Let’s dig into the relative performance of Victoria's Secret (NYSE: VSCO) and its peers as we unravel the now-completed Q3 apparel retailer earnings season.

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

The 9 apparel retailer stocks we track reported a satisfactory Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 2.1% below.

While some apparel retailer stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.7% since the latest earnings results.

Victoria's Secret (NYSE: VSCO)

Spun off from L Brands in 2020, Victoria’s Secret (NYSE: VSCO) is an intimate clothing and beauty retailer that sells its own brands of lingerie, undergarments, and personal fragrances.

Victoria's Secret reported revenues of $1.35 billion, up 6.5% year on year. This print exceeded analysts’ expectations by 4.6%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ EPS estimates.

Chief Executive Officer Hillary Super commented, “I am very encouraged by the strength of our third quarter business and the positive, early customer response to our holiday merchandise assortments. Sales increased 7% for the quarter, with mid-single digit growth in North America and 20+% growth from our International business."

Victoria's Secret pulled off the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 30.1% since reporting and currently trades at $30.06.

Is now the time to buy Victoria's Secret? Access our full analysis of the earnings results here, it’s free.

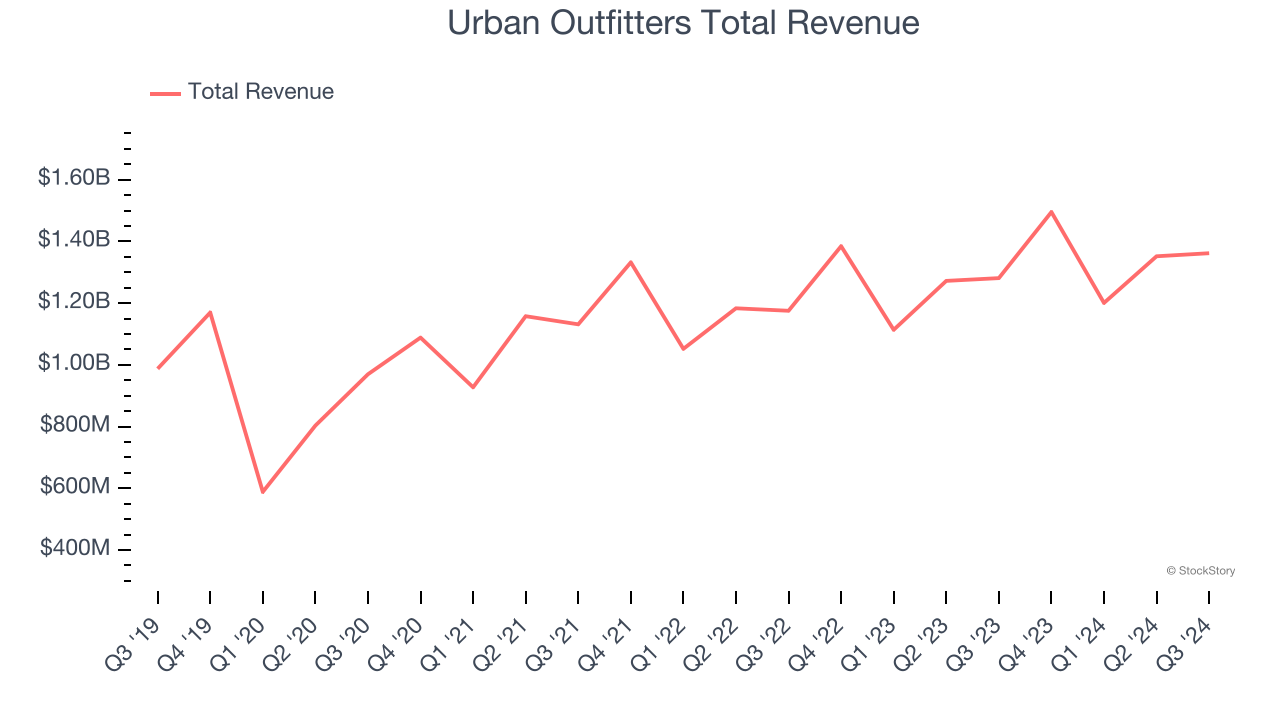

Best Q3: Urban Outfitters (NASDAQ: URBN)

Founded as a purveyor of vintage items, Urban Outfitters (NASDAQ: URBN) now largely sells new apparel and accessories to teens and young adults seeking on-trend fashion.

Urban Outfitters reported revenues of $1.36 billion, up 6.3% year on year, outperforming analysts’ expectations by 1.7%. The business had an exceptional quarter with an impressive beat of analysts’ gross margin estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 39% since reporting. It currently trades at $55.80.

Is now the time to buy Urban Outfitters? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Torrid (NYSE: CURV)

Promoting a message of body positivity and inclusiveness, Torrid Holdings (NYSE: CURV) is a plus-size women’s apparel and accessories retailer.

Torrid reported revenues of $263.8 million, down 4.2% year on year, falling short of analysts’ expectations by 6.6%. It was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

Torrid delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. Interestingly, the stock is up 34.6% since the results and currently trades at $6.23.

Read our full analysis of Torrid’s results here.

Tilly's (NYSE: TLYS)

With an emphasis on skate and surf culture, Tilly’s (NYSE: TLYS) is a specialty retailer that sells clothing, footwear, and accessories geared towards fashion-forward teens and young adults.

Tilly's reported revenues of $143.4 million, down 13.8% year on year. This result lagged analysts' expectations by 2.3%. Overall, it was a slower quarter as it also recorded revenue and EPS guidance for next quarter missing analysts’ expectations.

Tilly's had the slowest revenue growth among its peers. The stock is down 12% since reporting and currently trades at $3.80.

Read our full, actionable report on Tilly's here, it’s free.

Lululemon (NASDAQ: LULU)

Originally serving yogis and hockey players, Lululemon (NASDAQ: LULU) is a designer, distributor, and retailer of athletic apparel for men and women.

Lululemon reported revenues of $2.40 billion, up 8.7% year on year. This print surpassed analysts’ expectations by 1.6%. Overall, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ EBITDA estimates.

Lululemon scored the highest full-year guidance raise among its peers. The stock is up 6.5% since reporting and currently trades at $367.30.

Read our full, actionable report on Lululemon here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.