Rigid packaging solutions manufacturer Silgan Holdings (NYSE: SLGN) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 5.3% year on year to $1.41 billion. Its non-GAAP profit of $0.85 per share was 3.4% above analysts’ consensus estimates.

Is now the time to buy Silgan Holdings? Find out by accessing our full research report, it’s free.

Silgan Holdings (SLGN) Q4 CY2024 Highlights:

- Revenue: $1.41 billion vs analyst estimates of $1.40 billion (5.3% year-on-year growth, in line)

- Adjusted EPS: $0.85 vs analyst estimates of $0.82 (3.4% beat)

- Adjusted EBITDA: $170.6 million vs analyst estimates of $224.9 million (12.1% margin, 24.1% miss)

- Adjusted EPS guidance for the upcoming financial year 2025 is $4.10 at the midpoint, missing analyst estimates by 0.7%

- Operating Margin: 6.7%, down from 9.4% in the same quarter last year

- Free Cash Flow Margin: 61.3%, down from 78% in the same quarter last year

- Market Capitalization: $5.66 billion

"The Silgan team delivered another year of strong results, with record fourth quarter adjusted EPS and Adjusted EBIT and double digit free cash flow growth, and made significant progress on several important long-term strategic objectives that will benefit our Company in 2025 and beyond. We expanded our market leading dispensing business with the acquisition of Weener Packaging, extended our decades long partnership with our largest customer with another long-term contract extension, and delivered meaningful organic growth. The success of our winning strategy, the power of our portfolio, and the strength of our team continue to create value for our shareholders and position the Company for continued success well beyond 2025," said Adam Greenlee, President and CEO.

Company Overview

Established in 1987, Silgan Holdings (NYSE: SLGN) is a supplier of rigid packaging for consumer goods products, specializing in metal containers, closures, and plastic packaging.

