Since January 2020, the S&P 500 has delivered a total return of 81.4%. But one standout stock has more than doubled the market - over the past five years, Netflix has surged 172% to $896.25 per share. Its momentum hasn’t stopped as it’s also gained 31.9% in the last six months thanks to its solid quarterly results, beating the S&P by 24.5%.

Is now still a good time to buy NFLX? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does NFLX Stock Spark Debate?

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

Two Things to Like:

1. Global Streaming Paid Memberships Skyrocket, Fueling Growth Opportunities

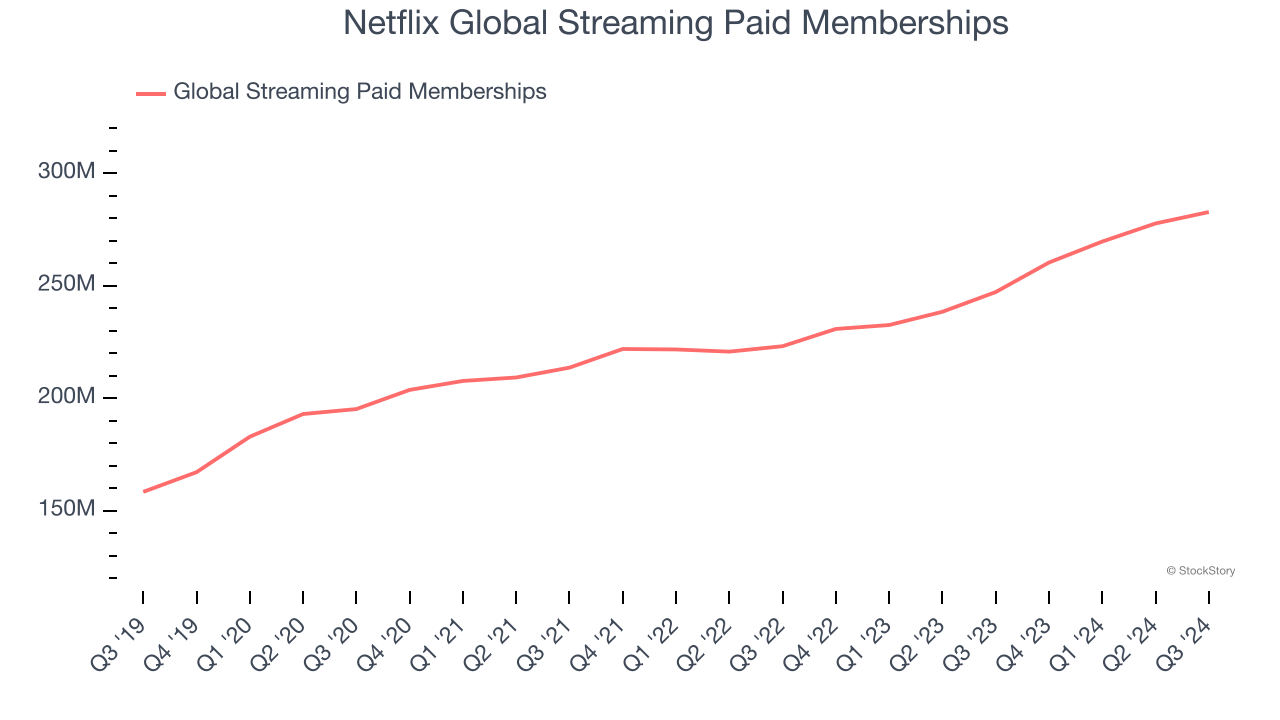

As a subscription-based app, Netflix generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Over the last two years, Netflix’s global streaming paid memberships, a key performance metric for the company, increased by 10.9% annually to 282.7 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

