Looking back on investment banking & brokerage stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Interactive Brokers (NASDAQ: IBKR) and its peers.

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

The 16 investment banking & brokerage stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.2% while next quarter’s revenue guidance was in line.

While some investment banking & brokerage stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4% since the latest earnings results.

Interactive Brokers (NASDAQ: IBKR)

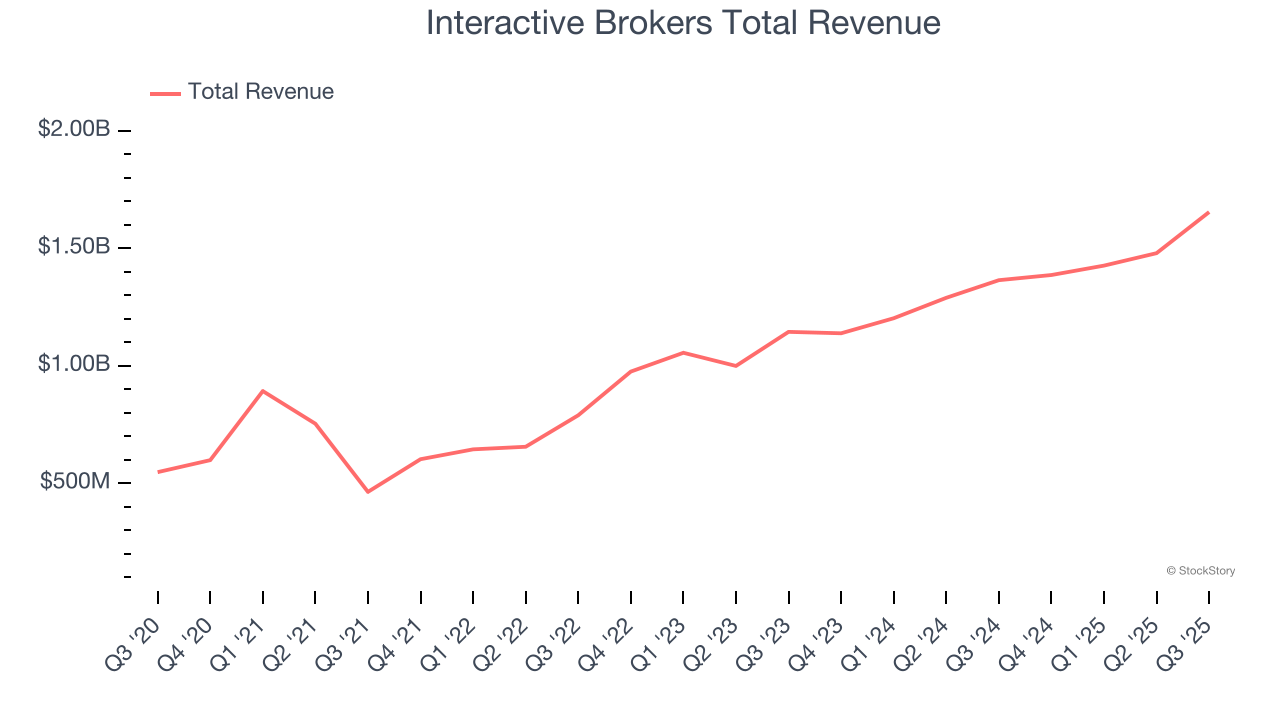

Founded in 1977 and known for its sophisticated trading technology and global reach across 150+ exchanges in 34 countries, Interactive Brokers (NASDAQ: IBKR) is a global electronic broker that provides low-cost trading and investment services across stocks, options, futures, forex, bonds, and other financial instruments.

Interactive Brokers reported revenues of $1.66 billion, up 21.2% year on year. This print exceeded analysts’ expectations by 8.1%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ revenue estimates and an impressive beat of analysts’ EBITDA estimates.

Unsurprisingly, the stock is down 5.4% since reporting and currently trades at $65.

Best Q3: Morgan Stanley (NYSE: MS)