Industrial Packaging

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

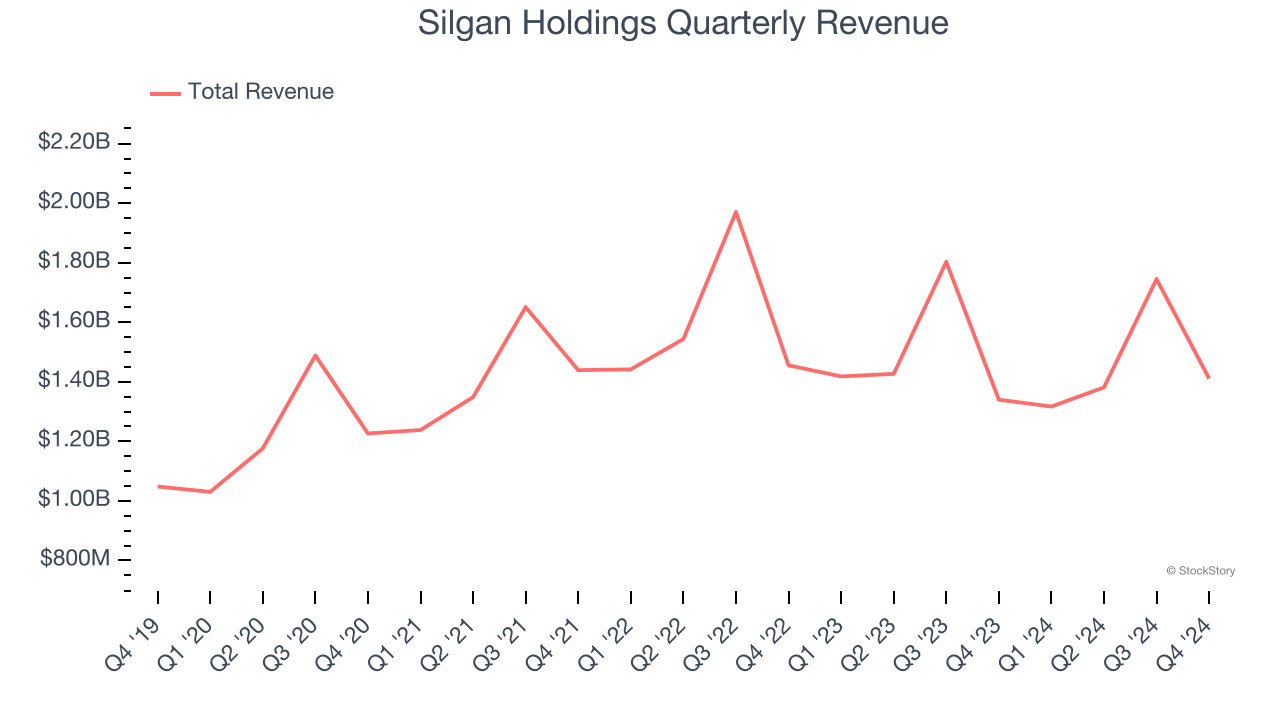

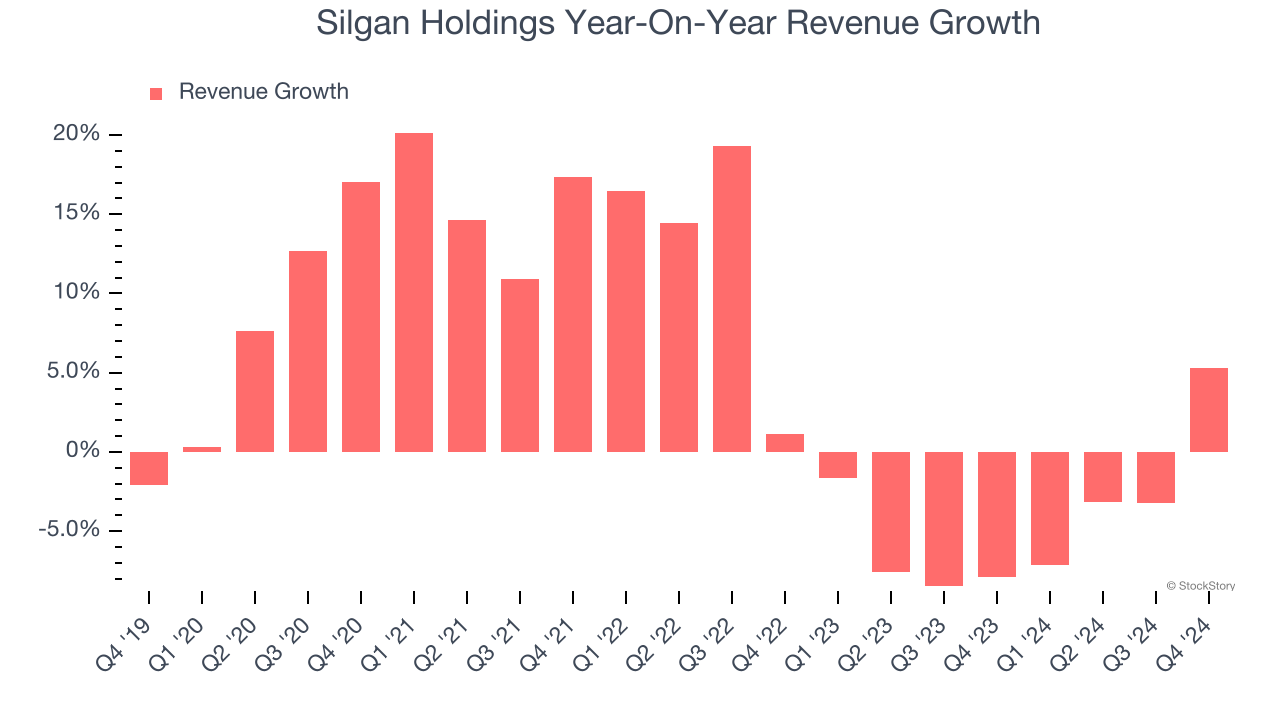

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Silgan Holdings’s sales grew at a tepid 5.5% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Silgan Holdings’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.4% annually. Silgan Holdings isn’t alone in its struggles as the Industrial Packaging industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Silgan Holdings grew its revenue by 5.3% year on year, and its $1.41 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.8% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and implies its newer products and services will catalyze better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