2. Increasing Free Cash Flow Margin Juices Financials

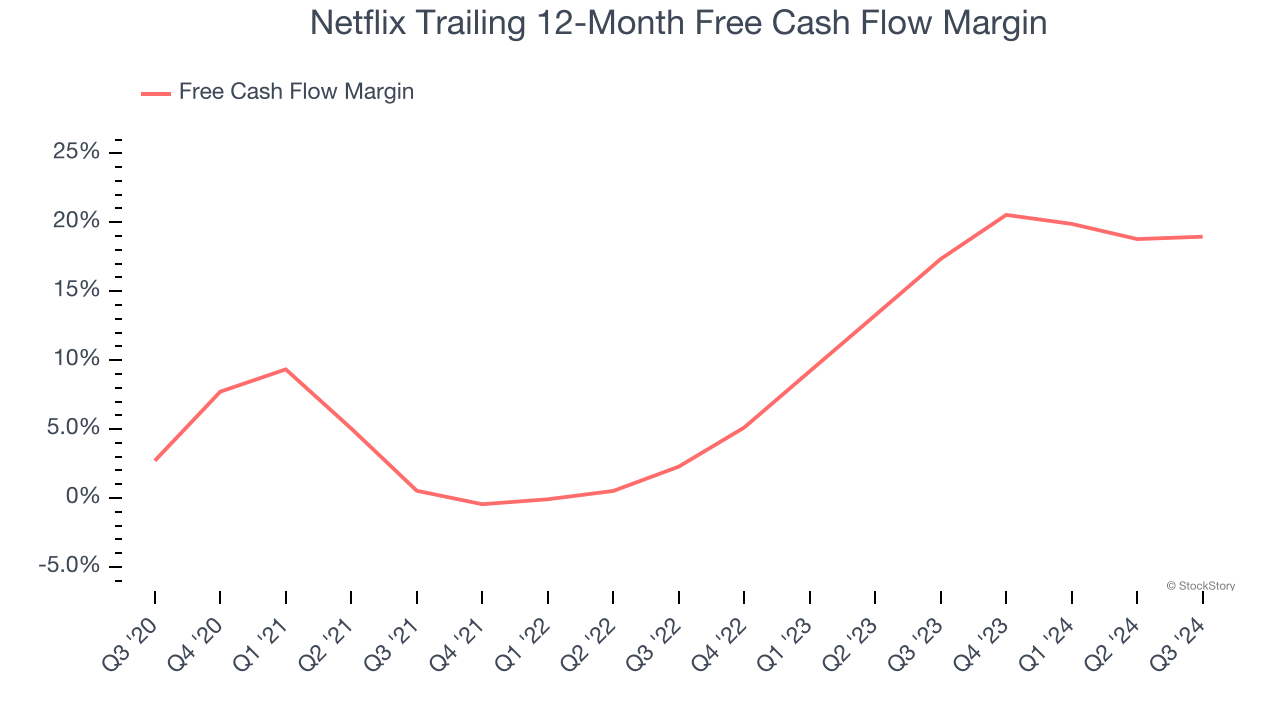

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Netflix’s margin expanded by 18.4 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose by more than its operating profitability. Netflix’s free cash flow margin for the trailing 12 months was 19%.

One Reason to be Careful:

Customer Spending Decreases, Engagement Falling?

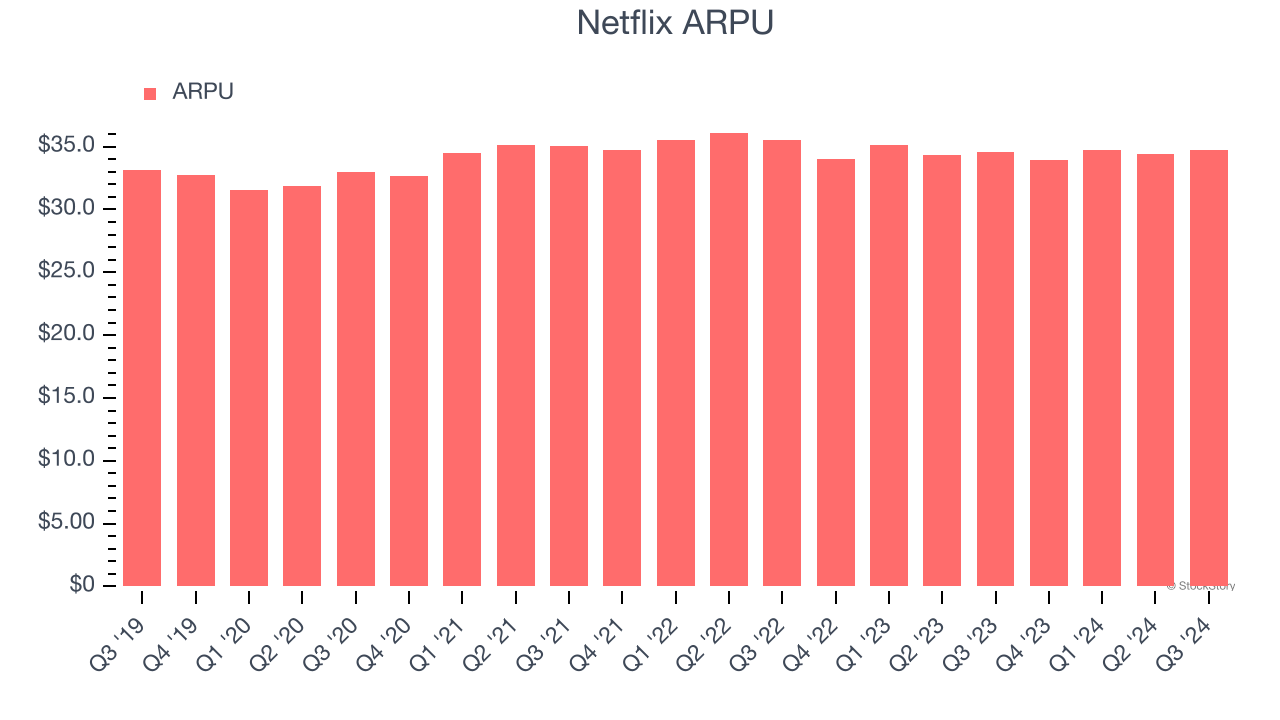

Average revenue per user (ARPU) is a critical metric to track for consumer subscription businesses like Netflix because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Netflix’s ARPU fell over the last two years, averaging 1.4% annual declines. This isn’t great, but the increase in global streaming paid memberships is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Netflix tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

Final Judgment

Netflix has huge potential even though it has some open questions, and with its shares beating the market recently, the stock trades at 31.6× forward EV-to-EBITDA (or $896.25 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Netflix

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.