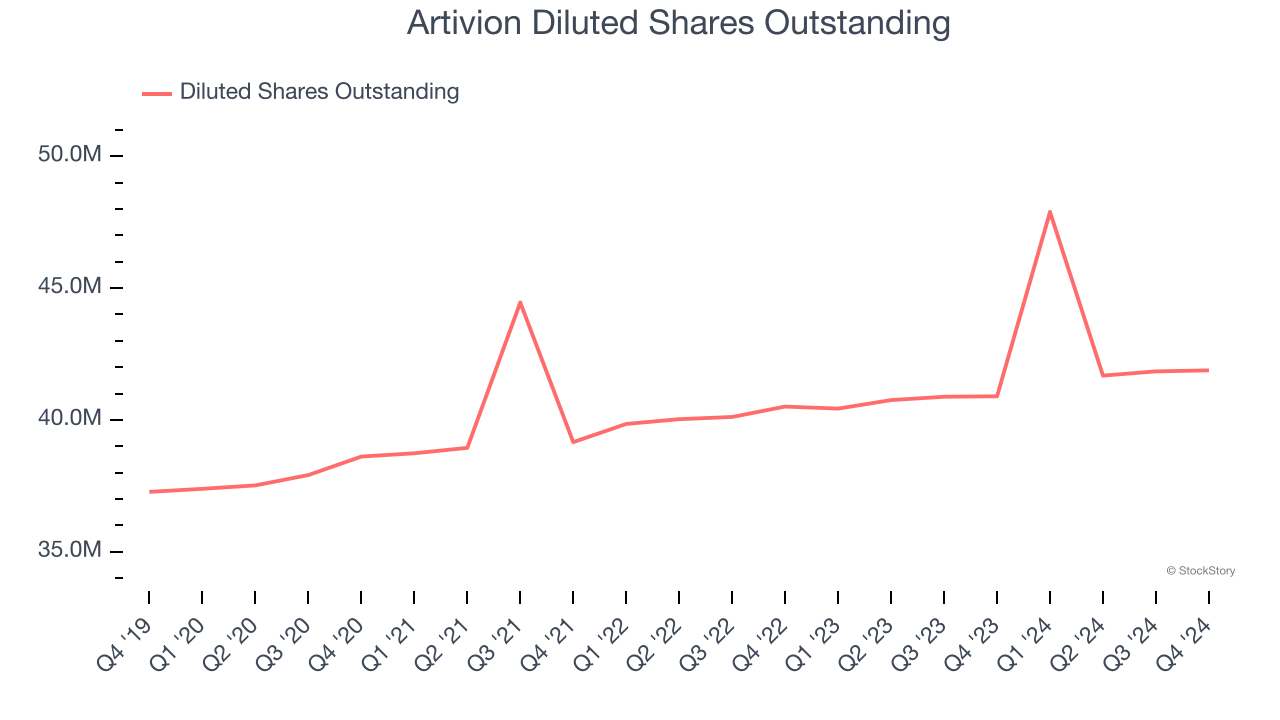

We can take a deeper look into Artivion’s earnings to better understand the drivers of its performance. A five-year view shows Artivion has diluted its shareholders, growing its share count by 12.4%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Artivion reported EPS at $0, down from $0.11 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Artivion to perform poorly. Analysts forecast its full-year EPS of $0.25 will hit $0.49.

Key Takeaways from Artivion’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EPS also fell short of Wall Street’s estimates. Looking ahead, 2025 revenue guidance was also slightly below. Overall, this was a weaker quarter. The stock remained flat at $27.85 immediately following the results.

Artivion’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.