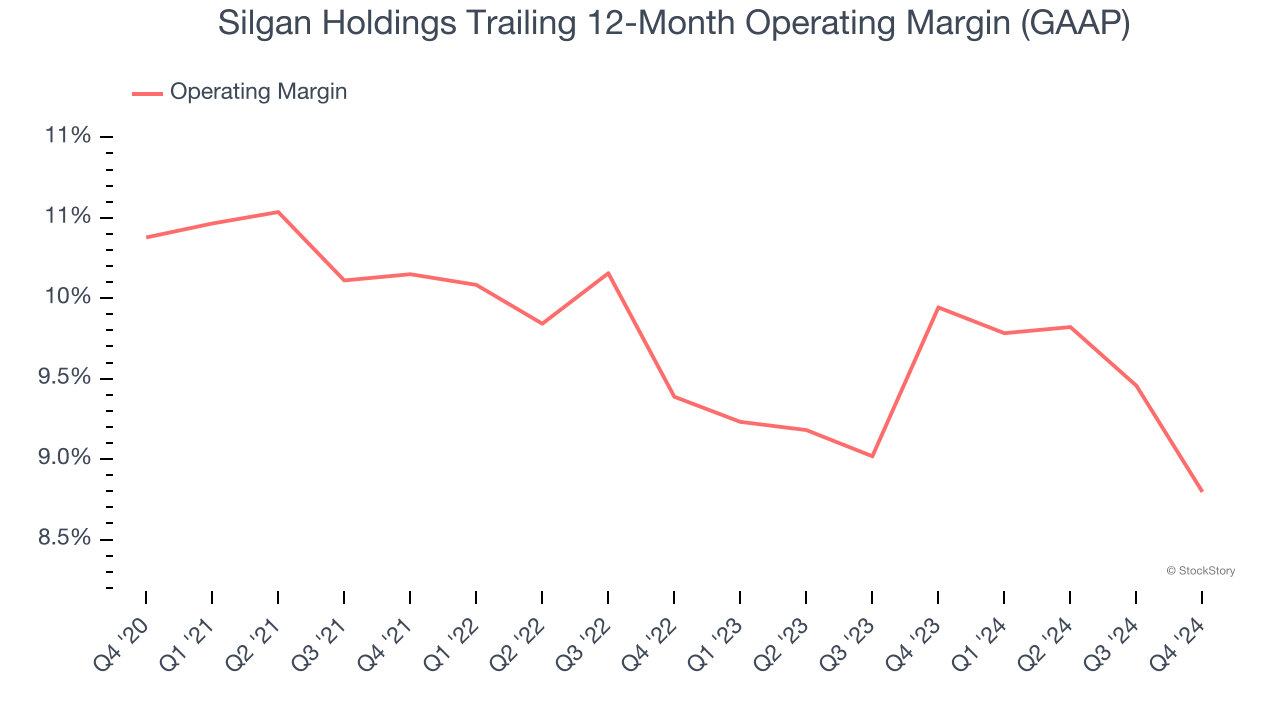

Operating Margin

Silgan Holdings has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.7%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Silgan Holdings’s operating margin decreased by 1.6 percentage points over the last five years. Even though its historical margin is high, shareholders will want to see Silgan Holdings become more profitable in the future.

In Q4, Silgan Holdings generated an operating profit margin of 6.7%, down 2.7 percentage points year on year. Since Silgan Holdings’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

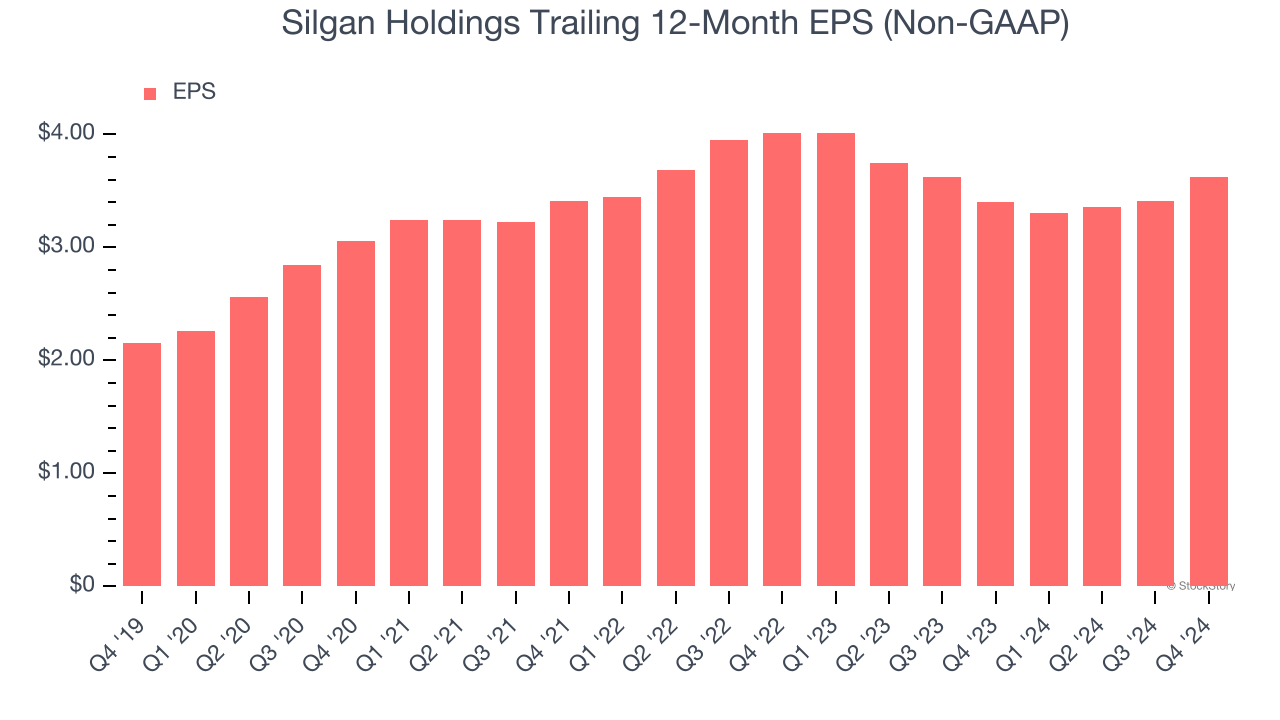

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Silgan Holdings’s EPS grew at a solid 11% compounded annual growth rate over the last five years, higher than its 5.5% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

