The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Donaldson (NYSE: DCI) and the rest of the gas and liquid handling stocks fared in Q3.

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 13 gas and liquid handling stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 2.2%.

Thankfully, share prices of the companies have been resilient as they are up 5.8% on average since the latest earnings results.

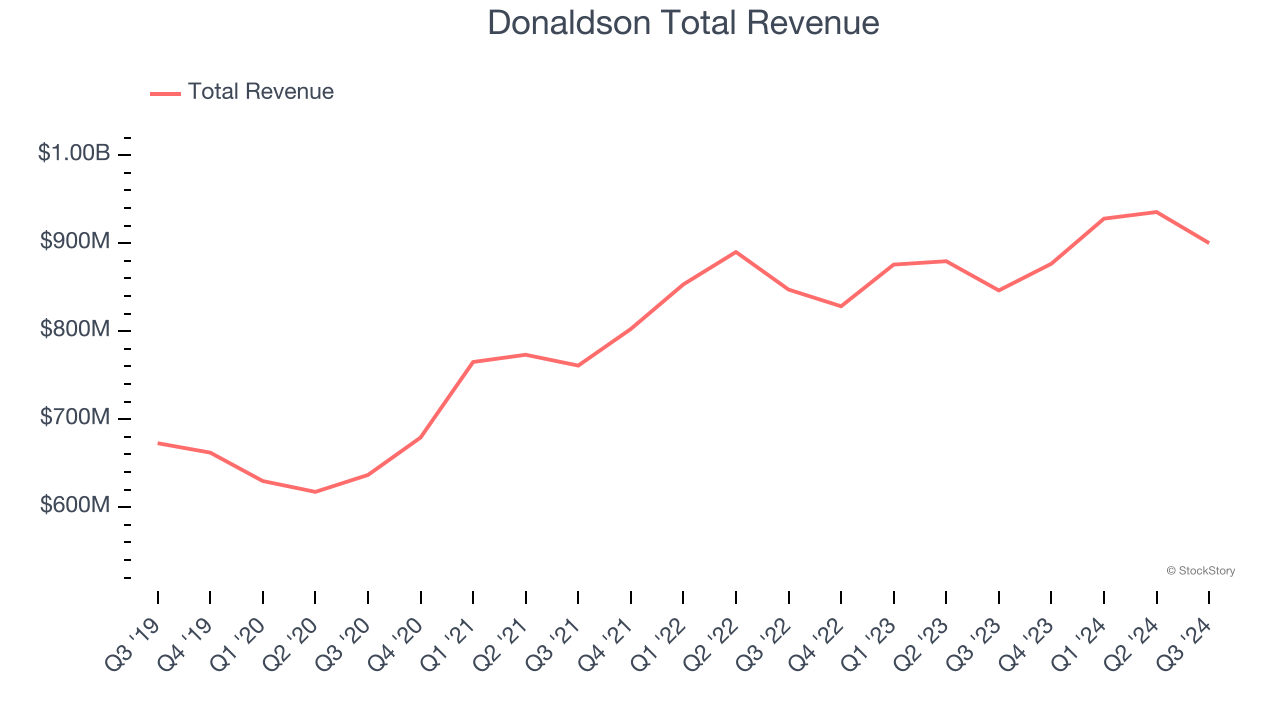

Donaldson (NYSE: DCI)

Playing a vital role in the historic Apollo 11 mission, Donaldson (NYSE: DCI) manufacturers and sells filtration equipment for various industries.

Donaldson reported revenues of $900.1 million, up 6.4% year on year. This print exceeded analysts’ expectations by 0.9%. Despite the top-line beat, it was still a mixed quarter for the company with full-year EPS guidance slightly topping analysts’ expectations but a slight miss of analysts’ adjusted operating income estimates.

Unsurprisingly, the stock is down 12.6% since reporting and currently trades at $68.26.

Is now the time to buy Donaldson? Access our full analysis of the earnings results here, it’s free.

