Over the past six months, Gates Industrial Corporation has been a great trade, beating the S&P 500 by 25.5%. Its stock price has climbed to $20.57, representing a healthy 33% increase. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Gates Industrial Corporation, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.We’re happy investors have made money, but we're cautious about Gates Industrial Corporation. Here are three reasons why GTES doesn't excite us and a stock we'd rather own.

Why Do We Think Gates Industrial Corporation Will Underperform?

Helping create one of the most memorable moments for the iconic “Jurassic Park” film, Gates (NYSE: GTES) offers power transmission and fluid transfer equipment for various industries.

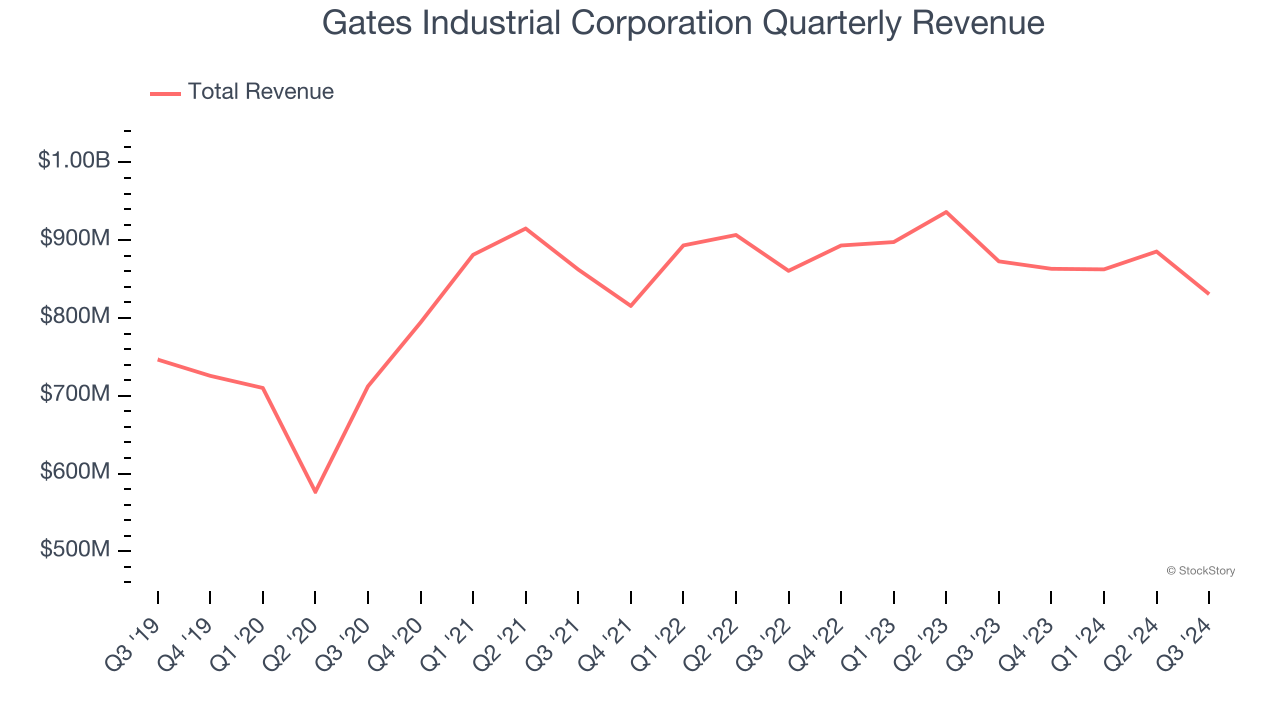

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Regrettably, Gates Industrial Corporation’s sales grew at a sluggish 1.8% compounded annual growth rate over the last five years. This was below our standards.

