Since January 2020, the S&P 500 has delivered a total return of 81.4%. But one standout stock has more than doubled the market - over the past five years, Hubbell has surged 179% to $415.01 per share. Its momentum hasn’t stopped as it’s also gained 13.4% in the last six months, beating the S&P by 6.1%.

Is now still a good time to buy HUBB? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does HUBB Stock Spark Debate?

A respected player in the electrical segment, Hubbell (NYSE: HUBB) manufactures electronic products for the construction, industrial, utility, and telecommunications markets.

Two Things to Like:

1. Operating Margin Rising, Profits Up

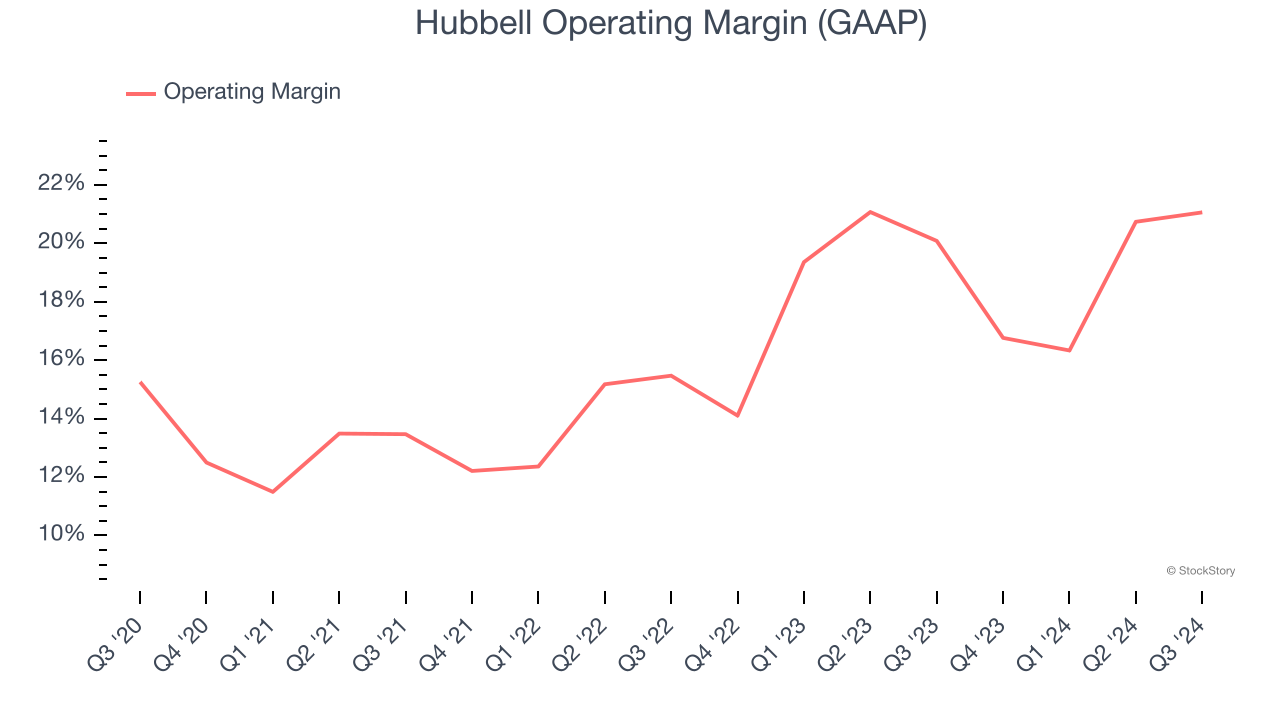

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Looking at the trend in its profitability, Hubbell’s operating margin rose by 5.4 percentage points over the last five years, showing its efficiency has meaningfully improved. . Its operating margin for the trailing 12 months was 18.8%.