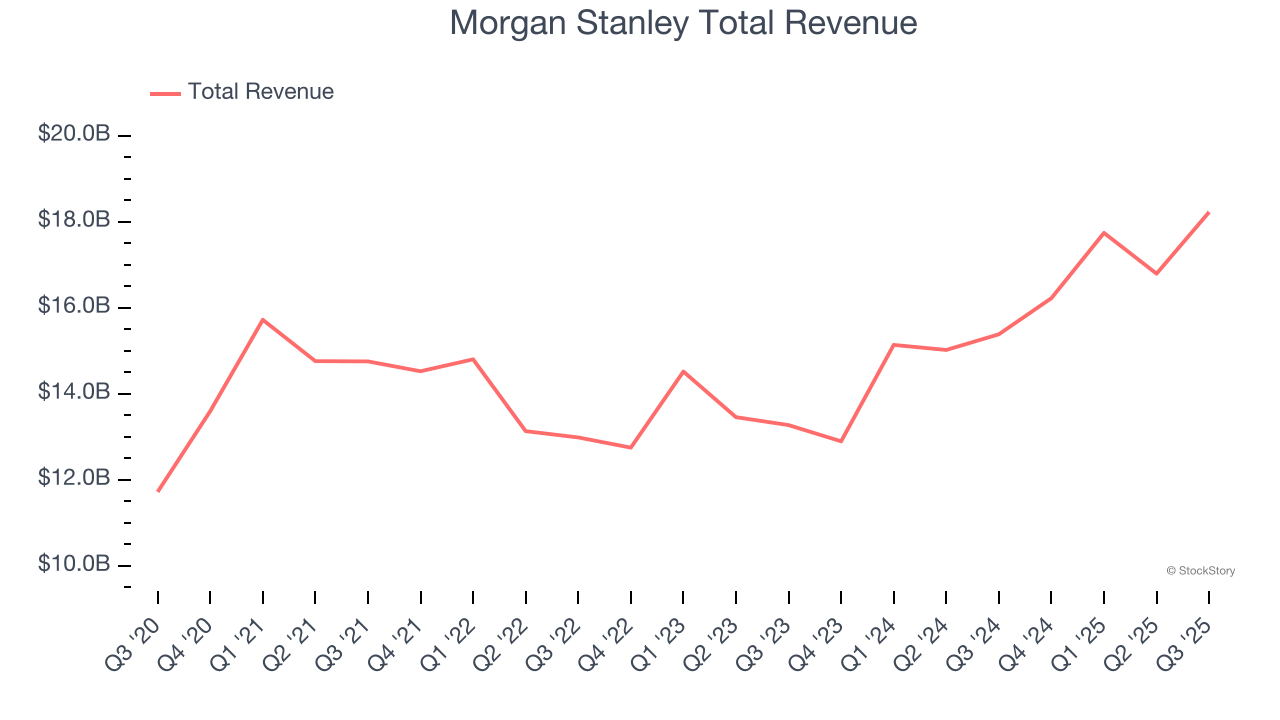

Founded in 1924 during the post-WWI economic boom by former JP Morgan partners, Morgan Stanley (NYSE: MS) is a global financial services firm that provides investment banking, wealth management, and investment management services to corporations, governments, institutions, and individuals.

Morgan Stanley reported revenues of $18.22 billion, up 18.5% year on year, outperforming analysts’ expectations by 9.2%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

The market seems content with the results as the stock is up 4.3% since reporting. It currently trades at $163.75.

Is now the time to buy Morgan Stanley? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Perella Weinberg (NASDAQ: PWP)

Founded in 2006 by veteran investment bankers Joseph Perella and Peter Weinberg during a wave of boutique advisory firm launches, Perella Weinberg Partners (NASDAQ: PWP) is a global independent advisory firm that provides strategic and financial advice to corporations, financial sponsors, and government institutions.

Perella Weinberg reported revenues of $164.6 million, down 40.8% year on year, falling short of analysts’ expectations by 8.4%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ EPS estimates.

Perella Weinberg delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 8.1% since the results and currently trades at $17.32.

Read our full analysis of Perella Weinberg’s results here.

Charles Schwab (NYSE: SCHW)

Founded in 1971 as a disruptive force challenging Wall Street's high fees and limited access, Charles Schwab (NYSE: SCHW) is a wealth management and brokerage firm that provides investment services, banking, and financial advice to individual investors and independent advisors.

Charles Schwab reported revenues of $6.14 billion, up 26.6% year on year. This print beat analysts’ expectations by 2.2%. It was a strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ revenue estimates.

The stock is down 1.7% since reporting and currently trades at $92.75.

Read our full, actionable report on Charles Schwab here, it’s free for active Edge members.

Jefferies (NYSE: JEF)

Tracing its roots back to 1962 and rebranded from Leucadia National Corporation in 2018, Jefferies Financial Group (NYSE: JEF) is a global investment banking and capital markets firm that provides advisory services, securities trading, and asset management to corporations, institutions, and wealthy individuals.

Jefferies reported revenues of $2.05 billion, up 21.6% year on year. This number topped analysts’ expectations by 8.4%. Overall, it was an incredible quarter as it also produced a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

The stock is down 18% since reporting and currently trades at $54.72.

Read our full, actionable report on Jefferies here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.