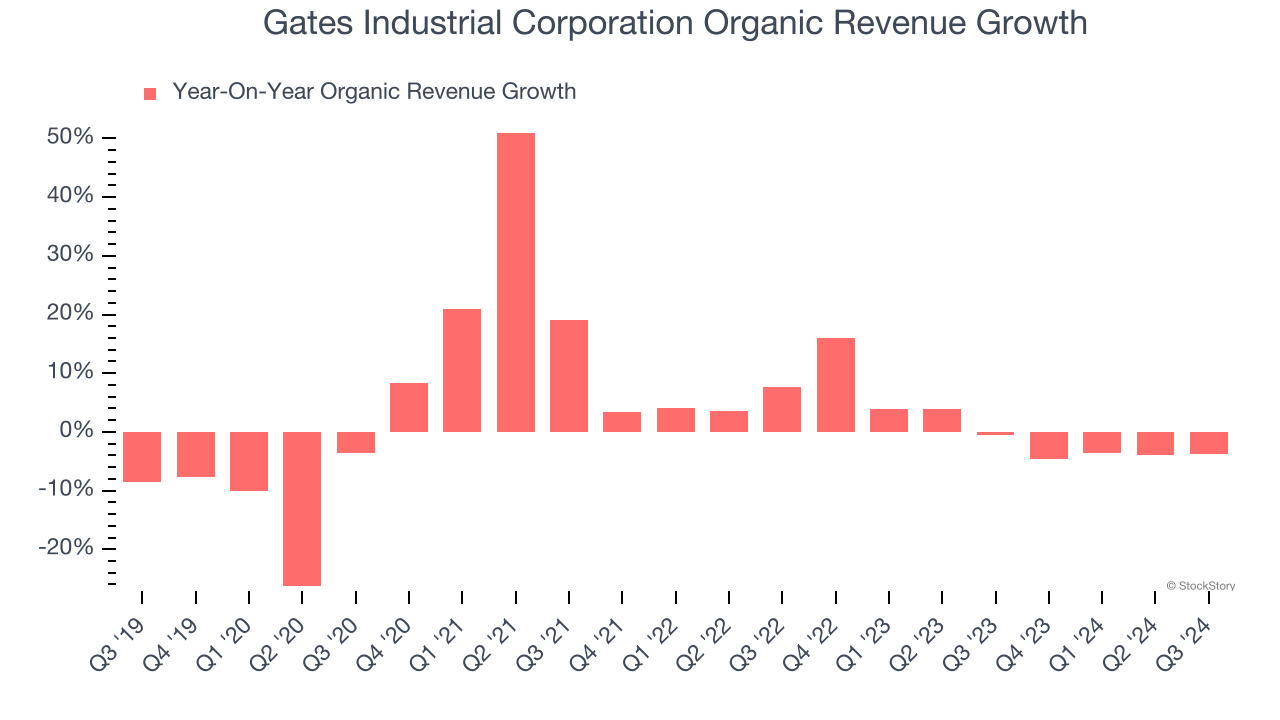

2. Core Business Falling Behind as Demand Plateaus

In addition to reported revenue, organic revenue is a useful data point for analyzing Engineered Components and Systems companies. This metric gives visibility into Gates Industrial Corporation’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Gates Industrial Corporation failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Gates Industrial Corporation might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

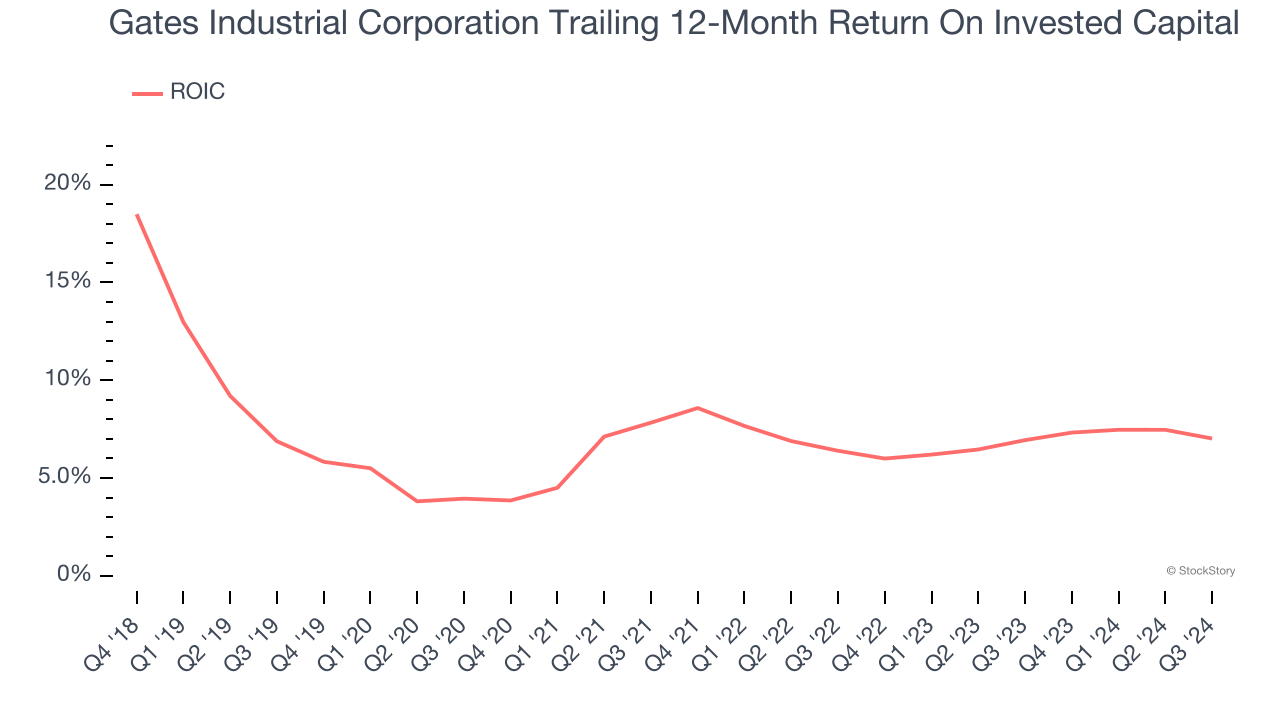

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Gates Industrial Corporation historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.4%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Gates Industrial Corporation, we’ll be cheering from the sidelines. With its shares outperforming the market lately, the stock trades at 13.7× forward price-to-earnings (or $20.57 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment. Let us point you toward KLA Corporation, a picks and shovels play for semiconductor manufacturing.

Stocks We Like More Than Gates Industrial Corporation

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.