2. Outstanding Long-Term EPS Growth

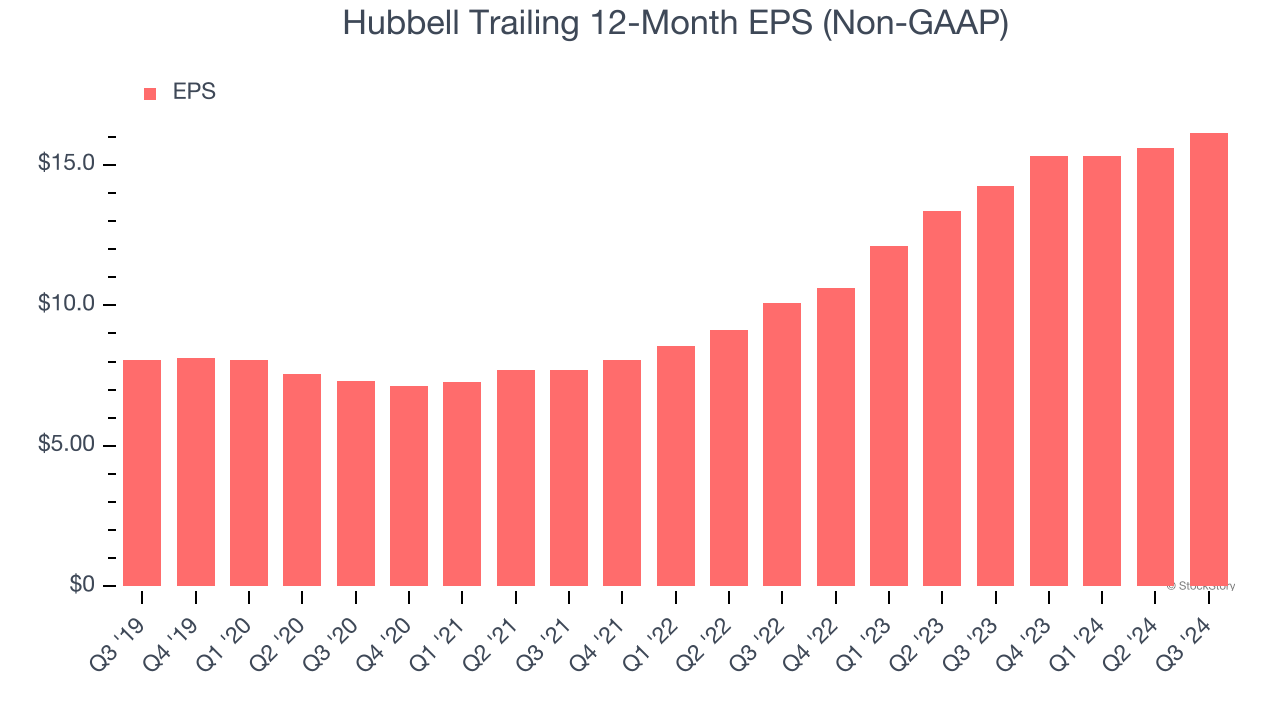

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Hubbell’s EPS grew at a spectacular 14.9% compounded annual growth rate over the last five years, higher than its 4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Slow Organic Growth Suggests Waning Demand In Core Business

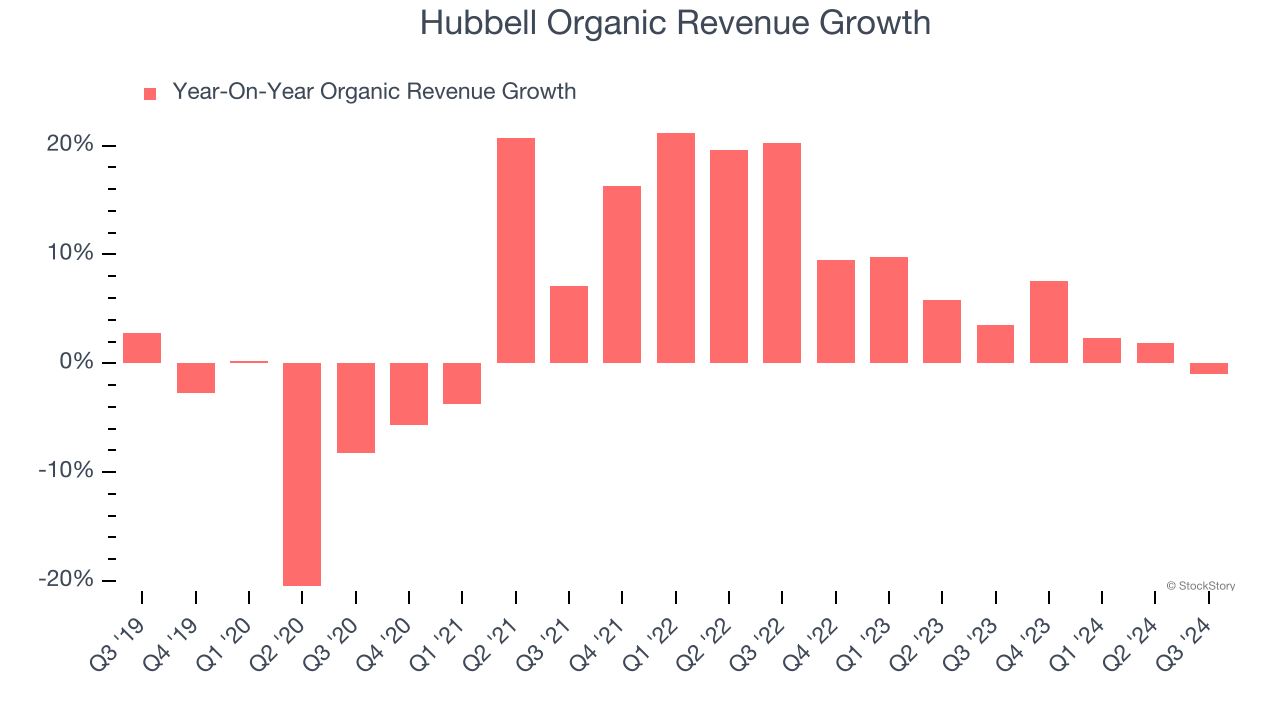

Investors interested in Electrical Systems companies should track organic revenue in addition to reported revenue. This metric gives visibility into Hubbell’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Hubbell’s organic revenue averaged 4.9% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

Hubbell’s merits more than compensate for its flaws, and with its shares outperforming the market lately, the stock trades at 24.1× forward price-to-earnings (or $415.01 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Hubbell

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.