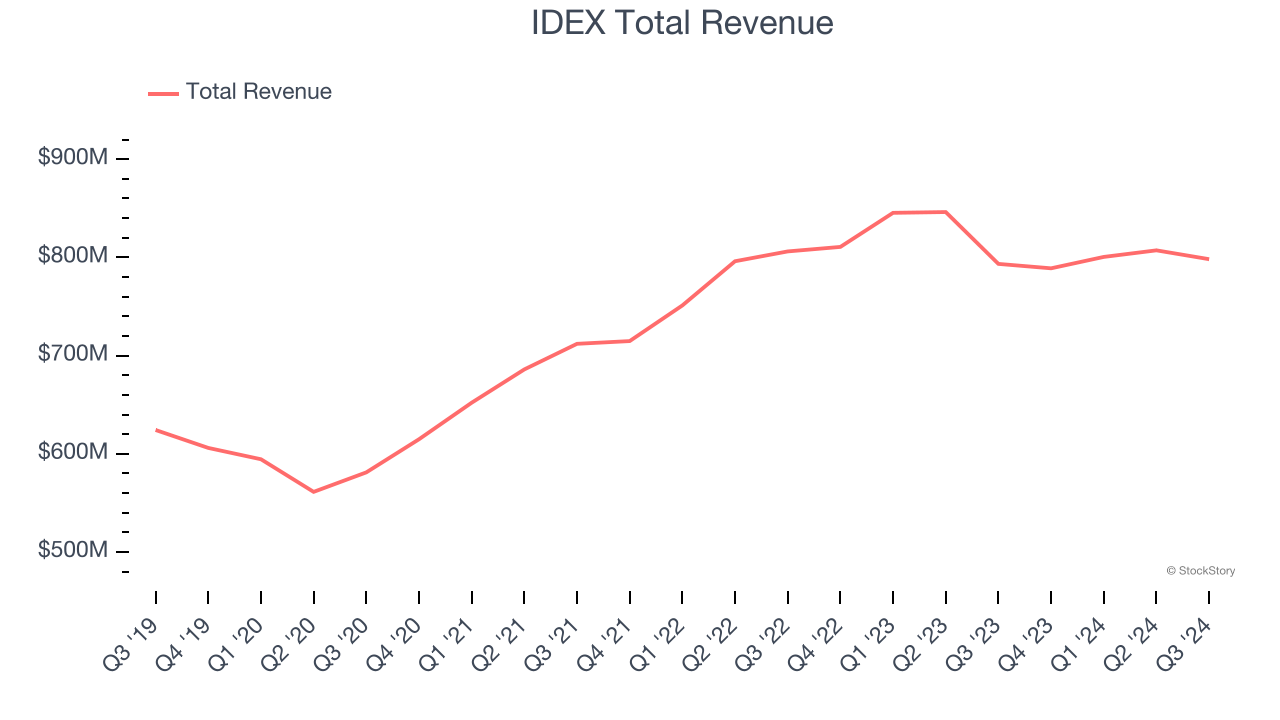

Best Q3: IDEX (NYSE: IEX)

Founded in 1988, IDEX (NYSE: IEX) is a global manufacturer specializing in highly engineered products such as pumps, flow meters, and fluidics systems for various industries.

IDEX reported revenues of $798.2 million, flat year on year, outperforming analysts’ expectations by 0.6%. The business had a satisfactory quarter with a solid beat of analysts’ adjusted operating income estimates but a slight miss of analysts’ organic revenue estimates.

The market seems content with the results as the stock is up 1.6% since reporting. It currently trades at $207.02.

Is now the time to buy IDEX? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Graco (NYSE: GGG)

Founded in 1926, Graco (NYSE: GGG) is an industrial company specializing in the development and manufacturing of fluid-handling systems and products.

Graco reported revenues of $519.2 million, down 3.8% year on year, falling short of analysts’ expectations by 3.4%. It was a disappointing quarter as it posted a miss of analysts’ Contractor revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

Interestingly, the stock is up 1.5% since the results and currently trades at $84.08.

Read our full analysis of Graco’s results here.

Parker-Hannifin (NYSE: PH)

Founded in 1917, Parker Hannifin (NYSE: PH) is a manufacturer of motion and control systems for a wide variety of mobile, industrial and aerospace markets.

Parker-Hannifin reported revenues of $4.90 billion, up 1.2% year on year. This result met analysts’ expectations. Zooming out, it was a slower quarter as it logged a significant miss of analysts’ adjusted operating income estimates.

The stock is up 2% since reporting and currently trades at $637.74.

Read our full, actionable report on Parker-Hannifin here, it’s free.

Standex (NYSE: SXI)

Holding over 500 patents globally, Standex (NYSE: SXI) is a manufacturer and distributor of industrial components for various sectors.

Standex reported revenues of $170.5 million, down 7.7% year on year. This result missed analysts’ expectations by 4.7%. Overall, it was a slower quarter for the company with a miss of analysts' sales and earnings estimates.

The stock is up 6.2% since reporting and currently trades at $191.05.

Read our full, actionable report on Standex here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.