Fidelity National Financial has been treading water for the past six months, recording a small loss of 1.7% while holding steady at $55.09. The stock also fell short of the S&P 500’s 11.7% gain during that period.

Does this present a buying opportunity for FNF? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free for active Edge members.

Why Does FNF Stock Spark Debate?

Issuing more title insurance policies than any other company in the United States, Fidelity National Financial (NYSE: FNF) provides title insurance and escrow services for real estate transactions while also offering annuities and life insurance through its F&G subsidiary.

Two Positive Attributes:

2. Stellar ROE Showcases Lucrative Growth Opportunities

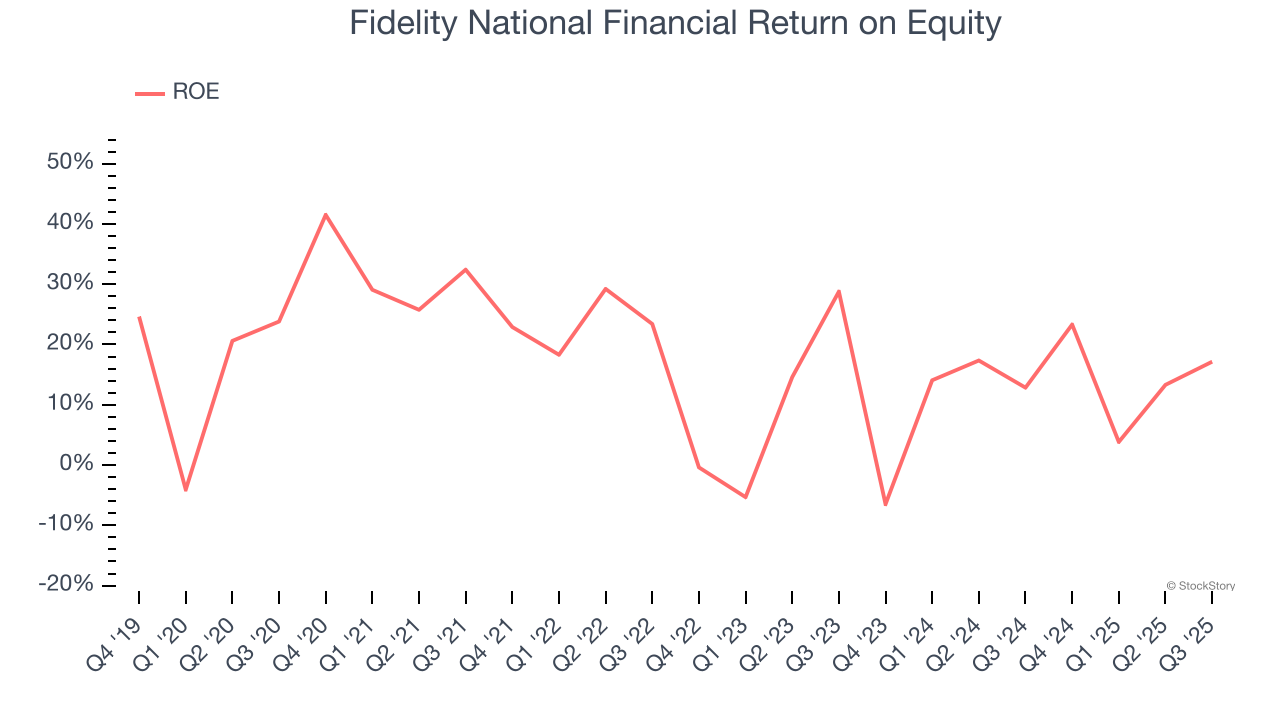

Return on equity (ROE) serves as a comprehensive measure of an insurer's performance, showing how efficiently it converts shareholder capital into profits. Strong ROE performance typically translates to better returns for investors through a combination of earnings retention, share repurchases, and dividend distributions.

Over the last five years, Fidelity National Financial has averaged an ROE of 17.8%, excellent for a company operating in a sector where the average shakes out around 12.5% and those putting up 20%+ are greatly admired. This shows Fidelity National Financial has a strong competitive moat.

One Reason to be Careful:

Net Premiums Earned Hit a Plateau

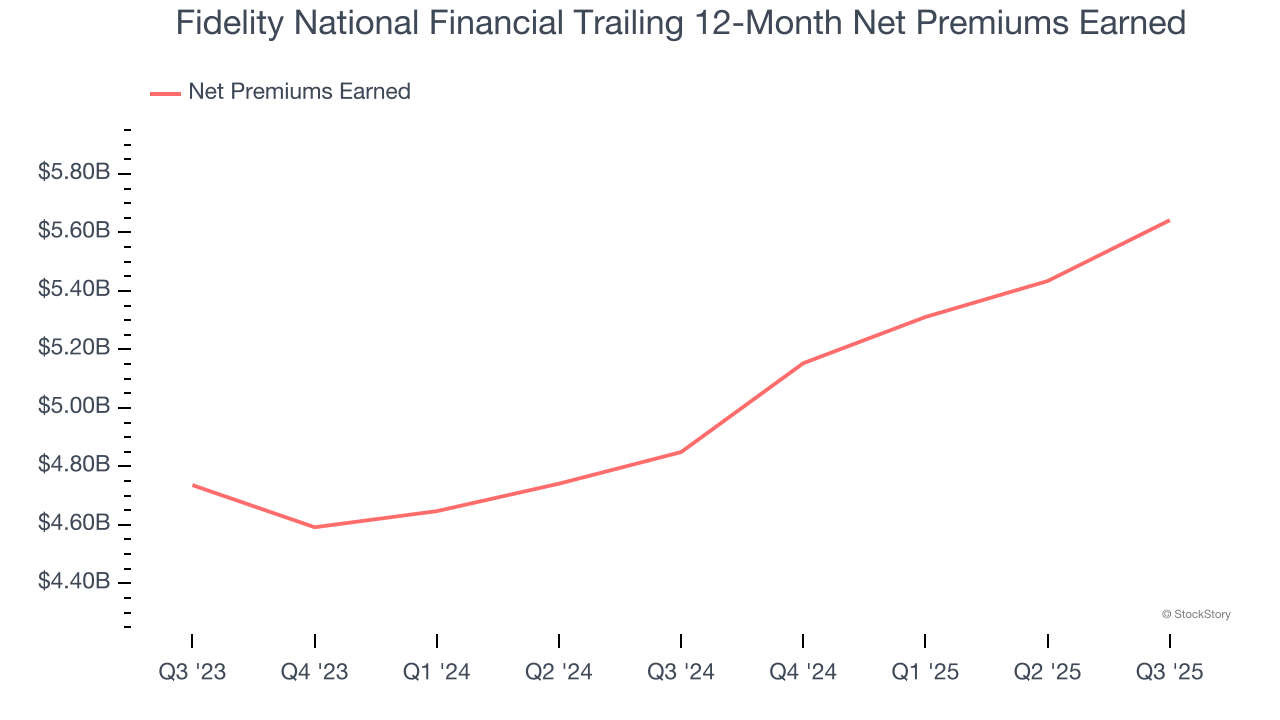

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore net of what’s ceded to reinsurers as a risk mitigation and transfer strategy.

Fidelity National Financial’s net premiums earned was flat over the last five years, much worse than the broader insurance industry. This shows that policy underwriting underperformed its other business lines.

Final Judgment

Fidelity National Financial’s merits more than compensate for its flaws. With its shares trailing the market in recent months, the stock trades at 1.6× forward P/B (or $55.09 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.