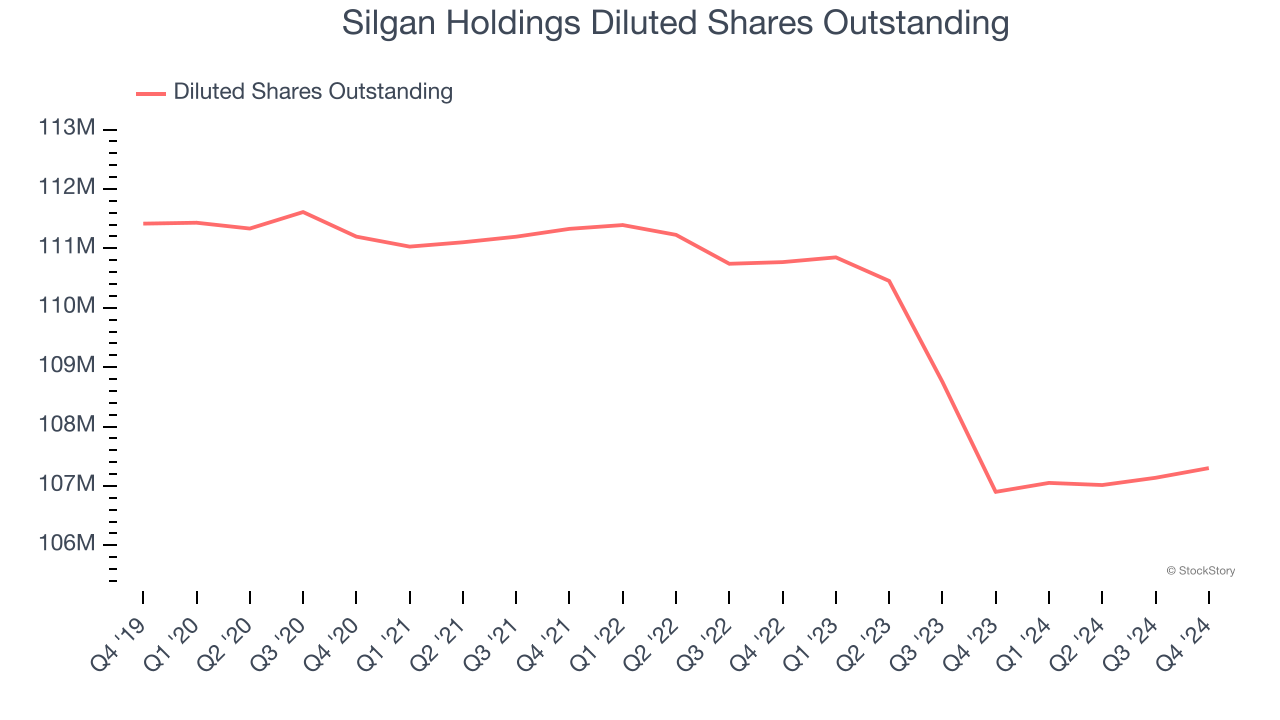

Diving into the nuances of Silgan Holdings’s earnings can give us a better understanding of its performance. A five-year view shows that Silgan Holdings has repurchased its stock, shrinking its share count by 3.7%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Silgan Holdings, its two-year annual EPS declines of 5% mark a reversal from its (seemingly) healthy five-year trend. We hope Silgan Holdings can return to earnings growth in the future.

In Q4, Silgan Holdings reported EPS at $0.85, up from $0.63 in the same quarter last year. This print beat analysts’ estimates by 3.4%. Over the next 12 months, Wall Street expects Silgan Holdings’s full-year EPS of $3.63 to grow 12.9%.

Key Takeaways from Silgan Holdings’s Q4 Results

It was good to see Silgan Holdings meet analysts’ revenue expectations this quarter. We were also glad its EPS guidance for next quarter came in slightly higher than Wall Street’s estimates. On the other hand, its full-year EPS guidance fell slightly short of Wall Street’s estimates. Overall, this was a mixed quarter, but the positives seem to be swaying the market reaction. The stock traded up 2% to $54.10 immediately after reporting.

Is Silgan Holdings an attractive investment opportunity right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.